A Rollover IRA is a powerful financial tool that allows investors to transfer their retirement savings from a previous employer's plan to a new, self-directed IRA account. This process enables individuals to maintain control over their investments and potentially benefit from a wider range of investment options. By rolling over, investors can diversify their portfolios, access tax-advantaged growth, and manage their retirement funds more flexibly. This strategy is particularly useful for those who have accumulated significant savings in a previous retirement plan and wish to explore alternative investment opportunities while maintaining the tax benefits of a traditional IRA. Understanding how a rollover IRA works is essential for anyone looking to optimize their retirement savings and make informed decisions about their financial future.

| Characteristics | Values |

|---|---|

| Definition | A rollover IRA allows you to transfer funds from one retirement account to another, often to a different financial institution or type of account. |

| Purpose | To provide flexibility in managing retirement savings, especially when you want to diversify investments or switch providers. |

| Tax Implications | Rollovers are generally tax-free, but there are rules to follow. You must complete the transfer within a specific time frame to avoid penalties. |

| Investment Options | Rollover IRAs can hold a variety of investments, including stocks, bonds, mutual funds, real estate, and precious metals. |

| Fees and Costs | Transferring funds may incur fees, and some financial institutions offer fee-free rollovers. |

| Timeframe | The process typically takes a few weeks, depending on the complexity and the institutions involved. |

| Documentation | You'll need to provide necessary documentation, such as account statements and transfer requests, to initiate the rollover. |

| Benefits | Allows for better investment management, potential cost savings, and the ability to choose from a wider range of investment options. |

| Risks | There's a risk of losing investment value during the transfer process, and early withdrawals may result in penalties. |

| Eligibility | Most retirement accounts, including traditional and Roth IRAs, 401(k)s, and 403(b)s, can be rolled over. |

| Frequency | Rollovers can be done periodically to review and adjust investments or when changing employers. |

What You'll Learn

- Rollover IRA: Transferring Assets from One IRA to Another

- Tax-Free Rollover: Moving Funds Without Incurring Penalties

- Investment Diversification: Strategies for Asset Allocation in Rollover IRAs

- Roth IRA Conversion: Rolling Over Traditional IRA to Roth IRA

- RMD and Rollover: Managing Required Minimum Distributions and IRA Transfers

Rollover IRA: Transferring Assets from One IRA to Another

When it comes to managing your retirement savings, understanding how to transfer assets between Individual Retirement Accounts (IRAs) is crucial. A Rollover IRA is a strategic move that allows you to move your retirement funds from one IRA to another, offering flexibility and potential tax advantages. This process is particularly useful if you want to diversify your investment portfolio or take advantage of different investment opportunities. Here's a step-by-step guide to help you navigate the process:

Understanding the Rollover Process:

