There are many factors that people consider when choosing which companies to invest in. Firstly, it is important to identify your goals and expectations. For example, younger investors may be interested in increasing their portfolio over a long time frame, whereas older investors may be more interested in capital preservation. It is also important to consider the type of service you expect from an investment firm, and whether you want an active or passive relationship with the firm.

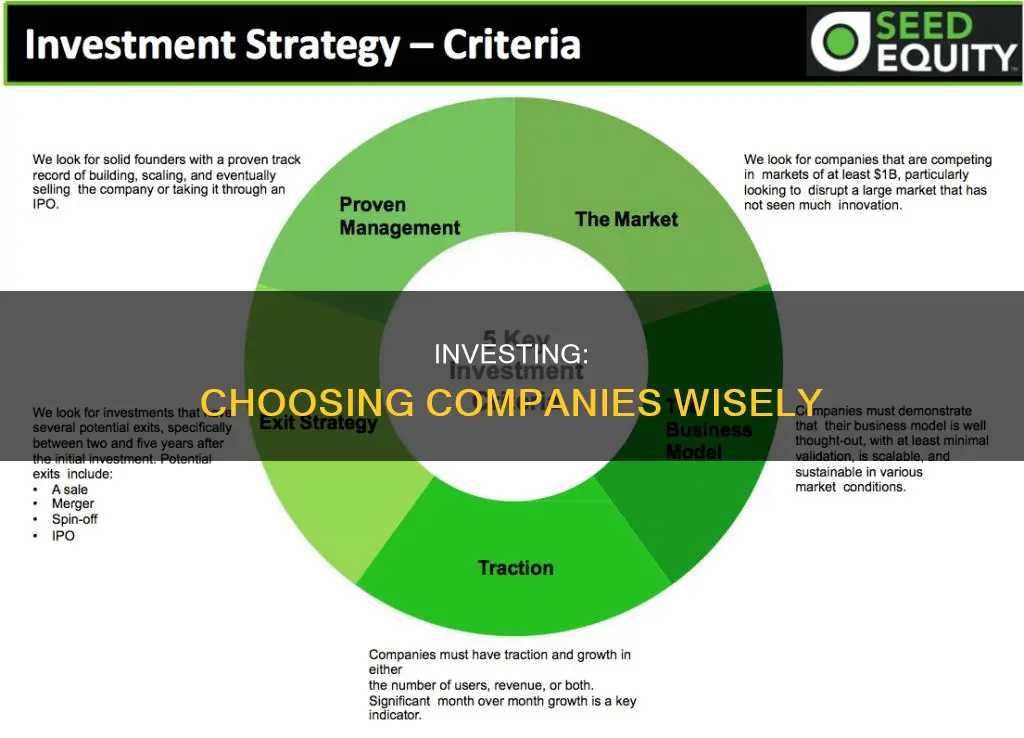

When choosing a specific company to invest in, it is important to understand the business and its model. You should also consider the company's financial health, including its revenue growth, debt, and bottom line. Other factors to consider include the company's competitive advantage, dividend payments, and the quality of its leadership.

It is also important to remember that investing is a risky business, and there are no guarantees. However, by doing your research and understanding your goals, you can make more informed decisions about where to invest your money.

| Characteristics | Values |

|---|---|

| Investment goals | Increase wealth, minimise loss, and capitalise on opportunities |

| Investor type | Income-oriented, wealth preservation, or capital appreciation |

| Company type | Publicly traded or private |

| Company understanding | Understand the business and its industry |

| Competitive advantage | Sustainable competitive advantage or "moat" |

| Company performance | Financial statements, marketing material, and public trading records |

| Company health | Revenue growth, debt, and bottom line |

| Company size | Large-cap, mid-cap, or small-cap |

| Dividends | Dividend payments are a sign of a healthy company |

| Company recognition | Top recognised and established brands |

What You'll Learn

Understand the business model

Understanding a company's business model is a crucial step in deciding whether to invest in it. A business model outlines how a company plans to make a profit and increase its revenue. It is a fundamental strategy that explains the company's ideas to investors and helps develop a set of goals.

A business model comprises several components, which are outlined below:

- Value proposition: This is a description of the products and services a company plans to sell, and why they are desirable to customers. It should also explain how the company's offerings differ from its competitors.

- Target market: A company's target market is the group of consumers interested in its products and services. Identifying the target market is crucial for creating an effective marketing strategy and ensuring the company's offerings meet the needs of its customers.

- Startup costs: A business model should include projected startup costs and explain how the company plans to secure financing.

- Competitive advantage: As many companies offer similar products and services, the business model must highlight any unique features or offerings that set the company apart from its competitors.

- Cost structure: A list of the company's fixed and variable expenses, and how these costs affect pricing.

- Key metrics: The company's primary method of measuring success and determining whether it is on track to meet its goals.

