Investing in Apple Inc. (AAPL) can be a lucrative venture for those interested in the technology sector. Apple is a well-known global brand, renowned for its innovative products and services, including the iPhone, iPad, Mac, and Apple Watch. When you invest in Apple, you're essentially buying a share of the company, which means you own a fraction of the business. This investment can grow over time as Apple's stock price rises, providing potential capital gains. Additionally, investors can earn dividends, which are a portion of the company's profits paid out to shareholders. Understanding Apple's financial performance, market position, and future prospects is crucial for making informed investment decisions. This overview will delve into the mechanics of investing in Apple, including how to buy shares, the factors influencing stock price, and the potential risks and rewards associated with this investment.

What You'll Learn

- Apple's Business Model: Apple's success stems from its innovative products, strong brand, and diverse revenue streams

- Stock Market Basics: Investing in Apple involves understanding the stock market, where shares are bought and sold

- Financial Performance: Apple's financial health is key; track revenue, profit margins, and market share to gauge investment potential

- Industry Trends: Stay informed about tech industry trends, as Apple's performance is closely tied to technological advancements

- Risk and Diversification: Diversifying investments is crucial; assess Apple's risks and consider a balanced portfolio

Apple's Business Model: Apple's success stems from its innovative products, strong brand, and diverse revenue streams

Apple Inc. has become one of the most valuable and influential companies in the world, largely due to its unique business model, which has driven its success and sustained its growth over the years. Here's an overview of how Apple's business model contributes to its achievements:

Innovative Products: Apple's primary strength lies in its ability to innovate and create groundbreaking products that captivate consumers worldwide. The company has a reputation for designing sleek, user-friendly devices with cutting-edge technology. From the introduction of the iPhone in 2007, which revolutionized the smartphone industry, to the iconic MacBook laptops and the powerful Apple Watch, each product is meticulously crafted to offer a premium user experience. Apple's focus on design, ease of use, and seamless integration of hardware and software sets it apart from competitors, attracting a dedicated customer base.

Strong Brand and Customer Loyalty: Apple has built a powerful brand that evokes a sense of loyalty and exclusivity. The company's logo, the bite of the apple, and its minimalist design aesthetic are instantly recognizable and have become cultural symbols. Apple's brand value is high, and it consistently ranks among the most valuable brands globally. This strong brand image encourages customers to choose Apple products over competitors, even at a higher price point. The company's focus on privacy, security, and sustainability further enhances its brand reputation, fostering a community of loyal customers who advocate for the Apple ecosystem.

Diverse Revenue Streams: Apple's business model is characterized by its ability to generate revenue from multiple sources, reducing dependency on any single product. The company's diverse revenue streams include:

- Hardware Sales: Apple sells a wide range of hardware products, including iPhones, iPads, Mac computers, Apple Watch, and AirPods. These devices are sold at premium prices, contributing significantly to the company's revenue.

- Services: Apple has successfully expanded its business beyond hardware by offering a range of services. These include the App Store, Apple Music, iCloud storage, Apple Pay, and Apple Care. Services now account for a substantial portion of Apple's revenue, providing a recurring income stream and fostering customer engagement.

- Software and Subscriptions: Apple's operating systems, iOS and macOS, are pre-installed on its devices, providing a platform for software sales and subscriptions. This includes the App Store, which offers a vast selection of applications, and Apple's subscription services, such as Apple TV+, Apple Arcade, and Apple Fitness+.

- Accessories and Licensing: Apple also generates revenue from accessories like chargers, cables, and cases, as well as licensing fees for its intellectual property.

By diversifying its revenue streams, Apple has created a robust and resilient business model that can adapt to market changes and consumer trends. This approach has allowed the company to maintain consistent growth and profitability, making it an attractive investment opportunity.

In summary, Apple's success is underpinned by its commitment to innovation, resulting in a portfolio of desirable products. The company's strong brand and customer loyalty further solidify its position in the market. With a diverse revenue model, Apple has demonstrated its ability to thrive in a highly competitive technology industry, making it a prominent player in the global economy and an appealing investment prospect.

