Fidelity's Automatic Investment Plan, commonly known as SIPC, is a powerful tool for investors looking to build wealth over time. This program allows investors to automatically invest a set amount of money at regular intervals, such as weekly, bi-weekly, or monthly. The key feature is that it helps investors overcome the emotional challenges of investing, such as the fear of missing out or the temptation to time the market. By setting up automatic contributions, investors can dollar-cost average their investments, which means they buy more shares when prices are low and fewer when prices are high. This strategy can lead to significant long-term gains and is a popular choice for those who want a disciplined approach to investing without the hassle of frequent manual transactions.

What You'll Learn

- Investment Plan: Fidelity's automatic investment plan allows investors to invest a fixed amount regularly

- Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, reducing risk

- Diversification: The plan automatically invests in a diverse range of assets to minimize risk

- Fee Structure: Understanding the fees associated with the automatic investment plan is crucial

- Performance Tracking: Investors can track the performance of their investments through the plan

Investment Plan: Fidelity's automatic investment plan allows investors to invest a fixed amount regularly

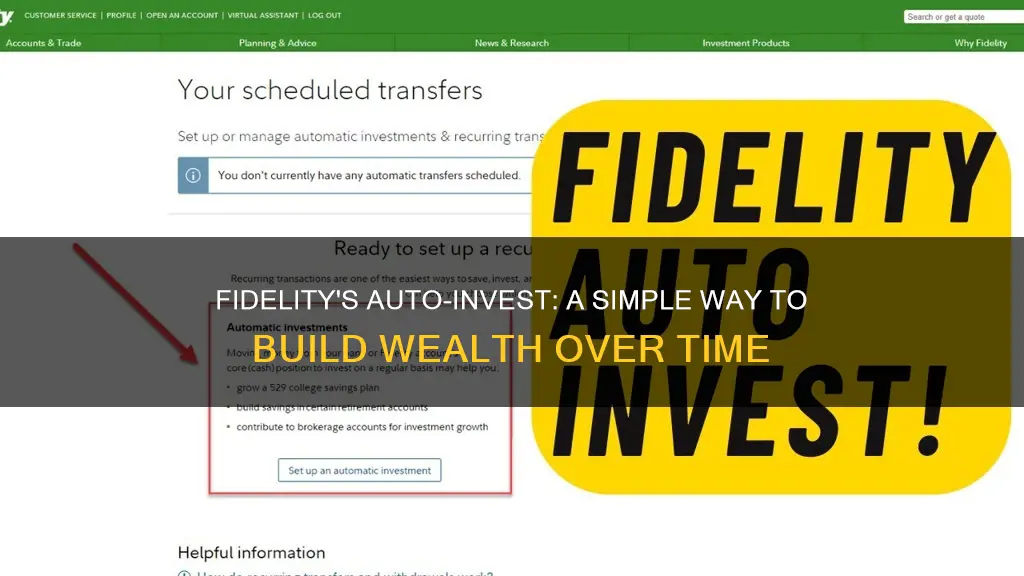

Fidelity's automatic investment plan, often referred to as dollar-cost averaging, is a powerful tool for investors who want to build wealth over time with a consistent strategy. This approach allows you to invest a fixed amount of money at regular intervals, regardless of the market's performance. Here's how it works and why it can be beneficial:

When you enroll in Fidelity's automatic investment plan, you set up a recurring investment schedule. This could be weekly, bi-weekly, monthly, or any other frequency that suits your preferences and financial situation. You determine the amount you wish to invest each time, which could be a small, manageable sum or a larger contribution. The key is consistency. By investing a fixed amount regularly, you remove the stress of trying to time the market and make investing a seamless part of your financial routine.

The beauty of this plan lies in its ability to smooth out market volatility. When you invest a fixed sum regularly, you buy more shares when prices are low and fewer when prices are high. This strategy effectively averages out the cost of your investments over time, reducing the impact of market fluctuations. For example, if you invest $100 every month, you might purchase 10 shares at $10 each and 5 shares at $12 each, resulting in a lower average cost per share. This approach is particularly advantageous during market downturns, as it allows investors to accumulate more shares at reduced prices.

One of the advantages of Fidelity's automatic investment plan is its simplicity. It eliminates the need for constant monitoring and decision-making. You can choose to invest in various assets, such as stocks, bonds, or mutual funds, depending on your risk tolerance and financial goals. The plan's automated nature ensures that your investments are diversified and aligned with your chosen asset allocation strategy. Additionally, Fidelity provides a wide range of investment options, allowing investors to tailor their portfolios to their specific needs.

