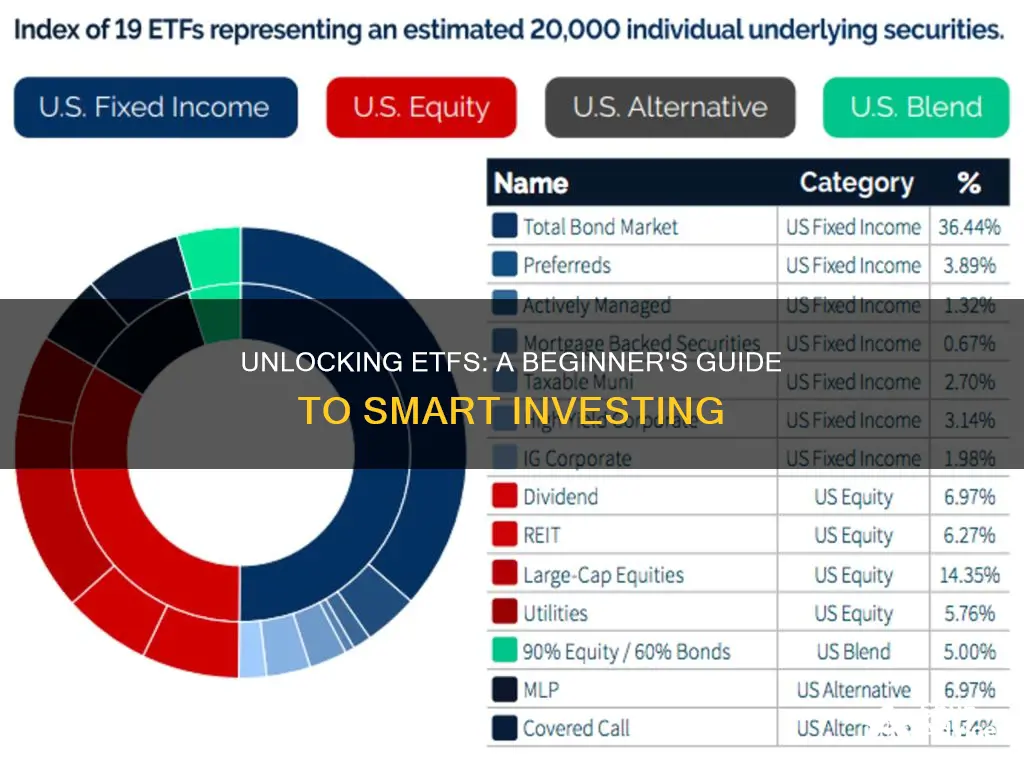

Exchange-Traded Funds (ETFs) are a popular investment vehicle that offers investors a way to diversify their portfolios and gain exposure to various markets, sectors, or asset classes. ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They are designed to track the performance of a specific index, basket of assets, or a particular market segment. When you invest in an ETF, you essentially buy a basket of securities that mirrors the performance of the underlying index or asset class. This investment strategy provides investors with a cost-effective and efficient way to invest in a diversified portfolio, as ETFs offer low management fees, high liquidity, and the ability to trade throughout the day, just like stocks. Understanding how ETFs work is essential for investors looking to build a well-rounded investment strategy and navigate the dynamic world of financial markets.

What You'll Learn

- Structure: ETFs are baskets of securities that track an index, offering diversification and low costs

- Trading: Investors buy and sell ETFs on stock exchanges, similar to individual stocks

- Fees: Management fees are typically lower than mutual funds, making ETFs cost-effective

- Tax Efficiency: ETFs often generate fewer taxable events compared to direct stock ownership

- Diversification: Holdings are spread across various assets, reducing risk and providing broad exposure

Structure: ETFs are baskets of securities that track an index, offering diversification and low costs

Exchange-Traded Funds (ETFs) are a popular investment vehicle that has gained traction in the financial world due to their unique structure and benefits. At its core, an ETF is a basket of securities, which can include stocks, bonds, commodities, or a combination of these, designed to track the performance of a specific index. This index could represent a particular market, sector, commodity, or even a group of assets. The key idea behind ETFs is to provide investors with a diversified portfolio that mirrors the performance of a broader market or a specific segment of it.

The structure of ETFs is such that they are listed on stock exchanges and can be traded throughout the day, just like individual stocks. When an investor buys an ETF, they are essentially purchasing a portion of the entire basket of securities. This diversification is a significant advantage as it reduces the risk associated with individual stock volatility. For instance, if an investor buys an ETF that tracks the S&P 500 index, they own a small piece of each of the 500 companies included in that index, thus spreading their risk across multiple companies and sectors.

One of the primary benefits of ETFs is the cost-effectiveness of investing. ETFs typically have lower expense ratios compared to actively managed mutual funds. This is because ETFs are passively managed, meaning they aim to replicate the performance of an index without the need for active stock selection and management. As a result, investors can achieve diversification and market exposure at a lower cost, making it an attractive option for long-term investors.