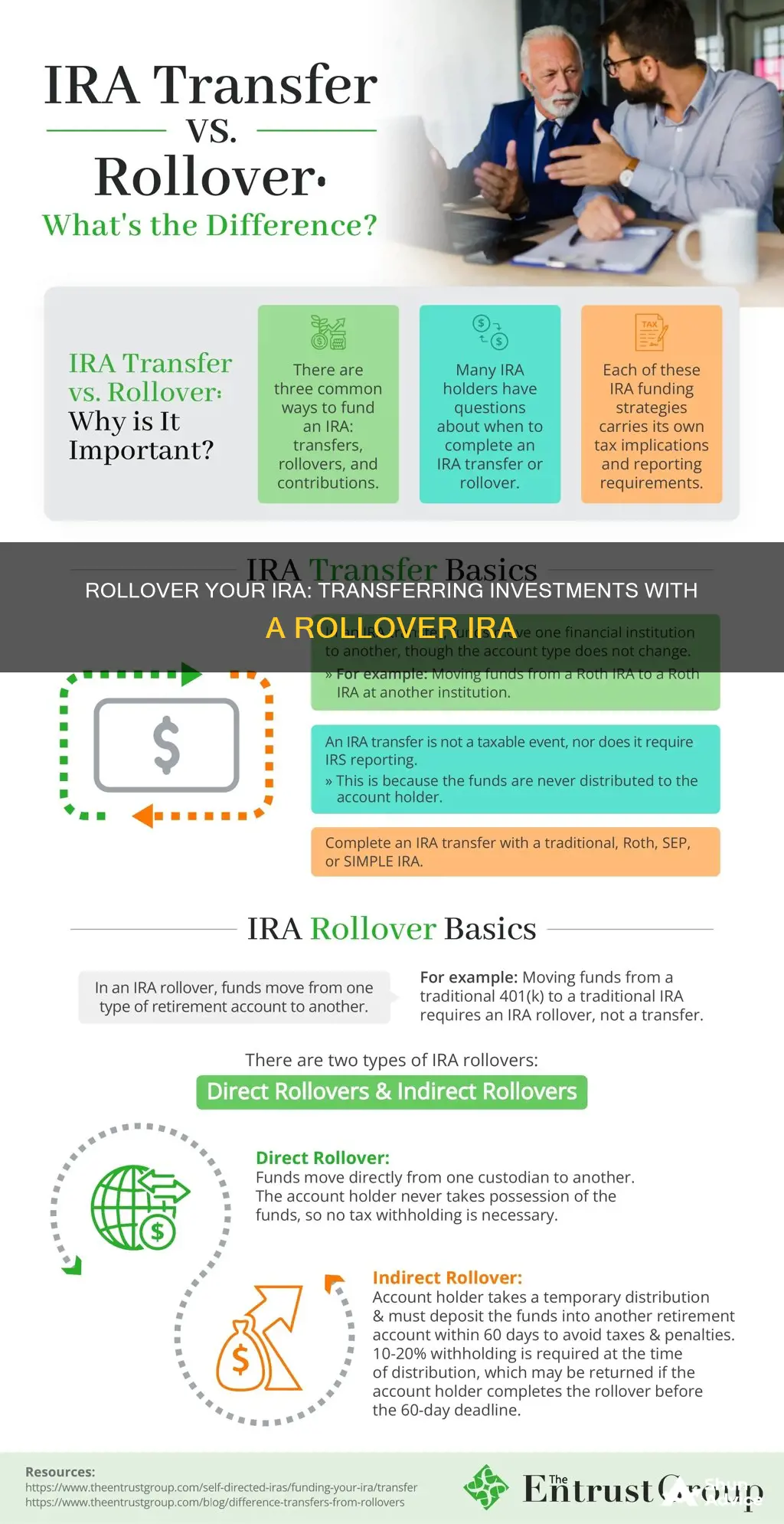

A rollover IRA is essentially a transfer of funds from one IRA account to another. This action is different from a direct transfer, where you might move money from one bank account to another. With a rollover, the funds are typically moved to a new IRA provider, allowing you to potentially access a wider range of investment options. It's important to note that this process is tax-deferred, meaning you won't owe taxes on the assets being rolled over, provided certain conditions are met.

Steps to Transfer Assets:

- Choose a New IRA Provider: Select an IRA provider that offers the types of investments you desire. Research their fees, investment options, and any additional services they provide. This step is crucial as it determines the investment environment for your rollover IRA.

- Complete the Rollover Forms: Contact your current IRA custodian and request the necessary paperwork for the rollover. They will provide forms that need to be completed and signed. Ensure you understand the tax implications and any deadlines associated with the rollover.

- Initiate the Transfer: Your current IRA custodian will send the funds to the new IRA provider. This process is typically done via a direct transfer, ensuring the assets remain in a tax-deferred status until they are invested in the new account.

- Invest in Your New IRA: Once the funds are transferred, you can now choose how to allocate your investments within the new IRA. This is where the real benefit of a rollover comes into play, as you can strategically diversify your portfolio or explore different investment strategies.

Benefits of Rollover IRAs:

- Flexibility: Rollovers allow you to move your retirement savings to a new financial institution, providing the freedom to choose the best investment options for your goals.

- Investment Diversification: By rolling over, you can spread your investments across different asset classes, reducing risk and potentially increasing returns over time.

