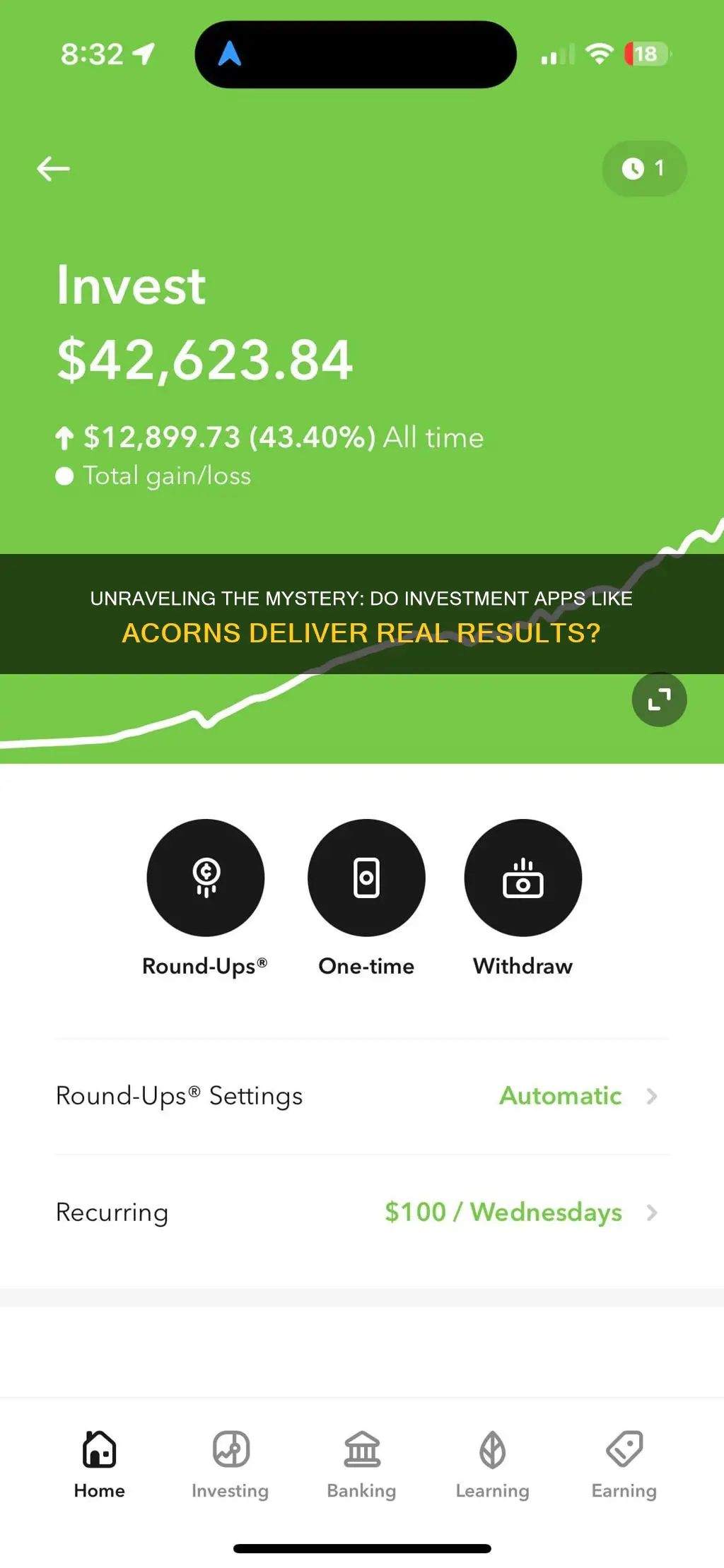

In today's digital age, investment apps have become increasingly popular, offering users a convenient way to invest in stocks, bonds, and other financial instruments. One such app is Acorns, which has gained traction for its automated investment and micro-investing features. However, as with any investment strategy, there are questions about the effectiveness and reliability of these apps. This paragraph aims to explore the functionality and performance of investment apps like Acorns, examining whether they truly deliver on their promises of helping individuals grow their wealth over time. By analyzing user experiences, market trends, and the underlying technology, we can determine if these apps are a viable option for those seeking to enter the world of investing.

