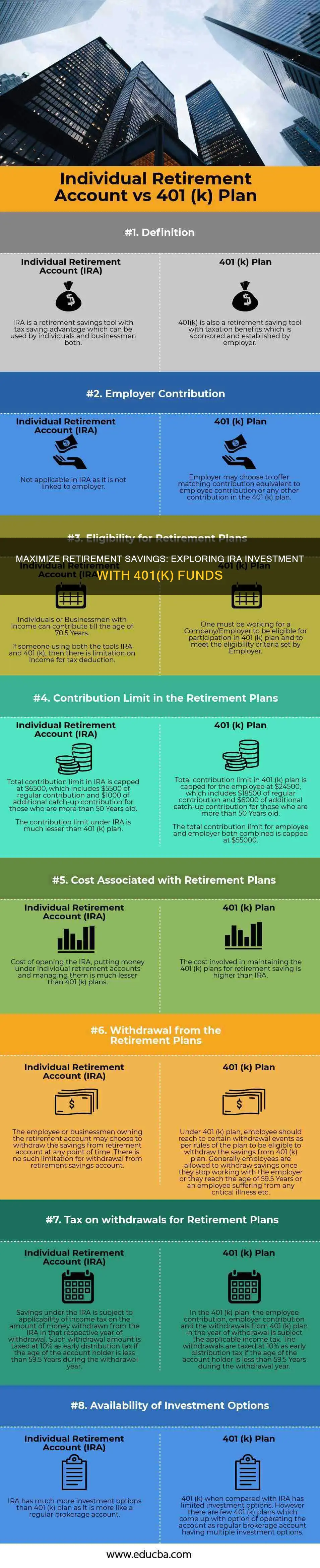

Both 401(k) plans and IRAs can help you reach your financial goals. A 401(k) is usually better if you have an employer match, plan loans, and discounted investment options. The 401(k) plans are also better for high earners because they don't restrict the tax benefits. An IRA is better if your top priority is investment selection, and you don't want your retirement plan tied to an employer. Since you can use both accounts, it could be worth splitting your funds between each to get the best of both worlds. A financial advisor can help you make this decision.

| Characteristics | Values |

|---|---|

| Tax benefits | Both 401(k) plans and IRAs can help you reach your financial goals. |

| Employer match | 401(k)s often include a match from your employer. |

| Investment selection | An IRA is better if your top priority is investment selection. |

| Employer tied | An IRA is better if you don't want your retirement plan tied to an employer. |

| Diversification | An IRA offers more flexibility and choice, giving you a greater chance to diversify your assets and reduce your investment risk. |

| Tax-advantaged | Both 401(k)s and IRAs help you save for retirement in a tax-advantaged manner. |

| Flexibility | An IRA offers more flexibility and choice. |

Tax benefits

Both 401(k) plans and IRAs can help you reach your financial goals and save for retirement in a tax-advantaged manner. 401(k) plans are usually better if you have an employer match, plan loans, and discounted investment options. 401(k) plans are also better for high earners because they don't restrict the tax benefits. An IRA is better if your top priority is investment selection, and you don't want your retirement plan tied to an employer.

If your employer offers a retirement plan, like a 401(k) or 403(b), and will match a percentage of your contributions, you should definitely take advantage of it—after all, it's free money for you. Plus you'll have a tax-advantaged account that allows you to save through automatic payroll deductions. If your employer doesn't offer a retirement plan, an IRA can be a good start to your retirement savings and another opportunity for your earnings to grow tax-advantaged.

IRAs may also allow you more flexibility in your investment choices, since you're able to choose the firm you invest with as well as the types of investments that make sense for you. All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Diversification does not ensure a profit or protect against a loss.

Understanding Timberland Investment Management Organizations: A Guide

You may want to see also

Investment selection

Both 401(k) plans and IRAs can help you reach your financial goals. A 401(k) is usually better if you have an employer match, plan loans, and discounted investment options. The 401(k) plans are also better for high earners because they don't restrict the tax benefits. An IRA is better if your top priority is investment selection, and you don't want your retirement plan tied to an employer. Since you can use both accounts, it could be worth splitting your funds between each to get the best of both worlds. A financial advisor can help you make this decision.

Contributing to both a 401(k) and an Individual Retirement Account (IRA) offers immense benefits. While 401(k)s often include a match from your employer, IRAs give you the flexibility to choose the investment firm you wish to work with. With all the different types of accounts you have to pick from, what's the right choice when it comes to retirement accounts? In many cases, you don't need to choose one over the other – we see value in exploring if an IRA may be right for you even if you already contribute to a 401(k). While 401(k)s and IRAs help you save for retirement in a tax-advantaged manner, they differ in important ways.

An IRA offers more flexibility and choice, giving you a greater chance to diversify your assets and reduce your investment risk. All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Diversification does not ensure a profit or protect against a loss.

