M1 Auto Invest is a feature offered by M1 Finance, a digital investment platform, that allows users to automate their investment strategy. It works by automatically investing a set amount of money into a chosen portfolio of stocks, bonds, and ETFs based on the user's risk tolerance and financial goals. This automated approach helps individuals build a diversified investment portfolio without the need for manual selection and rebalancing, making it an attractive option for those who prefer a hands-off approach to investing.

| Characteristics | Values |

|---|---|

| Investment Strategy | Automated, algorithm-driven, and diversified investment approach |

| Investment Vehicles | Stocks, bonds, ETFs, and other assets |

| Risk Management | Built-in risk management tools, including stop-loss orders and portfolio rebalancing |

| Portfolio Allocation | Dynamic allocation based on market conditions and user preferences |

| Tax Efficiency | Tax-efficient strategies to minimize capital gains and maximize returns |

| User Control | Customizable investment goals, risk tolerance, and contribution amounts |

| Market Analysis | Access to market research and insights to inform investment decisions |

| Performance Tracking | Real-time performance tracking and portfolio analysis |

| Fees | Low management fees and transaction costs |

| Accessibility | Available on web and mobile platforms, with easy account setup |

| Customer Support | 24/7 customer support and educational resources |

What You'll Learn

- Investment Strategy: M1 Auto Invest uses algorithms to automatically invest in a diversified portfolio

- Risk Management: It employs risk assessment tools to adjust investments based on market conditions

- Portfolio Rebalancing: Regularly rebalances the portfolio to maintain desired asset allocation

- Market Analysis: Utilizes market data and trends to inform investment decisions

- User Customization: Allows users to set investment goals and preferences for personalized auto-investing

Investment Strategy: M1 Auto Invest uses algorithms to automatically invest in a diversified portfolio

M1 Auto Invest is a feature offered by the M1 Finance platform that revolutionizes the way individuals approach investing. It utilizes sophisticated algorithms to automate the process of building and managing a diversified investment portfolio, making it an attractive option for those seeking a hands-off approach to investing. This strategy is designed to simplify the complex world of investing, allowing users to benefit from a well-rounded and balanced portfolio without the need for extensive financial knowledge.

The core principle behind M1 Auto Invest is the creation of a diversified portfolio tailored to the user's risk tolerance and financial goals. By employing algorithms, M1 Finance automatically allocates assets across various investment options, ensuring a balanced mix. This algorithm-driven approach considers factors such as market trends, historical performance, and risk assessments to make informed decisions on asset allocation. The system continuously monitors and adjusts the portfolio, aiming to optimize returns while managing risk.

When users activate M1 Auto Invest, they are essentially entrusting their investment journey to the platform's algorithms. The system begins by assessing the user's risk profile, which can be customized to their comfort level with risk. This customization ensures that the portfolio is aligned with the user's financial objectives. Once the risk tolerance is determined, the algorithm constructs a diversified portfolio, typically consisting of a mix of stocks, bonds, and other assets. This diversification is a key strategy to mitigate risks and provide a more stable investment experience.

Over time, the algorithms adapt and refine the portfolio based on market conditions and performance. They regularly rebalance the holdings to maintain the desired asset allocation. For instance, if the stock market experiences a significant surge, the algorithm may adjust the portfolio by selling a portion of the stocks and buying other assets to restore the original balance. This dynamic approach ensures that the investment strategy remains relevant and responsive to market changes.

M1 Auto Invest's algorithm-driven strategy offers several advantages. Firstly, it eliminates the need for manual research and decision-making, saving users time and effort. Secondly, the automated nature of the platform reduces the potential for emotional decision-making, which can often lead to suboptimal investment choices. Lastly, the diversification aspect provides a safety net, as a well-diversified portfolio is generally more resilient to market volatility. This investment strategy is particularly appealing to beginners or those with busy schedules, as it simplifies the investment process without compromising on the potential for growth.

Franklin Templeton-Putnam Deal: A Merger of Investment Giants

You may want to see also

Risk Management: It employs risk assessment tools to adjust investments based on market conditions

M1 Auto Invest is a feature within the M1 Finance platform that utilizes sophisticated risk management techniques to optimize investment portfolios. This tool is designed to automatically rebalance and adjust investments based on market dynamics, ensuring that users' portfolios remain aligned with their risk tolerance and financial goals. Here's a detailed explanation of how it works:

Risk Assessment and Adjustment: At the core of M1 Auto Invest is a robust risk assessment framework. This framework employs various tools and models to analyze market conditions and assess the potential risks associated with different investments. The platform considers multiple factors, including historical market data, volatility, and economic indicators, to make informed decisions. When market conditions change, the risk assessment tools come into play. For instance, if the market experiences a sudden downturn, the algorithm can identify this shift and promptly adjust the investment strategy.

