The early 1900s marked a pivotal era in the evolution of investing, characterized by significant shifts in market dynamics and economic policies. This period witnessed the rise of modern financial institutions, the establishment of stock exchanges, and the introduction of new investment vehicles, all of which transformed the way individuals and institutions approached wealth accumulation. Understanding the strategies and outcomes of investing during this time can provide valuable insights into the historical development of financial markets and the impact of economic changes on investment practices.

| Characteristics | Values |

|---|---|

| Market Conditions | The early 1900s saw the rise of stock markets, with the New York Stock Exchange (NYSE) becoming a major hub. Investing was seen as a way to grow wealth, with many individuals and institutions participating. |

| Investment Vehicles | Stocks, bonds, and mutual funds were the primary investment options. Stocks offered ownership in companies, while bonds provided a fixed income. Mutual funds allowed investors to pool money and invest in a diversified portfolio. |

| Economic Factors | The early 1900s experienced significant economic fluctuations, including the post-Civil War Reconstruction, the Gilded Age, and the early 20th century's economic challenges. Investing required careful analysis of market trends and economic indicators. |

| Regulatory Environment | The Securities Act of 1933 and the Securities Exchange Act of 1934 were landmark pieces of legislation that aimed to protect investors by requiring companies to disclose financial information and establishing regulations for stock exchanges. |

| Technological Advancements | The introduction of electric communication and the development of the telegraph improved market efficiency and information flow. Later, the internet revolutionized investing, making it more accessible and providing real-time data. |

| Investment Strategies | Value investing, as popularized by Benjamin Graham, gained traction. This strategy involved identifying undervalued companies with strong fundamentals. Other approaches included growth investing, income investing, and market-timing strategies. |

| Market Participants | Individual investors, financial institutions, and governments were active participants. Institutions like pension funds and insurance companies played a significant role in shaping investment trends. |

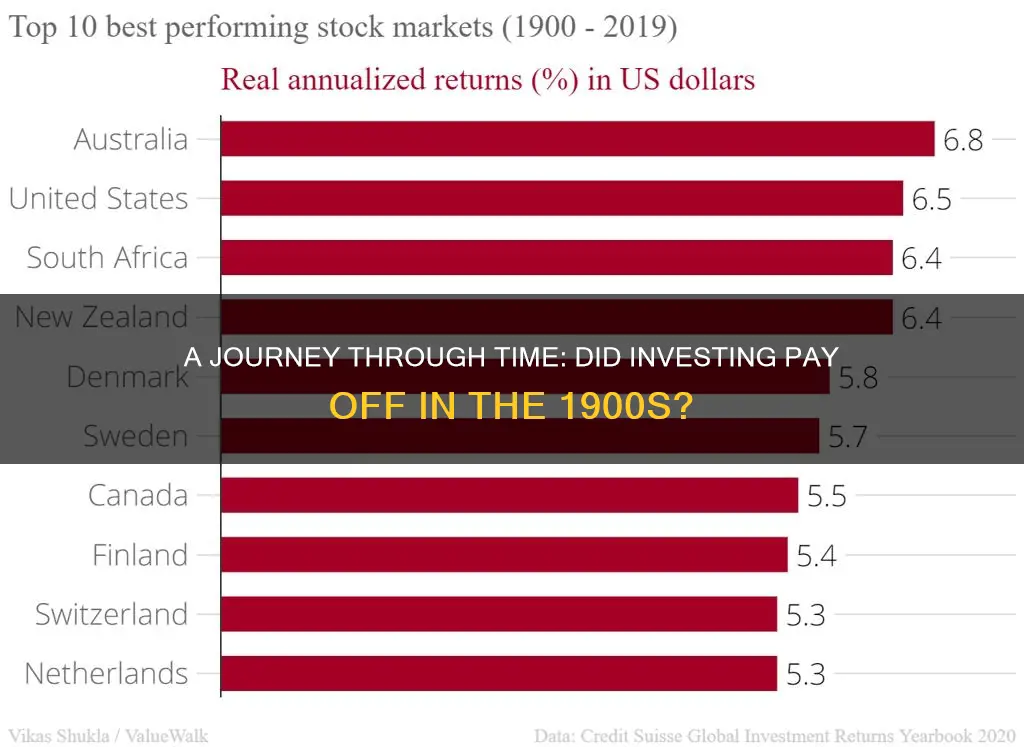

| Global Investment | International investing became more prominent, with the establishment of global markets and the need to diversify portfolios across borders. |

| Long-Term Perspective | Investing in the 1900s often emphasized a long-term view, focusing on compound interest and the power of consistent investment over time. |

| Education and Research | The importance of financial education and market research grew, with the emergence of investment advisors and financial publications providing guidance to investors. |

