Investment expenses are deductible from your federal income tax return, but only if they are incurred to produce or collect taxable income, or to manage, conserve, or maintain your investments.

Deductible investment expenses include:

- Professional investment advice

- Financial newspaper subscriptions

- Safe deposit box rent (when used to store investment papers)

- Fees incurred for replacing stock certificates

- Interest paid on money borrowed to invest in assets that produce taxable investment income or appreciate in value

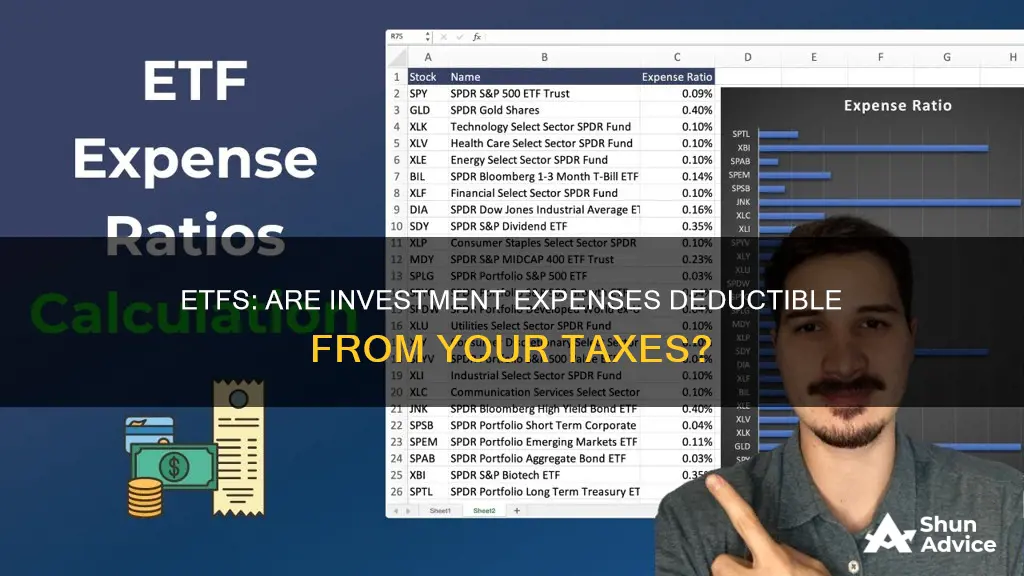

| Characteristics | Values |

|---|---|

| Are ETF investment expenses deductible? | No |

| What are investment expenses? | Amounts paid to produce or collect taxable income, or to manage, conserve, or maintain investments. |

| How much is deductible? | Investment expenses are miscellaneous itemized deductions, meaning your total costs generally have to be greater than 2% of your adjusted gross income before you benefit. Other limits may also apply. |

| What isn’t deductible? | Some investment costs, such as broker’s commissions for buying and selling stocks, are considered part of your basis and affect your gain or loss when you sell the investment instead of being currently deductible. |

| Are there other rules? | Yes, for example, travel and fees you pay to attend seminars, conventions, or other meetings – including stockholder meetings – are not deductible, nor are expenses related to tax-exempt income. |

What You'll Learn

Investment interest expenses

The amount you can deduct is limited to your net taxable investment income for the year. Any leftover interest expense can be carried forward to future years. Net investment income includes ordinary dividends and interest income, but not investment income taxed at long-term capital gains tax rates or municipal bond interest.

To determine your deductible investment interest expense, you need to know your net investment income and total investment interest expenses for loans used to purchase taxable investments. If your net investment income is greater than your total investment interest expenses, you can deduct the full amount of those expenses. If your net investment income is less than your total investment interest expenses, your deduction is limited to the amount of your net investment income.

For example, let's say you have $8,000 of net investment income and $10,500 of investment interest expenses. In this case, your deduction for investment interest expenses would be limited to $8,000, and you could carry forward the remaining $2,500 to future years.

It's important to note that qualified dividends that receive preferential tax treatment are not considered investment income for these purposes. However, you can choose to treat qualified dividends as ordinary income, which may increase your investment interest expense deduction. This strategy should be carefully considered as it cannot be revoked without IRS consent.

In addition to investment interest expenses, you may also be able to deduct capital losses from the sale of investments. Capital losses can be used to offset capital gains, and any net capital losses of more than $3,000 can be carried forward to future years.

AI ETF Investment: Strategies for Success

You may want to see also

Capital losses

How Capital Losses Work

Realised, Unrealised, and Recognised Losses

- Realised losses occur on the actual sale of the asset or investment.

- Unrealised losses are not reported.

- Recognised losses are the amount of a loss that can be declared in a given year.

When Deductions Can Be Taken

Any amount of capital loss can be netted against any capital gain realised in the same tax year, but only $3,000 of capital loss can be deducted from earned or other types of income in the year.

Unrealised vs Realised Losses

An investor buys a stock at $50 a share in May. By August, the share price had dropped to $30. The investor has an unrealised loss of $20 per share. They hold the stock until the following year, and the price climbs to $45 per share. The investor sells the stock and realises a loss of $5 per share. They can only report that loss in the year of sale; they cannot report the unrealised loss from the previous year.

Recognised Gains

Although all capital gains realised in a given year must be reported for that year, there are some limits on the amount of capital losses that may be declared in a given year in some cases. While any loss can ultimately be netted against any capital gain realised in the same tax year, only $3,000 of capital loss can be deducted against earned or other types of income in a given year.

