Understanding investment interest is crucial for anyone looking to grow their wealth. Investment interest refers to the earnings generated from an investment, typically in the form of dividends, interest, or capital gains. It's a fundamental concept in finance, allowing individuals to earn returns on their investments over time. This guide will explore how investment interest works, including the various types of interest, how it's calculated, and strategies to maximize your returns. Whether you're a seasoned investor or just starting, grasping the mechanics of investment interest is key to making informed financial decisions.

What You'll Learn

- Understanding Investment Interest: How interest rates impact investment returns and costs

- Types of Investment Interest: Fixed, variable, and compound interest in different investment vehicles

- Interest Calculation Methods: Formulae and tools for calculating interest on investments

- Tax Implications of Investment Interest: Tax treatment of interest income and deductions

- Interest Rates and Market Conditions: How interest rates affect investment strategies and market trends

Understanding Investment Interest: How interest rates impact investment returns and costs

Understanding the concept of investment interest is crucial for anyone looking to grow their wealth through various financial instruments. When you invest, you essentially lend your money to an entity, such as a government, corporation, or financial institution, in exchange for a promise of future returns. This is where the concept of interest comes into play. Investment interest refers to the additional income or charge you receive or pay for allowing your money to be used by others for a specified period.

Interest rates are a critical factor in determining the cost and return on investments. When interest rates rise, borrowing becomes more expensive, and lenders demand higher returns on their investments. This directly impacts the cost of borrowing for investors, especially those with loans or mortgages. For instance, if you have a fixed-rate mortgage, an increase in interest rates will lead to higher monthly payments, reducing the overall affordability of the investment. On the other hand, for those with savings accounts or bonds, rising interest rates can result in higher returns, as the interest earned on these investments is typically tied to market rates.

The relationship between interest rates and investment returns is a delicate balance. When interest rates are low, investors might seek higher returns by investing in riskier assets, such as stocks or high-yield bonds. This can lead to increased investment activity and potentially higher returns for those who can identify undervalued assets. However, during periods of low interest rates, investors might also consider alternative investments like real estate or commodities, which can offer more stable returns and act as a hedge against inflation.

Conversely, when interest rates are high, borrowing becomes more expensive, and investors may opt for safer, lower-yielding investments. This shift in investor behavior can impact the overall market dynamics. For instance, during a period of rising interest rates, the stock market might experience a downturn as investors move their capital to fixed-income securities, which offer more predictable returns. Understanding these dynamics is essential for investors to make informed decisions and manage their portfolios effectively.

In summary, investment interest is a critical component of the investment landscape, influencing both the cost of borrowing and the returns on savings. Interest rates play a pivotal role in shaping investment strategies, with rising rates often leading to higher costs for borrowers and increased returns for savers. Investors should stay informed about market trends and interest rate movements to make strategic decisions that align with their financial goals and risk tolerance.

Gamestop: The People's Stock

You may want to see also

Types of Investment Interest: Fixed, variable, and compound interest in different investment vehicles

Understanding the different types of interest associated with investments is crucial for anyone looking to grow their wealth. Investment interest can be categorized into three main types: fixed, variable, and compound interest, each with its own characteristics and implications for investors.

Fixed Interest: This type of interest is straightforward and predictable. When you invest in a fixed-income security, such as a bond or a fixed deposit, you are guaranteed to earn a set rate of interest over a specified period. For example, if you invest $1,000 in a one-year bond with a 5% fixed interest rate, you will earn $50 in interest at the end of the year. Fixed interest rates are attractive because they provide a stable and known return, making it easier to plan and manage your finances. This type of interest is particularly appealing to risk-averse investors who prefer a conservative approach to investing.

Variable Interest: In contrast, variable interest rates fluctuate based on market conditions and the performance of the underlying investment. This type of interest is commonly associated with investments like stocks, mutual funds, and some savings accounts. For instance, if you invest in a stock that pays dividends, the dividend rate can vary depending on the company's profitability and market trends. Variable interest can offer higher returns over time, but it also comes with more risk. Investors who are comfortable with market volatility and are willing to take on additional risk may find variable interest investments more appealing.

