Investment management firms use a variety of methods to determine a share price. Generally, the stock market is driven by supply and demand, and the price of a stock will fluctuate in relation to a number of factors. When a stock is sold, a buyer and seller exchange money for share ownership, and the price it is purchased at becomes the new market price. A stock's initial public offering (IPO) is usually at a price equal to the value of its expected future dividend payments. However, the stock price can change due to market forces, economic changes, industrial changes, and problems within the company.

| Characteristics | Values |

|---|---|

| Stock price determination | Driven by supply and demand, like any other market |

| Determined by a company's initial public offering (IPO) when shares are first put on the market | |

| Influenced by a variety of factors, including economic changes, industry changes, political events, war, and environmental changes | |

| Changes within a company can also cause stock price movement | |

| Law of supply and demand: if demand > supply, price increases; if supply > demand, price decreases | |

| Management or production changes: effective and efficient management and production can increase profits and share price | |

| Company's name prominence: scandals or negative associations can cause a drop in share price; breakthroughs can cause an increase | |

| Dividend discount models (DDMs): stock's current price equals the sum of all future dividend payments | |

| Relative valuation method: compares the stock price with the company's fundamentals |

What You'll Learn

Supply and demand

The stock market is driven by supply and demand, much like any other market. When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price. When another share is sold, this price becomes the newest market price, and so on.

The more demand for a stock, the higher it drives the price and vice versa. So while in theory, a stock's initial public offering (IPO) is at a price equal to the value of its expected future dividend payments, the stock's price fluctuates based on supply and demand.

If there is more demand than supply, the price will increase. Similarly, it will fall when supply exceeds demand. The price of the stock goes high when the demand is high if a company generates products that do not have a lot of competitors or are highly desired. The prices of stocks tend to plateau if the demand aligns with the supply. Additionally, the share price of the company drops if the supply is more than the demand.

The price of the stock might stay the same or increase even if the supply is more provided there is some variation. For example, if a company produces a good that not many others produce or a good that is highly desired or necessary, the price of its stock will climb because the demand is high.

In the stock market, the price is determined by a price discovery mechanism. It happens when the buyers and sellers agree on a price level. Stock prices depend on the bid and ask price of the stock. A "bid" is an offer to buy a certain number of shares for a specific price. An "ask" is an offer to sell a certain number of share at a particular price.

Exchanges calculate a stock's price in real time by finding the price at which the maximum number of shares are transacted at that moment. The price changes if there is a change in the buy or sell offer for the shares. It is the market price of the stock and it can be different from the intrinsic price.

Understanding Diverse Investment Portfolio Types and Their Benefits

You may want to see also

Intrinsic value

The intrinsic value of a business or security is its inherent value based on its future cash flow, risk, and growth potential. It is a core concept in value investing, which seeks to uncover hidden investment opportunities.

Financial analysts use fundamental and technical analyses to gauge a company's actual financial performance and determine its intrinsic value. While there is no universal standard for calculating intrinsic value, the metric often used in these calculations is discounted cash flows.

Calculating Intrinsic Value

Using discounted cash flow (DCF) analysis, future cash flows are estimated based on how a business may perform in the future. These cash flows are then discounted to today's value to obtain the company's intrinsic value. The discount rate used is often a risk-free rate of return, such as that of a 30-year Treasury bond, or the company's weighted average cost of capital (WAAC).

The DCF formula is as follows:

DCF = CF1/(1+r)1 + CF2/(1+r)2 + ... + TV/(1+r)n

Where:

- CF = the expected cash flow for a specific period (e.g., CF1 = cash flow year one)

- R = the discount rate

- TV = the terminal value (estimated cash flow after the projection period)

- N = the specific period (e.g., years, quarters, months, etc.)

###section

There are several methods for arriving at a fair assessment of a share's intrinsic value, including:

- Dividend Discount Models: These models calculate the fundamental value of a security, factoring in variables such as dividends and future cash flows, and utilising the time value of money (TVM).

- Residual Income Models: This method derives the value of a stock based on the difference in earnings per share and the per-share book value.

- Discounted Cash Flow Models: This is the most common valuation method, which resembles the Dividend Discount Model in its simplest form. It determines a fair value for a stock based on projected future cash flows.