The Bond Conundrum: Exploring the Impact of Bond Investment on Deprivation

You may want to see also

Stock Market Basics: Investing in Apple involves understanding the stock market, where shares are bought and sold

Investing in Apple, one of the world's most valuable companies, can be an attractive prospect for many investors. To understand how this works, it's essential to grasp the fundamentals of the stock market, which serves as the platform for buying and selling shares of companies like Apple.

The stock market is a global network of exchanges where investors can trade securities, including stocks. When you invest in Apple, you essentially buy a small ownership stake in the company. This is done through the purchase of Apple's shares, which are traded on stock exchanges such as the NASDAQ. Each share represents a fraction of ownership in the company, and the price of these shares fluctuates based on various factors.

To invest in Apple, you need to open a brokerage account with a reputable online or traditional brokerage firm. These firms act as intermediaries between investors and the stock market. They provide the necessary tools and platforms to buy and sell stocks, including Apple. When you place an order to buy Apple shares, your broker executes the trade on your behalf, connecting you to the stock market.

The stock market operates through a network of buyers and sellers. When you buy Apple shares, you are purchasing them from another investor who is selling. The price at which you buy the shares is determined by the supply and demand for Apple's stock at that moment. If there is high demand for Apple's shares, the price will likely increase, and vice versa. This dynamic nature of the market is what drives the price movements of Apple's stock.

Understanding the stock market is crucial for successful investing. It involves staying informed about market trends, analyzing financial data, and making informed decisions. Investors can monitor Apple's stock performance, news, and financial reports to assess its health and potential. Additionally, diversifying your investments across different companies and sectors is a prudent strategy to manage risk. Remember, investing in the stock market carries risks, and it's essential to conduct thorough research or consult financial advisors before making any investment decisions.

Chipper Cash: Unlocking Investment Opportunities with Mobile Money

You may want to see also

Financial Performance: Apple's financial health is key; track revenue, profit margins, and market share to gauge investment potential

Apple Inc., a technology giant, has consistently demonstrated strong financial performance, making it an attractive investment opportunity for many. To understand how investing in Apple works, it's crucial to delve into its financial health and key metrics.

Revenue is a fundamental indicator of Apple's financial performance. The company has consistently generated substantial revenue over the years, with a steady growth trend. Investors should analyze Apple's revenue growth rate, comparing it to industry averages and competitors. A consistent increase in revenue suggests a strong market position and potential for future growth. For instance, in the fiscal year 2022, Apple's total revenue reached $394.3 billion, showcasing its remarkable financial strength.

Profit margins are another critical aspect to consider. Apple's ability to generate profits from its sales is a testament to its operational efficiency. Investors should examine Apple's gross profit margin, operating profit margin, and net profit margin. These margins indicate how effectively Apple manages its costs and how much profit it generates per dollar of revenue. Historically, Apple has maintained healthy profit margins, often surpassing industry standards. For instance, in the same fiscal year, Apple's gross profit margin was approximately 38%, demonstrating its ability to control costs while generating substantial profits.

Market share is a powerful metric to assess Apple's position in the highly competitive technology industry. By tracking market share, investors can understand Apple's competitive advantage and potential for long-term growth. Apple's dominance in the smartphone market, with its iPhone, and its strong presence in the tablet and wearable technology sectors are well-documented. Analyzing market share data can provide insights into Apple's ability to retain customers and its potential to expand into new markets.

In addition to these financial metrics, investors should also consider Apple's financial stability and cash flow. A company with a robust financial position is more likely to navigate economic downturns and maintain its operations. Apple's consistent cash flow from operations and its ability to generate substantial cash reserves indicate a financially stable entity. This stability can provide a safety net during market fluctuations and support long-term investment strategies.

By closely monitoring Apple's financial performance, including revenue growth, profit margins, and market share, investors can make informed decisions. These financial indicators provide a comprehensive view of Apple's health and potential, allowing investors to assess the company's ability to create value over time.

