The age-old question of whether to rent or buy is a complex one, with many factors to consider. While buying a home is typically a long-term investment, it can be more expensive than renting on a monthly basis. This is largely due to the upfront costs associated with purchasing a property, such as a down payment, closing costs, and inspection fees. However, in some cities, the average monthly mortgage is cheaper than the average monthly rent, and over time, rents increase while mortgages remain fixed. Additionally, owning a home provides more freedom over your space and offers financial stability once the mortgage is paid off. On the other hand, renting offers flexibility and convenience, as the landlord is responsible for maintenance and repairs.

| Characteristics | Values |

|---|---|

| Cost of mortgage vs. rent | In 2023, the median monthly cost for homeowners with a mortgage in the US was $1,149, while the median rent cost was $747. |

| Maintenance costs | Rent includes maintenance costs, which are the responsibility of the landlord. For homeowners, maintenance and insurance costs are additional expenses on top of the mortgage payment. |

| Down payment | Homebuyers typically need to pay a substantial down payment upfront, which can be as low as 3.5% but is more commonly around 10-20% of the property value. |

| Flexibility | Renting offers more flexibility as there is no long-term commitment, while buying a home is typically a long-term investment. |

| Freedom | Renters have less freedom to modify their living space and may need landlord approval for basic maintenance, remodeling, or painting. Homeowners have more freedom to make modifications as long as they comply with laws and HOA rules. |

| Investment | Owning a home is an investment that can pay off in the long run, as the value of the house can increase over time, leading to a potential payout when sold. |

| Financial security | Renting is generally more affordable upfront, with lower security deposits or broker's fees, and is a better option for those with financial insecurity. |

| Location | The cost difference between renting and owning varies by location, with renting being cheaper than owning in large metros. |

Upfront costs

When it comes to upfront costs, there are several factors to consider when comparing renting to owning a home with a mortgage. Firstly, prospective homebuyers typically need to save for a substantial down payment, which can range from 3.5% to 20% or more of the property's value. This can be a significant barrier for many people looking to buy a home. Additionally, homebuyers may also need to pay closing costs, inspection fees, and other expenses that are unique to the home-buying process. These upfront costs can add up quickly and require careful financial planning.

On the other hand, renting typically comes with its own set of upfront costs, which are usually more affordable and manageable. These may include a security deposit, broker's fee, or the first month's rent. Renters may also need to budget for additional expenses, such as renters' insurance or any necessary deposits for utilities. While these costs are generally lower than the upfront costs of buying a home, they can still vary depending on the specific rental market and the requirements set by landlords.

The difference in upfront costs between renting and owning is an important consideration, especially for those who may have limited financial resources or are facing financial challenges. For individuals or families who are unable to save for a substantial down payment or cover closing costs, renting may be the more feasible option in the short term. It offers flexibility and lower initial expenses, making it a more accessible choice for those who are unable to purchase a home.

However, it is worth noting that the upfront costs of buying a home can be mitigated by various factors. For instance, certain loan programs may offer lower down payment requirements, and there are also assistance programs available for first-time homebuyers. Additionally, in some cases, the seller may agree to cover a portion of the closing costs, reducing the financial burden on the buyer. Therefore, while the upfront costs of owning a home are generally higher, there are ways to make homeownership more financially accessible.

Mortgage Acceleration: Letters vs. Foreclosure Action

You may want to see also

Maintenance

On the other hand, homeowners are responsible for maintaining and repairing their properties. This can be a burden, especially for those who are not handy or lack the necessary funds for unexpected repairs. Homeowners should be prepared for maintenance and repair costs, which can vary depending on the age and condition of the property. It is recommended to set aside a certain amount of money each month to cover these expenses.

The cost of maintenance and repairs for homeowners can vary significantly. While some may only need to perform basic maintenance, such as lawn care or minor repairs, others may encounter more significant issues, such as a broken furnace or roof leak, which can cost thousands of dollars to fix. In addition, homeowners may also choose to renovate or remodel their homes, which can be costly but may also increase the value of the property.

For landlords, maintenance and repairs are necessary to keep their properties in good condition and attract tenants. They may also need to make improvements to remain competitive in the rental market. These costs are part of doing business and are factored into the rent they charge. However, if a landlord neglects maintenance, it can lead to higher turnover rates and lower rental income.

Overall, maintenance is an essential consideration when deciding between renting and owning a home. While renting may offer the convenience of having maintenance covered by the landlord, owning a home gives you more control over the property but also comes with the responsibility and potential costs of maintenance and repairs. Proper planning and budgeting for maintenance can help homeowners avoid financial strain and ensure the comfort and longevity of their investment.

Federal Liens: Superior to Mortgages in New York State?

You may want to see also

Freedom to remodel

When you rent a home, you are often limited in the changes you can make to it. Landlords may not allow you to remodel, paint, or even do basic maintenance without their approval. This can be restrictive, especially if you want to personalise your living space or make significant changes to suit your needs and preferences.

On the other hand, owning a home gives you much more freedom to remodel and modify your space as you see fit. As a homeowner, you have the autonomy to make changes to your property, as long as you comply with relevant laws and any applicable homeowners' association (HOA) rules. This freedom to remodel can be a significant advantage for those who want to customise their living environment, whether it's through simple cosmetic changes or more extensive renovations.

While owning a home provides the liberty to remodel, it's important to consider the associated responsibilities and costs. Unlike renting, where maintenance and repairs are typically the landlord's responsibility, homeowners are responsible for all upkeep and associated expenses. This includes not only the financial burden but also the time and effort required for maintenance and repairs.