- Tax Advantages: As mentioned, rollovers are tax-deferred, allowing your investments to grow without immediate tax implications.

Remember, when considering a rollover IRA, it's essential to carefully review the terms and conditions of your current and potential new IRA providers. Understanding the rules and regulations surrounding IRAs will ensure a smooth transition and help you make informed decisions about your retirement savings.

Encouraging Factors for New Industry Investment

You may want to see also

Tax-Free Rollover: Moving Funds Without Incurring Penalties

Moving funds between Individual Retirement Accounts (IRAs) without incurring penalties is a strategic move that can optimize your retirement savings. This process, known as a tax-free rollover, allows you to transfer funds from one IRA to another while avoiding the potential tax consequences of a direct distribution. Here's a step-by-step guide to understanding and executing this process:

Understanding the Rules: Before initiating a rollover, it's crucial to understand the IRS regulations. The IRS allows tax-free rollovers between IRAs of the same type (traditional to traditional or Roth to Roth) and between different types (e.g., traditional to Roth). However, there are specific timeframes and requirements to meet. Typically, you have 60 days from the distribution date to set up the new IRA and transfer the funds, or you can recontribute the funds within this period without penalty.

Initiating the Rollover: The process begins with a distribution from your current IRA. This distribution should be done carefully to ensure it meets the IRS criteria for a tax-free rollover. You can choose to take a lump sum or make periodic payments over time. Once the funds are distributed, you have 60 days to find a new IRA provider and set up a new account.

Choosing the New IRA: When selecting a new IRA, consider your investment goals and risk tolerance. You can choose between traditional, Roth, SEP, or SIMPLE IRAs, each with its own advantages. For instance, a Roth IRA allows tax-free withdrawals in retirement, while a traditional IRA offers tax-deductible contributions. Research and choose the type that aligns best with your financial situation and retirement plans.

Transferring Funds: After setting up the new IRA, you can transfer the funds directly from the old IRA to the new one. This transfer is typically done by the IRA provider, who will handle the paperwork and ensure the funds are moved securely. It's essential to keep records of the distribution and rollover to ensure compliance with IRS regulations.

Avoiding Penalties: One of the critical aspects of a tax-free rollover is avoiding penalties. Penalties can include income tax on the distribution and a 10% penalty on withdrawals before age 59½, unless an exception applies. By following the 60-day rule and ensuring the funds are recontributed or directly transferred, you can avoid these penalties.

Strategic Benefits: Tax-free rollovers offer several strategic advantages. They provide flexibility in managing your retirement savings, allowing you to diversify your investments or take advantage of better investment opportunities. Additionally, rolling over funds can help you maintain your contribution limits, especially if you've reached the annual contribution limit for your current IRA.

In summary, a tax-free rollover is a powerful tool for managing your retirement savings. By understanding the rules, initiating the process carefully, and choosing the right IRA, you can move funds without incurring penalties, ensuring your retirement savings remain tax-efficient and well-managed.

Jewelry: A Sparkling Investment?

You may want to see also

Investment Diversification: Strategies for Asset Allocation in Rollover IRAs

When it comes to managing your retirement savings, diversifying your investments is a crucial strategy to ensure long-term financial security. This is especially important when considering a rollover IRA, which allows you to transfer funds from a previous retirement account into a new one, providing an opportunity to reassess and optimize your asset allocation. Here's a guide to understanding and implementing investment diversification within a rollover IRA:

Understanding Asset Allocation: Asset allocation is the process of dividing your investments across different asset classes such as stocks, bonds, real estate, and cash equivalents. The goal is to create a balanced portfolio that aligns with your financial goals, risk tolerance, and time horizon. In the context of a rollover IRA, diversifying your investments becomes even more critical as it can significantly impact your retirement savings' performance.

Strategies for Diversification: Diversification strategies can vary depending on your investment goals and risk profile. Here are some approaches to consider:

- Equity Allocation: Diversify your stock investments across various sectors and market capitalizations. Consider a mix of large-cap, mid-cap, and small-cap stocks to spread risk. You can also explore international equities to gain exposure to global markets.

