Fidelity offers a wide range of investment options, including stocks, bonds, exchange-traded funds (ETFs), mutual funds, and cryptocurrencies. With a Fidelity brokerage account, investors can choose and manage their own investments, while also having access to advisory services for more tailored investment strategies. Fidelity's investment options cover various asset classes, sectors, and markets, providing investors with opportunities for diversification and tailored risk management. The company also provides tools and resources to help investors make informed decisions and build portfolios aligned with their financial goals.

| Characteristics | Values |

|---|---|

| Investment options | Stocks, ETFs, mutual funds, bonds, cryptocurrencies, annuities, CDs, money market funds, sector funds, asset allocation funds, index funds, and more |

| Investment advisory services | Phone-based advisors, dedicated advisor with supporting team, digital investing plus access to coaching, Fidelity Managed FidFolios®, Fidelity Advisory Services Team, Fidelity® Wealth Management, Fidelity® Private Wealth Management |

| Minimum investment | $101 for phone-based advisors |

| $5,000 for Fidelity Managed FidFolios® | |

| $50,000 for Fidelity Advisory Services Team and Fidelity® Wealth Management | |

| $500,000 for Fidelity® Wealth Services Wealth Management service-level clients | |

| $2 million for Fidelity® Private Wealth Management | |

| Investment tools | Fidelity Crypto®, Stocks by the Slice℠, Fidelity® Basket Portfolios, margin loans, recurring investments, industry-leading research and analysis |

| Investment accounts | The Fidelity Account®, Fidelity Go®, Fidelity® Wealth Services, Fidelity Managed FidFolios®, Fidelity® Strategic Disciplines |

| Fees | $1 per bond, $19.95 minimum markup or markdown for representative-assisted trades, $19.95 flat charge for representative-assisted treasury auction orders, $250 maximum for all trades ($50 maximum for bonds maturing in one year or less) |

What You'll Learn

Fidelity's investment advisory services

Phone-based Advisors

You'll have access to a dedicated advisor with a supporting team. This service includes annual reviews of your investments and the use of tax-smart investing techniques designed to help you keep more of what you earn. The minimum investment for this service is $50,000.

Fidelity Managed FidFolios®

Fidelity's team of professionals will build and maintain a customized portfolio of individual stocks for you, with tax-smart investing techniques built-in. You can personalize your portfolio by eliminating stocks or industries. The minimum investment for this service is $5,000.

Fidelity® Wealth Management

With this service, you'll work with a dedicated advisor who will provide customized planning and investment management designed for your full financial picture. This service is generally available to those with $500,000 invested in an eligible Fidelity account.

Fidelity® Private Wealth Management

This service is for those with $2 million managed through Fidelity® Wealth Services or Fidelity® Strategic Disciplines and $10 million or more in total investable assets. It offers comprehensive planning, advice, and investment management delivered by your own dedicated wealth management team, who can also coordinate with your outside advisors, such as accountants or attorneys.

Fidelity Go®

Fidelity Go is an online service. Answer a few questions, and Fidelity will build an investment strategy to meet your needs, becoming more conservative as retirement nears. They will monitor the markets and rebalance your IRA when needed.

Fidelity Freedom® Funds

Fidelity Freedom Funds are a simple approach for retirement. Just pick the target date fund that matches your planned retirement year, and Fidelity will reduce risk as retirement nears.

Fidelity Asset Manager® Funds

Fidelity Asset Manager Funds offer asset class diversification and disciplined, ongoing asset allocation. They are managed to help meet your needs for income and growth potential.

Fidelity® Managed Accounts

Fidelity's managed accounts do not allocate large amounts of money to cash but instead stay invested. They can help you find the right mix of cash and investments by looking at your situation, including your timeline, goals, and feelings about risk.

Trade Deficits: Savings, Investments, and the Economy's Future

You may want to see also

Fidelity Managed FidFolios®

The power of tax-smart investment management is a key advantage of Fidelity Managed FidFolios®. This feature is designed to help you keep more of your earnings by employing tax-loss harvesting and other tax-efficient strategies. The team of professionals managing your portfolio will make investment decisions with tax implications in mind, aiming to maximize your after-tax returns.

Investing vs Saving: Understanding the Key Differences

You may want to see also

Fidelity® Wealth Management

Fidelity Wealth Management is an investment advisory service that provides nondiscretionary financial planning and discretionary investment management through one or more Personalized Portfolios accounts for a fee.

Fidelity Wealth Management offers a dedicated advisor who will provide customized planning and investment management designed for your full financial picture. This service is available through Fidelity Wealth Services and/or Fidelity Strategic Disciplines, both of which are advisory services offered for a fee.

