Crude oil ETFs are a great way to invest in oil without having to deal with the hassle and risk of directly investing in oil company stocks or storing barrels of oil. ETFs allow you to include oil investments in your strategy without directly investing in the company stocks of an oil producer. They are also more cost-effective as you make one purchase at one price and save on commissions.

There are a few things to keep in mind when investing in crude oil ETFs. Firstly, conduct thorough research and track oil prices to understand how oil ETFs react to different market conditions. Secondly, be aware of the risks involved as oil is a volatile commodity. Thirdly, consider the timing of your investment. It is generally better to invest when the future price of oil is lower than the current price, a situation known as backwardation. Finally, remember that crude oil ETFs are not suitable for a buy-and-hold strategy but are more suited for short-term trading.

| Characteristics | Values |

|---|---|

| Oil ETF with the Best 1-Year Return | United States Brent Oil Fund LP (BNO) |

| Oil ETF with the Lowest Fees and Most Liquidity | United States Oil Fund LP (USO) |

| Oil ETFs with the Best 12-Month Performance, Lowest Fees, and Most Liquidity | United States Brent Oil Fund LP (BNO), United States Oil Fund LP (USO) |

| Example of an Oil ETF | USO, the United States Oil Fund |

| Example of an Inverse Oil ETF | MicroSectors Oil & Gas Exp. & Prod. 3x Inverse Leveraged ETN |

| Example of an Oil ETF with a Benchmark | BNO, which benchmarks against the near-month futures contract |

| Example of an Oil ETF Issuer | USCF Investments |

What You'll Learn

Crude oil ETFs vs owning oil

Crude Oil Exchange-Traded Funds (ETFs) are a way to invest in crude oil without directly investing in the company stocks of an oil producer. They are a simple way to expose your investment strategy to the price and performance of oil without actually owning any oil. Crude oil ETFs consist of either oil company stocks or futures and derivative contracts that track the price of oil or oil-related indexes.

Advantages of Crude Oil ETFs:

- You can make one purchase at one price and save on commissions.

- You can usually short ETFs, use limit and stop-loss orders, and apply trading strategies as you add them to your portfolio.

- They offer tax advantages over other investments such as mutual funds.

- They are easily tradable as you can get in and out of ETFs at any time, without having to go through a broker-dealer or mutual fund company.

- They are low fee compared to mutual funds.

Disadvantages of Crude Oil ETFs:

- They may not deliver the return of the underlying index or crude oil prices due to tracking error.

- They are only suitable for short-term speculation as they frequently suffer from negative roll yield as futures contracts expire.

- They may lose some of their correlation to the underlying market when the NYMEX WTI futures roll approaches, which can inflate your costs due to slippage.

- Their performance may deviate from spot prices due to roll yield, transaction costs, and management fees.

Owning Oil

One way to invest in crude oil is to buy actual oil by the barrel. However, this is an inefficient method of portfolio diversification and can be a fire hazard.

Another way to own oil is to buy oil options. Options contracts give the buyer or seller the option to trade oil on a future date. If you choose to buy options directly in oil, you will need to trade them on a commodities exchange.

You could also buy crude outright in the spot market if you have deep pockets and sufficient storage facilities to accommodate a shipment of 600,000 barrels from a tanker or 25,000 barrels a month via pipeline.

Advantages of Owning Oil:

- You have direct access to the physical market.

- You have roughly 24-hour trading access.

Disadvantages of Owning Oil:

Section-title>

Both crude oil ETFs and owning oil have their advantages and disadvantages. Crude oil ETFs offer a simpler, more accessible way to gain exposure to oil prices, while owning oil provides direct access to the physical market and 24-hour trading access. Ultimately, the decision of whether to invest in crude oil ETFs or own oil depends on the investor's goals, risk tolerance, and financial situation.

Schwab's Auto-Invest Feature: A Smart ETF Strategy?