The structure of ETFs also allows for flexibility and ease of trading. Investors can buy and sell ETFs during regular stock market hours, and they can be traded like stocks. This liquidity is a significant advantage, especially for those who want to take advantage of short-term market opportunities or quickly adjust their investment strategy. Additionally, ETFs can be traded on margin, allowing investors to borrow funds to purchase more ETFs, potentially amplifying returns.

In summary, ETFs are structured as diversified investment vehicles that track specific indices. This structure offers investors a cost-effective way to gain exposure to a broad market or sector, reducing individual stock risk. The ability to trade ETFs like stocks provides liquidity and flexibility, making them a popular choice for both individual and institutional investors seeking efficient and diversified investment options. Understanding the structure and benefits of ETFs is essential for anyone looking to incorporate them into their investment strategy.

Rich People's Investment Strategies

You may want to see also

Trading: Investors buy and sell ETFs on stock exchanges, similar to individual stocks

Investors can trade Exchange-Traded Funds (ETFs) on stock exchanges, much like they would with individual stocks. ETFs are a type of investment fund that tracks an index, basket of assets, or a specific market segment. When you buy or sell an ETF, you are essentially purchasing a portion of the underlying assets or securities that the ETF holds. This process is facilitated by the stock exchange, which provides a platform for buyers and sellers to trade ETFs.

Trading ETFs involves placing orders through a brokerage account, similar to how you would trade stocks. Investors can choose to buy or sell ETFs based on their investment strategy and market conditions. When buying an ETF, investors are acquiring shares in the fund, which then represents ownership in the basket of securities it tracks. This is similar to buying shares in a mutual fund, but with the added benefit of trading on an exchange, allowing for more frequent buying and selling opportunities.

The trading process for ETFs is straightforward. Investors can place market orders, which are executed at the current market price, or limit orders, where they specify a desired price. Limit orders can be useful to get a specific price or to avoid potential market volatility. ETFs are typically more liquid than individual stocks, meaning they can be bought and sold quickly and efficiently, providing investors with flexibility and control over their trades.

Selling ETFs is also a simple process. Investors can choose to sell their ETF shares when they believe the investment has reached its potential or when market conditions suggest a profit opportunity. Similar to buying, investors can place market or limit orders to execute the sale. The proceeds from the sale can then be reinvested in other ETFs or withdrawn as cash, depending on the investor's financial goals.

Trading ETFs on stock exchanges offers investors a cost-effective and efficient way to diversify their portfolios. ETFs often have lower expense ratios compared to actively managed mutual funds, making them an attractive option for long-term investors. Additionally, the ability to trade ETFs frequently allows investors to take advantage of short-term market opportunities or adjust their portfolios based on changing market conditions. This flexibility and accessibility make ETFs a popular choice for both individual and institutional investors.

Savings, Investments, and the Free Enterprise Link

You may want to see also

Fees: Management fees are typically lower than mutual funds, making ETFs cost-effective

When it comes to investing, Exchange-Traded Funds (ETFs) have gained popularity due to their unique structure and cost-effectiveness. One of the key advantages of ETFs is the fee structure, which is significantly lower compared to traditional mutual funds. This lower cost structure is a major factor in attracting investors who are conscious of their investment expenses.

Management fees are a critical component of an ETF's expense ratio. These fees are charged to manage and operate the fund, ensuring its smooth functioning. ETFs typically have lower management fees because they are passively managed, meaning they aim to replicate the performance of a specific index or market segment. This passive approach reduces the need for active portfolio management, which is often associated with higher costs in mutual funds. As a result, investors can benefit from lower management fees, making ETFs an attractive option for those seeking cost-efficient investment vehicles.

The cost savings associated with ETFs are substantial. For instance, the average management fee for an ETF is often around 0.05% to 0.15% of the fund's assets, whereas mutual funds can charge anywhere from 0.5% to 2% or more. This significant difference in fees translates to substantial savings over time, especially for investors with larger portfolios. Lower fees mean more of the investment returns go directly to the investors, enhancing the overall performance and competitiveness of ETFs.

Additionally, ETFs offer transparency in their fee structure, allowing investors to easily understand the costs associated with their investments. This transparency is crucial for investors who want to make informed decisions and manage their expenses effectively. By providing clear fee information, ETFs empower investors to choose the most suitable investment options that align with their financial goals and risk tolerance.

In summary, the lower management fees of ETFs compared to mutual funds contribute to their cost-effectiveness. This advantage, combined with the passive management approach, makes ETFs an attractive choice for investors seeking efficient and affordable investment opportunities. Understanding the fee structure is essential for investors to maximize their returns and make informed decisions in the dynamic world of investing.

Paying Off Debt vs. Investing: Which Should You Prioritize?

You may want to see also

Tax Efficiency: ETFs often generate fewer taxable events compared to direct stock ownership

When it comes to investing, tax efficiency is a crucial aspect that can significantly impact an investor's long-term returns. Exchange-Traded Funds (ETFs) have gained popularity as a tax-efficient investment vehicle, offering a unique advantage over traditional stock ownership. One of the key reasons for this is the way ETFs are structured and traded.