- Resources: Details of the company's physical, financial, and intellectual resources or assets, and how these resources will be allocated to ensure the success of the business model.

- Problem and solution: Identifying the target customer's pain points and explaining how the company plans to resolve them.

- Revenue model: A framework for how the company plans to generate income, including the income sources it intends to pursue.

- Revenue streams: How the company plans to generate income, such as through the sale of products or services.

- Profit margin: An explanation of how the company uses its revenue to make a profit, providing insight into how well the company generates income from its regular operations.

Understanding these components of a company's business model is essential for making informed investment decisions. It allows investors to assess the company's potential for generating profits and increasing revenue, as well as its ability to adapt and create new growth opportunities.

Small Investments, Big Returns

You may want to see also

Assess the company's financial health

When deciding which companies to invest in, it is important to assess the company's financial health. This involves evaluating various aspects of the company's financial position, such as its profitability, liquidity, debt levels, and cash flow. Here are some key considerations:

Financial Statements:

The three primary financial statements to review are the Balance Sheet, Income Statement, and Cash Flow Statement.

Balance Sheet:

The Balance Sheet provides a snapshot of the company's financial position at a specific point in time. It lists the company's assets, liabilities, and shareholders' equity. Analyzing the Balance Sheet reveals information about the company's liquidity, debt levels, and net worth. For instance, a higher proportion of assets compared to liabilities indicates financial stability.

Income Statement:

The Income Statement, or Profit and Loss Statement, shows a company's revenues, expenses, and net income over a specific period. It helps evaluate a company's profitability, growth, and ability to generate consistent earnings. Positive net income and increasing revenues are signs of a financially healthy company.

Cash Flow Statement:

The Cash Flow Statement provides insights into a company's cash inflows and outflows during an accounting period. It helps determine the company's ability to generate cash and cover its operating and financing activities. A company with positive cash flow from operations is generally considered financially healthy as it can meet its obligations without relying heavily on external financing.

Financial Ratios:

Financial ratios are powerful tools for assessing a company's financial health. They help make sense of the numbers presented in financial statements. Here are some key financial ratios to consider:

Liquidity Ratios:

Liquidity ratios measure a company's ability to meet its short-term obligations. Common liquidity ratios include the Current Ratio, Quick Ratio, and Cash Ratio. A higher liquidity ratio indicates stronger financial health as it suggests the company has sufficient liquid assets to cover its short-term liabilities.

Profitability Ratios:

Profitability ratios assess a company's ability to generate profits relative to its sales, assets, and equity. Examples include Gross Profit Margin, Net Profit Margin, and Return on Assets (ROA). Higher profitability ratios indicate stronger financial performance and efficient operations.

Debt Ratios:

Debt ratios evaluate a company's debt levels relative to its total assets or equity. Key debt ratios include the Debt-to-Assets Ratio, Debt-to-Equity Ratio (D/E Ratio), and Interest Coverage Ratio. Lower debt ratios signify lower financial risk and a healthier financial position. A downward trend in the D/E ratio over time indicates that a company is on increasingly solid financial ground.

Non-Financial Factors:

While financial analysis is crucial, it's important to consider non-financial factors that can impact a company's financial health.

Market Position and Competitive Advantage:

A company's market position and competitive advantage significantly affect its financial health. Assessing factors such as market share, the competitive landscape, and unique value propositions helps determine the company's ability to maintain and grow its market position.

Management Quality and Corporate Governance:

The quality of a company's management and its corporate governance practices are vital to its financial health. Evaluating the qualifications and track record of the management team, as well as the transparency and effectiveness of corporate governance structures, provides insights into the company's long-term sustainability and risk management strategies.

Interpreting Results:

Interpreting financial ratios can be complex, as no single ratio provides a complete picture. It's important to compare ratios with industry standards, historical data, and competitors' performance. Additionally, consider the limitations of financial analysis, as external factors like economic conditions or regulatory changes can impact a company's financial health independently of the ratios.

By combining financial statement analysis, ratio analysis, and consideration of non-financial factors, investors can make well-informed decisions about a company's financial health and stability.

VC Bias: Do Looks Matter?

You may want to see also

Diversify your portfolio

Diversifying your portfolio is a crucial aspect of investment strategy. It helps to balance risk and reward by spreading your investments across various assets, reducing the volatility of your portfolio over time. Here are some detailed tips to help you diversify your portfolio effectively:

- Spread your investments: Diversification is about not putting all your eggs in one basket. Invest in a variety of companies and sectors rather than just one stock or industry. Consider investing in companies you know well, trust, and perhaps even use in your daily life. However, be mindful of the number of investments you take on – a portfolio of 20 to 30 different investments is generally manageable and provides a good level of diversification.