To get started, investors can follow these steps: First, open a Fidelity account and set up a brokerage account if you don't already have one. Then, choose the investment plan that suits your goals and risk tolerance. You can select from various investment options, including index funds, which are known for their low costs and broad market exposure. Finally, set up your recurring investment schedule, specifying the amount and frequency. Fidelity's platform often provides tools to help you track your investments and adjust your contributions as needed.

In summary, Fidelity's automatic investment plan offers a straightforward and effective way to invest regularly. By investing a fixed amount at regular intervals, investors can take advantage of dollar-cost averaging, which helps smooth out market volatility. This strategy allows for a disciplined and consistent approach to building wealth, making it an excellent choice for long-term investors who want to participate in the market without the burden of constant decision-making.

Unveiling the Inner Workings: A Guide to Investment Firms

You may want to see also

Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, reducing risk

Dollar-cost averaging is a powerful investment strategy that can help individuals mitigate risk and build wealth over time. This approach involves a consistent and disciplined investment plan, where an investor allocates a fixed amount of money at regular intervals, regardless of the asset's price. By doing so, investors can take advantage of the natural market fluctuations and potentially reduce the impact of market volatility on their portfolio.

The core principle behind dollar-cost averaging is to invest a set amount of money at regular, predetermined intervals, such as monthly or quarterly. For example, an investor might decide to invest $500 every month in a particular stock or mutual fund. This strategy is particularly effective when the market is in a downward trend, as it allows investors to purchase more shares when prices are low, and fewer shares when prices are high. Over time, this approach can lead to a lower average cost per share, thus reducing the overall risk associated with market volatility.

One of the key benefits of dollar-cost averaging is its ability to smooth out the impact of market timing. Instead of trying to predict the market's peak and bottom, investors can focus on their investment strategy and maintain their commitment to regular contributions. This disciplined approach helps to avoid the temptation of selling during market downturns or buying when prices are high, which can often lead to poor investment decisions. By consistently investing, investors can benefit from the long-term growth potential of the market, even during short-term fluctuations.

Implementing dollar-cost averaging can be a straightforward process. Investors can start by setting up automatic transfers from their bank account to their investment account at regular intervals. Many financial institutions and investment platforms offer this feature, allowing investors to automate their investment strategy. It is essential to choose an investment vehicle that aligns with your financial goals and risk tolerance, such as stocks, bonds, or mutual funds.

In summary, dollar-cost averaging is a strategic investment approach that involves investing a fixed amount at regular intervals. This method helps to reduce risk by averaging out the purchase price over time and can be an effective way to build wealth, especially during market downturns. By maintaining a disciplined and consistent investment plan, individuals can take control of their financial future and potentially achieve their long-term financial objectives.

Best Forex Trades to Make Today

You may want to see also

Diversification: The plan automatically invests in a diverse range of assets to minimize risk

Fidelity's automatic investment plan, often referred to as a Dollar-Cost Averaging (DCA) strategy, is designed to provide investors with a simple and effective way to build wealth over time. One of the key principles behind this approach is diversification, which is a fundamental concept in risk management.

Diversification is a strategy that involves spreading your investments across various asset classes, sectors, and geographic regions. By doing so, investors aim to minimize the impact of any single investment's performance on their overall portfolio. When you invest in a diverse range of assets, you reduce the risk associated with any one particular investment. For example, if you invest solely in stocks, a downturn in the stock market could significantly impact your portfolio. However, by diversifying into other asset classes like bonds, real estate, or commodities, you create a more balanced approach. This strategy ensures that your portfolio is not overly exposed to any single market or asset type, thus reducing the overall risk.

Fidelity's automatic investment plan utilizes this diversification strategy by automatically allocating your investments across different asset classes. This process is typically done by the investment manager or algorithm, which regularly reviews and adjusts the portfolio to maintain the desired level of diversification. The plan might invest a portion of your contributions in stocks, another portion in bonds, and potentially some in alternative investments like real estate investment trusts (REITs) or mutual funds. This automatic diversification ensures that your investments are not concentrated in a few select areas, providing a more stable and well-rounded approach to wealth accumulation.

The benefits of this diversification strategy are twofold. Firstly, it helps to smooth out the impact of market volatility. During periods of market decline, certain asset classes might perform better, offsetting the losses in others. This ensures that your portfolio doesn't experience a significant drop in value. Secondly, diversification allows for a more consistent long-term growth potential. By investing in a variety of assets, you increase the chances of capturing the upside potential of different markets and sectors.

In summary, Fidelity's automatic investment plan emphasizes diversification as a core component of its strategy. By automatically investing in a diverse range of assets, investors can minimize the risks associated with market fluctuations and build a more resilient portfolio over time. This approach provides a structured and disciplined way to invest, making it an attractive option for those seeking a long-term wealth-building strategy.

