Investment banking is a highly demanding profession, often associated with long hours and intense work cultures. The stereotype of investment bankers working 100-hour weeks has become a common perception, but is it an accurate reflection of reality? This paragraph aims to explore the truth behind the long hours, examining the factors that contribute to the demanding nature of investment banking and the varying work cultures within the industry. It will delve into the reasons why some investment bankers may work such extended hours, including the high-pressure environment, the need for quick decision-making, and the competitive nature of the job market. Additionally, it will highlight the potential consequences and benefits of such work patterns, as well as the efforts being made to address the issue of excessive working hours and promote a healthier work-life balance.

| Characteristics | Values |

|---|---|

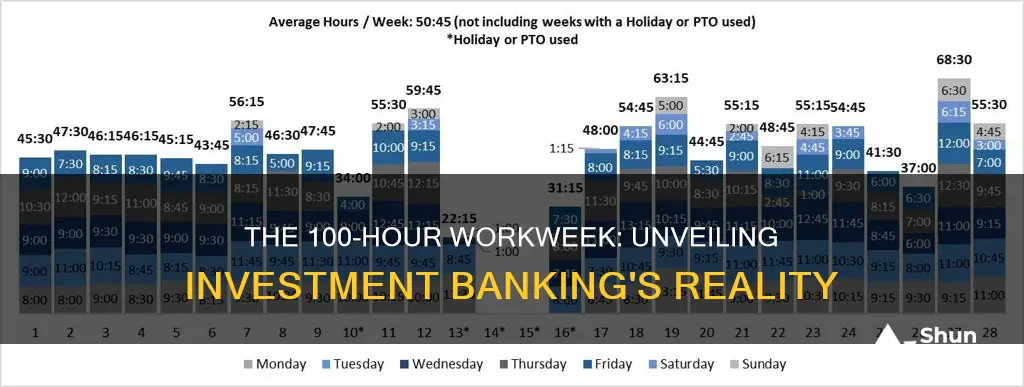

| Typical Work Hours | 60-80 hours per week, often more |

| Overtime | Common, with no clear end time |

| Stress Level | High, due to long hours and demanding clients |

| Salary | Competitive, but may not match the workload |

| Job Security | Can be challenging due to the industry's volatility |

| Work-Life Balance | Poor, with limited time for personal activities |

| Physical and Mental Health | Prone to burnout and health issues |

| Education and Skills | Requires advanced degrees and specialized skills |

| Career Progression | Fast-paced, with rapid advancement opportunities |

| Client Interaction | Frequent and demanding, requiring strong communication skills |

What You'll Learn

- Work-Life Balance: Investment bankers often face high-pressure environments, leading to long hours

- Compensation and Benefits: High earnings can justify extended workweeks, but benefits vary

- Industry Culture: Competitive and fast-paced, this culture encourages long hours

- Job Security: High demand and specialized skills can lead to extended work hours

- Personal Well-being: Long hours can impact health, requiring self-care strategies

Work-Life Balance: Investment bankers often face high-pressure environments, leading to long hours

The demanding nature of investment banking has long been a topic of discussion, with many wondering if the profession truly demands a 100-hour workweek. While it is true that investment bankers often find themselves in high-pressure environments, the reality is that the long hours are not a requirement but rather a consequence of the industry's culture and expectations.

In the fast-paced world of finance, investment bankers are often expected to be available around the clock, ready to respond to urgent client needs or market shifts. This culture of always being 'on' can lead to a sense of urgency and a fear of missing out, causing individuals to work extended hours. However, it is essential to recognize that this is not an inherent part of the job but rather a choice that can be made. Many investment bankers strive for a healthier work-life balance and actively manage their time to avoid burnout.

Long hours can have significant implications for an individual's well-being. The high-pressure environment may lead to increased stress, fatigue, and a higher risk of physical and mental health issues. It can also impact personal relationships and social life, as time spent with family and friends may be limited. Achieving a better work-life balance is crucial for long-term career satisfaction and overall happiness.

To address this challenge, investment bankers can adopt several strategies. Firstly, setting clear boundaries and communicating them to colleagues is essential. This may involve establishing specific work hours and ensuring that personal time is respected. Secondly, time management techniques can be employed to prioritize tasks and allocate time efficiently. Prioritizing self-care and making time for personal activities can also help reduce stress and improve overall well-being.

Additionally, firms can play a role in promoting a healthier work environment. Encouraging a culture that values productivity over sheer hours worked can be beneficial. Implementing policies that support flexible work arrangements and providing resources for employee well-being can contribute to a more sustainable and balanced approach to investment banking. By recognizing the potential drawbacks of long hours and taking proactive steps, investment bankers can strive for a more fulfilling and sustainable career path.

