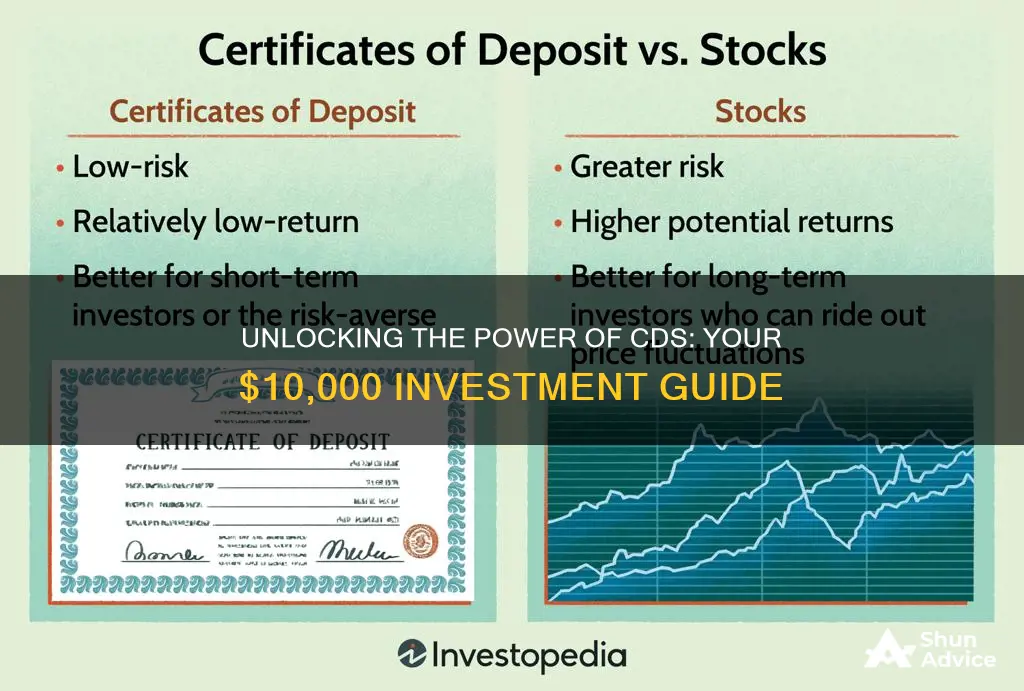

If you invest $10,000 in a certificate of deposit (CD), you're essentially lending your money to a financial institution for a fixed period. In return, the bank promises to pay you a predetermined interest rate over the term of the CD, which can range from a few months to several years. CDs are a low-risk investment option, offering a guaranteed return, and they can be a great way to grow your savings without the volatility of the stock market. Understanding how CDs work, including the interest calculation and compounding, can help you make an informed decision about where to park your money.

What You'll Learn

- Understanding CDS Basics: How credit default swaps function as insurance contracts

- Risk and Reward: The potential risks and rewards of investing in CDS

- Market Dynamics: How CDS prices fluctuate based on market conditions

- Investment Strategies: Approaches for managing CDS investments effectively

- Regulatory Considerations: Legal and regulatory frameworks governing CDS investments

Understanding CDS Basics: How credit default swaps function as insurance contracts

Credit Default Swaps (CDS) are financial instruments that play a crucial role in the global financial markets, offering a unique form of insurance against credit risk. When you invest a sum of money, such as $10,000, in the form of a CDS, you are essentially entering into a contract that provides protection against the default of a specific reference entity, often a bond or a loan. This concept can be likened to traditional insurance, where you pay a premium to be covered against a potential loss.

In the context of CDS, the investor (you) and the counterparty agree to terms where the investor receives protection against the credit risk of a particular reference obligation. This reference obligation could be a bond issued by a corporation or a government, or even a loan. The key idea is that if the reference entity defaults on its payments, the investor can claim compensation, thus mitigating potential losses.

The mechanics of a CDS contract involve a series of steps. Firstly, the investor pays an upfront premium to the counterparty, which serves as a form of consideration for the insurance-like coverage. This premium is typically a small percentage of the total value of the reference obligation. Secondly, the investor gains exposure to the creditworthiness of the reference entity. If the entity defaults, the investor can exercise their right to compensation, which is usually in the form of cash payments.

