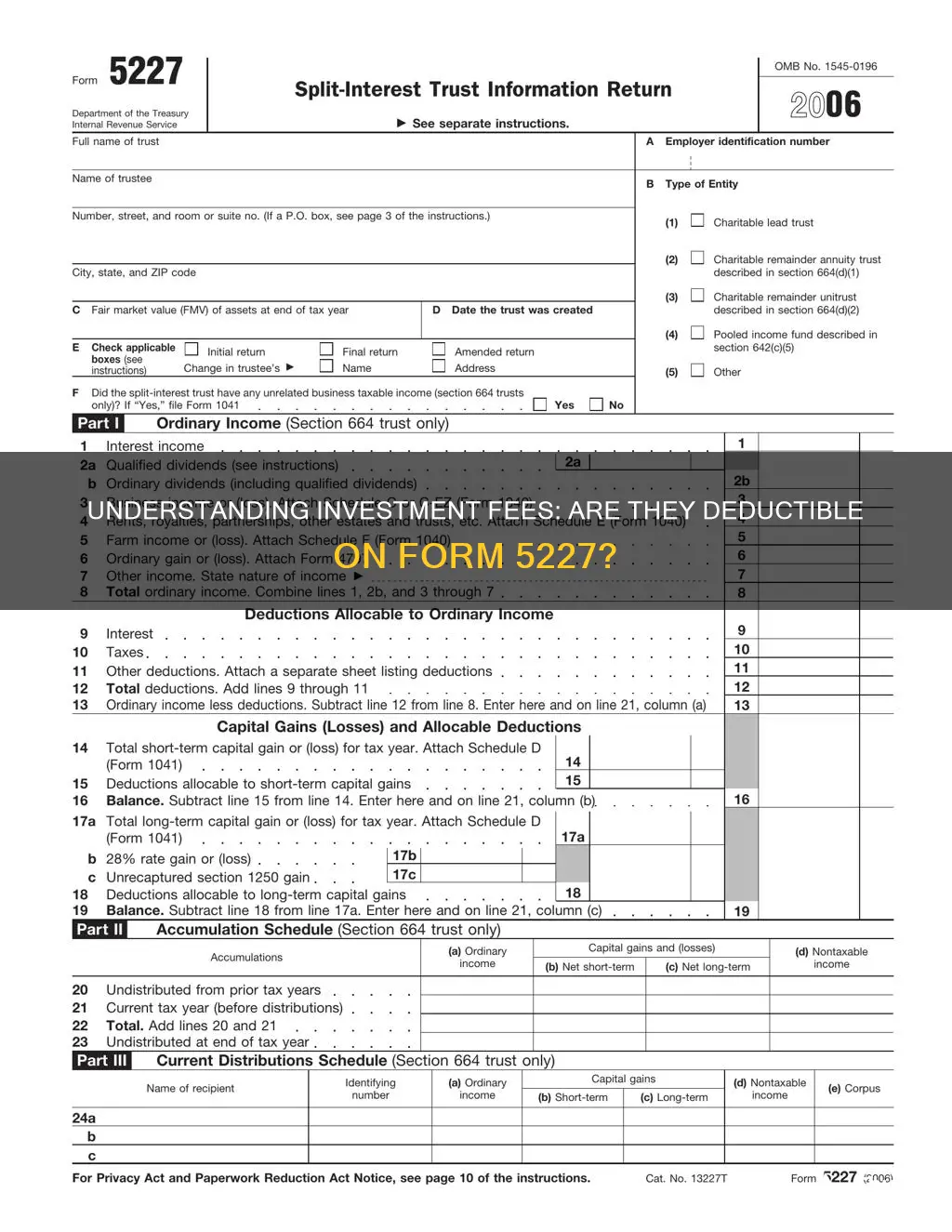

Form 5227, also known as the Split-Interest Trust Information Return, is an important document for reporting the financial activities of a split-interest trust. It is a crucial component of the annual tax filing requirement for Charitable Remainder Trusts, providing a detailed overview of the trust's income, deductions, balance sheet, and required distributions. While the form can be complex, it plays a vital role in ensuring compliance with IRS rules. One notable aspect of Form 5227 is its ability to track net investment income receipts and distributions, which is essential for charitable remainder trusts. In terms of investment management fees, it's important to distinguish between different types of fees and their tax implications. Management fees charged by investment firms or advisors are typically based on a set percentage of the portfolio value and may be eligible for tax deductions under certain conditions. On the other hand, fees associated with registered accounts, such as Tax-Free Savings Accounts (TFSA) or Registered Retirement Savings Plans (RRSP), are not tax-deductible. Understanding the nuances of investment fees and their tax treatment is crucial for effective financial planning.