Unemployed and Unretired: Navigating Investment Strategies for a Secure Future

You may want to see also

Compensation and Benefits: High earnings can justify extended workweeks, but benefits vary

The demanding nature of investment banking often leads to long work hours, with many professionals regularly working upwards of 100 hours per week. This high-pressure environment is often fueled by the desire to meet deadlines, secure lucrative deals, and maintain a competitive edge in the market. While the intense workweeks can be challenging, the substantial compensation and benefits package that investment bankers often receive can justify the extended hours.

Compensation in the investment banking sector is renowned for being lucrative, with base salaries and bonuses being significant factors in attracting top talent. Base salaries, while varying depending on experience, level, and firm, are generally competitive and can reach impressive figures. For instance, entry-level analysts might earn upwards of $100,000 annually, while more senior positions, such as vice presidents or directors, can command salaries exceeding $500,000. Bonuses, which are often a substantial portion of the total compensation, can further boost earnings, with some years' bonuses reaching or even exceeding the base salary.

In addition to competitive salaries, investment bankers also enjoy a range of benefits that can significantly enhance their overall financial well-being. These benefits often include comprehensive health insurance packages, retirement plans with generous employer contributions, and stock options or grants, which can provide long-term financial gains. For instance, many investment banks offer health insurance plans that cover a wide range of medical expenses, including mental health services, which are increasingly important in high-pressure careers. Retirement plans often include 401(k) matches, where the employer contributes a percentage of the employee's salary, further securing the individual's financial future.

However, it's important to note that the benefits can vary significantly depending on the firm, location, and individual role. Some banks may offer more comprehensive benefits packages, while others might focus on different aspects, such as flexible work arrangements or additional vacation days. For instance, certain firms may provide extensive parental leave, recognizing the importance of work-life balance and family responsibilities. Additionally, the availability of benefits can differ by region, with some countries offering more generous packages due to labor laws and cultural norms.

Despite the high earnings and attractive benefits, the extended workweeks and high-pressure environment can take a toll on an individual's well-being. It is crucial for investment bankers to maintain a healthy work-life balance to avoid burnout and maintain productivity. Many banks are now recognizing this and implementing initiatives to support employee well-being, such as flexible work arrangements, wellness programs, and mental health support.

Pooling Funds for Apartment Complex Investments

You may want to see also

Industry Culture: Competitive and fast-paced, this culture encourages long hours

The investment banking industry is renowned for its intense and demanding culture, often characterized by a highly competitive and fast-paced environment. This culture has become a defining feature of the profession, with long working hours being a common expectation. The pressure to excel and meet demanding client needs can lead to a work ethic that frequently extends beyond the standard 40-hour workweek.

In this industry, success is often measured by the ability to consistently deliver high-quality work under tight deadlines. Investment bankers are expected to be responsive, proactive, and available at all hours, especially during deal-making processes or when managing critical client relationships. This often results in a culture where putting in extra hours is not only accepted but also seen as a sign of dedication and commitment.

The competitive nature of the job market further reinforces this culture. With limited opportunities and a high number of applicants for each position, investment bankers often feel the need to stand out by demonstrating their willingness to work long hours. This can create a cycle where individuals feel pressured to maintain a certain level of productivity, leading to a lifestyle that may not be sustainable in the long term.

The fast-paced nature of the job also contributes to the long hours. Investment banking involves constant learning and adapting to market changes, new regulations, and evolving client needs. This dynamic environment demands a high level of focus and dedication, often requiring bankers to stay late or work through the weekend to keep up with the pace.

However, it is important to note that this industry culture has its drawbacks. The constant pressure and long hours can lead to burnout, affecting both physical and mental health. It can also impact personal relationships and overall well-being. As such, it is crucial for individuals in this field to maintain a healthy work-life balance and prioritize self-care to ensure long-term success and sustainability in their careers.

Savings and Investments: Economic Growth Engines

You may want to see also

Job Security: High demand and specialized skills can lead to extended work hours

The high-pressure environment in the investment banking sector often results in extended work hours for professionals in this field. Job security is a significant factor that contributes to this demanding work culture. Investment banking is a highly specialized and niche industry, and the demand for skilled professionals is consistently high. As a result, investment bankers often find themselves in high-pressure situations, requiring them to work long hours to meet deadlines, manage client expectations, and deliver results.

The nature of investment banking involves handling complex financial transactions, providing advisory services, and offering strategic solutions to clients. These tasks demand a deep understanding of financial markets, economic trends, and industry-specific knowledge. Investment bankers with specialized skills and expertise are often sought after by clients, making them indispensable in the industry. However, this high demand can lead to a culture of long work hours as professionals strive to deliver their best work and maintain their competitive edge.

Extended work hours are often a result of the fast-paced and dynamic nature of the job. Investment bankers frequently juggle multiple projects simultaneously, each with its own tight deadlines. They must manage client relationships, conduct research, analyze data, and prepare comprehensive reports or proposals. The pressure to deliver high-quality work promptly can lead to a culture of working late into the night or even over the weekend. This is especially true during busy periods, such as initial public offerings (IPOs), mergers and acquisitions (M&A) deals, or when dealing with time-sensitive market opportunities.

