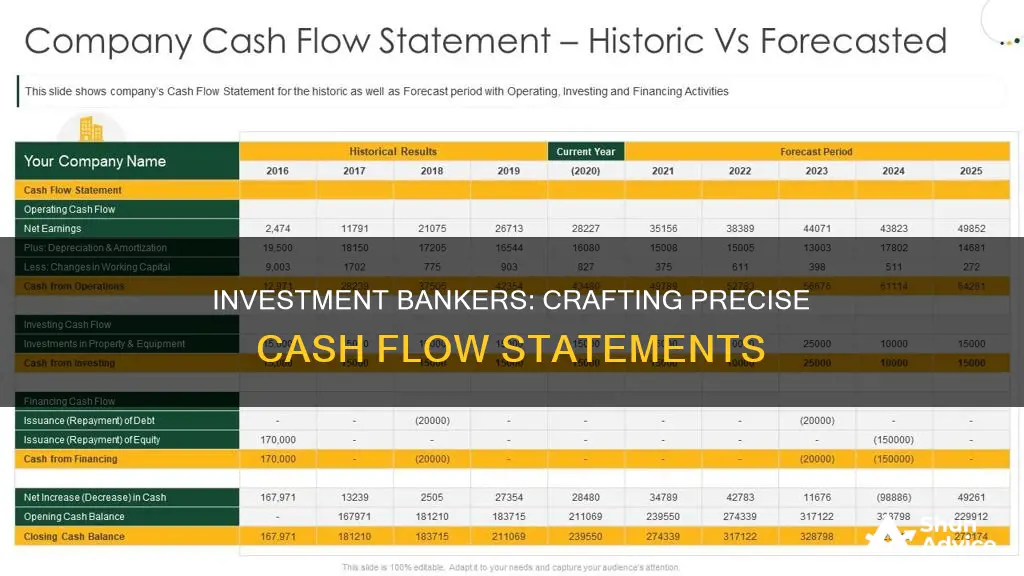

A cash flow statement is a financial report that details the inflow and outflow of cash and cash equivalents from a company over a specific period. It is one of the three main financial statements, the others being the balance sheet and the income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. It is an important tool for understanding a company's financial health, and it is used by investors, business owners, managers, and other stakeholders to make informed decisions. Investment bankers are likely to use cash flow statements to evaluate companies and advise their clients on investment decisions.

| Characteristics | Values |

|---|---|

| Purpose | To provide a detailed picture of what happened to a business’s cash during a specified period |

| Importance | One of the three fundamental financial statements; provides crucial financial data that informs organisational decision-making |

| Sections | Operating activities, investing activities, financing activities |

| Calculation methods | Direct method, indirect method |

What You'll Learn

- Cash flow statements provide a detailed picture of a business's cash flow during a specific period

- They are one of three fundamental financial statements used by financial leaders

- They are used to inform organisational decision-making, financial planning and investment strategies

- There are two common methods for calculating cash flow: the direct method and the indirect method

- Positive cash flow indicates a company has more money coming in than going out

Cash flow statements provide a detailed picture of a business's cash flow during a specific period

A cash flow statement provides a detailed picture of a business's cash flow during a specific period, usually a month, quarter, or year. It is one of the three fundamental financial statements used by financial leaders, alongside the income statement and balance sheet.

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. Operating activities refer to the cash flow generated from the company's regular goods or services, including revenue and expenses. Investing activities refer to the cash flow from purchasing or selling assets, such as physical or non-physical property. Financing activities refer to the cash flow from debt and equity financing, including raising cash and paying back debts to investors and creditors.

The cash flow statement is important because it provides insight into a company's liquidity and financial agility. It allows investors to understand if a company is generating enough cash from its core operations to sustain itself and make capital investments. It also helps business owners and managers to adjust strategies and make financial decisions.

There are two common methods for calculating and preparing the operating activities section of a cash flow statement: the direct method and the indirect method. The direct method involves listing all cash receipts and payments during the reporting period. The indirect method starts with net income and adjusts for changes in non-cash transactions, such as depreciation and amortization.

Supplies: Investing or Operating Cash?

You may want to see also

They are one of three fundamental financial statements used by financial leaders

A cash flow statement is one of the three fundamental financial statements used by financial leaders to gain crucial insights into a company's financial health and operational efficiency. It complements the other two statements, the balance sheet and the income statement, by tracking the inflow and outflow of cash. This statement is particularly useful for investors as it helps them assess whether a company is on solid financial ground and make more informed decisions about their investments.

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. Operating activities refer to the principal revenue-generating activities of a company, including cash flow from sales, purchases, and other expenses. Investing activities involve the acquisition and disposal of non-current assets and other investments, excluding cash equivalents. Financing activities result from changes in a company's capital structure, including borrowing and repaying loans, issuing and buying back shares, and dividend payments.

