Foreign direct investment (FDI) is a substantial, long-lasting investment made by a company or government into a foreign concern. FDI is a key element in international economic integration because it creates stable and long-lasting links between economies. FDI can be made in a variety of ways, including opening a subsidiary or associate company in a foreign country, acquiring a controlling interest in an existing foreign company, or through a merger or joint venture with a foreign company.

FDI decisions are strategic decisions that have a long-term impact on the company making the investment. Managers play a crucial role in FDI decisions, and their choices can be influenced by a range of factors, including risk perception, intuition, systematic search for information, individual characteristics, and external environmental factors.

The nature of the FDI decision can influence the decision-making method, and managers may rely on either intuition or a systematic search for information. Additionally, internal firm characteristics, such as size, routines, and structure, can impact the decision-making process. External factors, such as the uncertainty of the environment, political instability, and competition, also play a crucial role in FDI decisions.

Understanding how management handles FDI decisions involves exploring the interplay between individual motivations, cognitive capabilities, emotions, and the influence of the broader team dynamics.

| Characteristics | Values |

|---|---|

| Nature of the FDI decision | Systematic search of information, intuition |

| Manager's individual and demographic characteristics | Age, experience, education, emotional stability, cognitive capabilities, motivation |

| Internal firm characteristics | Size, routines, structure |

| External corporate environment | Political, cultural, economic, legislative considerations |

| Team factors | Trust, consensus, shared orientation |

What You'll Learn

Risk and uncertainty

The Impact of Uncertainty on FDI Decisions

Uncertainty refers to the difficulty in predicting environmental and organisational conditions, and it significantly influences strategic decisions, including FDI choices. In the context of FDI, uncertainty can arise from cultural differences, political and economic considerations, and the complex dynamics of the host country's business environment. This uncertainty can impact a manager's risk perception and decision-making process, affecting areas such as investment location, entry mode, timing, and speed of international investment.

Managerial Intentionality and Risk

Managerial Intentionality (MI) is a critical concept in understanding how managers navigate risk and uncertainty in FDI decisions. MI is based on three mental states: desire, belief, and intention. The interaction of these elements shapes a manager's actions. Belief, or Managerial Cognitive Capability, involves the ability to acquire and process information, sense opportunities, solve problems, and adapt to changing conditions. Emotions and affects, such as patriotism, can also influence FDI decisions by impacting a manager's preference for domestic investments over international ventures.

Firm Characteristics and Risk

Internal firm characteristics, such as size, routines, and structure, can influence the impact of managerial intentionality on FDI decisions. Smaller firms with less structured routines may provide managers with greater discretion, allowing them to exert more influence over FDI choices. Additionally, the level of risk a firm is willing to take may depend on its tolerance for uncertainty and its ability to manage dynamic environments.

External Environment and Risk

The external corporate environment also plays a crucial role in shaping FDI decisions. Political instability, regulatory frameworks, economic conditions, and industry characteristics are some of the external factors that managers consider when making FDI choices. For instance, countries with favourable regulatory environments, well-developed infrastructure, and stable political and economic conditions tend to attract more FDI.

Risk and Performance

While risk and uncertainty are inherent in FDI decisions, it is important to recognise that risk does not always lead to poor outcomes. In dynamic and uncertain environments, heuristics and intuition can enable effective decision-making. However, a systematic and rational approach does not guarantee success. Therefore, managers must strike a balance between intuitive and deliberate decision-making processes, adapting their approach to the specific context and nature of the FDI decision.

How Management's Investment Impacts Team Success

You may want to see also

Business group affiliation

One study found that small firms with business group affiliation are more likely to enter host countries with high political instability than large firms with such affiliation. This suggests that business group affiliation can provide risk mitigation and support for smaller firms venturing into riskier markets.

Additionally, business group affiliation can influence a company's risk preferences and location choices for FDI. Firms with business group affiliation may have different risk thresholds and location preferences compared to firms without such affiliation. The support and resources provided by a business group can enable firms to make riskier choices or enter more unstable markets.