The Evolution of Responsible Investment: A Conversation with Will Martindale

You may want to see also

Industry Trends: Stay informed about tech industry trends, as Apple's performance is closely tied to technological advancements

Staying informed about industry trends is crucial for investors who want to understand the dynamics of the tech sector, especially when it comes to Apple, a leading technology company. The tech industry is characterized by rapid innovation and constant evolution, and Apple's performance is intricately linked to these advancements. As a technology giant, Apple's success is often measured by its ability to innovate, adapt, and stay ahead of the curve.

One of the key trends to monitor is the development of new technologies and their impact on Apple's product lineup. The company is renowned for its focus on design and user experience, and any technological breakthroughs can significantly influence its product offerings. For instance, advancements in artificial intelligence (AI), augmented reality (AR), and machine learning have already shaped Apple's strategies. AI-powered features in iOS and macOS have enhanced user interactions, while AR applications have been integrated into various apps, showcasing Apple's commitment to staying at the forefront of these trends.

Additionally, keeping an eye on industry competitors and their strategies is essential. Apple's performance is often compared to its rivals, such as Samsung, Google, and Microsoft. Analyzing their product releases, market share gains, and technological breakthroughs can provide insights into Apple's position in the market. For example, if a competitor introduces a groundbreaking smartphone with superior camera technology, it could impact Apple's sales and market perception.

Another critical aspect is the global economic landscape and its effect on the tech industry. Economic trends, such as shifts in consumer spending habits, government policies, and international trade agreements, can influence Apple's sales and revenue. For instance, a global economic downturn might lead to reduced consumer spending on luxury goods, potentially impacting Apple's iPhone sales. Conversely, favorable economic conditions could drive demand for Apple's premium products.

Furthermore, staying informed about regulatory changes and industry standards is vital. Tech companies often face scrutiny from regulatory bodies, and any changes in laws or regulations can impact their operations. Apple has faced various legal challenges and investigations over the years, and keeping up with these developments is essential for investors. Changes in data privacy laws, antitrust regulations, or environmental standards could have direct consequences on Apple's business model and financial performance.

In summary, investing in Apple requires a deep understanding of the tech industry's trends and dynamics. By staying informed about technological advancements, competitor strategies, economic factors, and regulatory changes, investors can make more informed decisions. Apple's performance is closely tied to its ability to innovate and adapt, so keeping up with industry trends is crucial for assessing its potential and making sound investment choices.

Rent, Invest, or Buy: Navigating the Property Maze

You may want to see also

Risk and Diversification: Diversifying investments is crucial; assess Apple's risks and consider a balanced portfolio

Investing in Apple Inc. (AAPL) can be a strategic move for investors seeking exposure to the technology sector and innovative products. However, it's essential to understand the risks associated with this investment and the importance of diversification. Apple is a well-known technology giant, and its products and services have a global reach, making it a prominent player in the tech industry. The company's success is often attributed to its ability to innovate, with products like the iPhone, iPad, and Apple Watch, which have created a loyal customer base.

One of the primary risks associated with investing in Apple is its high valuation. As a result, the stock price can be sensitive to market sentiment and may experience volatility. Apple's dominance in the smartphone market has led to intense competition, with rivals constantly introducing new features and models. This competitive landscape could impact Apple's market share and revenue growth. Additionally, the company's reliance on a few key products, such as the iPhone, makes it susceptible to shifts in consumer preferences and trends.

Diversification is a critical strategy to manage risk effectively. By spreading investments across various assets, investors can reduce the impact of any single investment's performance on their overall portfolio. When considering Apple as part of a diversified portfolio, investors should assess the company's risks and potential benefits. A balanced approach might involve investing in Apple while also holding other technology stocks, consumer goods companies, or even exploring different sectors to ensure a well-rounded investment strategy.

In terms of diversification, investors can consider the following: Firstly, Apple's strong brand and customer loyalty can provide a stable foundation for investment. However, it's essential to monitor the company's performance in a competitive market. Secondly, investing in a range of technology companies can help mitigate the risks associated with Apple's specific product lines. This could include tech giants like Microsoft or Google, as well as smaller, innovative startups. Lastly, diversifying across different sectors, such as healthcare, finance, or energy, can further enhance risk management.

