Coinbase is a secure online platform for buying, selling, transferring, and storing digital currency. It is important to report your Coinbase transactions on your taxes to avoid trouble with the IRS. Coinbase reports Form 1099-MISC for customers who have earned more than $600 of income through means such as staking and referrals. Even if you earn less than $600, you are still required to report your Coinbase transactions that are considered income on your tax return. From 2025, Coinbase will be required to report all capital gains and losses to the IRS through Form 1099-DA.

| Characteristics | Values |

|---|---|

| Do I have to report my investments on Coinbase? | Yes, you are responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms. |

| Does Coinbase report to the IRS? | Yes, Coinbase reports information to the IRS on Form 1099-MISC. |

| What is the threshold for reporting Coinbase transactions? | Coinbase will issue Form 1099-MISC if you earn $600 or more in a year. |

| What are the tax implications of selling cryptocurrency? | Selling cryptocurrency is generally a taxable event and may be subject to capital gains tax. |

| What are the tax implications of converting cryptocurrency? | Converting one cryptocurrency to another can trigger capital gains tax or income tax. |

| What are the tax implications of receiving cryptocurrency as a result of a fork or airdrop? | Receiving cryptocurrency from a fork or airdrop is generally taxable and may be subject to income tax. |

| What are the tax implications of earning rewards on Coinbase? | Earning rewards on Coinbase is generally taxable and may be reported as "miscellaneous income" or "other income" on Form 1099-MISC. |

| What are the tax implications of using cryptocurrency for purchases? | Using cryptocurrency for purchases, including with a Coinbase debit card, can trigger income tax. |

| Are there any non-taxable Coinbase transactions? | Buying and holding cryptocurrency, as well as transferring crypto between Coinbase and other exchanges or wallets, are generally not taxable events. |

What You'll Learn

Reporting Coinbase transactions to the IRS

Coinbase is a secure online platform for buying, selling, transferring, and storing digital currency. It is essential to understand your tax obligations when using Coinbase, as crypto income is subject to U.S. taxes. Here is a detailed guide on reporting Coinbase transactions to the IRS.

Not all activities involving cryptocurrency are taxable. Buying and holding cryptocurrency, or transferring it between Coinbase accounts and wallets, are generally not considered taxable events. However, several types of transactions on Coinbase are indeed taxable:

- Selling cryptocurrency for fiat currency (USD, EUR, GBP, etc.)

- Converting one type of cryptocurrency to another

- Receiving cryptocurrency through a fork or airdrop

- Earning rewards on your Coinbase account, such as staking rewards or referral bonuses

- Using cryptocurrency for purchases, including with a Coinbase debit card

Tax Forms and Reporting Requirements

Coinbase is required to report certain types of transactions to the IRS, and you, as the taxpayer, must also report these transactions on your tax return. The specific tax forms and requirements depend on the nature of your Coinbase transactions:

- Income Tax: Coinbase reports income earned through its platform on Form 1099-MISC to both the taxpayer and the IRS. This includes miscellaneous income such as staking rewards, interest rewards, and referral bonuses. If you receive more than $600 in income during the year, Coinbase will issue you a 1099-MISC form. Even if you earn less than $600, you must still report this income on your tax return.

- Capital Gains Tax: While Coinbase currently does not send tax forms detailing capital gains and losses to the IRS, this will change starting with the 2025 tax year. At that point, Coinbase will be required to issue Form 1099-DA, which specifically reports gains and losses from crypto-assets. Even before this change, you are responsible for reporting all capital gains and losses on your tax return.

Calculating and Reporting Taxes

To accurately calculate and report your Coinbase taxes, follow these steps:

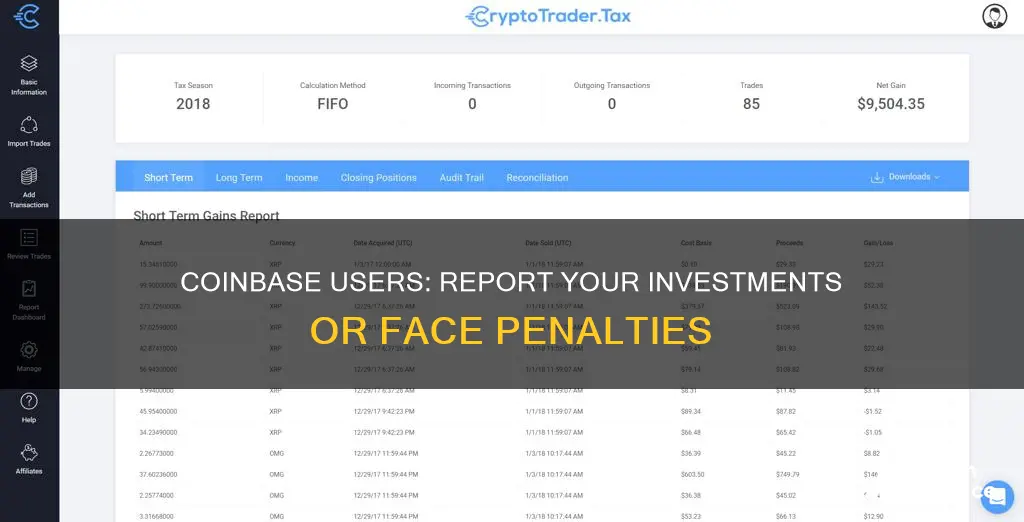

- Download Transaction History: Download your Coinbase transaction history as a CSV file from the Reports section of your account.