Compound Interest: This is a powerful concept in investing, where interest is earned not only on the initial principal amount but also on the accumulated interest from previous periods. In simple terms, compound interest allows your money to earn interest on top of interest. For example, if you invest $1,000 at an annual interest rate of 5% and the interest is compounded annually, after the first year, you will have $1,050. In the second year, you will earn interest on the new total of $1,050, resulting in a higher return. Compound interest is a key factor in the long-term growth of investments, especially in retirement accounts and long-term savings plans.

Different investment vehicles will offer varying combinations of these interest types. For instance, a savings account might provide a fixed interest rate, while a stock investment could yield variable interest through dividends. Understanding these concepts is essential for investors to make informed decisions and choose investment strategies that align with their financial goals and risk tolerance.

Invest or Repay: The Car Conundrum

You may want to see also

Interest Calculation Methods: Formulae and tools for calculating interest on investments

Understanding how investment interest works is crucial for anyone looking to grow their money. When you invest, you typically lend your money to a financial institution or an individual, and in return, you earn interest. This interest is a reward for the use of your capital and is calculated based on the amount invested, the time period, and the interest rate. There are several methods to calculate this interest, each with its own formula and considerations.

One common method is the simple interest calculation. This formula is straightforward and easy to understand: Interest = Principal * Rate * Time. Here, 'Principal' refers to the initial amount of money invested, 'Rate' is the interest rate (expressed as a decimal), and 'Time' is the duration of the investment in years. For example, if you invest $1,000 at an annual interest rate of 5% for 2 years, the simple interest earned would be $100 (5% * 1000 * 2). This method is simple but doesn't account for compounding, which is a key feature of many investment products.