Creating a balanced portfolio is a key strategy for long-term success. It involves regularly reviewing and rebalancing investments to ensure they align with an investor's goals and risk tolerance. By diversifying investments, investors can navigate market fluctuations and potential risks associated with individual companies, such as Apple. This approach allows for a more stable and sustainable investment journey, providing a solid foundation for wealth accumulation over time.

Unlocking Wealth: A Beginner's Guide to Gcash Investment Strategies

You may want to see also

Frequently asked questions

Investing in Apple, or any company, typically involves purchasing shares of that company's stock through a brokerage account. You can buy Apple stock on various online trading platforms or through a traditional stockbroker. When you buy a share, you become a shareholder and own a small portion of the company.

Starting an investment journey in Apple is relatively straightforward. Here's a simple process: First, choose a brokerage platform that suits your needs and preferences. Many platforms offer user-friendly interfaces and low fees. Then, open a brokerage account by providing personal information and funding it with money you're willing to invest. Finally, search for Apple's stock (ticker: AAPL) and place a buy order.

Investing in any company, including Apple, carries risks, but it can also offer significant potential rewards. Here are some factors to consider: Research Apple's financial performance, market position, and future prospects. Look at its revenue growth, profit margins, and competitive advantage in the tech industry. Analyze the company's management team and their track record. Consider your investment goals and risk tolerance. Diversifying your portfolio across different companies and sectors is generally a wise strategy.

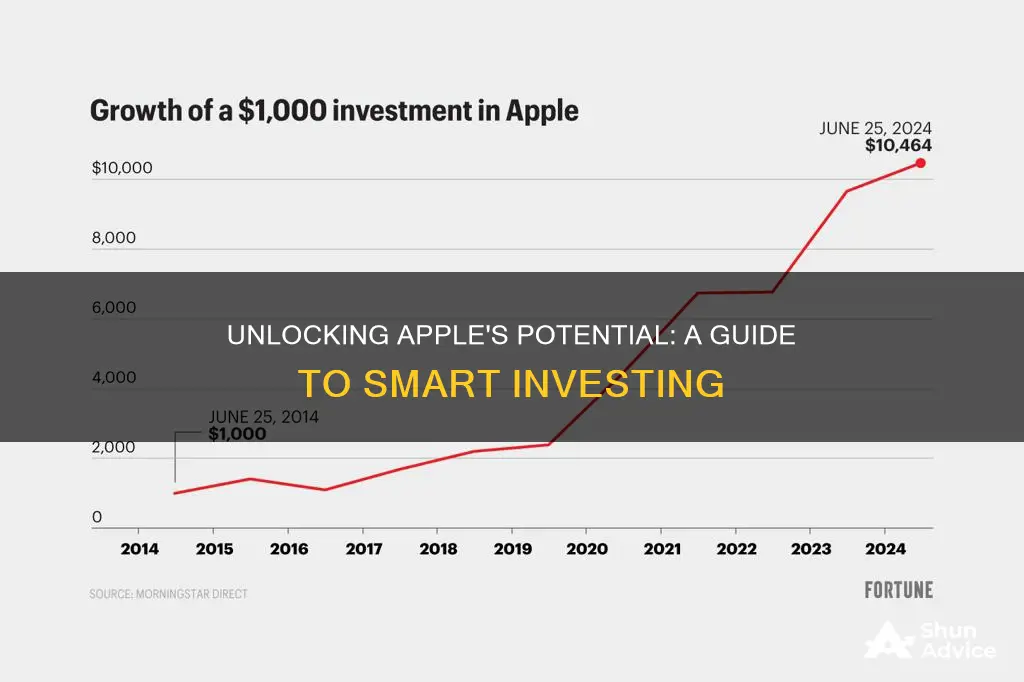

Investing in Apple's stock can potentially generate profits through various means. Firstly, you can benefit from capital appreciation, where the stock price increases over time, allowing you to sell at a higher price than your purchase price. Additionally, Apple pays dividends to shareholders, providing a regular income stream. However, it's important to note that stock prices can fluctuate, and there's always a risk of losing some or all of your investment.