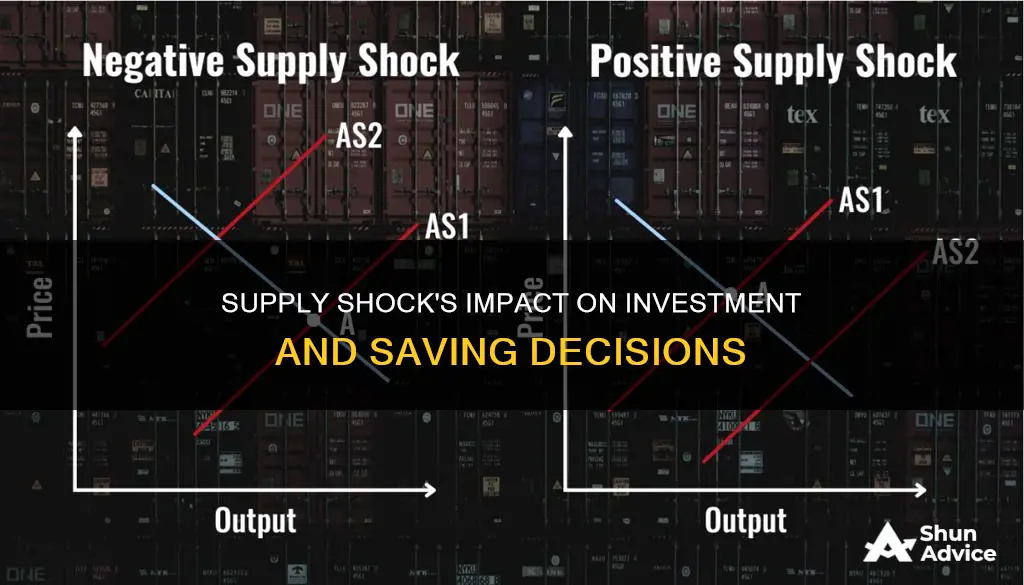

Supply shocks are unexpected events that cause a sudden change in the supply of a product or commodity, resulting in unforeseen price changes. They can be either positive or negative, with the former increasing output and decreasing prices, and the latter decreasing output and increasing prices. Supply shocks can have a significant impact on investment and saving due to their influence on prices and output. For example, a positive supply shock may lead to lower prices, which can increase investment opportunities as costs decrease. On the other hand, a negative supply shock can result in higher prices and reduced output, potentially discouraging investment and affecting savings.

| Characteristics | Values |

|---|---|

| Nature of Supply Shock | Unexpected event that changes the supply of a product or commodity |

| Impact on Price | Negative supply shock increases price, positive supply shock decreases price |

| Impact on Output | Negative supply shock decreases output, positive supply shock increases output |

| Impact on Economy | Stagflation (combination of rising prices and falling output) |

| Impact on Inflation and Unemployment | Negative supply shock increases inflation and unemployment, positive supply shock decreases both |

| Examples | Natural disasters, wars, pandemics, geopolitical events, technological advancements |

What You'll Learn

The impact of a supply shock on investment and saving

Supply shocks can have a significant impact on investment and saving, causing sudden and unexpected changes in output and market prices. These shocks can be either positive or negative, leading to increases or decreases in supply respectively, and can affect a specific product market or the economy as a whole. While the effects of a supply shock vary depending on its nature and scope, there are some general patterns that can be observed.

In the case of a positive supply shock, an increase in output can lead to a decrease in prices. This is because the supply curve shifts to the right, creating a surplus. This can be beneficial for consumers as it raises the overall standard of living. It can also encourage investment as costs decrease, allowing businesses to operate more efficiently and potentially expand their operations. For example, a positive supply shock in the technology industry, such as the rise of the internet in the 1990s, can lead to a paradigm shift in how information is accessed and shared, increasing output and reducing costs.

On the other hand, a negative supply shock can cause a decrease in output and an increase in prices. This occurs when the supply curve shifts to the left, creating a shortage. Negative supply shocks can be caused by various factors such as natural disasters, wars, or disruptions to the supply chain. For example, the COVID-19 pandemic disrupted supply chains and restricted the mobility of goods and people, resulting in a negative supply shock that affected many countries. Negative supply shocks can have a detrimental effect on investment and saving. As prices increase, consumers may be forced to save more or cut back on non-essential spending, while businesses may struggle to maintain profit margins and could be forced to reduce their investment activities.

Furthermore, the duration of a supply shock plays a crucial role in its impact. Temporary supply shocks, such as those caused by a stranded oil tanker blocking a trade route, may not have long-term effects on employment or production. However, permanent supply shocks, such as technological advancements or tighter regulations, can have more lasting consequences on the broader economy. Central banks and governments may intervene to mitigate the effects of supply shocks, but the adjustments can take time, especially in cases where external factors such as wars or natural disasters are involved.