Why Intrinsic Value Matters

Analysts employ these models to determine whether the intrinsic value of a security is higher or lower than its current market price, allowing them to categorise it as overvalued or undervalued. Investors can typically determine an appropriate margin of safety when calculating a stock's intrinsic value, where the market price is below the estimated intrinsic value.

Share prices are influenced by supply and demand in the market. They can also be influenced by a variety of other factors, such as company developments, macroeconomic conditions, and industry attractiveness.

Green Finance: Haven's Investment Management Strategy

You may want to see also

Dividend discount models

The DDM attempts to calculate the fair value of a stock, regardless of the prevailing market conditions. It takes into account dividend payout factors and the market's expected returns. If the value determined by the DDM is higher than the current trading price of shares, then the stock is undervalued and qualifies as a buying opportunity, and vice versa.

The formula for valuing a stock using the DDM is:

> Expected dividend per share / (Cost of capital equity - Dividend growth rate)

Where:

- Expected dividend per share is the expected dividend per share one year from the present time

- Cost of capital equity is the constant cost of equity capital for a company

- Dividend growth rate is the expected growth rate in perpetuity for the dividends

The DDM has several variations, including the Gordon Growth Model (GGM), which is the most common and straightforward calculation. The GGM assumes a stable dividend growth rate and takes into account three variables: the estimated value of next year's dividend, the company's cost of capital equity, and the constant growth rate for dividends in perpetuity.

While the DDM is a useful tool for valuing stocks, it has some limitations. It assumes a constant dividend growth rate, which may not be realistic for newer companies with fluctuating dividend growth rates or no dividends at all. Additionally, the output of the model is sensitive to the inputs, and small changes can lead to significant variations in the stock price. The model also fails when companies have a lower rate of return compared to the dividend growth rate.

Unlocking Your Savings: Reading Investment Statements

You may want to see also

Management changes

The way a company is managed and how it produces goods are essential factors that can influence share prices. Changes in the style of goods production or management can lead to a boost in efficiency, which results in increased profits and a subsequent rise in the share price. Conversely, negative changes in management can have the opposite effect, causing a decrease in share prices.

Company-level factors, such as a change in executive leadership, can directly drive price changes in publicly traded securities. Investors and analysts closely monitor price changes as they are often a visible indicator of a company's financial health and growth prospects.

It is worth noting that while management changes can impact share prices, other factors also play a role. These include the demand and supply dynamics of the market, the company's earnings and profitability, industry shifts, government regulations, and economic or industrial changes.

Strategies for Landing Investment Portfolio Leads

You may want to see also

Company's reputation

A company's reputation is a key factor in determining its share price. A company with a good reputation will often see higher demand for its shares, leading to a higher share price. Conversely, a company with a bad reputation may experience lower demand and a subsequent drop in share price.

In 2019, corporate reputation accounted for one-third of the valuation of the world's top 15 stock markets, or $16.77 trillion. This highlights the significant impact a company's reputation can have on its overall value.

A company's reputation is shaped by various factors, including the quality of its products or services, its social responsibility, leadership, customer service, and employee satisfaction. These factors can influence the emotions and trust that stakeholders have in the company, which in turn affects their investment decisions.

Additionally, a company's reputation can be influenced by news and social media coverage. Positive events or breakthroughs can enhance a company's reputation, while scandals, whether true or not, can have a negative impact.

It's important to note that a company's reputation is not just based on its past actions but also its expected future performance. Investors often look beyond current numbers and consider the growth prospects and future cash flows of a company when determining its share price.

Overall, a company's reputation plays a crucial role in shaping investors' perceptions and investment decisions, which ultimately impact its share price.

Understanding Inward Portfolio Investment: A Comprehensive Guide

You may want to see also

Frequently asked questions

A share price, also known as a stock price, is the cost of buying one share in a company. This price fluctuates according to market conditions and is determined in real-time by a stock exchange.

In the case of an IPO, the share price is determined by the company. After listing, the share price on a stock exchange is determined by matching the bid and ask prices from buyers and sellers.

