Investing with Chase offers a range of options for individuals looking to grow their wealth. Chase Investing provides access to various investment products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The platform is designed to be user-friendly, allowing investors to build and manage their portfolios online or through a mobile app. Chase offers a variety of investment accounts, such as individual retirement accounts (IRAs) and taxable investment accounts, to cater to different financial goals and risk tolerances. With Chase Investing, investors can take advantage of research tools, educational resources, and personalized advice to help them make informed decisions and navigate the complex world of investing with confidence.

What You'll Learn

- Investment Accounts: Chase offers various accounts for investing, each with unique features and benefits

- Portfolio Management: Investors can track and manage their investments through Chase's online platform or mobile app

- Research and Tools: Access market research, financial calculators, and educational resources to support investment decisions

- Customer Support: Chase provides dedicated support for investors, offering guidance and assistance when needed

- Fees and Costs: Understand the fees associated with investing, including transaction costs and account maintenance fees

Investment Accounts: Chase offers various accounts for investing, each with unique features and benefits

When it comes to investing, Chase offers a range of investment accounts tailored to different financial goals and risk tolerances. These accounts provide individuals with the opportunity to grow their wealth over time, offering various features and benefits to suit diverse investment strategies. Here's an overview of the investment accounts available through Chase:

Retirement Accounts: Chase provides retirement savings plans, including Traditional and Roth IRAs, which are popular choices for long-term investing. Traditional IRAs allow tax-deductible contributions, offering potential tax advantages during retirement. On the other hand, Roth IRAs enable tax-free growth and withdrawals, making them ideal for those seeking tax-free retirement income. These accounts often come with low fees and the flexibility to invest in a wide range of assets, allowing investors to build a diversified portfolio.

Investment Accounts: Chase's investment accounts cater to those seeking active management and potential higher returns. These accounts may include mutual funds, exchange-traded funds (ETFs), and other investment vehicles. Investors can choose from various strategies, such as growth-oriented, income-focused, or balanced portfolios, depending on their risk appetite. Chase's investment accounts often provide access to professional money management, allowing investors to benefit from the expertise of financial advisors.

Self-Directed Accounts: For investors who prefer a more hands-on approach, Chase offers self-directed investment accounts. These accounts empower individuals to make investment decisions independently, providing access to a wide array of investment options, including stocks, bonds, and real estate. Self-directed accounts offer flexibility and control but also require thorough research and due diligence. Chase may provide educational resources and tools to assist investors in navigating the investment landscape.

Education Savings Accounts: Chase also caters to investors looking to save for education expenses. These accounts, such as 529 plans, offer tax-advantaged savings for qualified education costs. Investors can choose from various investment options within the account, allowing for potential long-term growth. The earnings and qualified withdrawals from these accounts are often exempt from federal income tax, making them an attractive option for future education expenses.

Each of these investment accounts comes with its own set of rules, contribution limits, and tax implications. It is essential for investors to understand the features and benefits of each account type to make informed decisions. Chase provides resources and guidance to help investors navigate these options, ensuring they can choose the investment accounts that best align with their financial objectives and risk tolerance.

Sia Coin's Profit Potential: A Comprehensive Overview

You may want to see also

Portfolio Management: Investors can track and manage their investments through Chase's online platform or mobile app

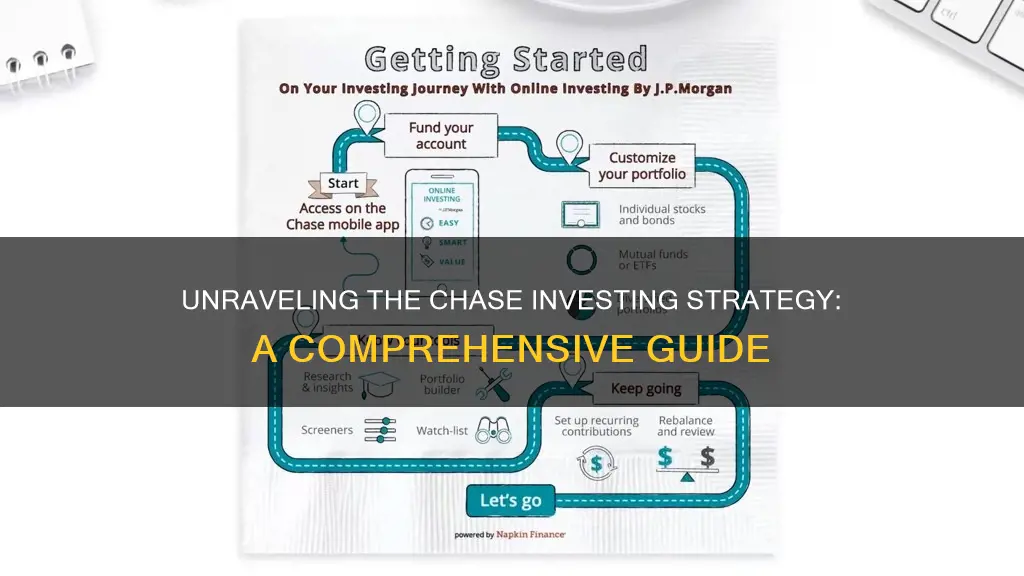

Chase's online platform and mobile app provide investors with a comprehensive suite of tools for portfolio management, offering a seamless and user-friendly experience. These digital interfaces are designed to empower investors to take control of their financial assets and make informed decisions. Here's a breakdown of how investors can effectively manage their investments through the Chase platform:

Accessing Your Portfolio: Investors can log into their Chase account through the online platform or mobile app using their credentials. Once logged in, they will be directed to their dashboard, which serves as a centralized hub for all their investment activities. This dashboard provides an overview of their portfolio, including a list of all investments, their current value, and performance metrics.

Investment Tracking: The platform allows investors to track the performance of their investments in real-time. Each investment will display key metrics such as price changes, percentage returns, and market capitalization. Investors can also view historical performance data, providing insights into the investment's past trends and volatility. This feature enables investors to make data-driven decisions and adjust their portfolio strategy accordingly.

Portfolio Management Tools: Chase's online platform offers a range of portfolio management tools to facilitate investment decisions. Investors can set up watchlists to monitor specific securities or asset classes they are interested in. These watchlists can be customized based on individual preferences and investment strategies. Additionally, the platform provides portfolio analysis tools, allowing investors to assess the diversification of their holdings, identify potential risks, and make adjustments to optimize their asset allocation.

Transaction Capabilities: Investors can initiate various transactions directly through the platform or app. This includes buying, selling, or transferring investments. The process is straightforward, requiring investors to select the desired investment, specify the transaction type, and confirm the action. Chase's digital infrastructure ensures that transactions are executed efficiently, providing investors with the flexibility to manage their portfolio actively.

Educational Resources: To enhance the investor experience, Chase provides educational resources within the platform. These resources cover various topics, including investment strategies, market trends, and financial planning. Investors can access articles, videos, and tutorials to deepen their understanding of the investment process and make more informed choices. The educational content is regularly updated to reflect the dynamic nature of the financial markets.

By utilizing Chase's online platform and mobile app, investors can efficiently track their investments, make strategic decisions, and stay informed about their financial portfolio. The user-friendly interface and comprehensive features empower investors to take a proactive approach to managing their investments, ultimately contributing to their long-term financial goals.

The Daily Grind: Investment Bankers' Commute to Success

You may want to see also

Research and Tools: Access market research, financial calculators, and educational resources to support investment decisions

When it comes to investing with Chase, a comprehensive understanding of the market and access to the right tools are essential for making informed decisions. Here's an overview of the research and resources available to support your investment journey:

Market Research: Chase provides its investors with access to a wealth of market research materials. This includes industry reports, economic forecasts, and company-specific analyses. By studying these resources, you can gain insights into market trends, identify potential opportunities, and make more strategic investment choices. The research covers various sectors and asset classes, ensuring that investors can explore diverse options. Whether you're interested in stocks, bonds, or alternative investments, the market research will help you stay informed about the factors driving market performance.

Financial Calculators: Calculators are a powerful tool for investors to estimate the potential returns on their investments. Chase offers a range of financial calculators that can help you with calculations such as compound interest, investment growth, and retirement planning. These calculators consider factors like investment amount, time horizon, and expected returns to provide valuable insights. For instance, you can use the calculator to determine how much your savings could grow over a specific period or to compare the potential returns of different investment options.

Educational Resources: Education is a cornerstone of successful investing. Chase recognizes this and provides a variety of educational materials to empower investors. These resources include webinars, tutorials, and articles covering various investment topics. From understanding basic investment concepts to learning about specific investment strategies, these educational tools cater to investors of all levels. For beginners, there might be introductory guides and videos, while more experienced investors can access advanced topics like tax-efficient investing or risk management.

Additionally, Chase may offer investment seminars or workshops, either online or in-person, where investors can learn from industry experts and gain practical insights. These resources ensure that investors are well-equipped to navigate the complex world of investing and make informed choices. By utilizing these educational materials, you can enhance your financial knowledge and feel more confident in your investment decisions.

In summary, Chase's research and tools section is a valuable asset for investors, offering a comprehensive approach to market analysis, financial calculations, and education. By leveraging these resources, investors can make more informed decisions, adapt to market changes, and potentially achieve their financial goals. It is a testament to Chase's commitment to providing a robust and supportive investing experience.

Farmland: The Ultimate Investment for Long-Term Stability

You may want to see also

Customer Support: Chase provides dedicated support for investors, offering guidance and assistance when needed

Certainly! Here's a detailed explanation of how Chase's dedicated support for investors works, focusing on the topic of "Customer Support: Chase provides dedicated support for investors, offering guidance and assistance when needed":

Understanding Chase Investing

Chase Investing is a comprehensive financial service offered by JPMorgan Chase Bank, N.A., designed to cater to the investment needs of individuals. It provides a range of investment options, including mutual funds, exchange-traded funds (ETFs), and retirement plans. Understanding how Chase Investing works involves recognizing its role as a financial advisor and the support it offers to investors.

