Lump sum investment is a financial strategy where an individual invests a large sum of money at once, typically for long-term financial goals. This approach involves committing a significant amount upfront, often with the expectation of long-term growth and potential returns. Understanding how lump sum investment works is crucial for anyone looking to make substantial financial commitments, as it involves strategic planning and a long-term perspective. This method can be particularly effective for those with a substantial amount to invest, offering the potential for significant returns over time.

What You'll Learn

- Understanding Lump Sums: Initial investment in full, immediate impact on portfolio

- Tax Implications: Tax benefits or penalties for immediate investment

- Risk and Return: Higher risk, potential for greater returns with lump sums

- Investment Strategies: Diversification and long-term strategies for lump sum investments

- Market Timing: Timing the market for optimal investment results

Understanding Lump Sums: Initial investment in full, immediate impact on portfolio

When you invest a lump sum, you're putting in a significant amount of money all at once, which can have a powerful impact on your investment portfolio. This approach is in contrast to investing regularly over time, often referred to as dollar-cost averaging. With a lump sum investment, you're essentially buying a portion of the investment immediately, which can lead to several key outcomes.

One of the most notable advantages is the immediate diversification of your portfolio. By investing a large sum upfront, you can quickly spread your money across various assets, such as stocks, bonds, or real estate. This diversification is crucial as it helps reduce the risk associated with individual investments. For instance, if you invest in a single stock and it underperforms, a lump sum investment would have already allocated your funds to other assets, minimizing the potential loss.

The timing of your investment also plays a significant role. When you invest a lump sum, you benefit from the power of compounding. This means that your money earns interest or returns, and these earnings, in turn, generate even more returns over time. This effect can significantly boost your portfolio's performance, especially in the long term. For example, if you invest $10,000 in a high-yielding fund, and it earns 10% interest in the first year, you'll have $11,000 at the end of that year. This process repeats, and your initial investment grows exponentially.

Additionally, lump sum investments can be particularly advantageous when the market is at a low point. If you time your investment right, you can purchase assets at a lower price, potentially increasing your returns when the market recovers. This strategy requires careful research and timing, but it can be a powerful way to build wealth over time.

In summary, investing a lump sum offers an immediate and substantial impact on your portfolio. It allows for diversification, leverages the power of compounding, and can be strategically timed to take advantage of market opportunities. Understanding these aspects can help investors make informed decisions about their investment strategies and potentially maximize their returns.

Will" de Inversión: Una Guía para Principiantes en Españo

You may want to see also

Tax Implications: Tax benefits or penalties for immediate investment

When considering a lump sum investment, understanding the tax implications is crucial as it can significantly impact your financial gains. One of the primary advantages is the potential for immediate tax benefits. When you invest a lump sum, you may be able to claim the full amount as a deduction in the year of investment, which can reduce your taxable income. This is particularly beneficial if you are in a higher tax bracket, as it can result in a substantial tax savings. For example, if you invest $10,000 and are in the 30% tax bracket, you could save $3,000 in taxes that year. This strategy is often used by individuals who want to maximize their tax benefits in the short term.

However, the tax treatment of lump sum investments can vary depending on the type of investment and your jurisdiction. In some cases, immediate deductions may not be allowed, and you might need to capitalize the investment and recover it over time. This means you would add the investment to the basis of the asset and recover it through depreciation or amortization, which could result in tax payments over multiple years. This approach is common for certain business investments or long-term assets.

Another important consideration is the potential for tax penalties if certain conditions are not met. For instance, if you invest a lump sum in a retirement account and withdraw the funds before reaching the required age, you may face significant penalties. Early withdrawals from retirement accounts are often taxed at a higher rate and may result in a 10% penalty on top of the regular income tax owed. This penalty is designed to discourage premature withdrawals and encourage long-term savings.

Additionally, the timing of your investment can impact tax treatment. If you invest a lump sum just before the end of the tax year, you may be able to claim the investment as a deduction for that year, even if the investment doesn't generate any immediate returns. This strategy can be useful for individuals who want to maximize their tax benefits in a specific year. However, it's essential to carefully plan and consult with a tax professional to ensure compliance with all relevant tax laws and regulations.

In summary, lump sum investments offer potential tax advantages, such as immediate deductions, but they also come with considerations like varying tax treatments, potential penalties for early withdrawals, and the need for careful timing. Understanding these tax implications is vital for making informed investment decisions and optimizing your financial strategy. It is always advisable to seek professional advice to navigate the complex world of tax laws and ensure your investments are structured in the most tax-efficient manner.

Airline Stocks: Time to Fly?

You may want to see also

Risk and Return: Higher risk, potential for greater returns with lump sums

When considering lump sum investments, it's important to understand the relationship between risk and potential returns. A lump sum investment involves committing a significant amount of money upfront, often for a long-term investment strategy. This approach can be associated with higher risk, but it also opens up the possibility of achieving greater returns over time.