Share prices are influenced by various critical internal and external factors, including new developments in the company, demand and supply components, and macroeconomic conditions. The price of a stock will also go up and down in relation to different factors, including changes within the economy as a whole, changes within specific industries, political events, war, and environmental changes.

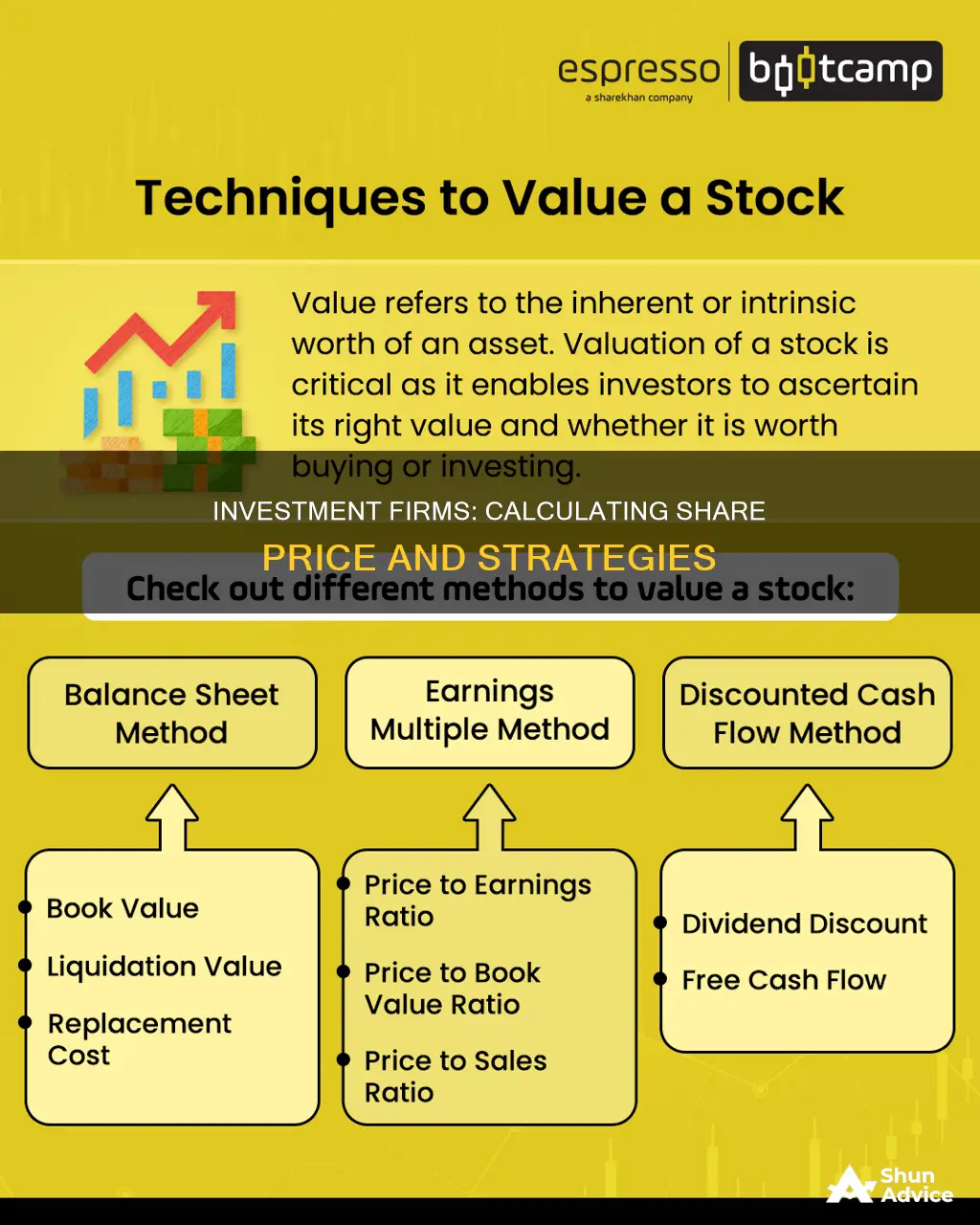

There are several methods to determine the intrinsic value of a stock, including the dividend discount model, the discounted cash flow method, and the relative valuation method.