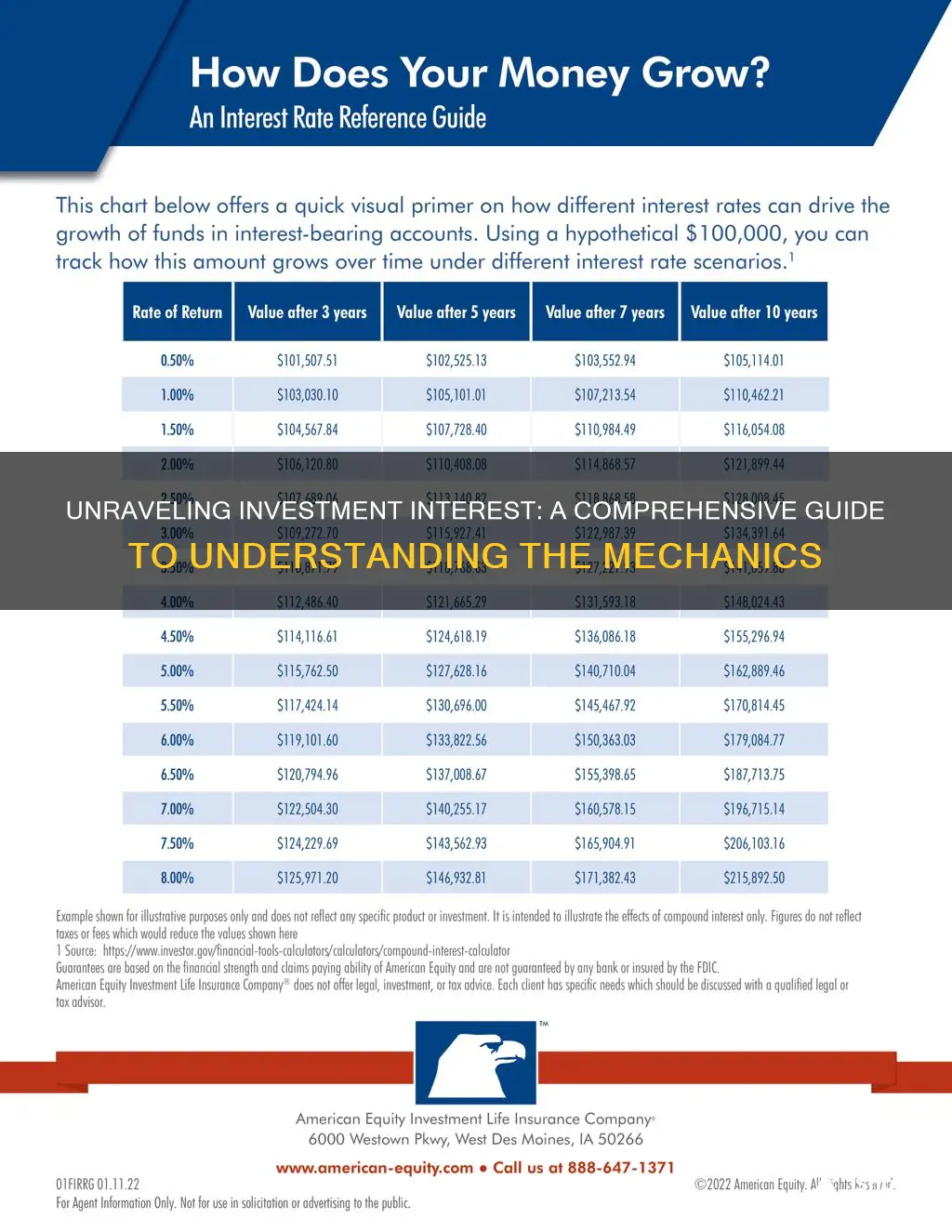

Compound interest is a more complex method, and it's where the real power of investments can be seen. The formula for compound interest is: Future Value = P(1 + r/n)^(nt). In this formula, 'P' is the principal amount, 'r' is the annual interest rate, 'n' is the number of times interest is compounded per year, and 't' is the time the money is invested for. For instance, if you invest $5,000 at an annual rate of 4%, compounded monthly, over 5 years, the future value of your investment would be approximately $7,389.16. This method shows how interest is added to the principal, and then interest is earned on the new total, leading to exponential growth.

Financial calculators and online tools are invaluable for investors, as they automate the calculation process. These tools can handle complex scenarios, including varying interest rates, different compounding periods, and even adjustable principal amounts. They provide an accurate and quick way to determine the interest earned or the final amount after a specified period. Many financial institutions and investment platforms offer these calculators, making it easy for investors to make informed decisions.

Additionally, some investments, like bonds, have specific interest calculation methods. Bond interest is often calculated using the coupon rate, which is a fixed percentage of the bond's face value paid annually. For instance, a $1,000 bond with a 4% coupon rate pays $40 in interest annually. Understanding these nuances is essential for investors to accurately assess the returns from their investments.

In summary, calculating investment interest involves using various formulae and tools, each catering to different investment types and scenarios. From simple to complex methods, investors can determine their earnings and make informed choices. Whether it's simple interest on a savings account or compound interest on a long-term investment, understanding these calculations is key to financial success.

Smart Ways to Invest $2,000

You may want to see also

Tax Implications of Investment Interest: Tax treatment of interest income and deductions

Understanding the tax implications of investment interest is crucial for investors as it can significantly impact their overall financial well-being. When you earn interest from investments, such as bonds, loans, or certain financial instruments, it is essential to know how this income is taxed to ensure compliance with tax laws.

Interest income from investments is generally taxable and must be reported on your tax return. The tax treatment of this income varies depending on the type of investment and the tax jurisdiction. In many countries, investment interest is treated as ordinary income, meaning it is taxed at the same rates as your regular income. For example, if you receive $1,000 in interest income from a bond, you would typically report this amount on your tax return and pay taxes accordingly.

However, there are some important considerations and deductions related to investment interest. One key aspect is the limitation on investment interest deductions. Tax authorities often allow investors to deduct a certain percentage of their investment interest income, but this deduction is subject to limitations. For instance, in some jurisdictions, the investment interest deduction is limited to the amount of investment income earned, ensuring that investors don't benefit from excessive tax deductions. This limitation helps prevent the use of investment interest as a loophole for tax avoidance.