Overall, supply shocks can have far-reaching consequences on investment and saving, affecting market prices, economic growth, inflation rates, and unemployment rates. The specific effects depend on the nature and scope of the shock, as well as the response from consumers, businesses, and policymakers.

Retirement Investment Rule: Navigating the Golden Years

You may want to see also

The effect of positive supply shocks on investment and saving

Positive supply shocks have a beneficial effect on an economy, increasing output and reducing prices. This can be caused by a number of factors, such as an advance in technology, a new manufacturing technique, or the discovery of new resource inputs. For example, the introduction of the assembly line in car manufacturing by Henry Ford created a positive supply shock.

When a positive supply shock occurs, the aggregate supply curve shifts to the right. This shift indicates an increase in output and a decrease in prices, which can lead to a higher overall standard of living for consumers. This is because consumers can purchase more goods at lower prices, which can also stimulate the economy by increasing consumption.

Positive supply shocks can also have a positive impact on investment and saving. With prices decreasing, consumers may have more disposable income, which can lead to increased savings. Additionally, the increased output and lower prices can create a more favourable environment for businesses to invest in new projects or expand their operations. This can further stimulate the economy and contribute to economic growth.

However, it is important to note that while positive supply shocks can have these beneficial effects, they may also have some negative consequences in certain situations. For example, monetary inflation, which can be considered a positive supply shock, can lead to a decrease in production efficiency and a drop in real demand over time. This occurs because the initial benefit of increased liquidity for some comes at the expense of others, as their purchasing power decreases while the supply of goods available to them remains the same or decreases.

In summary, positive supply shocks generally have a positive impact on investment and saving by increasing output, decreasing prices, and potentially increasing disposable income for consumers. This can create a favourable environment for businesses to invest and expand, while also stimulating the economy through increased consumption.

Investing in Commodities: Why?

You may want to see also

The effect of negative supply shocks on investment and saving

Negative supply shocks can have a significant impact on investment and saving. A negative supply shock is an unexpected event that leads to a decrease in the supply of a product, service, or commodity. This can be caused by various factors such as natural disasters, geopolitical events, or economic recessions. When such an event occurs, it can have a ripple effect on the economy, causing a shift in the aggregate supply curve and affecting both investment and saving behaviours.

One of the key effects of a negative supply shock is the increase in prices due to decreased output. When supply decreases, the price of goods or commodities tends to rise as they become scarcer. This can lead to a situation called stagflation, where prices rise while economic output falls. For example, during the 1973 Oil Crisis, OPEC restrictions on the production and sale of petroleum caused fuel shortages and led to an increase in fuel prices. This increase in prices can have a direct impact on investment and saving in several ways.

Firstly, higher prices can lead to a decrease in investment as businesses and individuals have less disposable income to invest in new ventures or expand existing ones. It may also become more difficult to obtain financing as lenders may be more cautious due to the uncertain economic climate. Additionally, the decrease in output caused by a negative supply shock can lead to a reduction in profits for businesses, further discouraging investment.

Secondly, negative supply shocks can impact saving behaviours. As prices rise, individuals may find it more challenging to save money as a larger portion of their income is spent on goods and services. This is especially true if wages fail to keep up with the increased cost of living. Furthermore, during economic uncertainties, individuals may become more cautious and prefer to save rather than invest, which can further slow down economic growth.

Moreover, negative supply shocks can also affect investment and saving through their impact on the financial markets. During times of economic shock, stock markets tend to be volatile, and investors may pull their money out of risky assets, leading to a decrease in investment. Additionally, central banks may intervene by implementing monetary policies to try to stabilize the economy. For example, they may increase interest rates to curb inflation, which can affect both investment and saving decisions.

Overall, negative supply shocks can have far-reaching consequences on investment and saving behaviours. The decrease in supply and subsequent increase in prices can lead to reduced investment opportunities and a shift in saving priorities for both businesses and individuals. The impact of such shocks can be felt across various sectors of the economy, and it may take time for the market to adjust and recover.

Analyzing Investment Opportunities: Strategies for Success

You may want to see also

How supply shocks affect interest rates and investment

Supply shocks can have a significant impact on interest rates and investment, with the effects depending on whether the shock is positive or negative. A positive supply shock increases output, causing prices to decrease, while a negative supply shock decreases output and causes prices to increase.

A positive supply shock can be caused by a new manufacturing technique, technological advancement, or the discovery of new resource inputs. For example, the introduction of the assembly line in car manufacturing by Henry Ford was a positive supply shock. Technological breakthroughs, such as the rise of the internet in the 1990s, can also lead to a positive supply shock by introducing new systems or innovations that lower prices.