What You'll Learn

- App Functionality: How do investment apps like Acorns execute financial transactions

- User Experience: What is the user experience like on these apps

- Security Measures: How secure are these apps in protecting user data

- Market Impact: Do these apps influence market trends and investment behavior

- Regulatory Compliance: Are these apps compliant with financial regulations

App Functionality: How do investment apps like Acorns execute financial transactions?

Investment apps like Acorns have gained popularity for their user-friendly approach to investing, allowing individuals to start building their financial portfolios with ease. These apps often utilize a strategy known as "round-up investing," where they round up the user's everyday purchases to the nearest dollar and invest the difference. For example, if a user spends $10.50 on coffee, the app would round this up to $11.00, and the extra 50 cents would be invested in a diversified portfolio of stocks and bonds. This method makes investing accessible to those who might not have large sums of money to invest initially.

The core functionality of these apps lies in their ability to automate the investment process, making it convenient and efficient. Users typically link their bank accounts or credit/debit cards to the app, which then tracks their spending and rounds up transactions accordingly. The invested amount is usually small, ranging from a few cents to a few dollars, depending on the purchase amount and the app's rounding rules. Over time, these small investments can accumulate, and the app may also offer the option to invest in specific stocks, ETFs, or mutual funds, providing users with more control over their investment strategy.

When it comes to executing financial transactions, investment apps employ a network of financial institutions and market makers to facilitate trades. When a user's purchase is rounded up, the app's backend system processes the transaction, ensuring that the investment is made at the best available market price at that moment. This process is often instantaneous, allowing users to benefit from market fluctuations without actively monitoring the markets. The app's algorithms are designed to minimize transaction costs and maximize the potential returns for users.

Additionally, these apps often provide educational resources and personalized financial advice to help users understand their investment choices. They may offer insights into different investment options, market trends, and financial planning strategies. By combining automated investing with educational tools, these platforms aim to empower individuals to take control of their financial future, even with small amounts of capital.

In summary, investment apps like Acorns simplify the process of investing by automating round-up transactions and providing a user-friendly interface. They execute financial transactions by rounding up everyday purchases and investing the difference, offering a low-cost entry point into the world of investing. With their accessibility, educational resources, and automated nature, these apps have the potential to help individuals build wealth over time, making investing a more democratic and achievable goal for a wide range of people.

Investing: What They Don't Tell You

You may want to see also

User Experience: What is the user experience like on these apps?

The user experience on investment apps like Acorns can vary significantly depending on individual preferences and financial goals. These apps are designed to make investing accessible and straightforward, often appealing to those who are new to the world of investing or prefer a more hands-off approach. Here's a breakdown of what users can expect:

Simplicity and Accessibility: One of the key features of these apps is their user-friendly interface, which simplifies the investment process. Users can typically set up an account quickly, often with just a few taps or clicks. The app guides you through the initial setup, allowing you to connect your bank account or card to facilitate transfers. This ease of access encourages users to start investing, even if they are unsure about the markets.

Automated Investing: Investment apps like Acorns often utilize a strategy known as "round-up investing" or "micro-investing." This means that for every purchase made using the app, the user can choose to invest the spare change or round up to the nearest dollar. For example, if you buy coffee for $4.50, the app might invest the 50 cents you didn't spend. This approach makes investing feel effortless and can be particularly appealing to those who struggle to set aside large sums of money for investments.

Educational Resources: Many of these apps provide educational content to help users understand the basics of investing. This can include articles, tutorials, and even video guides. Users can learn about different investment options, market trends, and how to manage their portfolios. The app might also offer personalized tips and recommendations based on your risk tolerance and financial objectives. This educational aspect empowers users to make informed decisions and adapt their strategies over time.

Portfolio Management: Users can track their investment portfolios in real-time, seeing how their money grows and the performance of their investments. The app provides a clear overview of holdings, allowing users to review their investments and make adjustments as needed. Some apps also offer the ability to set specific financial goals, such as saving for a house or retirement, and provide tailored investment plans to achieve those goals.

Community and Support: Some investment apps foster a sense of community among users, allowing them to connect and share their experiences. This can be a valuable feature for those seeking support and guidance. Additionally, customer support is usually readily available through in-app messaging or email, ensuring users can get assistance whenever needed.

In summary, investment apps like Acorns aim to democratize investing by making it accessible, simple, and tailored to individual needs. While the app's effectiveness may vary based on market conditions and individual financial situations, many users find these apps to be a convenient and educational tool for building their investment portfolios.

