Foreign investment plays a significant role in the economic growth and development of many countries, and its impact on GDP is a topic of great interest and debate among economists. The relationship between foreign investment and GDP is complex and multifaceted, as it can have both positive and negative effects on a country's economic performance. This paragraph will explore the various ways in which foreign investment can influence GDP, including its potential to boost economic growth, create jobs, and enhance productivity, while also considering the challenges and risks associated with foreign investment, such as potential negative environmental impacts and the risk of exploitation.

What You'll Learn

- Economic Growth: Foreign investment can boost GDP by increasing production and productivity

- Infrastructure Development: It often leads to improved infrastructure, benefiting local businesses and residents

- Job Creation: Direct investment creates jobs, reducing unemployment and boosting economic activity

- Technology Transfer: Foreign investors bring advanced technology, enhancing local industries and innovation

- Market Access: It provides access to new markets, increasing exports and revenue

Economic Growth: Foreign investment can boost GDP by increasing production and productivity

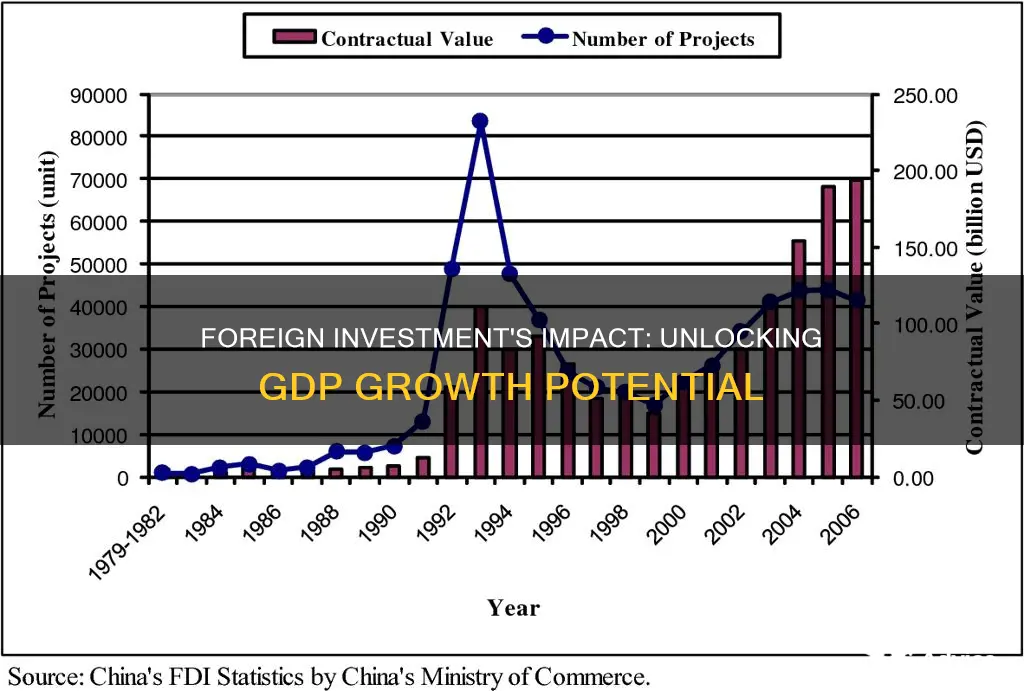

Foreign investment plays a crucial role in fostering economic growth and development, particularly in the context of increasing a country's Gross Domestic Product (GDP). When foreign investors inject capital into a nation's economy, it often leads to a surge in production and productivity, which are fundamental drivers of economic expansion. This phenomenon is a key aspect of the relationship between foreign investment and GDP growth.

One of the primary ways foreign investment stimulates economic growth is by providing additional capital for businesses and industries. This capital can be utilized to expand production facilities, purchase new machinery and equipment, and hire more workers. As a result, the production capacity of the country increases, allowing for higher output levels. For instance, a foreign investor might establish a new manufacturing plant in a developing country, bringing advanced technology and expertise. This not only creates jobs and generates income but also contributes to the country's overall production capabilities, potentially leading to an increase in exports and a positive trade balance.

Productivity gains are another significant outcome of foreign investment. International investors often bring advanced management techniques, technologies, and best practices to the table. These factors can enhance the efficiency of local businesses, leading to improved output per worker. For example, a foreign company might introduce a more streamlined supply chain management system, reducing waste and optimizing production processes. Over time, this can result in higher-quality goods and services being produced, which can attract more customers and further boost the economy.

The impact of foreign investment on production and productivity has a ripple effect throughout the economy. As production increases, it can lead to a more diverse and robust economic base. This diversity can make the economy more resilient to external shocks and fluctuations in the global market. Moreover, the additional income generated from increased production can stimulate domestic consumption and investment, further fueling economic growth.

