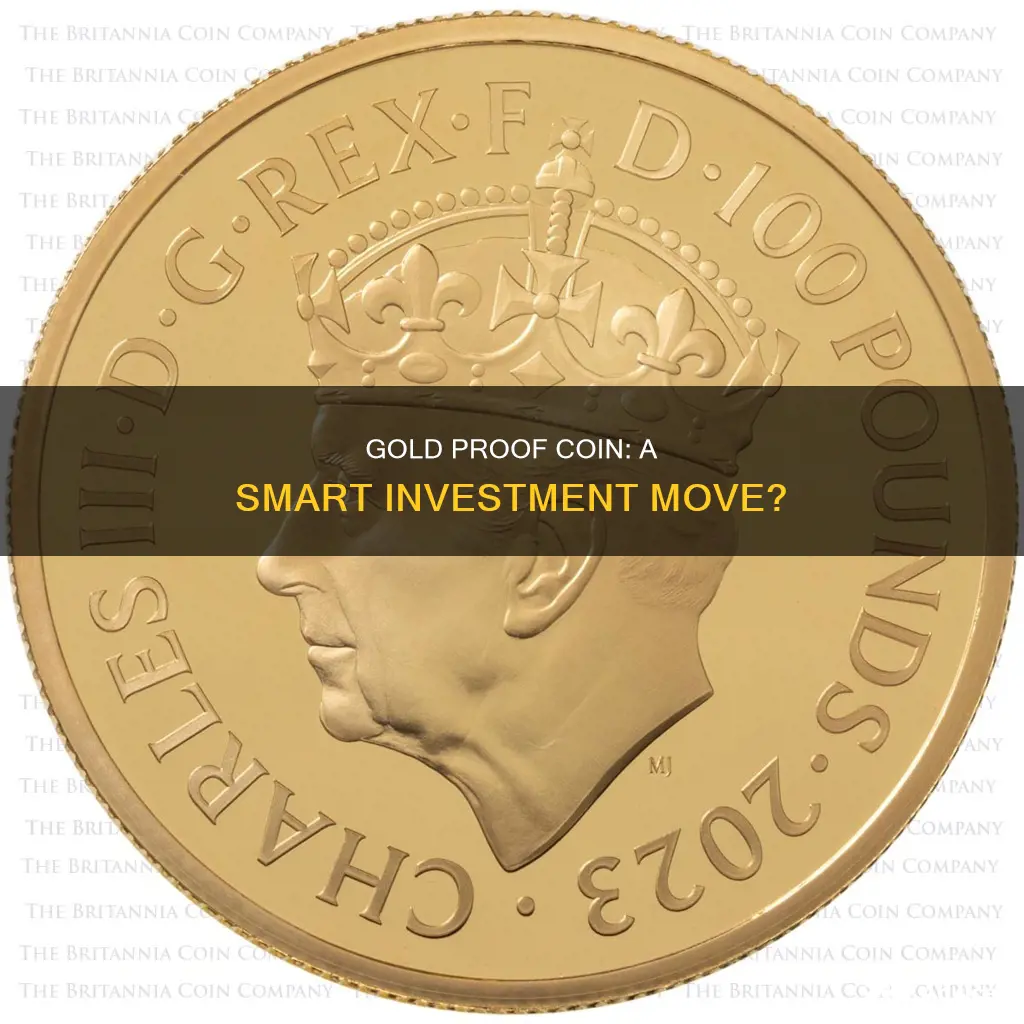

Gold proof coins are an attractive investment option for collectors and investors alike. Produced and sold by the US Mint, these coins are beautiful pieces of art made from precious metals. They are struck in sharp relief, with mirror-like backgrounds and frosted, sculpted foregrounds, resulting in a unique cameo effect. The US Mint itself considers proof coins to be the finest quality of coin produced. However, it is important to note that the term proof does not indicate the condition of the coin, and these coins can still be subject to wear and tear. The higher price of gold proof coins compared to their regular counterparts is mainly due to their collectibility factor and rarity.