The beauty of CDS lies in its flexibility and customization. Investors can choose the amount of protection they want, the duration of the contract, and the specific reference entity they wish to insure against. This allows for a tailored risk management strategy, especially for those with large investments or exposure to specific industries or sectors. For instance, a large institutional investor might use CDS to protect a portfolio of corporate bonds, ensuring that potential defaults do not significantly impact their overall financial health.

In summary, CDS function as insurance contracts, providing investors with a means to manage credit risk. By investing in a CDS, you gain protection against the potential default of a reference entity, allowing you to mitigate losses and maintain financial stability. Understanding the mechanics and benefits of CDS is essential for investors looking to navigate the complex world of financial derivatives and effectively manage their risk exposure.

Luxury Bags as an Investment: A Guide to Smart Purchasing

You may want to see also

Risk and Reward: The potential risks and rewards of investing in CDS

When considering an investment in Credit Default Swaps (CDS), it's crucial to understand the potential risks and rewards associated with this financial instrument. CDS are essentially insurance contracts that protect investors against the risk of default on a bond or loan. Here's an overview of the risks and rewards:

Risks:

- Counterparty Risk: One of the primary risks in CDS is counterparty risk. When you enter into a CDS contract, you are essentially agreeing to pay a premium to another party in exchange for protection against default. If the counterparty fails to honor the contract, you may face significant losses. This risk is particularly high in the case of investment-grade bonds, where the default risk is generally considered lower.

- Market Volatility: CDS markets can be highly volatile, especially during economic downturns or financial crises. The value of CDS contracts can fluctuate rapidly, and investors may face substantial losses if the underlying asset defaults or if market conditions change unfavorable.

- Liquidity Risk: CDS markets are not always liquid, meaning it can be challenging to buy or sell contracts quickly at a fair price. This lack of liquidity can result in losses if you need to exit a position in a hurry.

- Regulatory and Legal Risks: The regulatory environment for CDS is complex and evolving. Changes in regulations or legal interpretations can impact the way CDS are traded and settled, potentially leading to unforeseen risks for investors.

Rewards:

- Diversification: Investing in CDS can provide a means of diversifying your portfolio. By taking on credit risk, you can potentially earn higher returns compared to traditional fixed-income investments, especially during periods of economic recovery.

- Leverage: CDS contracts often involve leverage, allowing investors to gain exposure to a large amount of credit risk with a relatively small initial investment. This can amplify potential returns but also increases the risk of significant losses.

- Protection against Default: The primary reward of CDS is the protection it offers against credit default. If the underlying asset defaults, the CDS provider will compensate you, ensuring a level of security for your investment.

- Potential for Higher Yields: In a rising interest rate environment, CDS can offer attractive yields, especially for those seeking income generation. The premium payments received from CDS providers can provide a steady income stream.

In summary, investing in CDS can be a complex and risky endeavor. While it offers the potential for higher returns and diversification, it also carries significant counterparty, market, and regulatory risks. Investors should carefully assess their risk tolerance, conduct thorough research, and consider seeking professional advice before engaging in CDS transactions, especially with a substantial investment amount like $10,000. Understanding the underlying assets and market dynamics is essential to making informed decisions in the CDS market.

Strategic Retirement Planning: Navigating Wells Fargo's Investment Vehicle Options

You may want to see also

Market Dynamics: How CDS prices fluctuate based on market conditions

Credit Default Swaps (CDS) are financial derivatives that play a crucial role in the global financial markets, particularly in managing credit risk. When you invest in CDS, understanding how their prices fluctuate is essential for making informed decisions. Market dynamics significantly influence CDS pricing, and these fluctuations can have a substantial impact on your investment strategy. Here's an overview of how CDS prices move in response to various market conditions:

Market Sentiment and Credit Risk: CDS prices are highly sensitive to market sentiment and credit risk perceptions. When there is a general improvement in market sentiment, investors often become more optimistic about the creditworthiness of various entities. This optimism can lead to a decrease in CDS prices as the perceived risk of default decreases. For instance, if a country's economic outlook improves, investors might reduce their CDS holdings, causing the CDS price to drop. Conversely, during periods of market uncertainty or economic downturns, investors may seek protection through CDS, driving up the price as the market demands higher compensation for the perceived risk.

