When it comes to buying a home, it's important to understand the difference between mortgage pre-qualification and pre-approval. Pre-qualification is a preliminary step to estimate the size of the mortgage you could get, while pre-approval is a more detailed look at your finances and a conditional commitment from the lender to offer you a loan. Although a pre-approval letter indicates that the lender has evaluated your financial profile and creditworthiness, it is not a guarantee of final loan approval. The lender still needs to consider the property, approve the terms, and review the documentation. Buyers should be aware that there is still some uncertainty in the mortgage process, and unexpected issues can arise. Therefore, it is essential to carefully review all the terms and conditions and seek financial advice when considering a mortgage.

| Characteristics | Values |

|---|---|

| Pre-qualification | A preliminary step to determine the size of a mortgage you could get |

| Pre-approval | A more thorough evaluation of your finances than pre-qualification |

| Pre-approval letter | An offer (but not a commitment) to lend you a specific amount, good for 90 days |

| Pre-approval certificate | Lets you know the maximum amount you can pay for your future home |

| Final approval | One of the last steps before closing your mortgage |

What You'll Learn

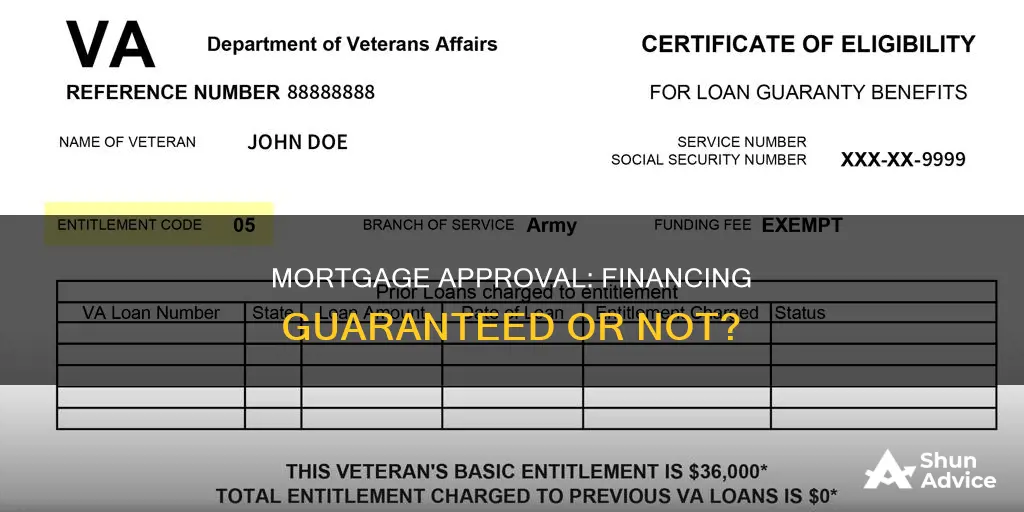

Pre-approval does not guarantee financing

Pre-approval is an important step in the mortgage process, but it is not a guarantee of financing. It is a conditional commitment from a lender, indicating that you are a serious buyer, but it is not a promise of a loan. A pre-approval letter outlines the maximum loan amount and estimated interest rate, based on an evaluation of your finances and creditworthiness. However, it is subject to the lender's final approval, which considers the property and terms in detail.

While pre-approval strengthens your position as a buyer, it does not ensure you will receive the loan. Lenders conduct a hard credit inquiry and assess your financial situation, including income, assets, debts, and credit history. Despite this thorough process, pre-approval does not guarantee financing because the lender's final decision considers the specific property and loan terms.

The pre-approval process provides an estimate of your borrowing capacity and indicates that you are a credible buyer. It is a valuable step, especially in a competitive market, as it increases your chances of having your offer selected. However, it is not a binding commitment from the lender. The final approval depends on various factors, including the property's financial appraisal, ensuring the property value aligns with the loan amount.

Additionally, pre-approval is typically valid for a limited period, often 60 to 90 days, and your financial situation at the time of pre-approval. If your circumstances change, such as income fluctuations or market shifts, the pre-approval may no longer be valid. It is essential to maintain financial stability and work closely with your lender to address any concerns that may impact your ability to secure financing.

Although pre-approval does not guarantee financing, it is a crucial step in the mortgage process. It provides valuable information about your borrowing capacity and enhances your credibility as a buyer. By understanding the limitations of pre-approval, you can manage your expectations and take the necessary steps to increase your chances of securing the financing you need to purchase your dream home.

Mortgage and Medical Bills: What's the Connection?

You may want to see also

Pre-approval is a conditional commitment

A pre-approval letter indicates that the company has taken the time to look into your financial profile as a mortgage candidate. It is based on assumptions and is not a guaranteed loan offer. It lets the seller know that you are likely to be able to get financing. Sellers frequently require a pre-approval letter before accepting your offer on a house.

The pre-approval considers your personal creditworthiness and borrowing capacity. It is a good idea to limit your home search to houses priced at an amount you can comfortably afford. It is also important to understand that pre-approval reflects your financial position at the time you obtained it. If your situation changes, your pre-approval may no longer be valid.

A pre-approval letter is not a guarantee that you’ll get a mortgage. The lender now needs to consider the property itself, approve all the terms and review the documentation before you transition from pre-approved to approved. The property you wish to buy has likely also been financially appraised to ensure that the property value aligns with the loan amount.