To be eligible for Fidelity Wealth Management, you must meet the general requirement of having $500,000 invested in an eligible Fidelity account. This will typically qualify you for support from a dedicated Fidelity advisor. The minimum investment to enroll in Fidelity Wealth Services is $50,000.

Fidelity Wealth Management can help you build and manage a portfolio that fits your needs. This includes helping you to select and manage your own portfolio of investments using a range of Fidelity investment options and tools.

Fidelity Wealth Management also offers access to a dedicated wealth management team that can provide comprehensive planning, advice, and investment management. This team can coordinate with your outside advisors, such as accountants or attorneys, to ensure that your financial needs are met.

Fidelity Wealth Management provides a range of investment options, including mutual funds, exchange-traded funds (ETFs), stocks, bonds, and more. These investment options can help you diversify your portfolio, manage risk, and take advantage of various market conditions to achieve your investment goals.

In addition, Fidelity Wealth Management can assist you in finding the right mix of cash and investments by considering your timeline, goals, and feelings about risk. They can also help you explore short-term investment options, such as savings accounts, money market funds, certificates of deposit (CDs), and short-term bonds.

With Fidelity Wealth Management, you can benefit from the expertise and resources of a global leader in mutual funds, offering you a wide range of investment choices to achieve your strategic goals.

Savings vs Investments: Where Should Your Money Go?

You may want to see also

Fidelity® Private Wealth Management

With Fidelity® Private Wealth Management, you'll have your own dedicated wealth management team, led by a Fidelity advisor. This team will provide extensive financial experience, comprehensive planning, and investment guidance, as well as personalised service. Your advisor will work closely with you to understand your needs and goals, and help you create a plan to meet those goals. This includes a deep review of your current financial strategies and access to wealth planning specialists.

Additionally, Fidelity® Private Wealth Management can provide guidance on legacy building and estate planning. They can help you with strategies for transferring, donating, or preserving your assets, coordinating with your outside professionals such as accountants or attorneys. They also offer support in discussing your plan with your family and aligning your wealth strategies with their needs.

Saving and Investing: Reddit's Money-Wise Wisdom

You may want to see also

Fidelity Freedom® Funds

The Freedom Funds follow a "glide path," which illustrates the funds' anticipated exposure to equity, bond, and short-term funds over time. This glide path strategy aims to balance investment returns and risks while seeking to meet retirement income objectives. Each fund has a target asset allocation composed entirely of Fidelity funds across a broad range of asset classes, including domestic and international equity funds, bond funds, and short-term funds. The funds are subject to the volatility of financial markets and may carry certain investment risks, including those associated with high-yield, small-cap, and foreign securities.

Fidelity has been managing the Freedom Funds since 1996 and has developed a strategy that combines a disciplined approach to fund management with the experience and judgment of its fund managers. While the fund managers take a long-term view on key asset allocation decisions, they also review each portfolio daily and make adjustments as needed. The funds are intended for investors who may not have the time, expertise, or interest in building and adjusting a diversified investment portfolio.

It is important to note that no target date fund is considered a complete retirement program, and there is no guarantee that any single fund will provide sufficient retirement income. The share price of the funds can fluctuate, and investors could lose money. Therefore, investors should carefully consider the investment objectives, risks, charges, and expenses of the funds before investing.

Invest Wisely for Your Grandchild's Future: A Guide

You may want to see also

Frequently asked questions

Fidelity offers a wide range of investment options, including stocks, exchange-traded funds (ETFs), mutual funds, bonds, and cryptocurrencies. You can also invest in precious metals like gold, silver, platinum, and palladium, as well as fractional shares of stocks and ETFs.

Fidelity offers commission-free stock and ETF trades, industry-leading research tools, and a wide range of investment options to suit your needs. They also provide access to investment advisory services and dedicated advisors to help you build and maintain a portfolio aligned with your financial goals.

You can open a Fidelity brokerage account in just a few minutes and start investing right away. Fidelity offers a variety of resources, including planning tools, investment ideas, and guided experiences to help you make informed investment decisions.

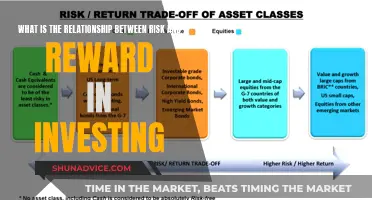

Investing carries inherent risks, and the value of your investments may fluctuate over time. It's important to consider your risk tolerance and financial goals before investing. Diversification and asset allocation can help manage risk but do not guarantee against losses.

Fidelity provides various tools and services to help you manage your investments effectively. You can access their Fixed Income Dashboard to visualize your cash flow and gain insights into your bond and CD holdings. They also offer fixed income webinars and retirement planning resources to help you make informed decisions about your investment strategy.