In summary, foreign investment is a powerful catalyst for economic growth, particularly in terms of boosting GDP. By increasing production capacity and enhancing productivity, foreign investors contribute to the overall economic development of a country. This, in turn, can lead to a more prosperous and sustainable economy, providing benefits that extend beyond the immediate impact of the investment itself. Understanding this relationship is essential for policymakers and economists seeking to promote economic growth and development.

Solar Incentives: Investing in a Brighter Future

You may want to see also

Infrastructure Development: It often leads to improved infrastructure, benefiting local businesses and residents

Foreign investment can significantly impact a country's GDP, and one of the key channels through which this occurs is infrastructure development. When foreign investors enter a market, they often bring with them capital, expertise, and technology, which can be channeled into improving the country's physical infrastructure. This includes the construction and upgrade of roads, bridges, ports, and utilities, all of which are essential for economic growth and development.

Improved infrastructure has a direct and positive effect on local businesses and residents. For businesses, better transportation networks mean easier access to markets, suppliers, and customers, reducing the cost of doing business and increasing efficiency. For example, a well-maintained road network can facilitate the timely delivery of goods, reducing the time and cost associated with logistics. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the resources to invest in their own infrastructure.

Residents also stand to gain from improved infrastructure. Access to reliable transportation can enhance mobility, making it easier for people to commute to work, access education, and utilize healthcare services. Additionally, better infrastructure can attract more businesses and services to the area, creating job opportunities and improving the overall quality of life. For instance, the development of a modern industrial park can bring in manufacturing companies, providing employment and contributing to the local economy.

The benefits of infrastructure development extend beyond the immediate area of construction. Improved connectivity can stimulate economic activity in surrounding regions, as it encourages the flow of goods, services, and people. This can lead to the development of new business clusters and the expansion of existing ones, further boosting the local economy. Moreover, the improved infrastructure can make the region more attractive to further foreign investment, creating a positive feedback loop that reinforces economic growth.

In summary, foreign investment, when directed towards infrastructure development, can have a profound impact on a country's GDP. By improving the physical infrastructure, local businesses and residents are provided with the necessary tools to thrive, leading to increased economic activity and overall development. This highlights the importance of strategic investment in infrastructure as a means to stimulate economic growth and improve the well-being of a nation's population.

Using Debt to Leverage Investments: A Strategic Guide

You may want to see also

Job Creation: Direct investment creates jobs, reducing unemployment and boosting economic activity

Foreign direct investment (FDI) plays a crucial role in fostering job creation and economic growth, particularly in the context of a country's GDP. When a foreign company invests directly in a host country, it brings with it a range of benefits that can significantly impact the local economy. One of the most notable advantages is the creation of employment opportunities, which in turn reduces unemployment rates and stimulates economic activity.

Direct investment often involves the establishment of new businesses or the expansion of existing ones. This process requires a workforce, and as a result, it directly contributes to job creation. For instance, when a foreign company sets up a manufacturing plant in a developing country, it not only brings new technology and expertise but also creates numerous job openings, from skilled technicians to administrative staff. These jobs provide income to local residents, increasing their purchasing power and contributing to the overall economic health of the region.

The positive impact of FDI on employment is twofold. Firstly, it provides immediate employment opportunities, which can be particularly beneficial in areas where local industries are underdeveloped or where unemployment rates are high. Secondly, it encourages the transfer of skills and knowledge, as foreign investors often bring advanced technologies and management practices. This knowledge transfer can lead to the development of a more skilled local workforce, making the region more attractive for future investments and further job creation.

Moreover, the job creation associated with FDI has a ripple effect on the local economy. As employees spend their earnings on goods and services, it stimulates demand and encourages local businesses to expand or create new ventures. This, in turn, leads to further job opportunities and a more vibrant economic environment. The multiplier effect of FDI can significantly boost the GDP of a country, as increased economic activity generates more tax revenue, which can be reinvested in public services and infrastructure.

In summary, foreign direct investment is a powerful catalyst for job creation, which is essential for reducing unemployment and stimulating economic growth. The establishment of new businesses and the expansion of existing ones provide immediate employment opportunities and contribute to the long-term development of a skilled local workforce. The positive impact of FDI on job creation and economic activity is a key factor in understanding how it can significantly increase a country's GDP.

Data Investment: Strategies for Maximizing Your Data's Value

You may want to see also

Technology Transfer: Foreign investors bring advanced technology, enhancing local industries and innovation

Foreign investment plays a pivotal role in driving economic growth, particularly through the mechanism of technology transfer. When foreign investors enter a country, they bring with them advanced technologies, innovative practices, and specialized skills that can significantly enhance local industries and foster innovation. This transfer of technology is a powerful catalyst for economic development, as it enables local businesses to modernize, improve productivity, and compete more effectively in both domestic and international markets.