Additionally, when remodelling your own home, you may need to obtain the necessary permits and approvals, which can be a complex and time-consuming process, depending on the scope of the project. It's also worth noting that extensive renovations can be costly, and financing them may require careful financial planning.

In conclusion, the freedom to remodel is a significant advantage of owning a home over renting. However, it's essential to carefully consider the responsibilities and costs associated with homeownership before making any decisions. While remodelling your own space can be rewarding, it requires a commitment to maintaining and improving your property over the long term.

Ladybird Deed: Mortgage Default Protection for Homeowners

You may want to see also

Long-term investment

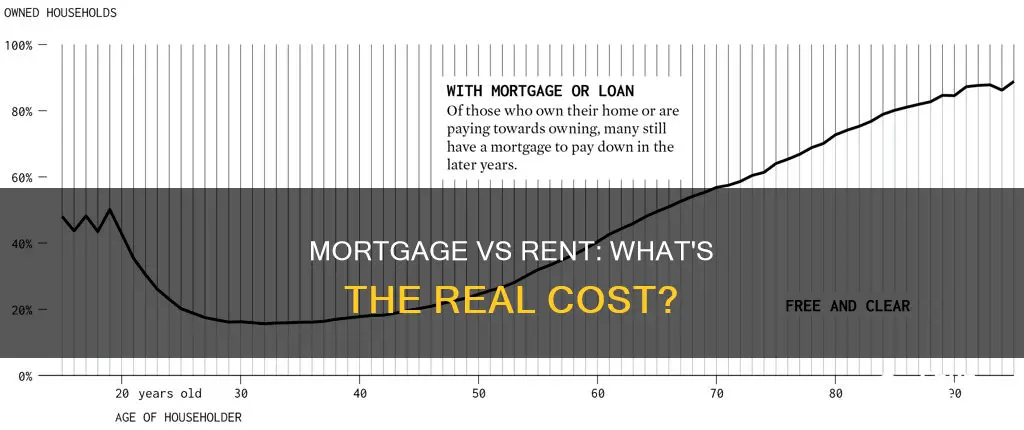

When it comes to long-term investment, buying a home with a mortgage can offer potential benefits. Firstly, it provides an opportunity for building equity. As you make regular mortgage payments, you gradually build up ownership in your home, which can lead to a significant payout if you decide to sell when the property value has increased. This is especially relevant considering that rent prices tend to increase over time, whereas a fixed-rate mortgage will remain the same, potentially making renting more expensive in the long run.

Additionally, once the mortgage is fully paid off, you eliminate a significant monthly expense. This can provide financial freedom to allocate your money towards other investments or savings goals. However, it is important to remember that homeownership comes with additional costs beyond the mortgage, such as maintenance, repairs, insurance, and property taxes, which can add up over time.

On the other hand, renting offers flexibility and lower upfront costs. It may be a better option if you don't plan to stay in one place for the long term or if you want to avoid the financial burden of maintenance and repairs. Renting also typically requires less cash upfront, as you may only need to pay a security deposit or broker's fee, whereas buying a home requires a substantial down payment, closing costs, and other expenses.

Ultimately, the decision between renting and buying depends on your individual circumstances and preferences. Buying a home can be a good long-term investment if you plan to stay in the same place for several years and are financially prepared for the associated costs. However, if flexibility and lower initial costs are more important to you, renting may be the more suitable option.

Mortgage and Note: Always Together?

You may want to see also

Affordability

Firstly, the upfront costs associated with renting are typically lower than those of buying. Renters usually need to pay a security deposit, broker's fee, or the first and last month's rent, which can be more affordable than the substantial down payment required for a mortgage. This down payment can range from 3.5% to 20% of the property value, and buyers may also need to cover closing costs, inspection fees, and other expenses.

Monthly costs are another critical factor in affordability. In general, renting is often cheaper than owning, especially in large metropolitan areas. The difference in median monthly costs between renters and homeowners with mortgages can be significant, with renting being hundreds of dollars less per month in some cases. However, it is worth noting that mortgage payments remain fixed over time, while rent prices can fluctuate and increase, potentially surpassing mortgage costs in the long run.

Additionally, maintenance and repair costs play a role in affordability. When renting, these expenses are typically the responsibility of the landlord and are included in the rent. In contrast, homeowners are responsible for maintaining and repairing their properties, which can add to their financial burden.

Another aspect to consider is the opportunity cost of investing in a home versus renting. Buying a home is a long-term investment that can pay off if the property value increases over time. On the other hand, renting provides flexibility and the freedom to move without the hassle of selling a home. For individuals facing financial challenges, renting may be a more affordable option, as defaulting on a mortgage can have severe consequences.

Lastly, it is worth noting that affordability can vary depending on location. In some US cities, it is cheaper to own a home than to rent, while in large metropolitan areas, renting may be more financially advantageous.

Deed and Mortgage: What Does the Paper Trail Show?

You may want to see also

Frequently asked questions

In general, yes. In 2023, the median monthly cost of a mortgage in the US was $1,904, while the median monthly rent cost was $1,406. However, this varies depending on location, with renting being cheaper than owning in large metros.

This is because the cost of buying a home is typically a long-term investment. If you don’t plan to stay in an area long-term, you may be better off renting.

Upfront costs of renting include a security deposit or broker's fee, which are likely to be more affordable than the upfront costs of a mortgage, such as a down payment.

Renting offers more freedom to move for a new job or a change of pace. It also means you don't have to pay for maintenance and repairs, which are the landlord's responsibility.

Although buying a home can be expensive, it can be a good long-term investment. Once the mortgage is paid off, you can eliminate a major monthly expense and put that money toward other financial goals.