To calculate the allowable deduction, investors need to determine their investment interest income and then apply the relevant tax rules. This may involve keeping records of interest earned from various sources and ensuring proper documentation. It is advisable to consult tax professionals or refer to the specific tax laws in your region to understand the exact rules and limitations regarding investment interest deductions.

Additionally, certain types of investments may have unique tax treatments. For example, tax-free municipal bonds issued by state or local governments often generate tax-exempt interest income, meaning the interest earned is not subject to federal income tax. However, state and local taxes may still apply, depending on your tax residency. It is essential to research and understand the tax implications of specific investment types to make informed financial decisions.

Unlocking Ethereum's Potential: A Beginner's Guide to Investing in Crypto

You may want to see also

Interest Rates and Market Conditions: How interest rates affect investment strategies and market trends

Interest rates play a pivotal role in shaping investment strategies and market dynamics. When central banks adjust interest rates, it creates a ripple effect across various sectors of the economy, influencing how individuals and institutions allocate their capital. Here's an exploration of this relationship:

Impact on Investment Strategies:

Interest rates have a direct bearing on investment decisions. When interest rates are low, borrowing becomes cheaper, encouraging businesses to invest in expansion projects, research, and development. This increased investment can stimulate economic growth and potentially drive up asset prices. Investors often view low-interest-rate environments as an opportunity to seek higher returns through riskier investments, such as stocks or growth-oriented funds. Conversely, during periods of high-interest rates, borrowing becomes more expensive, potentially discouraging new investments and leading investors to seek safer, lower-yielding assets.

Market Trends and Asset Allocation:

Interest rate changes can significantly impact market trends and asset allocation strategies. In a rising interest rate environment, fixed-income securities like bonds tend to become more attractive as their yields increase. This shift can lead to a rotation of assets, with investors moving from stocks to bonds in search of higher income. On the other hand, during periods of declining interest rates, the value of existing bonds may decrease, prompting investors to reconsider their bond holdings. Equities, especially those of companies with strong balance sheets, can also benefit from low-interest rates as they provide an attractive alternative to fixed-income investments.

Economic Indicators and Market Sentiment:

Interest rates are closely watched by investors as a key economic indicator. Changes in interest rates can signal the central bank's stance on inflation and economic growth. For instance, a series of rate cuts might indicate a proactive approach to stimulate the economy, potentially impacting market sentiment and investment flows. Investors closely monitor these signals to adjust their portfolios accordingly, making interest rate decisions a critical factor in their investment calculus.

Long-Term Investment Considerations:

Over the long term, interest rates can influence the overall return on investment. In a low-interest-rate environment, investors might need to explore alternative strategies, such as dividend reinvestment or share buybacks, to generate returns. In contrast, higher interest rates can provide a more traditional path to wealth accumulation through bond investments. Understanding these long-term implications is essential for investors to make informed decisions, especially when considering the potential impact on their investment horizons.

In summary, interest rates are a critical determinant of investment strategies and market trends. The interplay between interest rates and market conditions influences asset allocation, investment decisions, and overall market sentiment. Investors must stay informed about interest rate changes and their potential impact on their investment portfolios to navigate the dynamic landscape of financial markets effectively.

Encouraging Factors for New Industry Investment

You may want to see also

Frequently asked questions

Investment interest is the income or profit earned from an investment. It represents the return on an investment and can be in the form of dividends, interest, or capital gains.

Investment interest is typically calculated as a percentage of the initial investment. For example, if you invest $1000 and earn $50 in interest over a year, the interest rate would be 5% (50/1000).

Yes, there are various types, including simple interest, compound interest, and interest on savings accounts or bonds. Simple interest is a fixed rate, while compound interest grows exponentially over time.

Investment interest is generally tax-deductible for investors, which means it can reduce your taxable income. However, there are specific rules and limitations, and you may need to provide documentation to claim these deductions.

No, not all investments generate interest. Stocks, for example, typically provide dividends, while real estate investments may offer rental income. Some investments, like mutual funds or exchange-traded funds (ETFs), may have management fees instead of interest.