ETFs are designed to track the performance of a specific index, sector, or asset class. Unlike individual stocks, which are bought and sold directly, ETFs are traded on stock exchanges, similar to stocks. This trading process often results in fewer taxable events for investors. When you buy or sell individual stocks, you typically incur capital gains or losses, which are subject to taxation. However, with ETFs, the tax implications are different.

The tax efficiency of ETFs comes into play when you consider the underlying holdings. ETFs hold a basket of securities, such as stocks or bonds, and these holdings are constantly being adjusted to mirror the index they track. This dynamic nature of ETFs means that they can rebalance their holdings more frequently, often on a daily basis. As a result, when you buy or sell an ETF, you are essentially trading a basket of securities, not individual stocks. This frequent rebalancing can lead to a more consistent and less frequent realization of capital gains, which is a significant advantage for tax purposes.

In contrast, direct stock ownership may result in more frequent taxable events. When you hold individual stocks, you are more likely to experience capital gains or losses at the end of each tax year, especially if your portfolio includes stocks that have appreciated or depreciated significantly. This can result in higher tax liabilities, especially for investors in higher tax brackets. ETFs, with their frequent rebalancing, can help mitigate this issue by providing a more consistent and potentially lower-tax investment experience.

Additionally, ETFs often offer a cost-effective way to invest in a diversified portfolio. Many ETFs have lower expense ratios compared to actively managed mutual funds, making them an attractive choice for investors who want to minimize expenses while still benefiting from tax efficiency. By combining the advantages of diversification, frequent rebalancing, and lower costs, ETFs can be a powerful tool for investors seeking to optimize their tax efficiency and overall investment strategy.

Ethereum: Invest or Avoid?

You may want to see also

Diversification: Holdings are spread across various assets, reducing risk and providing broad exposure

When it comes to investing in Exchange-Traded Funds (ETFs), one of the key benefits is the concept of diversification. ETFs are designed to provide investors with a way to diversify their portfolios across various assets, sectors, or markets, which can significantly reduce risk and offer broad exposure to different areas of the economy.

Diversification is a fundamental principle in investing, and ETFs excel in this aspect. By holding a basket of securities, ETFs can replicate the performance of a specific index or sector. For example, an ETF might track the S&P 500 index, which includes 500 large-cap U.S. companies. This means that the ETF's holdings are spread across these 500 companies, ensuring that no single investment carries an excessive portion of the portfolio's risk. As a result, investors benefit from the diversification inherent in the index, reducing the impact of any one stock's performance on the overall portfolio.

The diversification within ETFs is achieved through a process called 'holding a diversified portfolio'. When you invest in an ETF, you are essentially buying a share of the fund, which then holds a collection of securities. These securities can include stocks, bonds, commodities, or even other ETFs. The fund's management team carefully selects and manages these holdings to ensure that the ETF mirrors the performance of the underlying index or sector. This approach allows investors to gain exposure to a wide range of assets without having to individually research and select each one.

This diversification strategy is particularly advantageous during volatile market conditions. If one sector or asset class underperforms, the impact on the overall portfolio is mitigated by the positive performance of other holdings. For instance, if the technology sector experiences a downturn, an ETF that is diversified across various sectors, including technology, healthcare, and consumer staples, will likely see some of its holdings perform well, thus reducing the overall risk.

In summary, ETFs offer investors a powerful tool for diversification by spreading investments across multiple assets, sectors, or markets. This approach helps to reduce risk and provides a more stable investment experience, making ETFs an attractive option for those seeking to build a well-rounded and balanced investment portfolio.

Where to Shop the Internet-Famous Brad Blouse

You may want to see also

Frequently asked questions

An ETF, or Exchange-Traded Fund, is a basket of securities that trade on an exchange like a stock. It is designed to track the performance of a specific index, sector, commodity, or asset class. ETFs offer investors a way to diversify their portfolios and gain exposure to a particular market or investment strategy.

ETFs and mutual funds both aim to replicate the performance of a specific investment strategy or market index. However, the key difference lies in how they are traded. ETFs are listed on an exchange and can be bought and sold throughout the trading day, similar to stocks. Mutual funds, on the other hand, are bought and sold at the end of the trading day based on their net asset value (NAV). ETFs typically have lower expense ratios and offer more liquidity.

Investing in ETFs is relatively straightforward. You can purchase ETFs through a brokerage account or a trading platform. When you buy an ETF, you are essentially buying a basket of securities that make up the fund. ETFs can be traded just like stocks, and you can choose to buy or sell them at any time during the trading day. It's important to research and select ETFs that align with your investment goals and risk tolerance.

ETFs offer several advantages for investors. Firstly, they provide diversification as they hold a basket of assets, reducing the risk associated with individual stocks. ETFs also have lower expense ratios compared to actively managed mutual funds. Additionally, ETFs offer transparency as their holdings are publicly disclosed, and they provide tax efficiency due to their structure. ETFs can also be a cost-effective way to gain exposure to specific markets or investment strategies without the need for individual stock picking.