What You'll Learn

- Stock Market Growth: The stock market experienced significant growth and expansion during the early 20th century

- Industrialization and Investment: Industrialization fueled investment opportunities, attracting investors to emerging industries

- Economic Policies: Government policies influenced investment trends, impacting market dynamics and investor behavior

- Market Volatility: The early 1900s saw market volatility, with economic cycles affecting investment returns

- Financial Innovation: Financial innovations, such as mutual funds, revolutionized investment strategies and accessibility

Stock Market Growth: The stock market experienced significant growth and expansion during the early 20th century

The early 20th century witnessed a remarkable transformation in the stock market, marking a period of significant growth and expansion. This era, often referred to as the 'Golden Age of Capitalism', saw the stock market evolve from a niche investment avenue to a cornerstone of the global financial system. The growth was fueled by a combination of factors, including technological advancements, economic prosperity, and a growing understanding of investment principles.

One of the key drivers of stock market growth during this period was the rapid industrialization and economic development across the United States and Europe. As industries expanded, companies sought funding to support their operations and growth, leading to an increased demand for stocks. The rise of large-scale corporations, such as those in the automobile, steel, and oil industries, created a vast pool of investment opportunities, attracting a diverse range of investors.

Technological advancements played a pivotal role in this expansion. The introduction of electric communication systems, such as the telegraph and later the telephone, revolutionized information exchange, making it easier for investors to access market data and news. This facilitated the development of more sophisticated investment strategies and the emergence of professional money managers, who could analyze market trends and make informed decisions on behalf of their clients.

Government policies also contributed significantly to the stock market's growth. In the United States, the introduction of the Federal Reserve System in 1913 provided a more stable monetary environment, which was crucial for long-term investments. Additionally, the passage of the Securities Act of 1933 and the Securities Exchange Act of 1934 brought a new level of regulation to the market, enhancing investor confidence and attracting more participants.

This period also saw the rise of mutual funds and index funds, which allowed investors to diversify their portfolios and benefit from the overall market growth. The introduction of these investment vehicles democratized access to the stock market, enabling individual investors to participate in the economic expansion. As a result, the stock market became a powerful engine for wealth creation, attracting a wide range of participants and driving economic growth.

Investments: Strategies for Persuasion

You may want to see also

Industrialization and Investment: Industrialization fueled investment opportunities, attracting investors to emerging industries

The early 1900s marked a pivotal era in the history of investing, characterized by the rapid pace of industrialization and the emergence of new industries. This period witnessed a significant shift in investment strategies, as investors sought to capitalize on the opportunities presented by the industrial revolution. The industrialization of the 1900s was a transformative force, leading to the development of various sectors such as manufacturing, transportation, and energy. This economic boom created a favorable environment for investors, offering a wide range of investment options and potential returns.

One of the key aspects of investing during this time was the rise of the stock market. The establishment of stock exchanges and the introduction of new financial instruments allowed investors to participate in the growth of companies. Many investors saw the potential in emerging industries and were willing to take risks by investing in these sectors. For instance, the automobile industry, which was in its infancy, attracted significant investment as investors believed in the long-term prospects of this revolutionary mode of transportation. Similarly, the electrical and telecommunications industries were also major recipients of investment, as they promised to transform the way people communicated and utilized energy.

The investment landscape of the 1900s was further shaped by the presence of visionary entrepreneurs and industrialists. These individuals often played a crucial role in driving investment into specific sectors. Henry Ford, for example, revolutionized manufacturing with his assembly line production methods, attracting investors who believed in the mass production of automobiles. Similarly, the development of the radio and later, television, by companies like RCA, sparked a wave of investment in the media and entertainment industry.

This era also saw the emergence of investment banks and financial institutions that played a pivotal role in facilitating investments. These institutions provided the necessary capital and expertise to support the growth of emerging industries. They helped companies raise funds through initial public offerings (IPOs) and facilitated mergers and acquisitions, allowing investors to diversify their portfolios and gain exposure to various sectors. The investment banking sector, with its ability to connect investors with promising opportunities, became an integral part of the investment ecosystem.

