Acorn investing, a strategy that involves investing small amounts of money regularly, has gained popularity as a way to build wealth over time. This approach is based on the idea that even small investments can grow significantly through compound interest and the power of compounding. However, many investors are curious about the effectiveness of this strategy and whether it truly works. In this paragraph, we will explore the concept of acorn investing, its principles, and the potential benefits and challenges it presents, providing an insightful overview for those considering this investment approach.

What You'll Learn

- Acorn's Investment Strategy: A detailed look at the platform's investment approach and its effectiveness

- User Experience: Exploring the user-friendliness and accessibility of Acorn's investment tools

- Market Performance: Analyzing the historical returns and growth of Acorn-managed portfolios

- Fees and Costs: Understanding the fee structure and its impact on overall returns

- Long-Term Benefits: Evaluating the long-term advantages and potential drawbacks of Acorn's investment model

Acorn's Investment Strategy: A detailed look at the platform's investment approach and its effectiveness

Acorns is a popular micro-investing app that has gained traction among individuals looking for a simple and accessible way to start investing. The platform's unique approach to investing involves rounding up transactions to the nearest dollar and investing the spare change in a diversified portfolio of stocks, bonds, and ETFs. This strategy, often referred to as "round-up investing," has sparked curiosity and debate about its effectiveness and potential benefits.

At its core, Acorns' investment strategy is designed to democratize investing by making it more affordable and accessible to people from all walks of life. Traditional investing often requires a substantial amount of capital, but Acorns aims to change that by allowing users to invest small amounts regularly. The platform's automated approach ensures that users can invest without the need for extensive financial knowledge or complex decision-making. This is particularly appealing to those who may not have the time or expertise to manage investments actively.

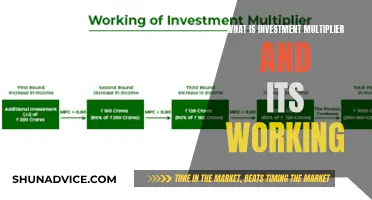

The investment approach of Acorns is based on the concept of dollar-cost averaging, which is a long-term investment strategy. By investing small amounts regularly, users can benefit from this approach, especially during volatile market periods. When markets are down, investors can purchase more shares at lower prices, and when markets are up, they can benefit from the increased value of their holdings. This strategy is often associated with long-term success and can help investors avoid the pitfalls of trying to time the market.

One of the key advantages of Acorns is its focus on diversification. The platform automatically invests users' spare change into a mix of stocks, bonds, and ETFs, ensuring a well-rounded portfolio. Diversification is a critical aspect of risk management, as it helps to spread risk across various asset classes. By investing in a range of assets, Acorns aims to provide a balanced approach, which can be particularly beneficial for beginners who may not have the experience to construct a diversified portfolio manually.

However, it's important to consider that Acorns' investment strategy may not be suitable for all investors. While it offers a low barrier to entry, the platform's simplicity may not cater to those seeking more advanced investment options. Additionally, the fees associated with Acorns, including a small management fee, might be a consideration for investors who prefer more traditional investment methods. Despite this, Acorns has gained a loyal user base, and its success can be attributed to its ability to simplify investing and make it accessible to a broader audience.

In conclusion, Acorns' investment strategy provides a unique and innovative approach to investing, particularly for those new to the world of finance. Its round-up investing method, dollar-cost averaging, and focus on diversification offer a compelling alternative to traditional investment methods. While it may not suit every investor's needs, Acorns has successfully demonstrated that investing can be made simple and accessible, potentially encouraging more people to take control of their financial future.

The Ultimate Guide to Buying a Farm: An Investment Seminar

You may want to see also

User Experience: Exploring the user-friendliness and accessibility of Acorn's investment tools

Acorns, a popular micro-investing app, has gained traction for its user-friendly approach to investing, making it accessible to individuals who might otherwise feel intimidated by the stock market. The app's core premise revolves around rounding up purchases to the nearest dollar and investing the spare change in a diversified portfolio of stocks, bonds, and ETFs. This innovative strategy allows users to invest small amounts regularly, making it an attractive option for those new to investing or with limited funds.

Upon signing up, users are greeted with a simple and intuitive interface, which is a key aspect of Acorns' user experience design. The onboarding process is straightforward, guiding users through the setup of their investment account and offering a personalized investment plan based on their financial goals and risk tolerance. The app's dashboard provides a clear overview of the user's investments, recent transactions, and performance, ensuring that investors can easily track their progress.