The concept of risk and return is fundamental in investing. Higher-risk investments typically offer the potential for higher returns, but they also come with a greater degree of uncertainty. In the context of lump sum investments, this means that you are putting your entire sum into a single investment vehicle or a diversified portfolio. This decision can lead to increased volatility in the short term, as market fluctuations can impact the value of your investment immediately. For example, if you invest a lump sum in the stock market, a sudden market downturn could result in a temporary decrease in the value of your investment.

However, the long-term nature of lump sum investments often allows investors to weather these short-term fluctuations. As time passes, the power of compounding can work in your favor. Compounding is the process where the returns on your investment are reinvested, generating additional returns over time. This effect can significantly boost the overall growth of your investment, especially in volatile markets. For instance, if you invest $10,000 in a high-risk, high-reward stock and it experiences a 10% annual return, your investment could grow to over $25,000 in just five years due to compounding.

Additionally, lump sum investments often benefit from the 'average cost' effect. When you invest a large sum at once, you purchase a larger number of shares or units, which can result in a lower average cost per unit. This is particularly advantageous in volatile markets, as it can provide a buffer against short-term price drops. Over time, as the market recovers, your lower average cost position can lead to more favorable returns.

In summary, lump sum investments carry higher risk due to their immediate exposure to market volatility. However, this approach can also lead to substantial rewards. By understanding the potential for higher returns and managing the associated risks, investors can make informed decisions about lump sum investments, potentially benefiting from the long-term growth and compounding effects. It is essential to carefully consider your risk tolerance and investment goals before committing a lump sum to any investment strategy.

Where to Invest Your Money

You may want to see also

Investment Strategies: Diversification and long-term strategies for lump sum investments

When you invest a lump sum, whether it's a one-time windfall or a significant savings goal, the key to success often lies in a well-thought-out strategy. Diversification is a cornerstone of this strategy, as it involves spreading your investment across various asset classes to minimize risk. For instance, you might allocate a portion of your lump sum to stocks, bonds, real estate, and even alternative investments like commodities or cryptocurrencies. Each asset class has its own risk and return profile, and by diversifying, you reduce the impact of any single investment's performance on your overall portfolio. This approach ensures that your lump sum investment is not overly exposed to any one market or sector, providing a more stable and potentially more profitable outcome.

Long-term investment strategies are particularly effective with lump sums. This approach involves a buy-and-hold strategy, where you invest your lump sum and then sit on it for an extended period, allowing your investments to grow and compound over time. The power of compounding interest is a significant advantage here, as your earnings earn interest, and that interest, in turn, generates more earnings. This strategy is often associated with investing in index funds or exchange-traded funds (ETFs) that track a specific market or sector, as these can provide broad exposure and diversification without the need for active stock picking.

One of the critical aspects of long-term investing is to remain disciplined and avoid the temptation to make frequent changes based on short-term market fluctuations. Market volatility is inevitable, but over the long term, markets tend to trend upwards, and a well-diversified portfolio can weather these storms. It's also essential to regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals. Rebalancing involves buying or selling assets to maintain your desired asset allocation, which is crucial for managing risk and staying on track with your investment strategy.

Additionally, consider the power of tax-efficient investing. In many jurisdictions, long-term capital gains are taxed at a lower rate than ordinary income. By holding your investments for the long term, you can potentially benefit from these lower tax rates. Furthermore, tax-efficient strategies like tax-loss harvesting can be employed, where you sell investments that have decreased in value to offset capital gains and reduce your taxable income.

Lastly, it's important to remember that lump sum investments are a significant financial commitment, and the strategy you choose should align with your financial goals and risk tolerance. Consulting a financial advisor can provide valuable insights and guidance tailored to your specific circumstances, ensuring that your lump sum investment is managed effectively and in line with your desired outcomes.

Bitcoin's Promise: Have the Rewards Outweighed the Risks?

You may want to see also

Market Timing: Timing the market for optimal investment results

Market timing is a strategy that involves attempting to predict the best time to buy or sell an investment, aiming to maximize returns and minimize potential losses. It is a complex and challenging task, as financial markets are influenced by numerous factors, and past performance is not always indicative of future results. However, successful market timing can significantly impact investment outcomes.

The core idea behind market timing is to enter the market when conditions are favorable, anticipating an upward trend, and exit before a potential downturn. This strategy requires a deep understanding of market trends, economic indicators, and various technical and fundamental analysis tools. Investors often use historical data, market indicators, and expert opinions to make these predictions. For example, an investor might analyze stock price charts to identify patterns, use moving averages to determine entry and exit points, or study economic cycles to time investments in real estate or commodities.