In summary, the 1900s were a period of immense growth and innovation, where industrialization fueled investment opportunities. Investors were drawn to emerging industries, believing in their potential to revolutionize various sectors. The stock market, visionary entrepreneurs, and the support of investment banks all contributed to a thriving investment environment. This era's investment strategies and outcomes laid the foundation for modern investment practices, shaping the way investors approach and analyze potential opportunities.

Hertz: Invest Now or Miss Out?

You may want to see also

Economic Policies: Government policies influenced investment trends, impacting market dynamics and investor behavior

Government economic policies played a pivotal role in shaping investment trends throughout the 1900s, significantly influencing market dynamics and investor behavior. During this period, various countries adopted different approaches to economic management, which had a profound impact on investment opportunities and strategies.

In the early 1900s, many nations embraced protectionist policies, implementing tariffs and trade barriers to shield domestic industries from foreign competition. These policies often led to a shift in investment patterns, as investors sought opportunities in sectors that were shielded from international markets. For instance, industries like steel, textiles, and automobiles benefited from protective tariffs, encouraging domestic production and investment in these sectors. This era also witnessed the rise of government-led industrialization efforts, where governments actively guided investment towards specific industries deemed crucial for national development.

The post-World War II era brought about a significant transformation in economic policies, with many countries adopting a more liberal approach to trade and investment. The establishment of international trade agreements, such as the General Agreement on Tariffs and Trade (GATT), aimed to reduce barriers and promote global trade. This shift encouraged foreign direct investment (FDI) and created new opportunities for investors worldwide. Governments began to recognize the benefits of attracting foreign capital, leading to the relaxation of restrictions and the adoption of more open economic policies.

The 1960s and 1970s saw the emergence of Keynesian economics, which advocated for active government intervention in the economy to manage demand and stabilize markets. This period witnessed the implementation of various economic policies, including fiscal and monetary measures, to influence investment and consumption. Governments used tools like tax incentives, subsidies, and interest rate adjustments to encourage investment in specific sectors or to stimulate overall economic growth. For instance, infrastructure development projects often required substantial investments, and governments played a crucial role in providing the necessary financial support.

Additionally, the 1980s and 1990s marked a shift towards neoliberal economic policies, emphasizing free markets, deregulation, and privatization. Governments reduced their direct involvement in economic activities, allowing market forces to play a more significant role. This period saw a surge in private investment, as businesses benefited from deregulation and the removal of government-imposed barriers. However, it also led to increased income inequality and the concentration of wealth, as certain industries became dominated by large corporations.

In summary, government economic policies were instrumental in shaping investment trends during the 1900s. From protectionist measures to liberal trade agreements, Keynesian interventions, and neoliberal reforms, these policies significantly impacted market dynamics and investor behavior. Understanding the historical context of these policies provides valuable insights into the evolution of investment strategies and the role of governments in fostering economic growth and development.

Big Home, Big Investment?

You may want to see also

Market Volatility: The early 1900s saw market volatility, with economic cycles affecting investment returns

The early 1900s was a period of significant market volatility, characterized by frequent and dramatic shifts in economic cycles. This era saw the global economy grapple with the aftermath of the late 19th-century industrial boom, which had led to an overproduction of goods and a subsequent economic downturn. The early 1900s were marked by a series of economic cycles, each with its own unique impact on investment returns.

One of the most notable economic cycles during this period was the Great Depression, which began in 1929 and lasted for about a decade. This global economic crisis had a profound effect on investment strategies and returns. The stock market crash of 1929, often referred to as Black Tuesday, saw the value of stocks plummet, leading to widespread panic and a significant decline in investment values. This event highlighted the risks associated with market volatility and the potential for rapid and severe losses.

In the years leading up to the Great Depression, the market experienced a period of rapid growth and speculation, particularly in the United States. This era, often referred to as the Roaring Twenties, saw a surge in stock prices, fueled by easy credit and a sense of economic optimism. However, this speculative bubble eventually burst, leading to a sharp decline in stock prices and a subsequent economic downturn. Investors who had bought into this speculative market found themselves with substantial losses when the bubble popped.

The economic cycles of the early 1900s also included periods of recovery and growth. After the Great Depression, the world economy began to stabilize, and many countries embarked on a path of post-war reconstruction. This period saw a resurgence in investment, as governments and businesses sought to rebuild and expand. However, the market's volatility meant that investment returns were often unpredictable, and investors had to navigate through these cycles with careful consideration.