In the context of technology transfer, foreign investors often provide access to cutting-edge research and development (R&D) capabilities. These investors may establish joint ventures or partnerships with local firms, allowing them to leverage their R&D expertise. This collaboration can lead to the development of new products, processes, or services that were previously unimaginable or unattainable for local industries. For instance, a foreign technology company might introduce a local manufacturing plant to the latest automation systems, enabling the plant to produce goods with higher efficiency and quality, thereby increasing its competitiveness in the global market.

The impact of technology transfer is far-reaching. It can lead to the creation of new jobs, as local industries expand their operations to meet the demands of new technologies. Additionally, it can stimulate local innovation, as local entrepreneurs and researchers are exposed to new ideas and methods, inspiring them to develop their own innovative solutions. This, in turn, can attract further foreign investment, creating a positive feedback loop that accelerates economic growth.

Moreover, technology transfer often results in the transfer of knowledge and skills. Foreign investors may provide training and education to local employees, ensuring that the workforce is equipped with the necessary skills to operate and maintain the new technologies. This knowledge transfer can have long-lasting effects, as it empowers local workers to adapt to changing technological landscapes and contributes to a more skilled and adaptable labor force.

In summary, foreign investment, through technology transfer, is a powerful driver of economic growth. It brings advanced technologies, fosters innovation, creates jobs, and enhances the overall productivity of local industries. By leveraging the expertise and resources of foreign investors, countries can accelerate their development, improve their global competitiveness, and ultimately contribute to a more robust and sustainable GDP growth. This process highlights the importance of foreign investment as a strategic tool for economic transformation and modernization.

Understanding Cash Investments: What Qualifies as Cash?

You may want to see also

Market Access: It provides access to new markets, increasing exports and revenue

Foreign investment plays a crucial role in boosting a country's GDP, and one of the key mechanisms is through market access. When a country attracts foreign investment, it gains the ability to tap into new and existing markets, which can significantly impact its economic growth. This is particularly true for developing nations, where foreign investment can act as a catalyst for economic development.

Market access is a powerful tool for countries to increase their exports and, consequently, their revenue. By attracting foreign investors, a country can open up its markets to international buyers, allowing for the sale of its goods and services on a larger scale. This is especially beneficial for industries that have traditionally faced barriers to entry in foreign markets, such as small and medium-sized enterprises (SMEs). With foreign investment, these businesses can gain the necessary resources, technology, and expertise to compete globally, leading to increased production and, ultimately, higher GDP.

The process of market access through foreign investment often involves the establishment of new production facilities, distribution networks, and sales channels in the host country. This infrastructure development not only creates jobs and stimulates local economies but also positions the country's products and services for global competition. As a result, the country's exports grow, and its presence in international markets becomes more prominent.

Moreover, foreign investment often brings with it advanced technologies, management practices, and marketing strategies that can enhance the productivity and efficiency of local industries. This transfer of knowledge and skills can lead to improved product quality, reduced costs, and better-adapted businesses, all of which contribute to increased competitiveness and, subsequently, higher export volumes.

In summary, market access is a critical aspect of how foreign investment positively influences a country's GDP. It enables countries to expand their reach into new markets, fostering increased exports and revenue. This, in turn, drives economic growth, creates jobs, and positions the country as a more attractive investment destination, thus creating a positive feedback loop that further enhances its economic development.

Investing Excess Cash in Shares: An Investment Activity?

You may want to see also

Frequently asked questions

Foreign investment can significantly contribute to a country's GDP growth. When foreign entities invest in a country, it often leads to increased capital inflows, which can stimulate economic activity. This can result in the expansion of businesses, creation of new jobs, and improved infrastructure, all of which are factors that boost a nation's economic output and, consequently, its GDP.

While foreign investment is a powerful catalyst for GDP growth, it is not the sole factor. A country's GDP is influenced by various economic activities, including domestic consumption, investment, government spending, and net exports. Foreign investment can enhance these factors, but a comprehensive economic strategy involving domestic policies and market conditions is essential for sustained GDP growth.

FDI brings multiple advantages. It can lead to technology transfer and knowledge sharing, improving a country's productivity and competitiveness. FDI projects often create jobs and attract further investment, fostering a positive economic environment. Additionally, FDI can help diversify an economy, reduce reliance on specific industries, and enhance overall economic resilience, all of which contribute to GDP growth.

Foreign investment, while beneficial, may carry certain risks. In some cases, it could lead to environmental degradation or social issues if not properly regulated. Moreover, a heavy reliance on foreign investment might create a vulnerability to external economic shocks. Balancing foreign investment with sustainable development practices and maintaining economic sovereignty is crucial to ensure long-term GDP growth.

Governments play a vital role in maximizing the benefits of foreign investment. They can implement policies that attract FDI, such as providing incentives, improving business regulations, and ensuring political stability. Additionally, governments should focus on diversifying the investment portfolio, promoting local businesses, and investing in education and infrastructure to create a robust economic environment that supports sustainable GDP growth.