Team investing is a collaborative approach to financial planning and wealth management, where a group of individuals pool their resources and knowledge to make investment decisions. This method leverages the power of teamwork, allowing members to share insights, diversify portfolios, and mitigate risks. By combining individual expertise and collective wisdom, team investors can make more informed choices, potentially leading to better returns and a more balanced investment strategy. This concept is particularly appealing to those who value community, shared learning, and the potential for increased financial growth through collective effort.

What You'll Learn

- Investment Strategy: Team Invest's approach to allocating capital across various assets

- Risk Management: Techniques to mitigate potential losses and protect investments

- Portfolio Construction: Building a diversified portfolio to optimize returns and manage risk

- Market Analysis: Research and insights to identify investment opportunities and trends

- Performance Tracking: Monitoring and evaluating the success of investments over time

Investment Strategy: Team Invest's approach to allocating capital across various assets

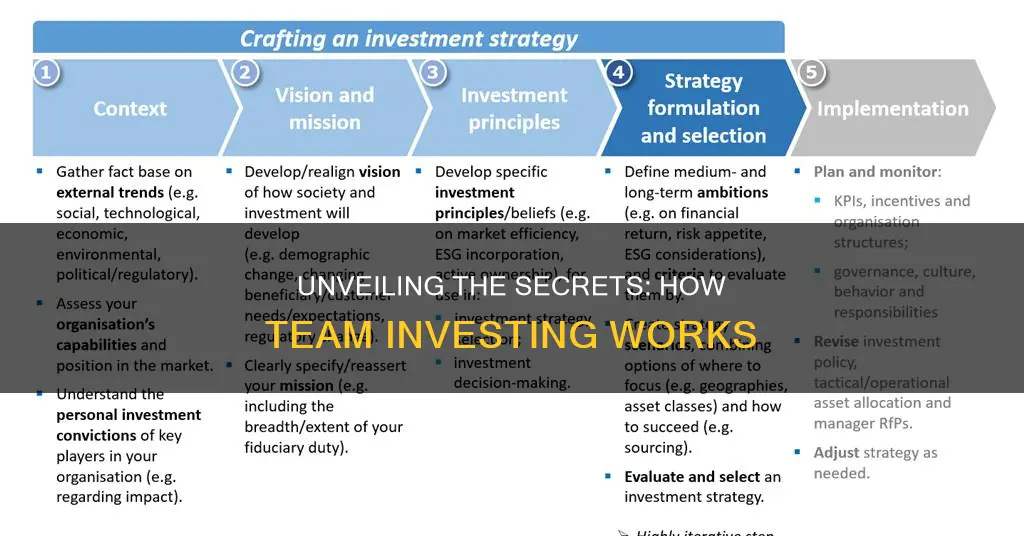

The Team Invests approach is a strategic investment methodology that emphasizes collaboration and a comprehensive understanding of the market to allocate capital effectively. This strategy involves a dedicated team of professionals who collectively analyze and decide on investment opportunities, aiming to optimize returns while managing risk. Here's an overview of their investment strategy:

Asset Allocation: Team Invests employs a disciplined approach to asset allocation, which is a critical aspect of their investment process. They believe in diversifying across various asset classes, including stocks, bonds, real estate, commodities, and alternative investments. By diversifying, the team aims to reduce risk and capture potential gains from different sectors and markets. The allocation strategy is not static but rather dynamic, adapting to market conditions and economic trends. For instance, during periods of economic growth, they might increase exposure to equity markets, while in a recession, they may shift towards more defensive assets like government bonds.

In-Depth Research and Analysis: At the heart of Team Invests' strategy is a rigorous research and analysis process. The team comprises experts in various fields, including financial analysts, economists, industry specialists, and data scientists. They employ a multi-faceted research approach, utilizing both quantitative and qualitative methods. Quantitative analysis involves statistical modeling, financial metrics, and risk assessments, while qualitative research includes industry trends, company-specific factors, and market sentiment. This comprehensive analysis helps the team identify undervalued assets, assess potential risks, and make informed investment decisions.

Collaborative Decision-Making: Collaboration is key to the Team Invests philosophy. The investment team meets regularly to discuss market trends, analyze research findings, and make collective decisions. This collaborative approach ensures that various perspectives are considered, reducing the risk of bias and promoting a more holistic view of the investment landscape. By sharing insights and ideas, the team can identify opportunities that might be overlooked by individual investors.

Risk Management and Portfolio Optimization: Risk management is an integral part of their strategy. Team Invests employs advanced risk management techniques to identify, assess, and mitigate potential risks associated with each investment. They use stress testing, scenario analysis, and value-at-risk (VaR) models to measure and control exposure. Additionally, the team regularly reviews and rebalances the portfolio to maintain the desired asset allocation and risk profile. This proactive approach ensures that the investment strategy remains aligned with the clients' goals and risk tolerance.

Long-Term Focus and Adaptive Strategy: Team Invests adopts a long-term investment horizon, believing that this approach allows for a more patient and disciplined approach to capital allocation. They focus on fundamental analysis and seek to identify companies or assets with strong growth potential and sustainable competitive advantages. The strategy is adaptable, allowing the team to quickly respond to market changes and adjust their positions accordingly. This flexibility enables them to capitalize on emerging opportunities while minimizing potential losses.