- Calculate Capital Gains and Losses: Use the detailed transaction history to calculate your capital gains and losses. You will need to record each sale or disposition on Form 8949. Consider using crypto tax software or consulting an experienced crypto CPA for assistance.

- Complete Schedule D: Use the totals from Form 8949 to complete Schedule D, which summarizes your capital gains and losses.

- Report Ordinary Income: Use Schedule C to report ordinary income, such as Coinbase Earn rewards, if you are self-employed. If you are not self-employed, report this income as 'Other Income' on Schedule 1.

Seeking Professional Guidance

Cryptocurrency taxes can be complex, especially if you have multiple trading accounts or engage in various crypto activities. Consider consulting a tax professional or using crypto tax software to ensure accurate and compliant reporting of your Coinbase transactions to the IRS.

Coins: Worth Investing or a Risky Business?

You may want to see also

Capital gains and income tax

In the US, crypto is considered a digital asset, and the IRS treats it like stocks, bonds, and other capital assets. As a result, the money you make from crypto is taxed at different rates, either as capital gains or as income, depending on how you acquired your crypto and how long you kept it.

Capital Gains

Crypto sales, conversions, payments, and income must all be reported to the IRS and state tax authorities, and each of these transactions has distinct tax implications. If you sell your crypto for more than you paid for it, you will owe taxes on your capital gains. The federal government taxes short-term and long-term gains differently. Long-term gains occur when you sell or dispose of your crypto after holding it for more than a year, and these are taxed at rates of 0%, 15%, or 20% (plus the NII for higher incomes). Short-term gains occur when you sell or dispose of your crypto after holding it for less than a year, and you will pay taxes on these at your ordinary income tax rate.

Income Tax

Crypto is taxed as income when it is received as payment for goods or services, or when it is received as income from mining, staking, or other incentives. This is taxed according to your income tax bracket.

BlackRock's Bitcoin Investment: Millions Poured In

You may want to see also

Coinbase tax forms

Coinbase issues tax forms to its customers and the Internal Revenue Service (IRS) in the United States. The type of form issued depends on the customer's income and activities on the platform. Here is an overview of the tax forms associated with Coinbase:

Form 1099-MISC

Coinbase currently issues Form 1099-MISC to customers who have earned $600 or more in income through staking, interest rewards, and Coinbase Learn and Earn rewards. This form is used to report 'miscellaneous' income to the IRS. If you meet the criteria, both you and the IRS will receive a copy of the form. It is important to note that Form 1099-MISC does not include relevant tax information about disposal events subject to capital gains tax, such as selling cryptocurrency for fiat currency.

Form 1099-B

Coinbase will issue Form 1099-B to customers who traded futures via Coinbase Finance Markets. This form is typically used by stockbrokers to report capital gains and losses from equities.

Form 1099-K

Coinbase stopped issuing Form 1099-K after 2020. This form showed gross transaction volume instead of total capital gains and losses, leading to confusion and the IRS sending warning letters to Coinbase customers.

Form 1099-DA

Starting in the 2025 tax year, Coinbase will be required to issue Form 1099-DA to report gains and losses from cryptocurrency and other digital assets. This form was specifically designed to report capital gains and losses from digital assets.

Gain/Loss Report

Coinbase provides all customers with a gain/loss report, which details every cryptocurrency disposal made on Coinbase that resulted in a capital gain or loss. This report includes transactions such as selling, spending, or converting crypto. It is important to note that the gain/loss report only includes transactions made using your Coinbase account and does not include activity from other platforms or Coinbase products like Coinbase Wallet, Coinbase Pro, or Coinbase Prime.

Raw Transaction Report

The raw transaction report lists the cost basis of all transactions without associated gains and losses. This report can be used to manually calculate gains and losses before filing taxes.

Other Forms

In addition to the forms mentioned above, there are other IRS forms that may be relevant to cryptocurrency transactions and taxes, such as Form 1040 (U.S. Individual Income Tax Return), Form 8949 (for reporting capital gains or losses), Schedule 1 (for reporting additional income and adjustments, including staking and mining income), and Schedule D (for summarizing capital gains and losses).

It is important to consult with a tax professional or specialist software to ensure accurate reporting of your Coinbase transactions and compliance with tax regulations.

Millennials: Is Bitcoin a Smart Investment?