What You'll Learn

- Form 5227 is a Split-Interest Trust Information Return

- It is filed by trustees on behalf of Charitable Remainder Trusts

- It includes details such as the trust's income, deductions, balance sheet, and required distributions

- The form allows the IRS to track the trust and ensure it's following the rules

- It must be filed annually

Form 5227 is a Split-Interest Trust Information Return

Form 5227 is a document used to report the financial activities of a split-interest trust. It is a type of trust that includes charitable lead trusts, charitable remainder annuity trusts (CRATs), charitable remainder unitrusts (CRUTs), and pooled income funds. The form is used to provide information on charitable deductions and distributions from the trust. Additionally, it helps determine if the trust is treated as a private foundation and subject to excise taxes under Chapter 42.

The Internal Revenue Service (IRS) issues Form 5227, which must be filed for tax years beginning on or after January 1, 2007. One of the significant changes made to the form is that charitable split-interest trusts are no longer required to file Form 1041-A, as sections of it have been incorporated into Form 5227. This form is now also open to public inspection, except for information related to non-charitable trust beneficiaries, which is listed in Schedule A.

When completing Form 5227, individuals must enter information in several sections, including General Information, Basic Return Information, Return Type, and Type of Entity. If the return is for a Charitable Lead or Pool Trust, there will be no taxable beneficiary, and no K-1s will be printed with the return. It is important to note that failure to file or late filing of Form 5227 can result in penalties for the trust and/or trustees.

While the provided sources do not explicitly mention investment management fees in relation to Form 5227, the form does cover charitable deductions and distributions, which may include investment-related activities. It is always recommended to consult with a tax professional or refer to the official instructions provided by the IRS for Form 5227 to ensure accurate reporting and compliance with tax regulations.

Building an Ally Investment Portfolio: A Guide

You may want to see also

It is filed by trustees on behalf of Charitable Remainder Trusts

Form 5227, or the Split-Interest Trust Information Return, is used to report the financial activities of a split-interest trust. This includes charitable remainder trusts, which are irrevocable trusts that allow donors to transfer property, cash, or other assets into the trust, receive annual income for life or a fixed term, and eventually pass the remainder to a qualified US charitable organisation.

Charitable remainder trusts must be filed annually by trustees on behalf of the trust. This form is used to report the trust's financial activities, including the disposition of assets, current and accumulated trust income, deductions, and distributions or payments from the trust. It also determines if the trust owes excise taxes for prohibited transactions.

Form 5227 consists of multiple parts that must be completed, including:

- Income and Deductions: This section reports the trust's ordinary income, capital gains or losses, nontaxable income, and deductions.

- Schedule of Distributable Income: This section is for charitable remainder trusts and reports the income of the trust for purposes of determining the character of distributions.

- Distributions for Charitable Purposes: This section details distributions of principal and accumulated income set aside for charitable purposes.

- Balance Sheet: This section provides a financial snapshot of the trust, including assets, liabilities, and net assets.

- Charitable Remainder Annuity Trust Information and Charitable Remainder Unitrust Information: These sections include specific information about the respective trust types.

- Statements Regarding Activities: This section includes statements about the trust's compliance with applicable rules and regulations.

- Questionnaire for Charitable Lead Trusts, Pooled Income Funds, and Charitable Remainder Trusts: This section gathers additional information about the trust type, distributions, and donor details.

Stocks and Credit Scores: The Impact of Investment Portfolios

You may want to see also

It includes details such as the trust's income, deductions, balance sheet, and required distributions

Form 5227 is used to report the financial activities of a split-interest trust. It is an important document for trustees to understand, as it must be filed annually on or before April 15th following the close of the trust's tax year. This form provides detailed information about the trust's operations and is submitted to the Internal Revenue Service (IRS).

The form includes a comprehensive overview of the trust's income, deductions, balance sheet, and required distributions. This means that the trust's earnings, such as interest, dividends, or capital gains, are disclosed. Additionally, any deductions claimed by the trust, which can reduce its taxable income, are also listed. The balance sheet offers a snapshot of the trust's financial position, including its assets, liabilities, and equity.

Form 5227 also outlines the required distributions that the trust must make to its beneficiaries. These distributions can be in the form of income, principal, or a combination of both, depending on the trust's provisions. The form ensures transparency and helps beneficiaries understand their entitlements.