One of the challenges of market timing is the inherent unpredictability of financial markets. While some investors may successfully time the market, others may find it difficult to consistently make accurate predictions. Market movements can be influenced by unexpected events, global crises, or shifts in investor sentiment, making it hard to consistently identify the optimal buying or selling points. Additionally, market timing strategies often require a high level of expertise and dedication, as they involve constant monitoring and quick decision-making.

To implement market timing effectively, investors should consider a combination of approaches. This may include a thorough analysis of market trends, studying historical data, and employing technical and fundamental analysis techniques. It is also crucial to have a well-defined investment strategy and risk management plan. Diversification is another essential aspect, as it helps reduce the impact of potential market downturns and provides a more stable investment portfolio.

In summary, market timing is a sophisticated investment strategy that aims to capitalize on market trends and economic conditions. While it can be a powerful tool for optimizing investment returns, it requires careful analysis, expertise, and a well-thought-out plan. Investors should be prepared for the challenges and uncertainties inherent in market timing and consider it as part of a broader investment strategy that may also include lump-sum investments and long-term holding periods.

Will Quinn's Investment Cabins: A Cozy Bet on Comfort and Returns

You may want to see also

Frequently asked questions

A lump sum investment refers to a single, large amount of money invested in a financial asset or a financial product. This is typically done with a one-time payment rather than through regular, periodic contributions. For example, if an individual decides to invest a substantial sum of money, like $10,000, in a mutual fund, this would be considered a lump sum investment.

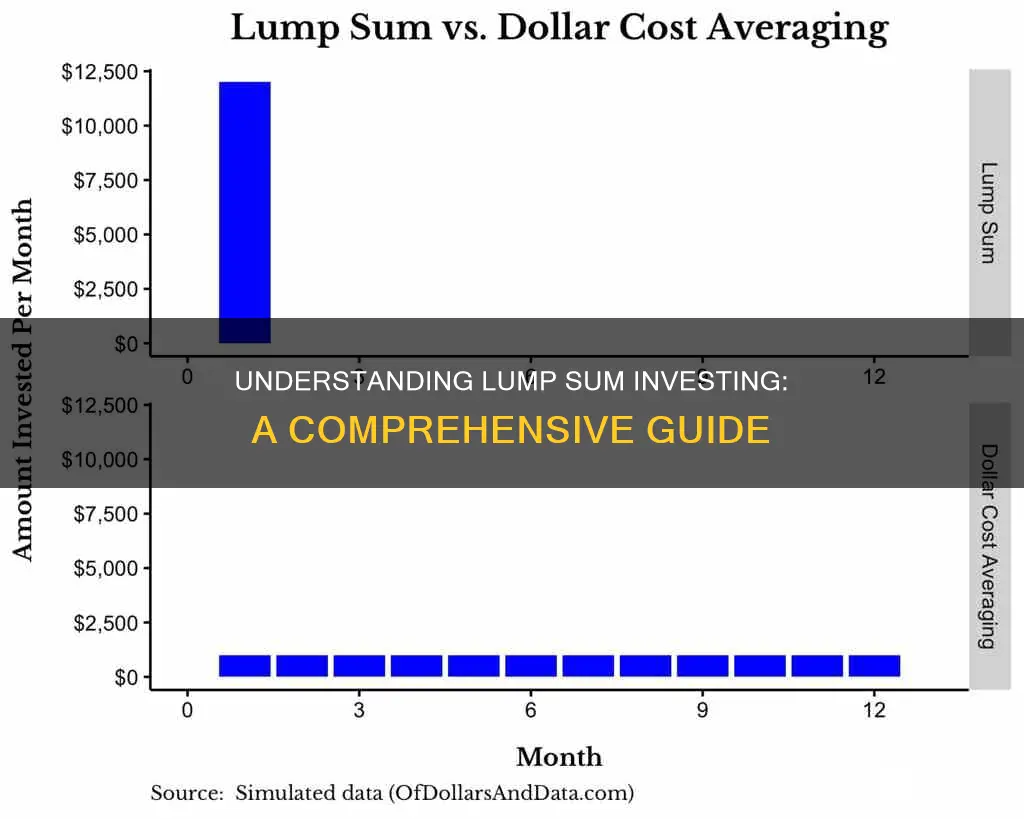

The key difference lies in the timing and frequency of investments. In a regular investment plan, investors make smaller, consistent contributions over time, such as monthly or quarterly. This approach is often referred to as dollar-cost averaging. With a lump sum investment, the entire amount is invested at once, and the timing is usually a one-time decision. This strategy can be more suitable for those who have a large sum of money to invest and want to maximize potential returns.

One of the primary benefits is the potential for higher returns due to the power of compounding. When a lump sum is invested, it can start earning returns immediately, and the accumulated gains can be reinvested, leading to exponential growth over time. Additionally, lump sum investments can be advantageous when the market is at a low point, as the value of the investment can increase as the market recovers. This strategy also simplifies investment planning, as there is no need to worry about regular contributions.