Furthermore, business group affiliation can enhance a company's negotiating power and influence in foreign markets. Companies within a business group may have stronger bargaining power when dealing with foreign governments, suppliers, or local partners. This can impact their ability to secure favourable contracts, navigate regulatory environments, and access resources.

In summary, business group affiliation plays a significant role in a company's FDI decisions by providing resources, knowledge, risk mitigation, and strategic advantages. Companies can leverage their business group affiliation to expand into new markets, enhance their negotiating power, and access valuable knowledge and relationships. However, the specific impact of business group affiliation on FDI decisions can vary depending on the size of the company, the nature of the business group, and the dynamics within the group.

ETFs: Managed Investments or Not?

You may want to see also

Political instability

On the other hand, some studies suggest that political instability can have a positive impact on FDI. The "helping hand" theory argues that political instability, especially when associated with corruption, can facilitate FDI. Corruption may allow businesses to bypass legal protocols, reduce bureaucratic hurdles, and navigate complicated procedures more easily.

Overall, political instability is a crucial factor for management to consider when making FDI decisions. It can significantly impact a country's ability to attract FDI and influence investors' perceptions of risk and stability in the host country.

To mitigate the risks associated with political instability, management can consider the following strategies:

- Diversification: Diversifying investments across multiple countries can help reduce the impact of political instability in a particular region.

- Political Risk Insurance: Management can purchase political risk insurance to protect their investments against political events such as political violence, currency inconvertibility, and expropriation.

- Due Diligence: Conducting thorough due diligence can help identify potential political risks and develop strategies to mitigate them.

- Country Selection: Management should carefully evaluate the political stability of potential host countries and select those with strong political institutions and a track record of stability.

- Government Relations: Building strong relationships with host governments and understanding their policies can help navigate political risks and create a more stable investment environment.

Global Investment Portfolio: Understanding Your Worldwide Assets

You may want to see also

Competition

For example, in 1996, General Motors announced a $500 million car plant investment in Asia, leading to a fierce competition between Thailand and the Philippines. Thailand ultimately won by matching the Philippines' tax incentives and providing additional benefits, including a 100% tax refund on raw materials for car exports and a $15 million grant for a training institute.

Another example is Canon Inc.'s 2001 decision to establish a large production facility in East Asia, which resulted in a competition between Vietnam and the Philippines. Vietnam won by offering a 10-year tax holiday, demonstrating the impact of tax incentives in attracting FDI.

The Czech Republic is another illustrative case. Initially reluctant to offer tax breaks, the country changed its policy after losing out on FDI to neighbouring countries like Hungary and Poland. This shift highlights how competition can drive countries to enhance their physical and legal infrastructure and implement stable macroeconomic policies to attract investors.

While competition for FDI can have positive effects, there are concerns about potential negative consequences. "Bidding wars" may strain public finances and distort investment allocation. Additionally, foreign entry may lead to profit shifting away from local firms and even their bankruptcy, impacting the local goods market. Therefore, governments must carefully weigh the benefits and drawbacks of attracting FDI through competitive incentives.

Strategies to Optimize Your Investment Portfolio for Maximum Returns

You may want to see also

Management decision-making models

- Individual Motivations: Agency Theory suggests that managers may be motivated by personal gain rather than solely focusing on shareholders' interests. This can lead to decisions that maximise sales or smooth income rather than profits.

- Cognitive Capabilities: This includes the ability to sense and seize opportunities, solve problems, and reconfigure strategies. Managers with superior cognitive capabilities can better perceive and interpret relevant data, make more effective decisions, and adapt to changing external conditions.

- Emotions and Affects: Emotions play a significant role in decision-making, though their effect is controversial. Positive emotions may increase the likelihood of engaging in foreign direct investment (FDI), while negative emotions like patriotism may lead managers to avoid FDI and favour domestic investments.

- Personality Traits: Emotional stability in CEOs, for example, can enhance their sensing capabilities over time, leading to better decision-making.

- Risk Preferences: Firms generally avoid risk when choosing FDI destinations, but they may take risks when facing intense competition in their home country or a lack of business group affiliation.

- Firm Size and Affiliation: Smaller firms with business group affiliation are more likely to enter politically unstable host countries than larger affiliated firms.