The impact of a positive supply shock on interest rates and investment is favourable. The increase in output leads to a surplus of goods or services, causing prices to decrease. This can stimulate investment as businesses take advantage of lower costs to expand their operations. Additionally, central banks may respond to the positive shock by lowering interest rates to boost economic growth and reduce unemployment, making borrowing more attractive for businesses and individuals.

On the other hand, a negative supply shock can be caused by an increase in input costs, natural disasters, wars, or other unforeseen events that disrupt the supply chain. For example, the COVID-19 pandemic disrupted supply chains and led to a negative supply shock.

The impact of a negative supply shock on interest rates and investment is unfavourable. The decrease in output leads to a shortage of goods or services, causing prices to increase. This can deter investment as businesses face higher costs and reduced availability of goods or services. Central banks may respond to a negative supply shock by lowering interest rates to stimulate aggregate demand and reduce unemployment. However, this decision can have the unintended consequence of further increasing the price level, leading to a dilemma known as stagflation.

In summary, supply shocks can have significant effects on interest rates and investment. Positive supply shocks tend to stimulate investment and may lead to lower interest rates, while negative supply shocks deter investment and can result in a challenging situation of high inflation and unemployment, with limited effective policy options.

Retirement Reality Check: Navigating a Secure Future Without Investments

You may want to see also

How supply shocks affect the general price level

A supply shock is an unexpected event that changes the supply of a product, service, commodity, or economy in general. It can be either positive (increasing supply) or negative (decreasing supply). Supply shocks have a direct impact on the general price level, causing it to increase or decrease, depending on the nature of the shock. Here's how supply shocks affect the general price level:

Negative Supply Shocks:

Negative supply shocks occur when an unforeseen event decreases the supply of a product or service. This can be caused by various factors such as natural disasters, wars, or disruptions in the supply chain. For example, the COVID-19 pandemic disrupted supply chains globally due to restrictions on the movement of goods and people, resulting in a negative supply shock.

When supply decreases due to a negative shock, the general price level tends to increase. This is because the reduced supply cannot meet the existing demand, leading to a shortage. As a result, prices rise as producers try to balance supply and demand. In some cases, this can lead to a situation called "stagflation," where prices rise and economic output falls simultaneously. The oil crisis of the 1970s, caused by an embargo on oil exports by the Organization of Arab Petroleum Exporting Countries (OAPEC), is a classic example of a negative supply shock leading to stagflation.

Positive Supply Shocks:

On the other hand, positive supply shocks occur when an unexpected event increases the supply of a product or service. Technological advancements, innovations, or favourable growing seasons for agricultural products can lead to positive supply shocks. For instance, the rise of the internet in the 1990s democratized knowledge and caused a positive supply shock by making information instantly accessible at a low cost.

When supply increases due to a positive shock, the general price level tends to decrease. This is because the increased supply exceeds the existing demand, creating a surplus. As a result, producers lower prices to encourage consumption and clear the surplus. Positive supply shocks can lead to a decrease in prices and an improvement in the overall standard of living.

Impact on Macroeconomic Variables:

Supply shocks, especially macroeconomic shocks, can have significant effects on economic variables such as economic growth, inflation rates, and unemployment rates. A negative supply shock can lead to a decrease in economic growth, an increase in inflation, and a rise in unemployment. On the other hand, a positive supply shock can boost economic growth, lower inflation, and reduce unemployment.

Duration and Impact of Shocks:

It is important to note that the duration and impact of a supply shock depend on how demand responds. If demand remains constant or inelastic (less responsive to price changes), a negative shock can have a more pronounced and long-lasting effect on prices. On the other hand, if demand is elastic (responsive to price changes), even a negative shock may have a milder impact on prices as demand falls when prices spike.

Lego Investments: Building Wealth with Bricks

You may want to see also

Frequently asked questions

A supply shock is an unexpected event that suddenly changes the supply of a product or commodity, resulting in a sudden change in price.

Supply shocks can be either positive or negative. A positive supply shock increases output and decreases prices, while a negative supply shock decreases output and increases prices.

Supply shocks can be caused by a variety of factors, including natural disasters, monetary policy, technological advancements, war, and geopolitical events.

A positive supply shock can lead to increased investment as businesses take advantage of lower prices and increased output. It can also lead to higher savings for consumers due to lower prices. On the other hand, a negative supply shock can cause businesses to reduce investment due to decreased output and higher prices. Consumers may also have lower savings as they pay more for goods.

Some examples of supply shocks include the oil crisis in the 1970s, the COVID-19 pandemic, and the semiconductor shortage during the pandemic.