If your employer offers a retirement plan, like a 401(k) or 403(b), and will match a percentage of your contributions, you should definitely take advantage of it—after all, it's free money for you. Plus you'll have a tax-advantaged account that allows you to save through automatic payroll deductions. If your employer doesn't offer a retirement plan, an IRA can be a good start to your retirement savings and another opportunity for your earnings to grow tax-advantaged.

Given their similar tax benefits, both 401(k) plans and IRAs can help you reach your financial goals. A 401(k) is usually better if you have an employer match, plan loans, and discounted investment options. The 401(k) plans are also better for high earners because they don't restrict the tax benefits. An IRA is better if your top priority is investment selection, and you don't want your retirement plan tied to an employer. Since you can use both accounts, it could be worth splitting your funds between each to get the best of both worlds. A financial advisor can help you make this decision.

Personal Investment Management: Your Wealth, Your Control

You may want to see also

Diversification

Investing in both a 401(k) and an IRA can offer immense benefits. While 401(k)s often include a match from your employer, IRAs give you the flexibility to choose the investment firm you wish to work with.

Investing in both a 401(k) and an IRA can offer immense benefits. While 401(k)s often include a match from your employer, IRAs give you the flexibility to choose the investment firm you wish to work with.

Investing in both a 401(k) and an IRA can offer immense benefits. While 401(k)s often include a match from your employer, IRAs give you the flexibility to choose the investment firm you wish to work with.

Understanding Investment Managers' Fiduciary Duties and Responsibilities

You may want to see also

Employer match

If your employer offers a retirement plan, like a 401(k) or 403(b), and will match a percentage of your contributions, you should definitely take advantage of it. This is free money for you and you'll have a tax-advantaged account that allows you to save through automatic payroll deductions.

K) plans are better for high earners because they don't restrict the tax benefits. They also often include a match from your employer, plan loans, and discounted investment options.

IRAs give you the flexibility to choose the investment firm you wish to work with. They are better if your top priority is investment selection, and you don't want your retirement plan tied to an employer.

Combining 401(k) plans and IRAs can make it even more comfortable. If you already contribute to a 401(k), it could be worth exploring if an IRA may be right for you.

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Diversification does not ensure a profit or protect against a loss.

Global Investing: An Indian's Guide to International Markets

You may want to see also

Retirement savings

Both 401(k) plans and IRAs can help you reach your financial goals. A 401(k) is usually better if you have an employer match, plan loans, and discounted investment options. The 401(k) plans are also better for high earners because they don't restrict the tax benefits. An IRA is better if your top priority is investment selection, and you don't want your retirement plan tied to an employer. Since you can use both accounts, it could be worth splitting your funds between each to get the best of both worlds. A financial advisor can help you make this decision.

If your employer offers a retirement plan, like a 401(k) or 403(b), and will match a percentage of your contributions, you should definitely take advantage of it—after all, it's free money for you. Plus you'll have a tax-advantaged account that allows you to save through automatic payroll deductions. If your employer doesn't offer a retirement plan, an IRA can be a good start to your retirement savings and another opportunity for your earnings to grow tax-advantaged.

Contributing to both a 401(k) and an Individual Retirement Account (IRA) offers immense benefits. While 401(k)s often include a match from your employer, IRAs give you the flexibility to choose the investment firm you wish to work with. With all the different types of accounts you have to pick from, what's the right choice when it comes to retirement accounts? In many cases, you don't need to choose one over the other – we see value in exploring if an IRA may be right for you even if you already contribute to a 401(k). While 401(k)s and IRAs help you save for retirement in a tax-advantaged manner, they differ in important ways.

IRAs may also allow you more flexibility in your investment choices, since you're able to choose the firm you invest with as well as the types of investments that make sense for you. All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Diversification does not ensure a profit or protect against a loss.

Investment Components in GDP: Understanding the Basics

You may want to see also

Frequently asked questions

Both 401(k) and IRA offer similar tax benefits, but 401(k) is better if you have an employer match, plan loans, and discounted investment options. 401(k) is also better for high earners as it doesn't restrict the tax benefits. IRA is better if your top priority is investment selection, and you don't want your retirement plan tied to an employer.

Combining both 401(k) and IRA can make it even more comfortable. If your employer offers a retirement plan, like a 401(k) or 403(b), and will match a percentage of your contributions, you should definitely take advantage of it. If your employer doesn't offer a retirement plan, an IRA can be a good start to your retirement savings and another opportunity for your earnings to grow tax-advantaged.

Contributing to both a 401(k) and an Individual Retirement Account (IRA) offers immense benefits. While 401(k)s often include a match from your employer, IRAs give you the flexibility to choose the investment firm you wish to work with. In many cases, you don't need to choose one over the other – we see value in exploring if an IRA may be right for you even if you already contribute to a 401(k).

IRAs may also allow you more flexibility in your investment choices, since you're able to choose the firm you invest with as well as the types of investments that make sense for you.

401(k) is usually better if you have an employer match, plan loans, and discounted investment options. 401(k) is also better for high earners as it doesn't restrict the tax benefits.