Cosigner Impact: Mortgage Approval and Beyond

You may want to see also

Pre-approval is based on a financial snapshot

Pre-approval is a conditional commitment from a lender to offer a loan of a specific balance, interest rate, and other criteria. It is based on a financial snapshot of the borrower at the time of the application. The lender will consider the borrower's income, assets, debts, and credit record. They will also perform a hard credit check, which involves requesting a copy of the borrower's credit report from one of the three major credit bureaus. This can have a small negative impact on the borrower's credit score.

The borrower will need to supply documentation such as pay stubs, W-2 statements, and signed tax documents from previous years. The pre-approval process can take a week or longer, depending on the lender. The pre-approval letter will include the maximum loan amount, the estimated interest rate, and an expiration date for the terms of the pre-approval.

While pre-approval gives an indication of the borrower's financial position, it is not a guarantee of final approval. The lender will still need to consider the property itself and review the documentation before granting final approval. There is a risk that the borrower's financial situation could change between pre-approval and final approval, which could affect their ability to secure a mortgage.

It is important for borrowers to understand that pre-approval is not a commitment to lend and that final approval is subject to the lender's review of the property and documentation. Borrowers should also be aware of the potential impact of the hard credit check on their credit score.

Mechanics Lien vs Mortgage: Who Takes Priority?

You may want to see also

Pre-approval is a competitive advantage

A mortgage pre-approval is a conditional commitment from a lender to offer you a loan of a specific amount. It is a more thorough evaluation of your finances than pre-qualification and can take more time. It is a competitive advantage as it lets the seller know that you are a serious buyer and that you can likely secure a mortgage. This makes it more likely that your offer on a home will be accepted.

The pre-approval process involves a hard credit check and a review of your financial documentation, such as proof of employment, income tax returns, and assets. The lender will determine your creditworthiness and relay the maximum loan amount you can borrow in the pre-approval letter. This letter is valid for a certain period, typically 60 to 90 days, and is not a guarantee of the final loan amount. It is based on your financial position at the time of pre-approval, and any changes to your circumstances may impact its validity.

Pre-approval is an important step when you are ready to make an offer on a home. It demonstrates to sellers that you are a qualified buyer and can secure financing, which is especially beneficial in a competitive market. By getting pre-approved, you can increase your chances of having your offer selected and move closer to finalizing your mortgage.

While pre-approval provides an estimate of your borrowing capacity, it is not a guarantee of mortgage approval. The lender still needs to consider the property itself, approve all the terms, and review the documentation before transitioning from pre-approved to approved. Therefore, it is essential to understand the factors that could impact your mortgage approval and work with your lender to address any potential issues.

Federal Liens: Superior to Mortgages in New York State?

You may want to see also

Pre-approval is not a guarantee of the final loan amount

A mortgage pre-approval is a conditional commitment from a lender to offer a loan of a specific amount. It is not a guarantee of the final loan amount. While it is an important step in the home-buying process, it is subject to certain factors and changes in your financial situation.

Firstly, a pre-approval is based on assumptions made by the lender about your financial profile. Lenders will conduct a hard credit check and review your income, assets, debts, and credit record. However, they may not uncover all relevant information during this process, and new details may emerge during the full underwriting process that could change the loan amount they are willing to offer. For example, if your debt-to-income ratio is too high, you may be considered a risky candidate, and the lender may reduce the loan amount or deny the loan altogether.

Secondly, a pre-approval reflects your financial position at the time it is obtained. If your financial circumstances change, such as a loss of income or an increase in debt, your pre-approval may no longer be valid. It is important to maintain financial stability and consistency throughout the home-buying process to ensure that your pre-approval remains accurate.

Additionally, a pre-approval does not consider the property itself. Once you have found a property you wish to purchase, the lender will need to approve all the terms and review the documentation related to the property. They will financially appraise the property to ensure that the value aligns with the loan amount. If the property's value is lower than expected, it could impact the final loan amount offered.

Furthermore, pre-approval offers usually have an expiration date, typically between 30 and 90 days. If you do not find a home or finalise your purchase within this timeframe, your pre-approval may expire, and the lender may reassess your financial situation, resulting in a different loan amount.

Lastly, it is important to understand that pre-approval is not a commitment to lend you the exact amount specified. Lenders are not obligated to provide you with the pre-approved loan amount, and they may adjust the terms based on various factors. While pre-approval increases your credibility as a buyer, it does not guarantee the final loan amount you will receive.

HOA Lien Foreclosure: Can It Wipe Out Your Mortgage?

You may want to see also

Frequently asked questions

Pre-qualification is a preliminary step to determine the size of a mortgage you could get. It is based on self-reported data and is a rough estimate of the mortgage size you could qualify for. Pre-approval, on the other hand, is a more thorough evaluation of your finances and signals what a lender can offer you, though it isn't a guarantee.

A mortgage pre-approval certificate, also known as a pre-approval letter, indicates that a lender has conducted a hard credit check and evaluated your finances to determine your creditworthiness. It is not a guarantee of financing but lets the seller know that you are likely to secure a loan.

Getting pre-approved gives you a competitive edge when making an offer on a house, especially in a hot market. It shows sellers that you are a serious buyer and can increase your chances of having your offer selected. It also helps you establish a budget and stick to your home price target.

After receiving pre-approval, you will need to undergo a full credit application and financial review once you have found a home you wish to purchase. The lender will consider the property itself, approve all the terms, and review the documentation before you transition from pre-approved to approved.