Moreover, the competitive landscape in investment banking further exacerbates the issue of long work hours. Investment banks often operate in a global market, and the industry is highly competitive. Professionals who can deliver exceptional results consistently are more likely to advance their careers and secure lucrative opportunities. This competitive nature drives investment bankers to work tirelessly to showcase their skills and maintain their reputation. As a result, extended work hours become a common practice to ensure that individuals stay ahead of the curve and meet the expectations of both clients and employers.

While the high demand and specialized skills of investment bankers contribute to job security, it is essential to maintain a healthy work-life balance. Prolonged periods of extended work hours can lead to burnout, decreased productivity, and potential health issues. Investment banks are increasingly recognizing the importance of employee well-being and are implementing initiatives to promote a healthier work environment. These measures include flexible work arrangements, wellness programs, and regular performance reviews to ensure that professionals can manage their workload effectively while maintaining a sustainable career path.

Invest or Repay Debt: The Smart Money Move

You may want to see also

Personal Well-being: Long hours can impact health, requiring self-care strategies

The demanding nature of investment banking often leads to long work hours, which can significantly impact personal well-being. While the industry is renowned for its high-pressure environment and intense deadlines, the physical and mental toll of such a lifestyle should not be overlooked. Investment bankers often find themselves working late into the night, with weekends frequently spent on projects and deals. This relentless work schedule can lead to chronic fatigue, increased stress levels, and a higher risk of burnout.

One of the most immediate effects of long hours is the disruption of sleep patterns. Sleep deprivation is a common issue among investment bankers, as late-night work sessions and early mornings can quickly throw off their natural sleep cycles. Over time, this can lead to a host of health problems, including impaired cognitive function, reduced productivity, and a weakened immune system. To combat this, it is essential to prioritize sleep hygiene. Establishing a consistent sleep schedule, creating a relaxing bedtime routine, and ensuring the workspace is comfortable and conducive to rest can all help improve sleep quality.

Maintaining a healthy diet is another crucial aspect of self-care for investment bankers. The fast-paced nature of the job often leads to frequent meals on the go, which can result in poor nutrition choices. Long hours may also reduce the time available for cooking and healthy meal preparation. However, making conscious efforts to eat nutritious meals can significantly impact energy levels and overall health. Investment bankers should aim for a balanced diet rich in fruits, vegetables, whole grains, and lean proteins. Packing healthy snacks and meals, even when on the move, can ensure that nutritional needs are met despite the demanding schedule.

Exercise is a vital component of personal well-being that often takes a backseat during long work hours. Physical activity is essential for managing stress, improving mood, and maintaining overall health. Even a short, intense workout or a brisk walk during lunch breaks can provide a much-needed energy boost and help clear the mind. Investment bankers should make a conscious effort to incorporate exercise into their daily routines, whether it's joining a gym, practicing yoga, or simply taking the stairs instead of the elevator.

Lastly, setting boundaries and practicing time management are essential skills for investment bankers to master. Learning to prioritize tasks and delegate when possible can help reduce the burden of long hours. It is also crucial to learn when to say no to additional work, especially if it interferes with personal commitments or well-being. By setting clear boundaries, investment bankers can ensure they are not only productive but also able to maintain a healthy work-life balance. This may involve learning to delegate tasks, saying no to non-essential work, and setting aside dedicated time for personal activities and hobbies.

How Investments Affect Long-Term Savings Goals

You may want to see also

Frequently asked questions

While it is not uncommon for investment bankers to work long hours, especially in the initial stages of their careers or during busy periods, the typical workweek is generally less extreme. The industry is known for its demanding nature, and many professionals aim to maintain a healthy work-life balance. However, the exact hours can vary depending on the role, seniority, and the specific deals or projects they are working on.

The sustainability of working 100-hour weeks is a concern for many, as it can lead to burnout and health issues. Investment banking firms are increasingly recognizing the importance of employee well-being and are implementing measures to promote a healthier work environment. These may include flexible work arrangements, wellness programs, and initiatives to encourage a better work-life balance.

Effective time management is crucial for investment bankers to maintain a healthy workload. This includes setting clear priorities, delegating tasks when possible, and utilizing efficient workflows. Many professionals also adopt a results-oriented approach, focusing on delivering high-quality work rather than solely on the number of hours worked. Additionally, networking and building relationships can help streamline processes and reduce the need for excessive hours.

Working long hours can have its advantages, such as increased productivity, better access to clients and resources, and the opportunity to take on more significant responsibilities. However, it is essential to strike a balance. Investment bankers who can manage their time effectively and maintain a healthy lifestyle tend to be more successful and satisfied in their careers. This may involve setting personal boundaries, taking regular breaks, and making time for personal activities and hobbies.