Credit Events and Default Risk: One of the most critical factors affecting CDS prices is the occurrence of credit events, particularly defaults. If a company or country defaults on its debt obligations, the value of the underlying CDS contract becomes relevant. In the event of a default, the CDS buyer can claim compensation from the seller, and this triggers a price adjustment. The more frequent and severe the credit events in a specific market or sector, the higher the CDS prices are likely to be, as investors demand higher protection. For instance, during the 2008 financial crisis, CDS prices soared due to numerous defaults in the financial sector.

Market Liquidity and Volatility: Market liquidity and volatility also play a significant role in CDS pricing dynamics. In liquid markets, where CDS contracts are actively traded, prices tend to be more stable and responsive to market conditions. However, in illiquid markets, CDS prices may be more volatile and less reflective of actual market sentiment. During periods of high market volatility, investors might demand higher premiums for CDS, expecting more frequent and severe credit events. Conversely, in stable markets, CDS prices may decrease as the perceived risk of default is lower.

Economic Indicators and Policy Changes: Economic indicators and policy decisions made by governments and central banks can significantly impact CDS prices. For example, interest rate changes, GDP growth forecasts, and inflation rates can influence the perceived credit risk of various entities. If central banks lower interest rates, it might stimulate economic activity, potentially reducing the perceived risk of default and leading to lower CDS prices. On the other hand, policy changes that affect the financial sector, such as new regulations or tax policies, can also impact CDS pricing, as they may alter the investment landscape and risk perceptions.

Understanding these market dynamics is crucial for investors looking to invest in CDS. By analyzing market sentiment, credit events, liquidity, and economic indicators, investors can make more strategic decisions regarding their CDS investments. It's important to note that CDS pricing is a complex process, and these fluctuations can have far-reaching implications for investors, especially in the context of a $10,000 investment, where even small price movements can result in significant gains or losses.

Cutting Out the Middleman: Strategies for Broker-Free Investing

You may want to see also

Investment Strategies: Approaches for managing CDS investments effectively

Before delving into investment strategies, it's crucial to understand how Collateralized Debt Obligations (CDOs) work, especially if you're considering an investment of $10,000. CDOs are complex financial instruments that are essentially bundles of debt obligations, such as mortgage-backed securities or corporate bonds. They are designed to provide investors with exposure to a diversified portfolio of these underlying assets. Here's a breakdown of how they function and how you can approach managing your investment effectively.

Understanding the Basics of CDOs:

When you invest in a CDO, you're essentially buying a slice of a larger, diversified portfolio. These portfolios are carefully constructed to include a wide range of debt instruments. The key idea is to spread risk across multiple assets, reducing the impact of any single default. CDOs are typically structured as tranched securities, meaning they are divided into different categories or tranches, each with varying levels of risk and reward. The most senior tranches are considered the safest and have the lowest risk of default, while the equity tranche is the riskiest.

Investment Strategies for Managing CDS:

- Diversification: The core principle of managing any investment, including CDOs, is diversification. If you invest $10,000, consider allocating your funds across multiple CDOs with different underlying asset portfolios. This approach minimizes the risk associated with any single CDO's performance. Diversification can be achieved by investing in CDOs with various credit ratings, sectors, or regions.

- Risk Assessment: Conduct thorough risk assessments for each CDO you consider. Analyze the underlying collateral, the tranche structure, and the historical performance of the issuing entity. Tools like credit default swaps (CDS) can be used to gauge the market's perception of risk. Understanding the risk profile of each investment will help you make informed decisions.

- Tranche Allocation: CDOs are structured with different tranches, each offering varying levels of risk and return. For a $10,000 investment, you might want to consider a strategy that balances risk and reward. Typically, more senior tranches are safer but offer lower returns, while equity tranches provide higher potential gains but are riskier. A strategic allocation could involve a mix of senior and equity tranches to suit your risk tolerance.

- Regular Review and Rebalancing: Market conditions and the performance of underlying assets can change over time. Regularly review your CDO investments and rebalance your portfolio as needed. This ensures that your $10,000 investment remains aligned with your risk and return objectives. Stay updated on economic trends and industry-specific news that might impact the performance of the underlying debt instruments.