The risk management process involves a dynamic approach to portfolio optimization. M1 Auto Invest continuously monitors the market and makes adjustments to the investment allocation. If a particular asset class becomes overvalued, the system may reduce its position to minimize potential losses. Conversely, when an undervalued asset presents an opportunity, the tool can increase its allocation to capitalize on the potential upside. This automated adjustment ensures that the portfolio remains well-diversified and aligned with the user's risk preferences.

Automated Rebalancing: One of the key benefits of M1 Auto Invest is its ability to automatically rebalance the portfolio. Rebalancing is a critical aspect of risk management as it helps maintain the desired asset allocation. Over time, market movements can cause a portfolio to deviate from the intended risk-reward profile. M1 Finance's algorithm regularly reviews the portfolio and makes necessary adjustments to bring it back to the target allocation. This process ensures that users' investments are not overly exposed to any single asset or sector, thus reducing overall risk.

User Control and Customization: Despite the automated nature of M1 Auto Invest, users retain control over their investment strategy. They can set their risk tolerance levels, which serve as guidelines for the platform's decision-making process. Users can choose from various risk profiles, such as conservative, moderate, or aggressive, which influence the initial asset allocation. Additionally, users can customize their investment goals, such as retirement planning or savings for a specific purchase, allowing the platform to tailor the risk management approach accordingly.

By employing risk assessment tools and making data-driven adjustments, M1 Auto Invest provides a dynamic and adaptive investment strategy. This feature empowers users to benefit from market opportunities while effectively managing risk, making it an attractive option for those seeking a hands-off approach to portfolio management.

Early Education: Worth the Investment?

You may want to see also

Portfolio Rebalancing: Regularly rebalances the portfolio to maintain desired asset allocation

M1 Auto Invest is a feature that allows users to automate their investment strategy by regularly rebalancing their portfolio to match a desired asset allocation. This process is crucial for investors who want to ensure their investments stay aligned with their risk tolerance and financial goals. Here's a detailed explanation of how Portfolio Rebalancing works within the M1 Auto Invest framework:

When you set up an M1 Auto Invest strategy, you define a target asset allocation, which could be, for example, 60% stocks and 40% bonds. This allocation represents your desired risk and return profile. The system then automatically buys and sells assets to bring your portfolio back to this target allocation whenever there is a deviation. For instance, if your stock allocation increases due to market fluctuations, the algorithm will sell some stocks and buy bonds to restore the original 60/40 ratio. This regular rebalancing is essential for long-term investors as it helps manage risk and ensures that the portfolio remains diversified.

The rebalancing process is triggered by market movements and the time intervals you set. You can choose how often the rebalancing occurs, such as weekly, bi-weekly, or monthly. This frequency is critical as it determines how quickly the portfolio adjusts to market changes. More frequent rebalancing can help minimize the impact of market volatility, but it may also increase transaction costs. Therefore, investors need to find a balance that aligns with their risk appetite and investment strategy.

M1's algorithm is designed to make these adjustments seamlessly, ensuring that your portfolio remains optimized according to your specifications. It continuously monitors the market and your portfolio, making buy and sell decisions to maintain the desired asset allocation. This automated approach removes the emotional aspect of investing, as human decisions are often influenced by short-term market fluctuations. By sticking to a predefined strategy, M1 Auto Invest helps investors stay committed to their long-term financial plans.

In summary, Portfolio Rebalancing is a powerful tool within M1 Auto Invest that enables investors to actively manage their risk exposure. By regularly adjusting the asset allocation, investors can ensure their portfolios are aligned with their goals and risk tolerance. This feature is particularly useful for those who want a hands-off approach to investing, allowing them to focus on other financial aspects while still benefiting from a well-diversified portfolio.

