The concept of cup and handle investing is a popular strategy in technical analysis, which involves identifying a specific chart pattern to predict future price movements. This technique aims to identify a cup-shaped formation, resembling a cup with a handle, on a stock's price chart. The idea is that once the cup is formed, a breakout from the handle could signal a potential upward trend. However, the effectiveness of this strategy is a subject of debate among investors, and it's essential to understand the principles and limitations before implementing it in your investment approach.

What You'll Learn

- Market Dynamics: Cup and handle patterns thrive in volatile markets, reflecting price swings

- Volume Analysis: Increased volume during the handle phase confirms the pattern's validity

- Support and Resistance: The handle acts as a support level, preventing significant price drops

- Trading Strategies: Investors use the pattern for buy/sell signals, often with stop-loss orders

- Risk Management: Despite potential profits, cup and handle investing carries risks, requiring careful risk assessment

Market Dynamics: Cup and handle patterns thrive in volatile markets, reflecting price swings

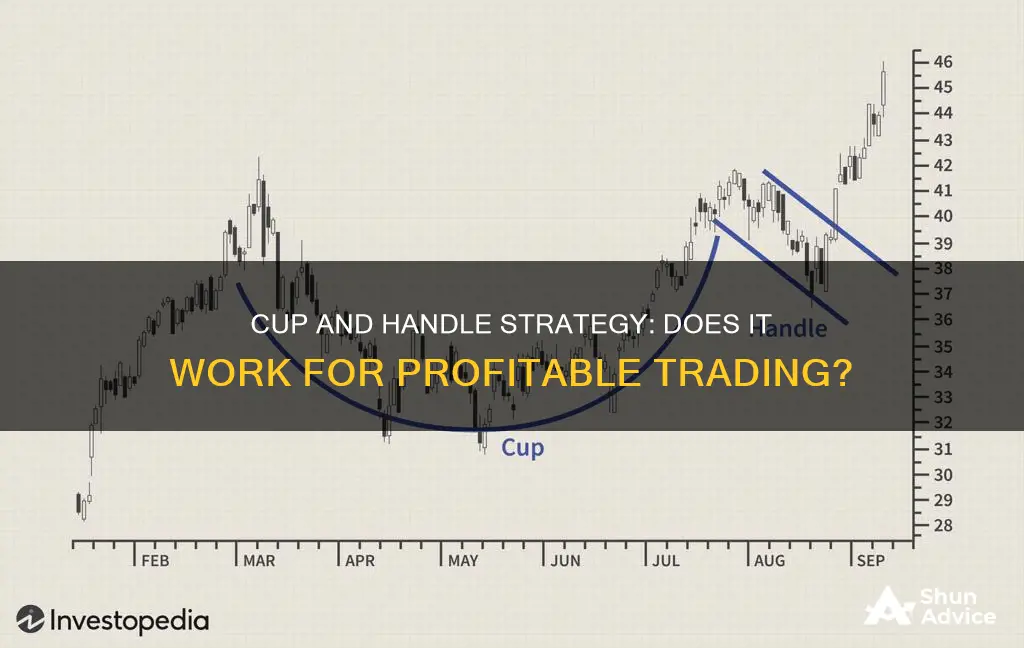

The 'cup and handle' pattern is a popular technical analysis tool that traders use to identify potential price movements, especially in volatile markets. This pattern is characterized by a cup-shaped price chart, resembling a 'U' shape, followed by a smaller handle, which is a brief price consolidation period. Understanding the dynamics of this pattern is crucial for investors looking to navigate volatile market conditions effectively.

In volatile markets, where price movements can be rapid and unpredictable, the cup and handle pattern becomes a valuable indicator. This pattern suggests that after a significant price decline or a period of consolidation, the market is likely to experience a rebound. The 'cup' phase represents a period of price recovery, where buyers start to gain control, pushing the price higher. This initial upward trend is followed by a period of price stabilization or a slight decline, forming the 'handle'. The handle is a critical phase as it tests the strength of the uptrend, and if the price breaks above the handle's resistance level, it confirms the pattern's validity.

Volatility often leads to increased trading activity, and the cup and handle pattern can be a trader's ally in such markets. When a stock exhibits this pattern, it indicates that the market is still finding its footing after a period of price swings. The pattern suggests that the price has found a new support level, and the handle phase is a buying opportunity for those who believe in the uptrend's continuation. This strategy is particularly useful in volatile markets as it provides a clear signal to enter a position when the price breaks out of the handle.

The beauty of the cup and handle pattern lies in its ability to provide a visual representation of market sentiment and potential price direction. In volatile markets, where news and events can significantly impact prices, this pattern helps traders make informed decisions. By recognizing this pattern, investors can anticipate potential price movements and adjust their strategies accordingly. For instance, during a volatile market, if a stock forms a cup and handle pattern, it could signal a potential buying opportunity, allowing investors to capitalize on the expected price rebound.