| Characteristics | Values |

|---|---|

| Quality | US Mint gold proof coins have reliable purity levels and are made from special blanks that have been treated, hand-polished and then cleaned before striking. |

| Price | The price of a US Mint gold proof coin is higher than that of a regular strike bullion coin. |

| Value | The value of a gold proof coin depends on its collectibility factor, rarity, and historical significance. |

| Investment | US Mint gold proof coins are a good investment for collectors due to their limited supply, unique features, and potential for appreciation over time. |

What You'll Learn

- Gold proof coins are made from specially treated blanks, hand-polished, cleaned, and struck at least twice

- Gold proof coins are more expensive than bullion coins due to their intricate, detailed designs and time-consuming production process

- Gold proof coins are rarer than bullion coins, with lower mintages, and are therefore more valuable

- Gold proof coins are highly sought-after by collectors due to their limited mintage, numismatic value, and historical significance

- Gold proof coins are a good investment if you are looking for a unique and valuable asset, but bullion coins are more liquid and flexible

Gold proof coins are made from specially treated blanks, hand-polished, cleaned, and struck at least twice

Gold proof coins are made through a specialised minting process that results in a unique finish. The blanks used for these coins are treated, hand-polished, and cleaned before striking. The dies used to strike the coins are also specially polished. This process is done to achieve a mirror-like background and enhanced definition.

The proof coins are then struck at least twice, resulting in a superior finish compared to other coins. This double striking process does not usually cause observable doubling but ensures that intricate elements of the original die are fully transferred to the coin. As a result, proof coins exhibit sharper rims, smoother fields, and more intricate details than typical circulation coins.

Historically, proof coins served as "trial run" samples for checking dies and archival purposes. They were not intended for general circulation and were often used to identify errors before mass minting. Today, proof coins are recognised as the highest-quality coins a mint can produce and are highly valued by collectors.

The process of creating gold proof coins, from the special treatment of blanks to the double striking process, ensures that these coins possess exceptional craftsmanship, purity, and a unique appearance. This intricate production process contributes to the value and collectibility of gold proof coins.

Litecoin Investment: Good or Bad Idea?

You may want to see also

Gold proof coins are more expensive than bullion coins due to their intricate, detailed designs and time-consuming production process

Gold proof coins are produced using a specialised minting process that requires time, skill, and the latest in minting technology. This process results in intricate, detailed designs and a high level of finish.

Proof coins start as highly polished blanks, which are then hand-loaded into a coin press and struck multiple times with specially treated dies. The combination of these elements results in a high level of detail, with frosted images and mirror-like backgrounds. The dies used to strike them are also specially polished. This process is done to ensure that the coins feature sharper detail and a high-quality finish.

The striking process is slower for proof coins, with no more than 50 coins able to be struck each hour. This results in lower mintages compared to bullion coins, making proof coins relatively scarce.

The labour-intensive production process of proof coins means they are more expensive than bullion coins. The scarcity of proof coins also contributes to their higher price.

Who Invests in Bitcoin? Understanding the Typical Investor

You may want to see also

Gold proof coins are rarer than bullion coins, with lower mintages, and are therefore more valuable

Gold proof coins are a good investment option for collectors due to their rarity and aesthetic value. They are rarer than bullion coins and have lower mintages, making them more valuable.

Gold proof coins are produced through a specialised process that sets them apart from other coins. They are struck multiple times, resulting in an exceptional finish with a mirror-like background and enhanced definition. This intricate process limits the number of coins that can be produced per hour, making proof coins rarer than bullion coins.

The U.S. Mint classifies proof coins as the "finest quality of coin produced". They are made from special blanks that are treated, hand-polished, and cleaned before striking. The dies used are also specially polished to ensure a high-quality finish. This attention to detail and the slower production method result in lower mintages for proof coins compared to bullion coins.

The rarity of gold proof coins, combined with their superior finish and aesthetic appeal, makes them highly sought-after by collectors. The market for proof coins is wider due to their collectability, and their limited numbers contribute to their value.

While the gold content in proof coins is the same as their regular strike counterparts, proof coins consistently command higher prices. For example, an American Eagle Proof gold coin typically carries a premium around 9% higher than non-proof versions.

In addition to their collectability, gold proof coins also hold their value over time. For instance, a top-graded 2006 American Gold Eagle proof coin was worth 16% more than its non-proof version in October 2021.