You may want to see also

Oil ETF risks and rewards

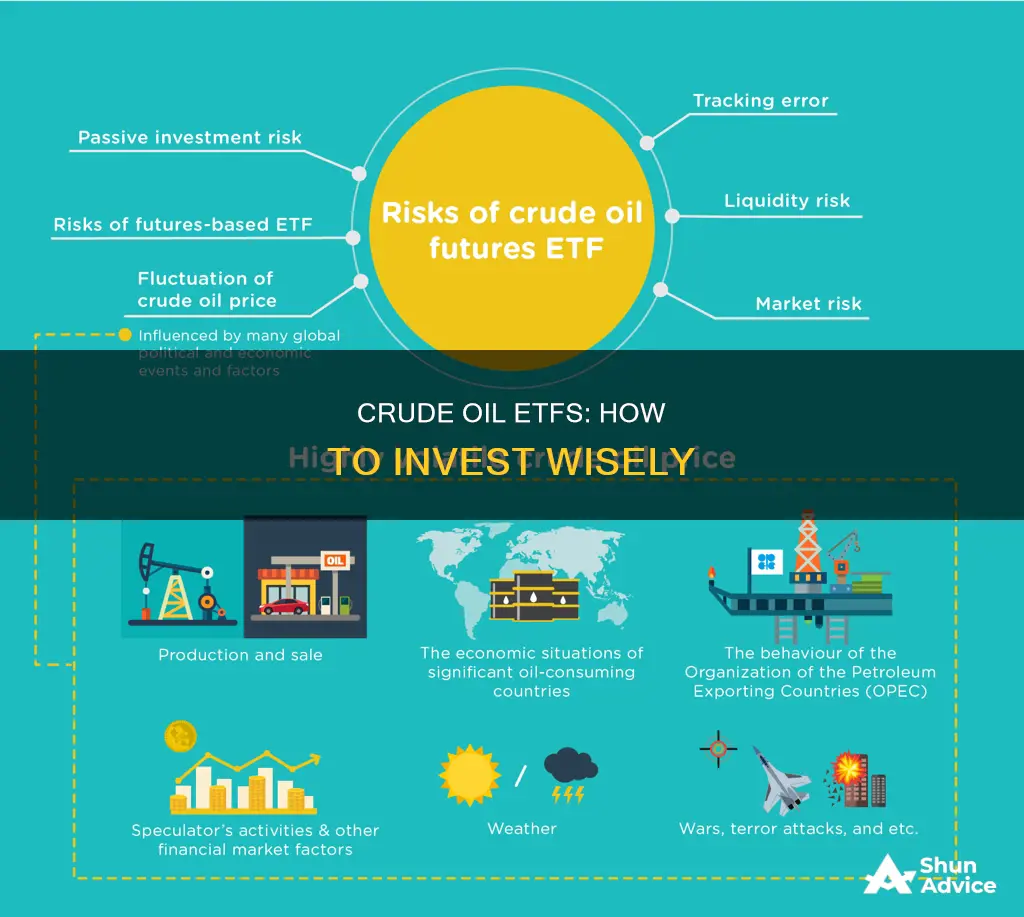

Oil ETFs are a popular way to gain exposure to the oil industry and potentially earn high returns. However, as with any investment, there are risks to consider. This article will outline the key risks and rewards of investing in oil ETFs.

Rewards

Oil ETFs offer investors several benefits, including:

- Diversification: Oil ETFs provide exposure to the oil industry without the need to buy and sell individual stocks. This helps to diversify an investor's portfolio, spread risk, and reduce overall volatility.

- Cost-effectiveness: ETFs generally have lower management fees than actively managed funds, making them a more cost-effective option.

- Inflation hedge: Oil prices tend to rise with inflation, so investing in oil ETFs can help protect an investor's purchasing power.

- Global exposure: Many oil ETFs hold a diversified portfolio of oil-related assets from different parts of the world, providing investors with exposure to the global oil industry.

- Convenience: Oil ETFs offer a convenient way for investors to gain exposure to the oil market without dealing with the logistics of handling single energy-related stocks or investing in oil futures.

- Tax advantages: Capital gains taxes on oil ETFs are deferred until the position is sold, unlike other investments such as mutual funds.

Risks

Some of the key risks associated with investing in oil ETFs include:

- Volatility: Oil prices can be highly volatile, and oil ETFs can be equally volatile. Geopolitical events, changes in global supply and demand, and other factors can cause significant price fluctuations.

- Geopolitical risks: Oil production and transportation are often concentrated in regions susceptible to conflict, such as the Middle East. Any disruption to oil supplies can lead to price spikes that negatively impact investors.