Dedicated Customer Support

One of the key features that sets Chase Investing apart is its dedicated customer support. Chase understands that investing can be complex and intimidating for many people. Therefore, they provide a team of knowledgeable professionals who are committed to assisting investors with their financial journeys. This support is available through various channels, ensuring investors can access guidance whenever needed.

Assistance and Guidance

The dedicated support team at Chase Investing offers a wide range of assistance. They can help investors:

- Understand Investment Options: The team educates investors about different investment products, their risks, and potential returns. They provide clear explanations to ensure investors make informed decisions.

- Develop Investment Strategies: Based on an investor's financial goals, risk tolerance, and time horizon, the support team can help create personalized investment strategies. They offer recommendations and adjustments as market conditions change.

- Monitor Portfolio Performance: Investors can rely on the support team to provide regular updates on their portfolio performance. They can offer insights and advice on how to navigate market fluctuations.

- Address Questions and Concerns: Whether it's about fees, tax implications, or general investment principles, the dedicated support team is available to answer questions promptly and accurately.

Accessibility and Convenience

Chase Investing prioritizes accessibility and convenience in its customer support. Investors can reach out through multiple channels, including:

- Phone: Investors can speak directly with a representative for personalized assistance.

- Online Chat: A live chat feature allows investors to get quick answers to their queries.

- Email: For more detailed inquiries, investors can send emails to the dedicated support team.

- In-Person Appointments: For those who prefer face-to-face interaction, in-person appointments can be arranged with a financial advisor.

Chase Investing's dedicated customer support is a cornerstone of its service. By providing knowledgeable professionals and multiple support channels, Chase empowers investors to make informed decisions and navigate their financial journeys with confidence. This level of support is essential in building trust and long-term relationships with investors.

Land Investment: Navigating the Purchase for Profitable Returns

You may want to see also

Fees and Costs: Understand the fees associated with investing, including transaction costs and account maintenance fees

When it comes to investing with Chase, it's crucial to understand the various fees and costs involved to ensure you're making informed decisions about your financial future. Here's a breakdown of the key areas to consider:

Transaction Costs:

Investing often involves buying and selling assets, and these transactions come with associated costs. Chase typically charges a commission for each trade, which can vary depending on the type of investment and the platform used. For example, stock trades may incur a flat fee or a percentage-based commission, while mutual fund purchases might have a per-share charge. It's essential to review the specific fee structure of the investment products you're interested in. Some investments might also have additional fees for options or futures trading.

Account Maintenance Fees:

In addition to transaction costs, Chase may impose account maintenance fees to cover the operational expenses of managing your investment portfolio. These fees can include annual or monthly charges for services like portfolio management, research, and reporting. High-frequency trading accounts or those with a large number of transactions might be subject to higher maintenance fees. Understanding these costs is vital as they can impact your overall investment returns.

Other Potential Expenses:

Beyond the direct fees, there could be other costs associated with investing through Chase. These might include advisory fees for personalized investment strategies, management fees for actively managed funds, or even penalties for early withdrawals or fund redemption. It's important to carefully review the terms and conditions of your investment accounts to identify all potential expenses.

Transparency and Disclosure:

A reputable financial institution like Chase should provide transparent fee disclosures to ensure investors are well-informed. This includes detailed breakdowns of fees, their frequency, and the services they cover. Investors should ask for and review these documents to ensure they understand the costs associated with their investment choices.

Comparative Analysis:

To make the most of your investment journey, it's beneficial to compare the fees and costs across different investment platforms and products offered by Chase. This analysis can help you identify cost-effective options and ensure that the fees align with the level of service and investment opportunities provided.

Pay More Down Payment or Invest: Navigating the Trade-Offs

You may want to see also

Frequently asked questions

Chase Investing is designed to be user-friendly for new investors. It offers a simple and intuitive interface, allowing users to easily navigate through various investment options. You can start by setting up an account, linking your bank account, and then choosing from a range of investment products like mutual funds, exchange-traded funds (ETFs), and stocks. The platform provides educational resources and tools to help beginners understand the market and make informed decisions.

Chase Investing offers several advantages. Firstly, it provides access to a wide range of investment choices, allowing you to diversify your portfolio. The platform also offers low fees and competitive rates, making it an affordable option. Additionally, Chase Investing provides research and analysis tools, market insights, and personalized recommendations to help investors make strategic decisions. It also offers a mobile app for on-the-go access and real-time updates.

Managing your investments is straightforward with Chase Investing. You can easily track the performance of your portfolio in real-time. The platform provides a dashboard that displays your holdings, recent transactions, and market value. You can also set up alerts and notifications for important updates. Additionally, you can adjust your investment strategy by buying, selling, or rebalancing your holdings. The platform's customer support team is also available to assist with any queries or guidance needed.