- Consider index or bond funds: Index funds, which track various indexes, and fixed-income funds can be great additions to your portfolio. These funds tend to have low fees and provide long-term diversification. While they may be passively managed, which can be suboptimal in inefficient markets, they are a wonderful way to gain instant diversification.

- Regularly add to your portfolio: Employ a strategy called dollar-cost averaging, where you invest a fixed amount of money in your chosen portfolio of securities at regular intervals. This helps smooth out the peaks and valleys caused by market volatility. By investing the same amount over time, you buy more shares when prices are low and fewer when prices are high.

- Know when to exit an investment: While buying and holding, as well as dollar-cost averaging, are sound strategies, it's important to stay informed about your investments and the overall market conditions. Keep an eye on the companies you invest in so that you can cut your losses and move on when necessary.

- Monitor fees and commissions: Understand the fees you are paying, whether they are monthly or transactional. Be aware of any changes to your fees over time, as these can eat into your bottom line. However, keep in mind that $0 commission-free trading is now offered by many online brokers for certain stocks and ETFs.

- Invest in different asset classes: Besides stocks, consider investing in other asset classes such as bonds, commodities, real estate, and cryptocurrencies. These non-stock options provide further diversification and help reduce the overall risk and volatility of your portfolio.

- Allocate your investments wisely: Traditionally, financial advisors have recommended a 60/40 portfolio, with 60% of capital allocated to stocks and 40% to fixed-income investments. However, some argue for more stock exposure, especially for younger investors. Within your stock portfolio, aim for a mix of tech, energy, healthcare, and other industries. Include a range of large-cap, small-cap, dividend, growth, and value stocks.

- Invest in fixed-income assets: Investing in fixed-income assets like bonds is another important step in diversifying your portfolio. While this may reduce your overall returns, it will lower the risk profile and volatility of your portfolio.

- Explore real estate investments: Adding real estate to your portfolio can further enhance diversification. Consider investing in real estate investment trusts (REITs), which own income-producing commercial real estate. REITs have historically increased portfolio returns while reducing volatility.

Public Utilities: Worth the Investment?

You may want to see also

Research the company's management

When deciding whether to invest in a company, it is important to research the company's management. This is a critical factor in stock analysis.

Analysts often visit the company and interact with its management to gain a first-hand understanding of its workings. You can assess the company's management and board quality by doing some research online. There is a lot of information available about every public company, including the backgrounds of key executives.

A company is only as good as its leaders' ability to steer the enterprise, so it is important to research the management team and ensure their interests are aligned with investors.

Why Invest in Farms?

You may want to see also

Consider the company's competitive advantage

When deciding which companies to invest in, it is important to consider the competitive advantage of the company. This refers to the factors that allow a company to produce goods or services better or more cheaply than its rivals. A competitive advantage can be broken down into comparative advantages and differential advantages.

Comparative advantage refers to a company's ability to produce something more efficiently than a rival, leading to greater profit margins. This can be achieved through economies of scale, efficient internal systems, and geographic location. For example, a company that manufactures a product in a country with lower labor costs than its competitors can offer an equal product at a lower price.

Differential advantage, on the other hand, occurs when a company's products are seen as both unique and of higher quality relative to those of a competitor. This can be achieved through advanced technology, patent-protected products or processes, superior personnel, and strong brand identity. For instance, Apple is known for its innovative products and savvy marketing campaigns, which have helped build an elite brand.

When evaluating a company's competitive advantage, consider the following:

- Cost structure: Can the company produce goods or services at a lower cost than its competitors?

- Branding: Does the company have a strong, recognizable brand?

- Quality of product offerings: Are the company's products or services of high quality and unique compared to competitors?

- Distribution network: How effective is the company's distribution network in reaching customers?

- Intellectual property: Does the company have patents or other intellectual property that gives it an advantage?

- Customer service: Is the company able to provide superior customer service that keeps customers loyal?

By considering these factors, investors can evaluate a company's competitive advantage and make more informed investment decisions.

Middle-Aged Investors: Saving Enough?

You may want to see also

Frequently asked questions

It's important to first decide what type of service you expect from an investment firm. Identify your goals, research the company's reputation and background, and determine the type of relationship you want with the firm.

Income-oriented investors focus on buying stocks in companies that pay good dividends regularly. Investors who aim at wealth preservation have a low tolerance for risk. Investors who are looking for capital appreciation are looking for the stocks of companies in their early growth years and are willing to take higher risks.

Assess the financial health of the company by looking at financial and annual reports, revenue growth, debt, and long-term records. Try to go for large-cap or mid-cap companies and emphasise companies that pay dividends.

Determine your investing goals, find companies you understand, determine if the company has a competitive advantage, determine a fair price for the stock, and buy a stock with a margin of safety.

Commit to a timeline, determine your risk tolerance, learn about stock performance indicators, choose the right asset classes, and aim to keep costs low.