- Environmental risks: With the world's shift towards renewable energy, oil companies may face challenges in maintaining profitability. The increasing popularity of electric vehicles, for example, could lead to a decline in demand for oil.

- Limited diversification: Investing in oil ETFs can limit diversification as they are focused on a single sector. Investors may not have exposure to other sectors, such as technology or healthcare.

- High management fees: Oil ETFs can have high management fees, which can eat into returns over time.

- Tracking error: Commodity and midstream exchange-traded funds may not always deliver the return of the underlying index or crude oil prices.

- Negative roll yield: Commodity ETFs often suffer from negative roll yield as futures contracts expire, making them suitable only for short-term speculation.

Investing in oil ETFs can be a lucrative opportunity for investors, but it is important to carefully consider the risks and rewards. Oil ETFs can provide exposure to the oil market, potential high returns, and diversification benefits. However, the volatile nature of the oil industry and various geopolitical and environmental risks can lead to significant losses. Investors should assess their risk tolerance and conduct thorough research before investing in oil ETFs.

ETFs: Minimum Investment Requirements and How They Work

You may want to see also

Best and worst times to invest in oil ETFs

When considering investing in crude oil ETFs, timing can be crucial. Several factors can influence the performance of oil ETFs, and thus, there are some key moments that can be advantageous or detrimental for investors. Here are some insights into the best and worst times to consider when investing in oil ETFs:

One of the best times to invest in oil ETFs is during periods of economic growth and recovery. Oil demand is often linked to economic activity, particularly in sectors such as transportation, manufacturing, and industry. When the economy is expanding, these sectors tend to experience increased activity, driving up the demand for oil. This increased demand can lead to rising oil prices and positive performance for oil ETFs. For example, in the aftermath of a recession or during periods of strong economic growth, investing in oil ETFs may be a strategic choice.

Conversely, one of the worst times to invest in oil ETFs is during economic downturns or recessions. During these periods, economic activity slows down, and demand for oil tends to decrease. This can lead to a surplus of oil in the market, causing prices to decline. Investing in oil ETFs during a recession may result in underperformance or losses as the value of the funds may drop along with oil prices. It is generally advisable to be cautious when the economic outlook is negative or uncertain.

Seasonality also plays a role in the performance of oil ETFs. Typically, demand for oil tends to peak during the summer months in the Northern Hemisphere, particularly due to increased travel and vacationing. This seasonal increase in demand can drive up oil prices, making it a favourable time to invest in oil ETFs. On the other hand, winter months may see a decrease in demand, especially if the weather is mild, leading to lower oil prices. Thus, the period leading up to and during the summer can be a strategic time to consider investing in oil ETFs.

In addition, it is important to monitor geopolitical events and their impact on oil-producing regions. Conflicts, political instability, or sanctions in major oil-producing countries can disrupt supply chains and influence oil prices. For example, tensions in the Middle East or Russia's invasion of Ukraine have had significant effects on oil markets. Investing in oil ETFs during periods of heightened geopolitical risk can offer opportunities for gains as supply concerns drive up oil prices. On the other hand, the resolution of such conflicts or the easing of tensions may lead to a decrease in oil prices.

Another factor to consider is the state of the oil market itself. Times when oil inventories are low and supplies are tight can be advantageous for investing in oil ETFs. This scarcity can drive up oil prices and create a favourable environment for investments. Conversely, it may be unwise to invest during periods of oversupply or when inventories are high, as this can put downward pressure on oil prices. Monitoring inventory levels and supply-demand dynamics can help identify opportune moments to enter the market.

In summary, investing in crude oil ETFs requires a careful consideration of timing. Economic growth, seasonal demand, geopolitical events, and market dynamics all play a role in influencing oil prices and the performance of oil ETFs. By understanding these factors, investors can make more informed decisions about when to enter or avoid the market, ultimately improving their chances of achieving favourable returns.

A Beginner's Guide to ETF Investing

You may want to see also

Oil ETF structures

There are two main types of ETF structures: physical and synthetic.

Physical ETFs are the most common type, where the fund tracks the target index by holding all or some of the underlying assets of the index. For example, an ETF that tracks the S&P 500 Index will consist of either all 500 companies in the index or a representative sample of that basket of stocks.