In summary, the cup and handle pattern is a powerful tool for investors to navigate volatile markets. Its market dynamics-driven approach helps identify potential price swings and provides a clear signal for entry and exit points. By understanding and recognizing this pattern, investors can make more informed decisions, especially in turbulent market conditions, and potentially benefit from the price movements it predicts. This strategy is a testament to the effectiveness of technical analysis in volatile trading environments.

Who Invests in Schools?

You may want to see also

Volume Analysis: Increased volume during the handle phase confirms the pattern's validity

When analyzing the Cup and Handle pattern, volume plays a crucial role in confirming the validity of this technical trading strategy. The Cup and Handle is a popular chart pattern used by traders to identify potential price reversals or breakouts. It consists of a cup-shaped formation followed by a handle, resembling a teacup. The key to identifying a successful Cup and Handle is the volume behavior during the handle phase.

Increased volume during the handle phase is a strong indicator that the pattern is valid and may lead to a significant price movement. Here's why:

- Confirmation of Demand: In the Cup and Handle pattern, the handle represents a period of consolidation where the price forms a smaller range after the initial cup-shaped rise. During this handle phase, if trading volume increases, it suggests that buyers are actively participating in the market, creating a stronger demand for the security. This increased volume confirms that the pattern is not just a random fluctuation but a genuine price movement with underlying market interest.

- Strength of the Breakout: The handle phase is critical as it sets the stage for a potential breakout. When volume rises during this period, it indicates that the market participants are not just buying or selling at the current price levels but are actively pushing the price higher or lower. This heightened volume can lead to a more robust and sustainable price movement, making the breakout more reliable.

- Identifying False Signals: Without sufficient volume, a Cup and Handle pattern might be considered a false signal. Low volume during the handle could mean that the market is indecisive or that the pattern is not yet mature. By observing increased volume, traders can filter out such false signals and focus on patterns with genuine momentum.

- Risk Management: Volume analysis during the handle phase can also help traders manage their risk. If the volume fails to confirm the pattern, it may indicate a potential breakdown, allowing traders to take appropriate actions to protect their positions.

In summary, volume analysis is an essential tool for traders to validate the Cup and Handle pattern. Increased volume during the handle phase provides confirmation of the pattern's validity, indicating a strong demand and potential price movement. Traders should pay close attention to volume behavior to make informed decisions and manage their investments effectively.

Where to Invest: Sector Strategies

You may want to see also

Support and Resistance: The handle acts as a support level, preventing significant price drops

The concept of support and resistance is a fundamental principle in technical analysis, and it plays a crucial role in understanding the behavior of stock prices within the Cup and Handle pattern. When we talk about the handle in this context, it refers to the stage of the pattern where the price forms a horizontal or slightly downward-sloping trend line. This handle acts as a critical support level, which is essential for the overall structure and reliability of the Cup and Handle pattern.

Support, in simple terms, is a price level where a stock's price tends to find a floor and stop falling further. In the case of the handle, this support level is formed by the horizontal line connecting the lowest points of the pattern's upward trend (the cup) and the subsequent downward trend (the handle). This support level is significant because it indicates a strong barrier that buyers are willing to enter at this price, preventing the stock from dropping significantly. When the price approaches this handle support, it often creates a buying opportunity, as the stock is expected to bounce back and continue its upward trajectory.

The effectiveness of the handle as a support level is evident in its ability to maintain the integrity of the Cup and Handle pattern. If the handle support is broken, it could lead to a breakdown of the entire pattern, signaling a potential trend reversal or a failure of the bullish setup. Traders often look for confirmation of support by observing the volume during these price movements. When the volume increases during a test of support, it strengthens the case that the handle is a robust resistance level, as it indicates strong buying interest at that price.

Understanding and identifying support and resistance levels, especially the handle's role, is crucial for making informed trading decisions. Traders can use this knowledge to set stop-loss orders, manage risk, and determine entry and exit points for their trades. By recognizing the handle as a critical support level, investors can make more accurate predictions about price movements and potentially improve their overall trading performance.

In summary, the handle in the Cup and Handle pattern serves as a powerful support level, preventing significant price drops and providing valuable insights for traders. Recognizing this support zone allows investors to make strategic decisions, manage risk effectively, and potentially capitalize on the bullish opportunities presented by this technical pattern.

Measuring Investment: People Over Profits

You may want to see also

Trading Strategies: Investors use the pattern for buy/sell signals, often with stop-loss orders

The Cup and Handle pattern is a popular technical analysis tool used by traders to identify potential buy and sell signals in financial markets. This pattern is visually represented on a price chart and is characterized by a cup-shaped formation followed by a handle. It is considered a bullish continuation pattern, indicating that the price is likely to continue its upward trend after the handle phase. Traders often use this pattern to generate trading signals, making it a valuable strategy in their investment toolkit.