Mark Cuban's Current Investment Interests

You may want to see also

Security Measures: How secure are these apps in protecting user data?

The security of user data is a critical aspect when considering the use of investment apps, especially those that offer automated investment services like Acorns. These apps often handle sensitive financial information, and ensuring the protection of user data is essential to maintaining trust and avoiding potential fraud. Here's an overview of the security measures typically employed by such apps:

Encryption and Data Protection: Investment apps employ robust encryption protocols to secure user data. When users input their financial information, such as bank account details or investment preferences, the app encrypts this data using advanced algorithms. This encryption ensures that even if data is intercepted, it remains unreadable to unauthorized parties. The industry standard for encryption is often AES-256, which is considered highly secure and is used by many financial institutions.

Two-Factor Authentication (2FA): Adding an extra layer of security, 2FA is a common feature in these apps. Users are required to provide two different forms of identification to access their accounts. This could be a password or PIN combined with a unique code sent to the user's mobile device. 2FA significantly reduces the risk of unauthorized access, even if a user's password is compromised.

Secure Data Storage: User data is stored securely on servers that employ various security measures. These servers are often located in secure data centers with access controls, surveillance, and regular security audits. Data centers may also use encryption for data at rest, ensuring that even if a physical breach occurs, the data remains protected. Additionally, many apps utilize cloud storage, which offers robust security features and regular backups, ensuring data recovery in case of loss or corruption.

Fraud Detection and Monitoring: Investment apps invest in sophisticated fraud detection systems. These systems monitor user activities for any suspicious behavior, such as unusual login patterns or high-value transactions. Advanced machine learning algorithms can identify potential fraud in real-time, allowing the app to take immediate action, such as locking the account or alerting the user. Regular security audits and penetration testing are also conducted to identify and patch any vulnerabilities.

Compliance and Regulatory Standards: Reputable investment apps adhere to strict industry regulations and standards. They ensure compliance with data protection laws, such as GDPR or CCPA, depending on the region. These regulations mandate how user data should be handled, stored, and protected. Apps that meet these standards provide users with peace of mind, knowing their data is being managed securely and in compliance with legal requirements.

While investment apps like Acorns offer convenience and automated investment services, it is essential to understand the security measures in place to protect user data. The above-mentioned security practices ensure that user information remains confidential and secure, allowing individuals to invest with confidence. Users should also be encouraged to take personal responsibility by choosing strong passwords, regularly updating their security settings, and being vigilant about any potential security threats.

Retirement Investing: Should You Continue to Play the Long Game?

You may want to see also

Market Impact: Do these apps influence market trends and investment behavior?

The rise of investment apps has sparked a revolution in the financial industry, offering users convenient access to the markets and a plethora of investment options at their fingertips. Apps like Acorns, Robinhood, and others have gained immense popularity, especially among younger generations, for their ability to democratize investing and make it more accessible. But the question remains: do these apps truly influence market trends and investment behavior?

Firstly, it's important to understand the mechanics of these investment apps. They often utilize a "round-up" or "micro-investing" strategy, where users can round up their everyday purchases to the nearest dollar and invest the difference. This approach allows individuals to invest small amounts regularly, making it an attractive option for those who may not have large sums to invest. By doing so, these apps encourage a habit of investing, even if it's just a few cents or dollars at a time. This micro-investing strategy can potentially lead to a significant accumulation of wealth over time, as the power of compounding becomes evident.

The influence of these apps on market trends is an intriguing aspect to explore. With a large user base, these platforms can collectively impact market dynamics. For instance, when a significant number of users invest in a particular stock or asset, it can create a ripple effect, driving up demand and potentially influencing the asset's price. This phenomenon is often referred to as the "crowd effect," where the actions of a large group can shape market trends. Additionally, the ability of these apps to provide real-time market data and personalized investment advice can further enhance this impact, as users make informed decisions based on the information provided.

Moreover, the ease of use and accessibility offered by investment apps have the potential to attract new investors to the market. Traditional investing often requires a certain level of financial knowledge and a minimum amount of capital, which can deter many individuals. Investment apps, however, simplify the process, making it more inclusive. As a result, a broader range of people may enter the market, increasing overall trading activity and potentially influencing market trends. This influx of new investors can also contribute to the diversification of investment portfolios, which is a positive development for the market.