One of the strengths of Acorns is its ability to automate the investment process, removing the complexity often associated with traditional investing. Users can set up automatic contributions, known as 'Round-Ups', which round up their purchases to the nearest dollar and invest the difference. This feature is particularly appealing to those who struggle to save or invest regularly, as it makes the process effortless and almost invisible. For instance, if a user buys coffee for $4.75, the app will round up to $5.00 and invest the extra 25 cents. Over time, these small amounts can accumulate, providing an opportunity for long-term wealth building.

Additionally, Acorns offers a range of investment options tailored to different risk appetites. Users can choose from various portfolios, including a conservative, balanced, or aggressive strategy, each with a different allocation of stocks, bonds, and ETFs. This customization allows investors to align their portfolio with their financial goals and risk tolerance, ensuring a more personalized and engaging experience. The app also provides educational resources and articles to help users understand their investments and make informed decisions.

However, while Acorns excels in its user-friendliness, there are a few considerations to keep in mind. The app's investment strategies, while diversified, might not offer the same level of control as traditional brokerage accounts. Users may want to explore additional investment options available on the platform to further diversify their portfolios. Nonetheless, Acorns remains a popular choice for those seeking a simple, accessible, and automated way to start investing. Its focus on user experience and accessibility has contributed to its success in engaging a new generation of investors.

Investing: Good or Bad Idea?

You may want to see also

Market Performance: Analyzing the historical returns and growth of Acorn-managed portfolios

The concept of Acorn Investing, a strategy popularized by the app Acorns, has gained traction among investors seeking a simple and automated approach to building wealth. This method involves rounding up purchases to the nearest dollar and investing the spare change into a diversified portfolio of stocks, bonds, and ETFs. While the idea is appealing for its accessibility, the question of whether Acorn Investing truly delivers on its promise of long-term growth is a valid concern.

To evaluate the effectiveness of Acorn Investing, a historical analysis of the market performance of Acorn-managed portfolios is essential. This analysis can provide insights into the strategy's potential and limitations. Historical data from various sources, including Acorns' own performance reports and independent financial research, can be utilized for this purpose. By examining the returns and growth rates of Acorn-managed portfolios over different time periods, investors can make informed decisions.

One key aspect of this analysis is to compare the performance of Acorn Investing against traditional investment methods. Did Acorn-managed portfolios outperform or underperform the broader market indices during different economic cycles? For instance, did the strategy's focus on micro-investments and rounding up purchases yield higher returns during periods of market growth, or did it lag behind during market downturns? A comprehensive review of historical data can provide a clearer picture of the strategy's resilience and potential benefits.

Additionally, the diversification aspect of Acorn Investing is crucial to its success. The strategy aims to provide a diversified exposure to various asset classes. By analyzing the historical composition of Acorn-managed portfolios, investors can assess the effectiveness of this diversification. Did the strategy successfully spread risk across different sectors and asset types? Did the performance of the portfolio remain stable or improve over time due to this diversification?

In conclusion, a thorough examination of historical market performance is essential to determine the validity of Acorn Investing. By reviewing the returns, growth patterns, and risk-adjusted performance of Acorn-managed portfolios, investors can make an informed decision about the strategy's effectiveness. This analysis should consider both the advantages of accessibility and automation, as well as the potential trade-offs in terms of market performance and long-term wealth accumulation.

Unraveling SIP: A Comprehensive Guide to SIP Investment Strategies

You may want to see also

Fees and Costs: Understanding the fee structure and its impact on overall returns

When considering whether Acorn Investing is a viable option, it's crucial to delve into the realm of fees and costs, as these can significantly influence your overall investment returns. The fee structure of Acorn Investing is designed to be transparent and straightforward, but understanding its intricacies is essential for investors.

Acorn Investing typically operates on a subscription-based model, where users pay a monthly or annual fee for access to their investment platform. These fees can vary depending on the plan chosen. For instance, the basic plan might offer a limited number of investments or lower management fees, while premium plans provide more comprehensive features and potentially higher returns. It's important to carefully review the fee schedule to ensure it aligns with your investment goals and risk tolerance.

Management fees are a significant component of the cost structure. These fees are charged as a percentage of the assets under management and cover the operational expenses of the investment firm. The rate can vary widely, and it's a critical factor in assessing the long-term impact on your returns. Lower management fees can leave more room for investment growth, especially over extended periods. Additionally, transaction fees may apply for each investment made, which can add up, particularly for frequent traders.