When investing in gold proof coins, it is essential to consider your investment goals and conduct thorough research. Buying from reputable dealers and ensuring the authenticity of the coins with certificates of authenticity are crucial steps in the process.

In summary, gold proof coins are rarer than bullion coins due to their lower mintages, specialised production process, and the attention to detail that goes into creating them. This rarity, combined with their superior finish and collectability, makes gold proof coins a valuable investment option for collectors.

A Small Bitcoin Investment: Can It Make You a Millionaire?

You may want to see also

Gold proof coins are highly sought-after by collectors due to their limited mintage, numismatic value, and historical significance

Limited Mintage

Proof coins are typically released in limited quantities by mints such as the United States Mint, making them rare and sought-after by collectors. The limited availability of certain proof coins can drive up their numismatic value over time.

Numismatic Value

Gold proof coins possess high numismatic value due to their historical, cultural, and aesthetic appeal. They are often considered works of art, with intricate designs and exceptional craftsmanship. The combination of precious metal content and artistic beauty enhances their desirability among collectors.

Historical Significance

The historical significance of gold proof coins is another crucial factor in their collectability. Many gold coins were minted during significant historical events or periods, providing a tangible connection to the past. Collectors value the ability to associate these coins with specific eras, increasing their appeal and worth.

Additionally, some gold proof coins may be proofs of historically popular or significant coins, further enhancing their numismatic value.

Other Considerations

While gold proof coins offer these advantages, there are also considerations to keep in mind. The market for proof coins is speculative, and the high initial premiums associated with these coins should be factored into investment decisions. The potential for counterfeiting and scams is another risk to be aware of, although buying from reputable dealers can mitigate this issue.

The Pros and Cons of Bitcoin Investments

You may want to see also

Gold proof coins are a good investment if you are looking for a unique and valuable asset, but bullion coins are more liquid and flexible

Gold proof coins are minted with a unique, meticulous process that combines bullion blanks with proof striking methods. This results in coins with a mirror-like background and frosted, detailed designs. The US Mint itself declares proof coins to be the "finest quality of coin produced".

Gold proof coins are a good investment if you are looking for a unique and valuable asset. Their value is derived from their intrinsic worth, which comes from their weight and purity, as well as their numismatic value, which can increase over time due to their limited production and unique design. Their collectability factor is higher than regular bullion coins, as they are produced in lower numbers and are sought after by collectors.

However, if you are looking for a more liquid and flexible investment, bullion coins may be a better option. Bullion coins are the cornerstone of most precious metal investment portfolios and are minted to provide a convenient and cost-effective way to acquire precious metals. They are produced in larger quantities, making them more readily available and easier to sell quickly. Their value is primarily determined by metal spot prices, making them a more straightforward investment choice.

Both types of coins have their advantages and appeal to different types of investors. Gold proof coins are ideal for those seeking a unique and valuable asset, while bullion coins are more suitable for those wanting a practical and flexible way to invest in precious metals.

The Cost of Investing in Bitcoin: A Comprehensive Guide

You may want to see also

Frequently asked questions

The answer depends on several factors, including rarity, demand, historical significance, and metal content. While gold proof coins may have a higher resale value due to their collectibility factor and rarity, it is essential to consider your investment goals and conduct thorough research before purchasing.

When investing in US Mint gold proof coins, it is crucial to evaluate factors such as rarity, demand, historical significance, and metal content. Rarity significantly influences coin investment viability, and US Mint coins have produced many rare numismatic pieces that attract collectors and investors. Additionally, the US Mint is known for its high-quality production processes, and their gold proof coins undergo special treatment, hand-polishing, cleaning, and striking to create an exceptional finish.

To maximise the investment potential of US Mint gold proof coins, focus on purchasing coins with high premium values due to their collectible and investment appeal. Seek uncirculated coin sets with limited circulation, ensuring they have undergone professional grading to assess their condition and minimise wear. Additionally, consider the historical significance of the coins, as commemorative issues often resonate more deeply with buyers.

US Mint gold proof coins can be purchased directly from the US Mint website or through authorised local dealers and online markets. The US Mint website provides an easy-to-use interface and professional customer service to facilitate purchases for collectors and investors. However, it is important to exercise caution and only purchase from reputable sources adhering to governmental regulations to safeguard the integrity of your investments.