You may want to see also

Taxable and non-taxable Coinbase transactions

Coinbase doesn't provide tax advice, but it's important to understand the tax implications of your Coinbase transactions. In general, crypto is considered a digital asset in the US, and the IRS treats it like stocks, bonds, and other capital assets. Your crypto transactions may be taxed as either income or capital gains, depending on the specifics of the transaction.

Non-taxable Coinbase transactions

The following are some examples of non-taxable events:

- Buying crypto with cash and holding it: Simply purchasing and owning crypto is not taxable. However, when you sell it, the gains are "realized," and you may owe taxes.

- Donating crypto to a qualified tax-exempt charity or non-profit: You may be able to claim a charitable deduction for this.

- Receiving a gift: If you receive crypto as a gift, you generally won't incur a tax until you sell it or engage in another taxable activity, such as staking.

- Giving a gift: You can gift up to $17,000 per recipient per year without paying taxes for 2023 and $18,000 per recipient for 2024.

- Transferring crypto to yourself: Moving crypto between your wallets or accounts is not taxable.

Taxable Coinbase transactions

On the other hand, here are some examples of taxable events:

- Selling crypto for cash: If you sell your crypto for more than you paid for it, you'll owe taxes on the capital gains.

- Converting one crypto to another: Converting one type of crypto to another is considered a sale by the IRS and is therefore taxable.

- Spending crypto on goods and services: Spending crypto is similar to selling it in the eyes of the IRS, and you'll likely owe capital gains taxes.

- Getting paid in crypto: If you receive crypto as compensation from an employer, it will be taxed according to your income tax bracket.

- Getting crypto in exchange for goods or services: If you accept crypto as payment, you must report it as income to the IRS.

- Mining crypto: Taxes on mined crypto are based on the fair market value of the coins at the time they were received. Crypto mined as a business is taxed as self-employment income.

- Earning staking rewards: Staking rewards are taxed similarly to mining proceeds, based on the fair market value of the rewards when received.

- Earning other income: Rewards earned from holding certain cryptocurrencies are considered taxable income.

- Getting crypto from a hard fork: Taxes on crypto acquired from a hard fork depend on how you use the asset and when it's available for withdrawal.

- Getting an airdrop: Receiving crypto through a marketing campaign or giveaway is taxable as income.

- Receiving other incentives or rewards: Any free crypto received, such as referral bonuses, must be reported as income.

Canada eCoin: A Smart Investment Move?

You may want to see also

How to report Coinbase on your taxes

If you have investments on Coinbase, you may need to report them on your taxes. Coinbase is a secure online platform for buying, selling, transferring, and storing digital currency. Cryptocurrency transactions on Coinbase may be subject to capital gains tax and income tax.

There are two types of crypto taxes: capital gains and income. Capital gains tax is a federal tax on the profits you made from selling certain assets. Income tax, on the other hand, is a federal tax on the money you earned.

Coinbase will issue a Form 1099-MISC to customers who have earned $600 or more in income through staking, interest rewards, and Coinbase Learn and Earn rewards. If you are a US customer who traded futures, you will receive a 1099-B form for this activity. Non-US customers will not receive any forms from Coinbase and must use their transaction history report to fulfil their local tax obligations.

If you receive a 1099-MISC form from Coinbase, you should report this and all of your other crypto-related income on your tax return. If you are self-employed, report your Coinbase income on Schedule C. If you are not self-employed, report your Coinbase income as 'Other income' on Schedule 1.

Even if you do not receive a tax form from Coinbase, you are still required to report all of your taxable income from cryptocurrency. Not reporting your income is considered tax evasion, which is a serious crime.

Easy Ways to Earn Bitcoins Without Investment

You may want to see also

Frequently asked questions

Yes, you are responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1.

Not all Coinbase users will receive tax forms, even if they have taxable activity. If you didn't receive Form 1099-MISC from Coinbase, you can follow these steps to file your Coinbase taxes:

- Download Transaction History: Download your Coinbase transaction history as a CSV file from the Reports section of your account.

- Calculate Capital Gains and Losses: Use the detailed transaction history from each crypto wallet and exchange to calculate capital gains.

- Complete Schedule D: Use the totals from Form 8949 to complete Schedule D.

Taxable crypto transactions on Coinbase include:

- Selling cryptocurrency for fiat (e.g. USD, EUR, GBP)

- Converting one cryptocurrency to another

- Receiving cryptocurrency as a result of a fork or airdrop

- Earning rewards on your Coinbase account

- Using cryptocurrency for purchases, including purchases made with a Coinbase debit card

The following Coinbase transactions are not taxable:

- Buying and holding cryptocurrency

- Transferring crypto between Coinbase and other exchanges or wallets

Income is taxed at your ordinary income tax rate, whereas capital gains are taxed as either long-term capital gains (LTCG) or short-term capital gains (STCG). The tax rate for LTCG depends on whether the taxpayer is in the highest or lowest tax bracket, with rates varying between 0%, 15%, or 20%.