- Fixed Income Portfolio: Construct a bond portfolio with a mix of government, corporate, and municipal bonds. Diversifying across different credit ratings and maturity dates can provide a steady income stream and potential capital appreciation.

- Alternative Investments: Explore alternative asset classes like real estate investment trusts (REITs), commodities, or private equity. These investments can offer diversification benefits and potentially hedge against market volatility.

- Target Date Funds: Consider using target date funds, which are designed to allocate assets based on a specific retirement year. These funds automatically adjust their asset allocation as you get closer to retirement, providing a convenient way to diversify.

Benefits of Diversification: Diversifying your rollover IRA offers several advantages. Firstly, it reduces risk by not concentrating your investments in a single asset class. This approach can help smooth out market volatility and protect your portfolio's value over time. Secondly, diversification allows you to capture potential returns from various markets and sectors, maximizing the growth of your retirement savings.

Regular Review and Rebalancing: Investment diversification is an ongoing process that requires regular review and adjustment. Market conditions and personal circumstances change, so it's essential to periodically assess your asset allocation. Rebalance your portfolio by buying or selling assets to restore the desired allocation percentages. This practice ensures that your investment strategy remains aligned with your goals and risk tolerance.

By implementing these diversification strategies, you can create a well-rounded investment portfolio within your rollover IRA, potentially enhancing your retirement savings and providing a more stable financial future. Remember, diversification is a long-term strategy, and it's essential to stay committed to it, especially during market fluctuations.

Solar's Dark Side: The Shady Truth About Investing in Sunshine

You may want to see also

Roth IRA Conversion: Rolling Over Traditional IRA to Roth IRA

The process of converting a traditional IRA to a Roth IRA, often referred to as a Roth IRA conversion, is a strategic financial move that allows individuals to potentially enjoy tax-free growth and withdrawals in retirement. This conversion involves moving funds from a traditional Individual Retirement Account (IRA) to a Roth IRA, which operates under different tax rules. Here's a step-by-step guide to understanding and executing this conversion:

Understanding the Conversion:

When you convert a traditional IRA to a Roth IRA, you are essentially paying taxes on the assets in your traditional IRA upfront, with the goal of avoiding taxes on future withdrawals. Traditional IRAs allow tax-deductible contributions, which grow tax-deferred until retirement. In contrast, Roth IRAs use after-tax contributions, offering tax-free growth and withdrawals in retirement. The conversion process ensures that you pay taxes on the pre-tax contributions, thus converting them into after-tax contributions in the Roth IRA.

Steps to Convert:

- Determine Eligibility: You can convert a traditional IRA to a Roth IRA if you meet certain criteria. Typically, you must have earned income, as self-employed individuals or those with a spouse who has earned income can convert their traditional IRA.

- Calculate Tax Liability: The first step is to calculate the tax you owe on the converted amount. This is done by taking the total value of your traditional IRA and applying the appropriate tax rate for your income bracket. It's essential to consider the potential tax savings in the future when making this decision.

- Complete Form 1099-R: Your IRA custodian will provide you with Form 1099-R, which details the distribution from your traditional IRA. You'll need to report this distribution on your tax return, along with the tax paid.

- Make the Payment: After calculating the tax liability, you must pay the tax due to the IRS. This payment is made from your own funds and is not deductible, as it is a one-time conversion.

- Transfer Funds: Once the tax payment is made, you can proceed with the transfer. You'll need to provide the necessary documentation to your new Roth IRA custodian, who will then receive the converted funds.

Benefits of Roth IRA Conversion:

- Tax-Free Growth: One of the primary advantages is the potential for tax-free growth in the Roth IRA. Any earnings or capital gains generated within the Roth IRA will not be taxed, providing a significant long-term benefit.

- Qualified Distribution: Withdrawals from a Roth IRA are tax-free and penalty-free, as long as they meet certain criteria. This means you can take distributions tax-free in retirement, providing financial security.

- Flexibility: Roth IRAs offer more flexibility in terms of withdrawal rules, allowing you to withdraw contributions at any time without penalties, providing a safety net for emergencies.