Synthetic ETFs, on the other hand, do not invest in assets directly. Instead, they hold a series of agreements with a third party, often an investment bank, who promises to pay back an agreed level of return when the asset (in this case, oil) reaches a certain price. Synthetic ETFs are ideal for exposure to hard-to-access assets like commodities. They often offer higher potential returns than buying stocks or other vehicles that involve directly holding the asset, but they also come with greater risk, including potential exposure to counterparty risk.

When considering how to choose between the two structures, it's important to keep in mind the client's investment goals. Physical ETFs are more widely available and usually have lower risk. Synthetic ETFs can provide greater access to different assets and potentially higher returns but often with more associated risk.

- United States Oil Fund LP (USO): This ETF is structured as a commodity pool and is meant to mirror the percentage change in the spot price of West Texas Intermediate (WTI) crude oil. It is a synthetic ETF.

- United States Brent Oil Fund LP (BNO): This ETF is structured to mirror the daily percentage change in the spot price of Brent Crude oil. It is also a synthetic ETF.

- Energy Select Sector SPDR Fund (XLE): This ETF holds shares of energy companies that are part of the S&P 500 index, such as ExxonMobil and Chevron. It is likely a physical ETF.

- Vanguard Energy ETF (VDE): This ETF provides exposure to companies involved in producing energy products such as oil, natural gas, and coal. It is likely a physical ETF.

ETFs: The Retail Investor's Friend or Foe?

You may want to see also

Oil ETF tax advantages

Oil ETFs are a great way to gain exposure to the oil industry without directly investing in oil company stocks. They offer a simple way to include oil investments in your strategy and provide tax advantages that other investments don't.

Capital Gains Taxes

With oil ETFs, capital gains taxes are incurred only when the fund is sold. This gives ETFs a significant advantage over other investments, such as mutual funds, where taxes are paid annually even if the investment is retained. This feature of oil ETFs allows you to benefit from tax deferral and potentially increase your after-tax returns.

Easier Trading

Oil ETFs offer the advantage of easier trading compared to other investments. You can buy and sell them directly, just like the stocks in your portfolio, without having to go through a broker-dealer or mutual fund company. This provides you with more flexibility and control over your investments.

Lower Fees

Oil ETFs generally have lower fees compared to mutual funds. This means you get to keep more of your investment returns. Lower fees can translate to higher overall returns, especially over the long term.

Trading Strategies

Oil ETFs provide you with a wide range of trading options. You can sell an oil ETF to help reduce your downside risk if you want to stabilize your oil investments. You can also use oil ETFs to hedge against downside risk for both industry and foreign investments. Additionally, you can explore inverse oil ETFs, which track the price of oil in the opposite direction, although these come with higher risk.

No Direct Ownership

Oil ETFs allow you to invest in the oil industry without directly owning any oil or having to stock up on barrels in your garage. This not only makes your investment strategy more efficient but also avoids the fire hazard associated with storing oil.

Diversification

Oil ETFs provide instant diversification in the oil industry with a single trade. You get exposure to the price of oil from a variety of securities, reducing the need to purchase individual stocks or make complicated decisions about which companies to choose.

While oil ETFs offer these tax advantages and more, it's important to remember that investing in the oil industry carries risks. Oil is a volatile commodity, and prices can fluctuate significantly. Therefore, it's crucial to conduct thorough research and understand the potential risks before investing.

ETFs: A Liquid Investment Option?

You may want to see also

Frequently asked questions

Crude oil ETFs allow you to invest in the price and performance of oil without actually owning any oil itself. They are a simple way to gain exposure to the oil industry without directly investing in the company stocks of an oil producer. They also save on commissions as you make one purchase at one price.

As of early 2022, some of the best oil ETFs include the United States Oil Fund, Vanguard Energy ETF, and the iShares U.S. Oil Equipment and Services ETF.

It depends on the price of oil in future months. If the price of crude is higher in the future than it is today, it is known as contango. If the price in future months is lower than today, it is referred to as backwardation. It is better to buy an oil ETF when the future price of oil is lower than the current price (backwardation).

Oil is a volatile commodity and all investments that track its price come with high risk. Oil ETFs are also subject to tracking error, meaning they may not deliver the return of the underlying index or crude oil prices.