For example, say that Frank realised a capital gain of $10,000. He also realised a capital loss of $30,000. He will apply $10,000 of his loss against his gain, but can only deduct an additional $3,000 of his loss against his other income for that year.

Then, he can deduct the remaining $17,000 ($30,000 - $10,000 - $3,000) of his capital loss in $3,000 increments from income every year from then on until the entire amount has been deducted.

However, if he realises another capital gain in a future year before he has exhausted this amount, then he can deduct the total remaining loss against that gain.

Short-Term vs Long-Term Capital Losses

Calculating Capital Losses

When capital gains and losses are reported on the tax return, the taxpayer must first categorise all gains and losses between long and short-term and then aggregate the total amounts for each of the four categories.

Next, the long-term gains and losses are netted against each other, and the same is done for short-term gains and losses. Finally, the net long-term gain or loss is netted against the net short-term gain or loss. This final net number is then reported on Form 1040.

Capital Loss Strategies

Although novice investors often panic when their holdings decline substantially in value, experienced investors who understand the tax rules are quick to liquidate some of their losers to generate capital losses.

Smart investors also know that capital losses can save them more money in certain situations. That is, capital losses used to offset short-term gains or other ordinary income will save investors more money than when used to offset long-term capital gains.

That's because they're reducing the amount of taxable income subject to ordinary income tax rates, which are higher than capital gains tax rates.

ETFs: A Smart Investment Strategy for Your Money?

You may want to see also

Qualified dividends

Qualified vs. Unqualified Dividends

Not all ETF dividends are taxed the same. They're broken down into qualified and unqualified dividends.

Unqualified dividends are taxed from 10% to 37%.

Requirements for a dividend to be considered qualified

For a dividend to be considered qualified, it must meet special requirements issued by the IRS.

The dividend must be paid by a U.S. company or a qualifying foreign company.

The dividends weren't previously excluded by the IRS as qualified dividends.

The holding period is met. The holding period for most types of qualified dividends requires you to have held the investment unhedged for more than 60 days during the 121-day period that starts 60 days prior to the ex-dividend date.

Tax rates on qualified dividends

The tax rates on qualified dividends are 0%, 15%, and 20%, depending on your filing status and your tax bracket. The dividends aren't taxed as qualified dividends, however, if you hold the stock for fewer than 60 days during that 121-day period.

You could pay 0% taxes on qualified ETF dividends if you're in one of the lower tax brackets. You would still pay tax when you sold the ETF itself but you wouldn't pay taxes as long as you satisfy the qualified dividend requirements for holding.

This threshold is $47,025 for 2024 and $48,350 for single taxpayers in 2025. You would pay no taxes on qualified dividends as long as your modified adjusted gross income (MAGI) is below these levels. The next dividend rate is 15% for incomes between $47,025 and $518,900 in 2024. The thresholds increase to between $48,350 and $533,400 in 2025. Individuals who have incomes greater than this will pay a 20% tax on their qualified dividends.

The favourable tax treatment for qualified dividends is intended as an incentive to regularly use a share of their profits to reward their shareholders. It also gives investors a reason to hold onto their stocks long enough to earn dividends.

A Beginner's Guide to Silver ETF Investing

You may want to see also

Investment fees and expenses

- Professional investment advice

- Financial newspaper subscriptions

- Safe deposit box rent (when used to store investment papers)

- Fees incurred for replacing stock certificates

However, it's important to note that not all investment expenses are deductible. For example, broker's commissions for buying and selling stocks are considered part of your basis and will affect your gain or loss when you sell the investment. Travel fees to attend seminars, conventions, or other meetings are also not deductible.

When it comes to investment interest expenses, you can generally deduct interest paid on money you borrow to invest, but there are restrictions. The deduction is limited to the amount of taxable investment income earned in the same year, and you can only claim it by itemizing deductions on Schedule A and filing Form 4952. Additionally, interest incurred from a 'passive activity' investment, such as rental properties, generally does not qualify for the investment interest deduction.

A Beginner's Guide to ETF Investing

You may want to see also

Brokerage fees

Even a small brokerage fee will add up over time, and a few fees can significantly reduce your portfolio's return.

When choosing a broker, it is important to consider the fees they charge. Some brokers offer commission-free trading, while others may charge between $3 and $7 per trade.

- Trade commission: Charged when you buy or sell stocks or other investments, such as options or ETFs.

- Mutual fund transaction fee: Charged when you buy or sell mutual funds.

- Expense ratio: An annual fee charged by mutual funds, index funds, and ETFs, expressed as a percentage of your investment in the fund.

- Sales load: A sales charge or commission on some mutual funds, paid to the broker or salesperson who sold the fund.

- Management or advisory fee: Paid to a financial advisor or robo-advisor, typically a percentage of assets under management.

- 401(k) fee: An administrative fee to maintain the plan, often passed on to plan participants by the employer.

A Beginner's Guide to Investing in ETFs with Fidelity

You may want to see also

Frequently asked questions

Investment expenses are deductible if they are used to produce or collect taxable income, or to manage, conserve, or maintain your investments. However, if the investment produces nontaxable income, such as tax-exempt bonds, the expenses are not deductible.

Examples of deductible investment expenses include professional investment advice, financial newspaper subscriptions, and safe deposit box rent when used to store investment papers.

Examples of non-deductible investment expenses include broker's commissions for buying and selling stocks, travel fees to attend seminars or conventions, and expenses related to tax-exempt income.