Paying it Forward: Honoring Those Who Invest in Us

You may want to see also

Market Analysis: Utilizes market data and trends to inform investment decisions

Market analysis is a critical component of M1 Auto Invest's strategy, as it leverages market data and trends to make informed investment decisions. This process involves a comprehensive examination of various financial markets, including stocks, bonds, commodities, and currencies, to identify patterns, opportunities, and potential risks. By analyzing market data, M1 Auto Invest can gain valuable insights into market dynamics, allowing it to make strategic choices that align with its investment objectives.

The market analysis process begins with data collection from multiple sources, ensuring a diverse and comprehensive dataset. This includes historical price data, trading volumes, economic indicators, and news sentiment. M1 Auto Invest employs advanced data analytics techniques to process and interpret this information, identifying key trends and patterns. For instance, it might analyze historical stock prices to determine if a particular asset is undervalued or overvalued, providing a basis for potential investment opportunities.

One of the key benefits of market analysis is the ability to identify market trends and cycles. By studying historical data and market behavior, M1 Auto Invest can predict short-term and long-term market movements. This is particularly useful for timing investments, as it allows the platform to make strategic decisions based on anticipated market shifts. For example, if market analysis indicates an impending economic downturn, M1 Auto Invest can adjust its investment strategy to minimize potential losses and protect capital.

Additionally, market analysis helps M1 Auto Invest assess the impact of global events and news on specific markets. Geopolitical tensions, natural disasters, or changes in government policies can significantly influence market behavior. By staying informed about these events and their potential consequences, M1 Auto Invest can make timely adjustments to its investment portfolio, ensuring that it remains aligned with the overall market direction.

The platform's market analysis capabilities also extend to risk management. By analyzing market data, M1 Auto Invest can identify potential risks associated with specific investments or asset classes. This includes assessing credit risk, liquidity risk, and market volatility. Through this analysis, M1 Auto Invest can implement appropriate risk mitigation strategies, such as diversification or hedging, to protect its investors' capital.

Equitable Investment: Unlocking Business Growth Through Shared Ownership

You may want to see also

User Customization: Allows users to set investment goals and preferences for personalized auto-investing

M1 Auto Invest is a powerful feature that allows users to customize their investment journey and align it with their unique financial goals and risk tolerance. This level of user customization is a key differentiator, as it empowers individuals to take control of their financial future. Here's how it works:

When you sign up for M1, you'll be guided through a comprehensive process to understand your investment objectives. This involves setting clear goals, such as saving for a house, retirement, or a child's education. Users can also specify their preferred time horizon for these goals, whether it's short-term, medium-term, or long-term. By defining these parameters, M1 can tailor its investment strategies accordingly. For instance, a user aiming to buy a house in the next two years might prefer a more conservative approach, while someone planning for retirement in 20 years could opt for a more aggressive strategy.

The platform then delves into your risk tolerance, which is a crucial aspect of personalized investing. Users can choose from a range of options, indicating their comfort level with risk. This could range from very conservative, where the focus is on capital preservation, to very aggressive, where the goal is to maximize returns despite potential volatility. This step ensures that the auto-investing feature adapts to individual risk preferences, providing a customized experience.

One of the standout features is the ability to set specific investment preferences. Users can choose the types of assets they want to invest in, such as stocks, bonds, or ETFs, and even select particular sectors or industries they are interested in. For example, an investor passionate about technology might allocate a significant portion of their portfolio to tech-focused ETFs. This level of customization ensures that the auto-investing strategy aligns with the user's interests and knowledge, making the investment process more engaging and informed.

Additionally, M1 offers the flexibility to adjust these preferences over time. As users' financial situations and goals evolve, they can easily modify their investment strategy. This adaptability is essential for long-term financial success, as it allows investors to stay on track and make adjustments as their circumstances change. With M1 Auto Invest, users can feel confident that their investments are working towards their specific goals, providing a sense of control and peace of mind.

Planning for the Golden Years: Navigating the World of Retirement Investing

You may want to see also

Frequently asked questions

M1 Auto Invest is an automated investment platform that allows users to invest in a diversified portfolio of stocks, bonds, and ETFs with minimal effort. It is designed to help individuals build wealth over time by providing a simple and efficient way to invest.