Limited Edition Prints: The Art of Investing in Signed, Numbered Masterpieces

You may want to see also

Fee Structure: Understanding the fees associated with the automatic investment plan is crucial

When considering Fidelity's automatic investment plan, understanding the fee structure is essential to ensure you are making informed decisions about your investments. The fees associated with this service can vary, and being aware of these costs is crucial for managing your financial resources effectively.

The primary fee you should be aware of is the expense ratio, which is a measure of the annual cost of investing in a particular fund or account. This ratio is typically expressed as a percentage and represents the management and operational expenses incurred by the fund. For example, if a fund has an expense ratio of 0.50%, it means that 0.50% of the fund's assets is used to cover these expenses each year. These fees are usually included in the overall performance of the investment, so it's important to compare expense ratios when choosing investment options.

In addition to the expense ratio, there may be other fees associated with the automatic investment plan. These can include transaction fees, which are charged for each purchase or sale of an investment, and redemption fees, which are applicable when you withdraw or redeem your investments. It's important to review the specific terms and conditions of your Fidelity account to understand the exact fees that may apply. Some funds might also have sales charges or distribution fees, which are typically applied when you initially purchase the investment.

Another aspect to consider is the impact of compounding on your investments. As you invest regularly through the automatic plan, your money can grow exponentially due to compounding. This means that the interest or returns earned on your investments are reinvested, generating additional returns over time. While this can significantly boost your long-term growth, it's essential to remember that compounding also means your fees are applied to a growing investment base, which can impact your overall returns.

Lastly, it's worth noting that Fidelity may offer different fee structures or tiers for their automatic investment plans. These tiers could provide varying levels of benefits or charges, so it's crucial to review the details of your specific plan. Understanding these fee structures will enable you to make informed choices and potentially optimize your investment strategy.

Unraveling the Process: How Investing in Businesses Creates Wealth

You may want to see also

Performance Tracking: Investors can track the performance of their investments through the plan

Performance tracking is a crucial aspect of managing your investments, and Fidelity's automatic investment plan offers a comprehensive way to monitor your portfolio's performance. This feature allows investors to stay informed and make data-driven decisions about their financial journey. Here's how it works:

When you enroll in the Fidelity automatic investment plan, you gain access to a powerful performance-tracking tool. This tool provides a detailed overview of your investment's growth and progress over time. It displays key metrics such as the total return, capital appreciation, and dividend income generated by your investments. By offering a clear visualization of your portfolio's performance, investors can quickly identify trends and make adjustments as needed.

The performance tracking system provides a historical record of your investments, allowing you to compare different periods and assess the impact of market fluctuations. You can view monthly, quarterly, or annual performance summaries, making it easy to identify the best-performing assets and those that may require rebalancing. This historical data is invaluable for long-term investors who want to understand the impact of their investment strategy over time.

Additionally, Fidelity's platform offers customizable alerts and notifications. Investors can set up alerts for specific performance milestones, such as reaching a certain percentage return or achieving a particular investment goal. These alerts ensure that you stay informed about your portfolio's progress and can take prompt action if needed. The ability to set personalized triggers empowers investors to take control of their financial journey.

In summary, the performance-tracking feature within the Fidelity automatic investment plan is a powerful tool for investors. It provides a comprehensive view of investment performance, historical data analysis, and customizable alerts. By utilizing this feature, investors can make informed decisions, adjust their strategies, and stay on track to meet their financial objectives. This level of transparency and control is a significant advantage of using Fidelity's automated investment services.

Why Early College Programs Are Worth the Investment

You may want to see also

Frequently asked questions

Fidelity's Automatic Investment Plan, also known as Dollar-Cost Averaging, is a strategy that allows investors to invest a fixed amount of money at regular intervals, typically monthly. This approach helps investors build a diversified portfolio over time by investing in the same amount regardless of the asset's price.

The plan works by automatically transferring a specified amount from your linked bank account into your investment account. You can choose the investment options you want to participate in, such as stocks, bonds, or mutual funds. The investments are made at predetermined intervals, providing a consistent approach to investing.

This method offers several advantages, including the potential for long-term wealth accumulation, diversification, and reduced market impact. By investing a fixed amount regularly, investors can buy more shares when prices are low and fewer when prices are high, thus averaging out the cost over time.

Absolutely! You have the flexibility to choose from various investment options within the Fidelity platform. This includes different mutual funds, exchange-traded funds (ETFs), and other investment vehicles. You can also adjust your contribution amount and schedule to align with your financial goals and risk tolerance.