Furthermore, Form 5227 assists in determining whether the trust is treated as a private foundation. This classification is significant because private foundations are often subject to specific excise taxes under Chapter 42 of the Internal Revenue Code. By providing detailed financial information, the form helps establish the trust's tax status and any applicable tax liabilities.

Completing Form 5227 accurately and comprehensively is essential for compliance with tax regulations and maintaining transparency in the trust's financial activities and distributions.

Understanding Your Total Investment Portfolio

You may want to see also

The form allows the IRS to track the trust and ensure it's following the rules

Form 5227, also known as the Split-Interest Trust Information Return, is an important document that must be filed annually for Charitable Remainder Trusts. This comprehensive form serves as a detailed report of various aspects of the trust, including its income, deductions, balance sheet, and required distributions. One of its key purposes is to enable the IRS to track the trust and ensure compliance with IRS rules.

The form includes several sections that facilitate this tracking and oversight by the IRS. Firstly, the header of Form 5227 contains essential information about the trust, such as its name, the name and address of the trustee, and the fair market value of its assets at the end of the previous tax year. This foundational information sets the context for the rest of the form.

Part I of the form delves into the trust's income and deductions, with five distinct sections: Capital Gains and Losses, Deductions Allocable to Income Categories, Gross Income, and more. This part is crucial for understanding the financial activities and performance of the trust.

Part IV of Form 5227 is dedicated to tracking changes in the trust's balance sheet, specifically the fluctuations in its assets and liabilities. This section is important for evaluating the trust's financial health and stability over time.

Additionally, the form includes a section for reporting the net investment income tax, which charitable remainder trusts have been required to track since 2013. This aspect of the form further enhances the IRS's ability to monitor the trust's financial activities and ensure compliance with tax regulations.

By requiring trusts to complete and submit Form 5227, the IRS gains valuable insights into the operations and financial status of Charitable Remainder Trusts. This information allows the IRS to verify that the trust is adhering to the applicable rules and regulations, promoting transparency and accountability in the management of these trusts.

Creating Your First Investment Portfolio: A Beginner's Guide

You may want to see also

It must be filed annually

Form 5227, also known as the Split-Interest Trust Information Return, must be filed annually by trustees on behalf of trusts. This is a crucial document and an important part of the annual tax filing requirement for Charitable Remainder Trusts. It serves as a detailed report of the trust's income, deductions, balance sheet, and required distributions, among other elements. This helps the IRS keep track of the trust and ensure it is following the necessary rules.

The form includes a header with basic information about the trust, such as the name of the trust, the name and address of the trustee, and the fair market value of assets at the end of the previous tax year. It also includes the trust's EIN, a unique identifying number. The type of trust is also specified, whether it is a Charitable Lead Trust, a Charitable Remainder Trust, or a Pooled Income Fund.

Part I of the form details the trust's income and deductions, including capital gains and losses, and deductions allocable to income categories. This information is obtained from the 1099s and K-1s of the trust's investments. If the trust has multiple assets invested in different places, each of these investments will generate a 1099 or K1 form, which are then consolidated to create the relevant trust document.

Part IV of the form tracks the changes in the trust's balance sheet, specifically the changes in its assets and liabilities. It is important to note that the End-of-Year Book Value and the Fair Market Value (FMV) may not match due to how the assets in the trust are measured in accounting terms.

The form must be signed and dated by the trustee before being mailed to the corresponding address. While the IRS is transitioning to e-filing, this step is still necessary for now.

Form 5227 plays a crucial role in ensuring compliance and providing transparency to the IRS regarding the financial activities and distributions of Charitable Remainder Trusts.

Invest or Save? Where Should Your Money Go?

You may want to see also

Frequently asked questions

Form 5227 is a Split-Interest Trust Information Return, which is filed by trustees on behalf of trusts.

Form 5227 is used to report the financial activities of a split-interest trust, including charitable deductions and distributions. It helps the IRS track the trust and ensure compliance with IRS rules.

Form 5227 includes basic information about the trust, such as the name of the trust, name and address of the trustee, fair market value of assets, gross income, and the type of trust. It also includes details on the trust's income, deductions, balance sheet, and required distributions.

Form 5227 is an annual tax filing requirement for Charitable Remainder Trusts.

Yes, the form has specific sections for reporting the trust's income, deductions, and distributions. It is important to accurately report personal information, income, and deductions.