- Consider Leverage and Fees: Be mindful of any leverage or fees associated with your CDO investments. Some CDOs offer leverage, which can amplify returns but also increases risk. Additionally, consider the management fees and transaction costs, as these can impact your overall returns. Understanding these factors will help you make more informed investment decisions.

Water Rights: An Investment Guide

You may want to see also

Regulatory Considerations: Legal and regulatory frameworks governing CDS investments

When considering an investment of $10,000 in Credit Default Swaps (CDS), it's crucial to understand the regulatory landscape that governs these financial instruments. CDS are complex derivatives that allow investors to speculate on the creditworthiness of borrowers or to hedge against potential credit defaults. However, due to their potential impact on financial stability and market dynamics, they are subject to strict regulations.

The legal and regulatory frameworks for CDS vary by jurisdiction, but they generally aim to ensure transparency, protect investors, and maintain market integrity. In the United States, for example, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have established rules for CDS trading. The SEC requires disclosure of certain information, such as the identity of the reference entity and the terms of the swap, to ensure that investors have access to relevant data. The CFTC, on the other hand, regulates the trading of CDS as derivatives, overseeing the exchanges and clearinghouses where these contracts are traded.

One key regulatory consideration is the requirement for central clearing. Many jurisdictions mandate that CDS transactions be cleared through designated central counterparties (CCPs). CCPs act as intermediaries, reducing counterparty risk and ensuring that transactions are settled in a standardized and transparent manner. This requirement enhances market stability and provides a layer of protection for investors. For instance, in the European Union, the European Securities and Markets Authority (ESMA) has implemented rules that mandate central clearing for certain CDS, particularly those related to sovereign debt and corporate bonds.

Additionally, regulatory bodies often impose capital requirements and risk management standards on financial institutions that deal in CDS. These requirements ensure that banks and other financial entities have sufficient capital to absorb potential losses and maintain their financial stability. The Basel Committee on Banking Supervision, for instance, has provided guidelines for banks' risk management practices, including the treatment of CDS as part of their trading book exposure.

Investors should also be aware of the legal and regulatory risks associated with CDS, such as the potential for counterparty default or the impact of regulatory changes on the value of their investments. It is essential to conduct thorough research, understand the underlying assets and reference entities, and seek professional advice when investing in CDS, especially with substantial amounts like $10,000. Staying informed about regulatory developments is crucial to ensure compliance and mitigate potential legal and financial risks.

Purchasing Power: Navigating the British Pound as an Investment Option

You may want to see also

Frequently asked questions

CDs, or Certificate of Deposits, are time deposits offered by banks or credit unions. When you invest $10,000 in a CD, you're essentially lending your money to the financial institution for a fixed period. In return, the bank pays you a predetermined interest rate over the term of the CD. The key advantage is the guaranteed return, as long as you keep the money in the CD until maturity.

CD terms can vary widely, typically ranging from 6 months to 5 years or more. The longer the term, the higher the interest rate is usually offered. For instance, a 1-year CD might offer a competitive rate, while a 5-year CD could provide a more attractive yield. It's essential to compare rates and terms from different financial institutions to find the best deal.

Interest on CDs is typically calculated as simple interest, meaning it's applied to the principal amount only. For example, if you invest $10,000 at an annual interest rate of 4%, you'll earn $400 in interest over the term. The interest is added to the principal, and you'll receive the total amount at maturity. Some CDs may also offer compound interest, where interest is earned on the accumulated interest.

While CDs are generally considered low-risk investments, there are a few considerations. First, early withdrawal penalties can be significant if you need to access your funds before maturity. Additionally, if the bank fails, the FDIC (Federal Deposit Insurance Corporation) typically insures CDs up to $250,000 per ownership category, so your principal is protected. However, it's essential to choose a reputable financial institution to minimize risk.

Withdrawing funds early can result in penalties. The penalty amount is usually a percentage of the interest that would have been earned over the remaining term. For instance, if you withdraw after 6 months, you might lose 1-2 months' worth of interest. It's crucial to review the terms and conditions of the specific CD you're considering to understand the early withdrawal penalty structure.