Considerations:

It's crucial to carefully consider the tax implications and potential future tax savings. While the conversion may seem like an upfront cost, it can lead to significant tax advantages in retirement. Consulting a financial advisor or tax professional is recommended to ensure you make an informed decision based on your specific financial situation and goals.

Retirement Planning: Why Investing is a Must, Not a Maybe

You may want to see also

RMD and Rollover: Managing Required Minimum Distributions and IRA Transfers

Understanding the intricacies of managing Required Minimum Distributions (RMDs) and IRA transfers is crucial for anyone looking to optimize their retirement savings. When it comes to rolling over investments, it's essential to grasp the concept of RMDs and how they interact with your Individual Retirement Account (IRA). RMDs are the minimum amount of money that must be withdrawn from a traditional IRA or 401(k) account by a certain age, typically 72 years old, to avoid a penalty. These distributions are calculated based on the account balance and the life expectancy of the account owner. The key to managing RMDs effectively is to understand the rules and options available to you.

One of the most common strategies to manage RMDs is through a rollover IRA. A rollover IRA allows you to transfer funds from an existing retirement account, such as a 401(k) or traditional IRA, to a new or existing IRA. This process can be particularly useful when you want to diversify your investments or move funds to a more suitable retirement vehicle. By rolling over, you can avoid the immediate tax impact of RMDs and potentially benefit from tax-deferred growth in the new IRA. It's important to note that there are specific rules and deadlines for rollovers, and any failure to comply can result in penalties.

When considering a rollover, it's crucial to choose the right type of IRA. Traditional IRAs and Roth IRAs have different tax implications and contribution limits. Traditional IRAs offer tax-deductible contributions and tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement. Understanding the differences will help you make an informed decision. Additionally, you can explore various investment options within your IRA, such as stocks, bonds, mutual funds, or real estate, allowing you to customize your portfolio according to your financial goals and risk tolerance.

The process of rolling over investments typically involves several steps. First, you'll need to close your existing retirement account and receive the distribution. This amount must be rolled over directly to the new IRA within a specified period, usually 60 days, to avoid penalties. It's essential to work with a financial advisor or IRA specialist to ensure compliance with IRS regulations. They can guide you through the process, help you choose the right IRA type, and provide investment advice tailored to your needs.

In summary, managing RMDs and IRA transfers is a critical aspect of retirement planning. Rollover IRAs offer a strategic way to manage RMDs by providing tax-advantaged growth and investment flexibility. By understanding the rules, choosing the appropriate IRA type, and following the rollover process, you can effectively navigate the complexities of retirement savings and ensure a secure financial future. Remember, seeking professional advice is invaluable in making informed decisions regarding your retirement investments.

The Ultimate Guide to Buying Investment Multifamily Homes: Unlocking Financial Freedom

You may want to see also

Frequently asked questions

A Rollover IRA is a type of individual retirement account that allows you to transfer funds from an existing retirement account, such as a 401(k) or traditional IRA, into a new account. This process helps individuals consolidate their retirement savings and potentially benefit from a more diverse investment strategy.

Rollover IRAs provide flexibility by allowing investors to move their retirement funds between different investment options. This can be advantageous as it enables diversification, helping investors spread their risk across various asset classes like stocks, bonds, mutual funds, or real estate.

While Rollover IRAs offer investment flexibility, there are certain rules and restrictions. Investors can typically choose from a wide range of investment options, including mutual funds, exchange-traded funds (ETFs), and even certain alternative investments. However, it's important to review the specific guidelines of your IRA provider and ensure compliance with IRS regulations.

Yes, one of the key benefits of a Rollover IRA is the ability to avoid early withdrawal penalties. Traditional IRAs and 401(k)s often impose penalties for withdrawals before a certain age. By rolling over, you can keep the funds in a tax-advantaged account and continue growing your investments without incurring penalties.

Regular review and rebalancing of your investments are essential to maintain your desired asset allocation. It is recommended to review your Rollover IRA at least annually or whenever there are significant market changes. Rebalancing involves adjusting your portfolio to ensure it aligns with your risk tolerance and investment goals, which may require buying or selling certain assets.