For investors, the early 1900s presented a challenging environment. The frequent economic cycles and market volatility meant that investment strategies had to be dynamic and adaptable. Long-term investors who could weather the storms of market cycles often found success, as they could take advantage of opportunities during periods of growth. However, short-term traders and speculators faced significant risks, as the market's volatility could lead to substantial losses. This era underscores the importance of a long-term investment perspective and the need for investors to carefully manage their risk exposure during volatile market conditions.

The Tech Investing Revolution: Unlocking a New Era of Opportunities

You may want to see also

Financial Innovation: Financial innovations, such as mutual funds, revolutionized investment strategies and accessibility

Financial innovation played a pivotal role in transforming the investment landscape during the 1900s, making it more accessible and diverse for investors. One of the most significant innovations was the introduction of mutual funds. Mutual funds, as we know them today, emerged as a structured investment vehicle in the early 20th century, allowing individuals to pool their money and invest in a diversified portfolio of assets. This concept revolutionized the way people approached investing, offering a more accessible and cost-effective way to participate in the financial markets.

Prior to mutual funds, investing was often limited to those with substantial wealth, as individuals typically had to invest directly in individual stocks or bonds. The high costs associated with buying and selling securities made it challenging for the average person to enter the market. Mutual funds changed this dynamic by providing a way for investors to gain exposure to a wide range of securities without the need to purchase each one individually. This democratization of investing enabled a broader segment of the population to participate in the financial markets, fostering a more inclusive investment culture.

The concept of mutual funds is based on the idea of collective investment, where multiple investors contribute their capital to a fund managed by a professional fund manager. This manager then invests the pooled money in various financial instruments, such as stocks, bonds, or other assets, on behalf of the fund's shareholders. By diversifying the portfolio, mutual funds aimed to reduce risk and provide more stable returns compared to investing in individual securities. This strategy not only made investing more accessible but also offered a level of professional management that many individual investors could not afford.

The 1900s saw the growth of mutual fund companies, which began to offer a wide array of funds catering to different investment goals and risk appetites. These funds could be categorized based on their investment objectives, such as growth, income, or a balanced approach. Investors could now choose funds that aligned with their financial goals, making it easier to navigate the complex world of investing. This level of customization and accessibility was a significant departure from the traditional investment methods of the past.

Furthermore, the introduction of mutual funds had a profound impact on investment strategies. Fund managers could employ various techniques to optimize returns, such as active management, where they actively selected securities to buy and sell, or passive management, which involved tracking a specific market index. These strategies allowed investors to benefit from professional expertise, further enhancing the appeal of mutual funds. As a result, the 1900s witnessed a surge in mutual fund popularity, leading to the establishment of numerous fund families and a more vibrant investment industry.

Annuity Advantage: Unlocking a Lifetime of Financial Freedom

You may want to see also

Frequently asked questions

In the early 1900s, investing was a more hands-on and less systematic process. Investors often relied on personal connections, industry knowledge, and gut feelings to make decisions. There was less access to financial data and research, and the stock market was less regulated, leading to higher risks and potential for fraud.

Yes, the 1900s witnessed several significant investment bubbles, such as the Roaring Twenties, where the stock market experienced a massive surge, fueled by speculative investing and easy credit. This era ended with the Wall Street Crash of 1929, a devastating market crash that had a profound impact on the global economy.

The 20th century saw the emergence of various financial innovations that transformed investing. For instance, the development of mutual funds and index funds in the 1920s and 1930s allowed investors to diversify their portfolios more easily. The invention of electronic trading systems in the late 20th century further revolutionized the industry, making trading faster and more accessible.

Absolutely. Government interventions and regulations played a crucial role in shaping the investment landscape. The Great Depression led to significant policy changes, including the establishment of the Securities and Exchange Commission (SEC) in 1934, which aimed to protect investors and maintain market integrity. These regulations continue to influence modern investment practices.

The 1900s produced several legendary investors and entrepreneurs. For example, John D. Rockefeller, who dominated the oil industry in the late 19th and early 20th centuries, became the first American worth over a billion dollars. Other notable figures include Andrew Carnegie, who built a vast business empire in steel, and J.P. Morgan, a prominent financier and banker. Their success stories continue to inspire and influence investors even today.