The cash flow statement is important because it provides a detailed picture of a company's cash position during a specific period. It helps determine a company's ability to operate in the short and long term, its liquidity, and its ability to meet debt obligations and fund operating expenses. It is also a valuable tool for business owners, managers, and stakeholders to understand their company's value, guide financial decision-making, and contribute to its future success.

There are two common methods for calculating and preparing the operating activities section of a cash flow statement: the direct method and the indirect method. The direct method involves listing all cash receipts and payments during the reporting period, while the indirect method starts with net income and adjusts for changes in non-cash transactions. Both methods are accepted by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Cash Investments: What Are They?

You may want to see also

They are used to inform organisational decision-making, financial planning and investment strategies

Cash flow statements are used to inform and guide organisational decision-making, financial planning, and investment strategies. They are one of the three fundamental financial statements used by financial leaders, alongside income statements and balance sheets. These statements provide crucial financial data and insights into a company's financial health, operations, and value.

A cash flow statement is a financial report that details the inflow and outflow of cash within an organisation over a specific period, usually a month, quarter, or year. It is broken down into three sections: operating activities, investing activities, and financing activities. Operating activities refer to the cash flow generated from the delivery of regular goods or services, including revenue and expenses. Investing activities cover cash flow related to the buying and selling of assets, such as property or equipment, using free cash rather than debt. Financing activities involve cash flow from debt and equity financing, including raising cash and paying back debts to investors and creditors.

Analysing a cash flow statement can help answer key business questions, such as whether the company is generating enough cash from its core operations to sustain itself, if capital investments align with available cash, and if the financial strategy is effective in the long term. This information is valuable for investors, creditors, and company stakeholders when making financial decisions and investments.

The cash flow statement also plays a crucial role in understanding a company's liquidity and operational efficiency, which are vital for day-to-day operations and strategic planning. It provides insights into the company's ability to manage its cash, including how cash is generated, reinvested, and allocated. This information is essential for evaluating a company's liquidity, financial agility, and overall financial health.

Additionally, cash flow statements are important for financial analysis and planning. They show the liquidity position, changes in assets, liabilities, and equity, and help predict future cash flows. This information is crucial for long-term business planning and securing loans or lines of credit.

Securities Trading: Part of Investing Cash Flow?

You may want to see also

There are two common methods for calculating cash flow: the direct method and the indirect method

The direct method is one of two accounting treatments used to generate a cash flow statement. It uses actual cash inflows and outflows from the company's operations, instead of modifying the operating section from accrual accounting to a cash basis. The direct method measures only the cash that's been received, typically from customers, and the cash payments or outflows, such as to suppliers. The inflows and outflows are then netted to arrive at the cash flow. This method is also known as the income statement method.

The indirect method is the other accounting approach used to create a cash flow statement. It uses increases and decreases in balance sheet line items to modify the operating section of the cash flow statement from the accrual method to the cash method of accounting. The indirect method starts with net income and then removes non-cash items, non-operational gains, and losses to calculate cash flow from operating activities. Adjustments are made for changes in connector accounts to convert accrual accounting figures to cash balances.

The direct method is more time-consuming and complex as it requires listing all cash disbursements and receipts. On the other hand, the indirect method is simpler to prepare as most companies keep their records on an accrual basis. The indirect method is also commonly used, especially by larger firms, due to its ease of use and direct connection to the balance sheet.

While both methods have their advantages and disadvantages, the Financial Accounting Standards Board (FASB) prefers that companies use the direct method because it offers a clearer picture of cash flows in and out of a business. However, the indirect method is widely preferred, and the FASB recommends a reconciliation of the cash flow statement to the balance sheet when the direct method is used.

General Partners: Cash Investment Strategies and Decisions

You may want to see also

Positive cash flow indicates a company has more money coming in than going out

Positive cash flow is an indicator of a company's financial health. It means that a company has more money coming in than going out, and that its liquid assets are increasing. This enables the company to cover its obligations, reinvest in its business, return money to shareholders, pay expenses, and maintain a buffer against future financial challenges.

Positive cash flow is calculated by taking the total cash inflow and subtracting the total cash outflow. It is usually calculated over a specific period, such as a month, quarter, or year.

A company's cash flow statement is one of its three key financial statements, alongside the income statement and balance sheet. The cash flow statement details the sources and usage of cash, acting as a checkbook to reconcile the balance sheet and income statement. It is particularly useful for investors, who can use it to determine whether a company is on solid financial ground and make better, more informed decisions about their investments.

The three sections of a cash flow statement are:

- Operating activities: This includes cash flow associated with sales, purchases, and other expenses.

- Investing activities: This includes cash flow associated with buying or selling property, equipment, and other financial assets.

- Financing activities: This includes cash flow associated with borrowing and repaying loans, issuing and buying back shares, and dividend payments.

The cash flow statement is a valuable tool for understanding a company's financial health and making strategic decisions.

Cash Investments: Revenue or Not?

You may want to see also