Another aspect to consider is the impact of fees on your overall investment performance. Higher fees can eat into your potential gains, especially in volatile markets. For example, if an investment strategy generates a 10% return but incurs a 2% management fee, the net return to the investor is only 8%. Over time, these fees can accumulate and significantly reduce the overall returns. It's essential to compare the fee structure of Acorn Investing with similar investment platforms to gauge its competitiveness.

Furthermore, understanding the fee waiver or rebate policies can be advantageous. Some investment platforms offer fee waivers for a certain period, especially for new investors or during promotional offers. These waivers can provide a temporary boost to your returns, allowing you to potentially recover some of the fees incurred. However, it's crucial to read the terms and conditions carefully to understand the eligibility criteria and the duration of the waiver.

In summary, fees and costs play a pivotal role in the success of Acorn Investing. Investors should carefully analyze the fee structure, including management and transaction fees, to ensure they are competitive and aligned with their investment strategy. By understanding the potential impact on returns, investors can make informed decisions and potentially optimize their investment outcomes.

TBN Network's Retirement Fund Options: A Secure Investment Path?

You may want to see also

Long-Term Benefits: Evaluating the long-term advantages and potential drawbacks of Acorn's investment model

The Acorns investment model, a micro-investing platform, has gained popularity for its approach to making investing accessible and affordable for everyday individuals. It operates by rounding up purchases to the nearest dollar and investing the spare change in a diversified portfolio of stocks, bonds, and ETFs. While Acorns has been praised for its user-friendly interface and ability to encourage saving and investing, it's important to evaluate its long-term benefits and potential drawbacks.

One of the significant long-term advantages of Acorns is its ability to automate savings and investing. Traditional investing often requires a substantial amount of capital upfront, which can be a barrier for many people. Acorns' micro-investing approach allows users to invest small amounts regularly, making it easier for individuals with limited financial resources to start building a portfolio. Over time, this consistent contribution can lead to substantial wealth accumulation, especially with the power of compound interest. For example, an individual who invests $5 per day, $25 per week, or $100 per month could potentially amass a significant nest egg over their working years, even with modest returns.

Another benefit is the diversification it offers. Acorns invests in a mix of assets, providing a diversified portfolio from the start. This diversification strategy is a fundamental principle of modern portfolio theory, which suggests that spreading investments across various asset classes can reduce risk. By investing in a range of stocks, bonds, and ETFs, Acorns aims to provide a balanced approach, potentially offering better long-term returns compared to investing in a single asset or a limited number of stocks. This strategy can be particularly advantageous for long-term goals, such as retirement, where consistent performance and risk mitigation are essential.

However, there are potential drawbacks to consider. One concern is the fee structure. Acorns charges a small fee for its services, which is typically a percentage of the assets under management. While these fees are generally lower than traditional investment management fees, they can add up over time, especially for larger accounts. Additionally, the performance of Acorns' investments may not match the market's overall performance, as the platform's strategy is to invest in a wide range of assets, which may not always outperform the market.

In conclusion, Acorns' investment model offers long-term benefits by making investing accessible, automating savings, and providing diversification. These advantages can contribute to building a substantial financial portfolio over time. However, potential drawbacks, such as fees and performance considerations, should be carefully evaluated to ensure that the investment strategy aligns with an individual's financial goals and risk tolerance. As with any investment platform, it is essential to understand the risks and benefits to make informed decisions.

Shares to Buy: Best Bets

You may want to see also

Frequently asked questions

Acorn Investing is a micro-investing app that allows users to invest small amounts of money regularly. It rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio of stocks and ETFs.

Acorn Investing simplifies investing by making it accessible and affordable. Users link their debit or credit card to the app, and every time they make a purchase, the app rounds up the transaction to the nearest dollar. The spare change is then invested in a portfolio of carefully selected assets. The app also offers the option to invest in specific themes or causes, allowing users to align their investments with their values.

Absolutely! Acorn Investing is designed to be user-friendly and accessible to everyone, regardless of their investment experience. It removes the complexity often associated with traditional investing, making it an excellent choice for beginners who want to start building their financial future without feeling overwhelmed. The app provides educational resources and insights to help users understand their investments and make informed decisions.

Acorn Investing offers several advantages. Firstly, it democratizes investing by allowing anyone to invest, regardless of the amount they have. Secondly, the app's automated approach makes saving and investing effortless, as users don't need to remember to transfer money manually. Additionally, the app provides a fun and engaging way to learn about personal finance and investing, making it an educational tool for financial literacy.