- Contextual Factors: External factors such as policy environment and market resources, and internal factors like corporate governance structure and resources also influence strategic decisions.

- Group Dynamics: Individual managers' judgments may change when making decisions as a group. The level of trust and consensus among group members can impact the collective decision-making process.

Vanguard Value Index Portfolio: What's Inside?

You may want to see also

Frequently asked questions

FDI refers to an investment in or the acquisition of foreign assets with the intention to control and manage them. It is a substantial, lasting investment made by a company or government into a foreign concern.

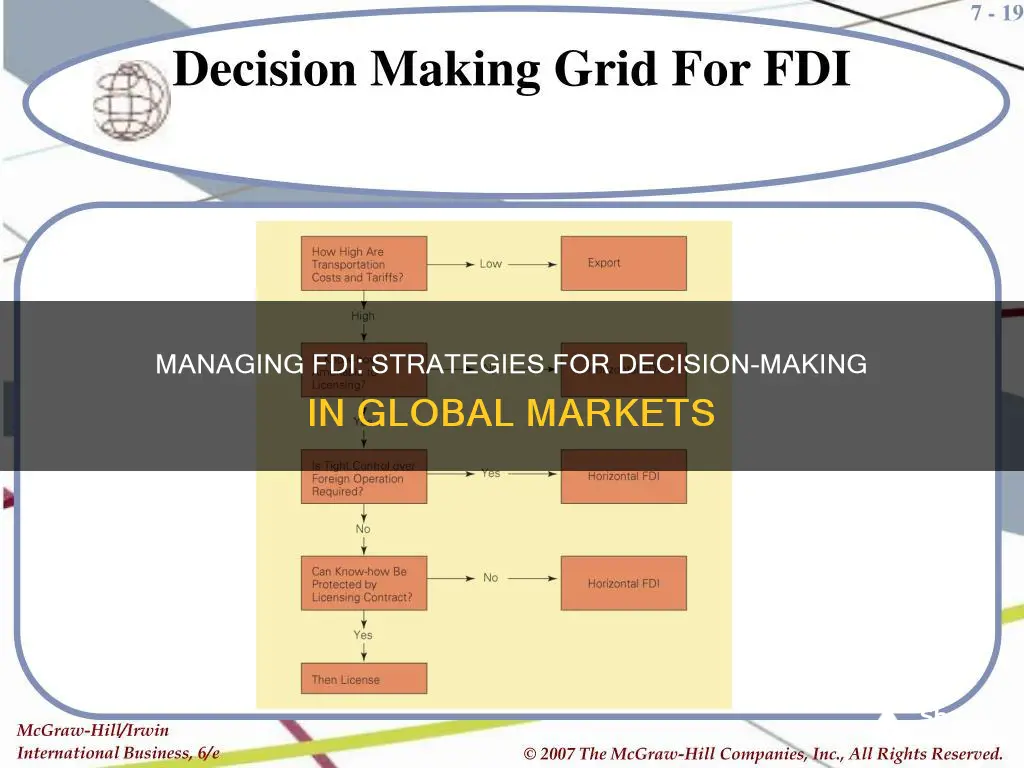

FDI can be categorised as horizontal, vertical, or conglomerate. Horizontal FDI occurs when a company duplicates its home country industry chain into the destination country to produce similar goods. Vertical FDI takes place when a company acquires a business to exploit natural resources in the host country or to acquire distribution outlets to market its products in the host country. Conglomerate FDI is a combination of horizontal and vertical FDI.

FDI decisions are influenced by a range of factors, including cost, logistics, market, natural resources, know-how, customers and competitors, policy, ease of entry and exit, culture, impact on revenue and profitability, and expatriation of funds. Additionally, managers' cognitive capabilities, emotions, personality traits, and motivation play a crucial role in FDI decisions.

Political instability can influence FDI decisions, with firms generally avoiding countries with high political instability. However, small firms with business group affiliation may be more likely to enter such countries compared to larger firms.

FDI can benefit developing countries by facilitating technology transfer, promoting competition, providing employee training and human capital development, and contributing to corporate tax revenues. Additionally, FDI has proven to be more resilient during financial crises compared to other forms of capital flows.