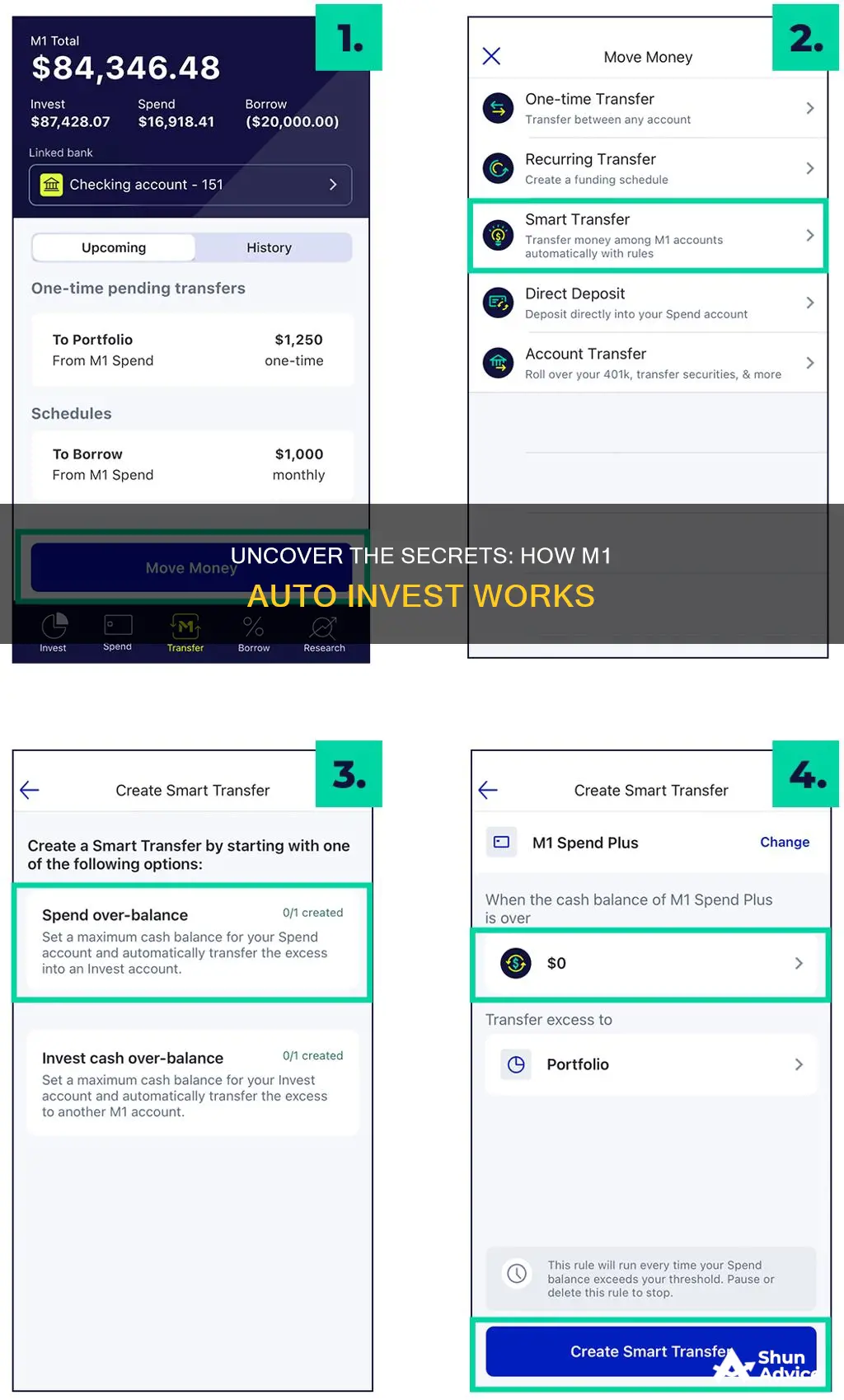

M1 Auto Invest utilizes a strategy called "Dollar-Cost Averaging" where users can set up recurring investments at regular intervals. The platform automatically invests a specified amount of money into the chosen assets based on the user's preferences and risk tolerance. This approach helps to reduce the impact of market volatility and provides a consistent investment strategy.

This service offers several advantages, including simplicity and convenience. Users can start investing with a small amount of money and gradually build their portfolio. The platform also provides educational resources and insights to help investors understand their investments. Additionally, M1 Auto Invest offers a low-cost structure, making it an affordable option for long-term investors.

Absolutely! M1 Auto Invest provides a customizable experience. Users can choose their preferred assets, set investment amounts, and adjust the investment schedule according to their financial goals. The platform also offers the ability to rebalance the portfolio periodically to maintain the desired asset allocation.