When identifying the Cup and Handle pattern, traders look for a clear cup formation, which is a rounded bottom with a slight upward slope. This cup represents a period of consolidation or a temporary pause in the price movement, allowing the market to accumulate momentum. The handle, which follows the cup, is a smaller price range that extends from the cup's peak, forming a 'handle' shape. The handle is crucial as it confirms the strength of the pattern and provides a potential entry point for traders.

Investors use this pattern to signal potential buying opportunities. When the price breaks above the handle's resistance level, it is considered a buy signal, indicating that the upward trend is likely to continue. Traders often set a stop-loss order below the handle's support level to limit potential losses if the pattern fails. This strategy helps manage risk and ensures that traders are not exposed to significant downward price movements.

The Cup and Handle pattern is particularly useful for long-term investors who aim to capitalize on sustained market trends. By identifying this pattern, traders can enter positions with the expectation of a favorable price movement. Additionally, the pattern's visual nature makes it accessible to traders of all experience levels, allowing for easier interpretation and implementation in trading strategies.

However, it is essential to note that no trading strategy is foolproof, and the Cup and Handle pattern should be used in conjunction with other technical indicators and risk management techniques. Traders should also consider market conditions, such as volatility and overall market sentiment, to make well-informed trading decisions. When combined with proper risk assessment, the Cup and Handle pattern can be a valuable tool for investors seeking to optimize their trading strategies.

Unlocking the Door to Investment: A Guide to Purchasing a Second Home

You may want to see also

Risk Management: Despite potential profits, cup and handle investing carries risks, requiring careful risk assessment

The concept of "cup and handle" investing is an intriguing strategy in technical analysis, aiming to identify potential price reversals and profitable opportunities. However, it is essential to approach this strategy with a comprehensive understanding of the risks involved to ensure successful implementation. Despite the potential for significant profits, cup and handle investing carries inherent risks that require careful risk assessment and management.

One of the primary risks associated with this strategy is the reliance on historical patterns and technical indicators. Cup and handle patterns are formed by specific price movements, and investors assume that these patterns will repeat in the future. However, financial markets are dynamic and influenced by numerous factors, making past performance an unreliable predictor of future outcomes. Market conditions can change rapidly, and what worked in the past may not work in the same way again. Therefore, investors must be cautious and adapt their strategies accordingly.

Risk management in cup and handle investing involves several key considerations. Firstly, investors should define their risk tolerance and establish clear stop-loss orders. A stop-loss order is a crucial risk management tool that automatically sells an asset when it reaches a certain price, limiting potential losses. By setting appropriate stop-loss levels, investors can minimize the impact of adverse market movements and protect their capital. Additionally, diversifying the investment portfolio is essential to mitigate risks. Instead of concentrating funds in a single cup and handle pattern, investors should consider a broader range of investments to spread risk.

Another critical aspect of risk management is ongoing monitoring and analysis. Cup and handle patterns may not always unfold as expected, and market conditions can change, rendering the initial analysis obsolete. Investors should regularly review their positions, adjust stop-loss orders, and re-evaluate their strategies based on current market trends and data. Staying informed and proactive in risk management is vital to adapting to the ever-changing market environment.

In conclusion, while cup and handle investing offers the potential for profitable trades, it is a strategy that demands careful risk assessment and management. Investors should approach this technique with a realistic understanding of its limitations, employing risk-mitigating measures such as stop-loss orders and portfolio diversification. By combining technical analysis with robust risk management practices, investors can navigate the complexities of the financial markets and make informed decisions that align with their investment goals.

Investing: Hold or Fold?

You may want to see also

Frequently asked questions

A cup and handle pattern is a technical analysis chart pattern used in stock trading to identify potential price reversals or breakouts. It consists of a rounded 'cup' shape followed by a smaller 'handle' shape, both of which are connected by a 'stem'. This pattern is often considered a bullish continuation pattern, suggesting that the stock's price will continue to rise after the handle breaks out above the cup's resistance level.

The cup and handle strategy involves identifying this pattern in a stock's price chart and then taking a long position, expecting the price to rise. The 'cup' represents a period of consolidation or a temporary price decline, while the 'handle' is a smaller range where the price consolidates before breaking out. Investors aim to buy near the end of the handle and sell when the price reaches the resistance level of the cup, or even higher, to capture the upside potential.

For a cup and handle pattern to be considered valid and reliable, it should exhibit certain characteristics. Firstly, the cup should be symmetrical or slightly asymmetric, with a clear resistance level at the top. The handle should be smaller in magnitude and duration compared to the cup, and it should be connected to the cup by a stem. Additionally, the volume during the handle should be lower than the volume during the cup, indicating a period of consolidation.

While the cup and handle pattern can be a useful tool for technical analysis, it is not without risks. This strategy relies on historical price patterns and assumes that future behavior will resemble past trends, which may not always be the case. False breakouts can occur, leading to potential losses if the price fails to break out as expected. It is essential to use this pattern in conjunction with other technical indicators and risk management techniques to minimize risks and make informed investment decisions.