However, it is essential to approach the market impact of these apps with a critical eye. While they provide an excellent entry point for investing, the influence on market trends may not always be predictable or consistent. Market behavior is complex and influenced by numerous factors, and individual app users' actions might not always align with broader market forces. Additionally, the potential for herding behavior, where users follow trends set by others, could lead to market bubbles or corrections. Therefore, while investment apps have the power to influence market trends, it is a delicate balance, and further research and analysis are required to fully understand their long-term effects.

New Media Investment Group Merger: When Will It Be Finalized?

You may want to see also

Regulatory Compliance: Are these apps compliant with financial regulations?

The rise of investment apps like Acorns has sparked interest in automated investing, offering users a convenient way to start investing with small amounts of money. However, when it comes to regulatory compliance, it's crucial to understand the legal framework governing these apps to ensure they operate within the boundaries of the law.

Financial regulations are designed to protect investors and maintain the integrity of the financial markets. These regulations often require investment firms and platforms to adhere to strict rules, including transparency, disclosure, and the protection of client assets. Investment apps, especially those that provide automated investment services, must navigate these regulations to offer a legitimate and safe investing experience.

One key aspect of regulatory compliance is the registration and licensing of investment apps. In many jurisdictions, investment platforms are required to register with financial authorities and obtain the necessary licenses to operate legally. This ensures that the app meets specific standards and is subject to regular oversight. For instance, in the United States, investment apps might need to comply with regulations set by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations often include requirements for customer due diligence, anti-money laundering (AML) procedures, and the protection of client funds.

Additionally, investment apps should provide clear and comprehensive disclosures to their users. This includes transparent fee structures, potential risks associated with investments, and the app's investment strategies. Users have the right to know how their money is being managed and should be provided with all the necessary information to make informed decisions. Compliance with disclosure requirements ensures that investors are not misled and can make choices aligned with their financial goals.

Another critical factor is the security and protection of user data and funds. Investment apps must implement robust security measures to safeguard user information and assets. This includes encryption, two-factor authentication, and regular security audits. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union, is essential to ensure user privacy and prevent unauthorized access to sensitive financial data.

In summary, while investment apps like Acorns offer a convenient way to invest, it is essential to consider their regulatory compliance. Users should be aware of the legal framework governing these apps to ensure they operate within the boundaries of the law. By adhering to registration requirements, providing transparent disclosures, and implementing robust security measures, investment apps can offer a legitimate and safe investing experience while maintaining compliance with financial regulations.

Smart Strategies for Investing Your Child's Savings

You may want to see also

Frequently asked questions

Investment apps like Acorns are a type of financial technology (fintech) platform that aims to make investing more accessible and user-friendly. They typically operate by rounding up your everyday purchases to the nearest dollar and investing the spare change in a diversified portfolio of stocks, bonds, or other assets. This process is often referred to as "micro-investing" or "round-up investing." Acorns, for example, also offers features like automated savings, fractional shares, and the ability to invest in specific sectors or themes.

Yes, investment apps like Acorns are legitimate and can be a great way to start investing, especially for beginners or those who want a low-risk approach. These apps provide an easy and automated way to invest small amounts of money regularly, which can help individuals build a diversified portfolio over time. However, it's important to note that the returns may be modest compared to traditional investing methods, and the value of your investments can fluctuate.

While investment apps like Acorns can help you start building a financial portfolio and potentially earn some returns, it's unlikely that you'll make substantial profits solely through these platforms. The investment amounts are typically small, and the fees associated with micro-investing can add up over time. However, these apps can be a good starting point for beginners to learn about investing and gradually build their wealth.

The main risks associated with investment apps are related to the potential for market volatility and the limited control you have over your investments. Since these apps often invest in a diversified portfolio, the risk is generally lower compared to investing in individual stocks. However, market fluctuations can still impact the value of your investments. Additionally, some apps may charge fees for certain features or services, which can eat into your returns.

When selecting an investment app, consider your financial goals, risk tolerance, and the level of control you want over your investments. Research different apps and compare their features, fees, and investment options. Look for apps that offer educational resources and a user-friendly interface. It's also a good idea to start with a small amount of money and gradually increase your investments as you become more comfortable with the process.