Pension Investments: Unlocking Your Retirement Savings Potential

You may want to see also

Risk Management: Techniques to mitigate potential losses and protect investments

Risk management is a critical component of any investment strategy, and it involves a systematic approach to identifying, assessing, and mitigating potential risks that could impact the value of an investment. Effective risk management is essential for investors to navigate the complexities of the financial markets and safeguard their capital. Here are some techniques to consider when it comes to risk mitigation:

- Risk Identification: The first step is to identify the various types of risks associated with an investment. This includes market risk, which refers to the potential for losses due to fluctuations in asset prices, such as stocks or bonds. Credit risk is another aspect, which involves the possibility of default by borrowers in debt instruments. Additionally, consider operational risks, such as errors or fraud within a financial institution, and liquidity risk, which is the challenge of converting assets into cash without significant loss. A comprehensive risk assessment is crucial to understanding the potential pitfalls.

- Risk Assessment and Analysis: Once risks are identified, investors should conduct a thorough analysis to understand their likelihood and potential impact. This process involves quantifying the risks by assigning probabilities and potential losses. For instance, a sensitivity analysis can be performed to gauge how different scenarios affect the investment's value. Investors can use historical data and market trends to estimate these probabilities and potential outcomes. This analytical approach helps in prioritizing risks and allocating resources effectively.

- Diversification: Diversification is a powerful risk management technique. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of any single risk factor. Diversification ensures that the portfolio is not overly exposed to any one type of risk. For example, a well-diversified portfolio might include a mix of large-cap stocks, bonds, real estate, and commodities, each with its own set of risks and potential rewards. This strategy aims to minimize the volatility of the overall investment by not concentrating capital in any one area.

- Risk Monitoring and Control: Effective risk management requires ongoing monitoring and control. Investors should establish key risk indicators and regularly review their investment positions. This includes tracking market trends, economic indicators, and news that could impact the investments. Implementing stop-loss orders or setting price targets can help limit potential losses. Additionally, regular portfolio reviews and rebalancing are essential to ensure the investment strategy remains aligned with the risk tolerance and goals of the investor.

- Risk Mitigation Strategies: There are various strategies to mitigate identified risks. For market risk, investors can employ hedging techniques, such as options or futures contracts, to protect against potential price declines. Credit risk can be managed by conducting thorough credit analysis and diversifying the debt portfolio. Operational risks might be addressed by implementing robust internal controls, fraud detection systems, and regular audits. Insurance and guarantees can also be utilized to protect against specific risks, such as property damage or liability.

By implementing these risk management techniques, investors can make more informed decisions, build resilient portfolios, and protect their capital from potential losses. It is a dynamic process that requires continuous evaluation and adjustment to changing market conditions and individual investment goals.

Investing: Why the Delay?

You may want to see also

Portfolio Construction: Building a diversified portfolio to optimize returns and manage risk

Portfolio construction is a critical process in investment management, focusing on creating a well-diversified investment portfolio that aims to optimize returns while effectively managing risk. This process involves a systematic approach to asset allocation, selection, and arrangement to achieve specific financial goals. The primary objective is to construct a portfolio that can withstand market volatility and provide stable, long-term returns.

The first step in portfolio construction is to define the investment objectives and risk tolerance of the investor. This involves assessing the investor's financial goals, time horizon, and ability to withstand market fluctuations. For instance, a retiree seeking a steady income stream over a long period might prefer a more conservative portfolio, while a young investor aiming for long-term wealth accumulation could opt for a more aggressive strategy. Understanding the investor's profile is crucial as it guides the asset allocation decisions.

Asset allocation is a fundamental strategy in portfolio construction. It involves dividing the portfolio among different asset classes such as stocks, bonds, cash, and alternative investments. The allocation should be based on the investor's risk tolerance and financial goals. A common approach is to use a 60/40 or 50/50 model, where a portion of the portfolio is allocated to stocks for potential capital appreciation, and the remaining to bonds for stability and income. However, this allocation can be customized based on individual circumstances. For instance, a young investor might allocate more to stocks, while an older investor might prefer a higher bond allocation.

Diversification is a key principle in portfolio construction. It involves spreading investments across various assets, sectors, and geographic regions to reduce risk. By diversifying, investors can minimize the impact of any single investment's poor performance on the overall portfolio. This can be achieved by investing in different types of securities, industries, and markets. For example, a portfolio might include domestic and international stocks, various sectors like technology, healthcare, and financials, and different types of bonds. The goal is to create a balanced portfolio that can weather market downturns in any specific sector or region.

Regular review and rebalancing of the portfolio are essential to maintain its desired level of risk and return. Market conditions and investor circumstances change over time, and a portfolio that was well-constructed initially might become unbalanced. Rebalancing involves buying or selling assets to restore the original asset allocation. For instance, if the stock market has outperformed bonds, the portfolio might become overly weighted towards stocks. Rebalancing would involve selling some stocks and buying bonds to return the portfolio to its target allocation. This process ensures that the portfolio remains aligned with the investor's risk tolerance and financial objectives.

Unlocking Wealth: Understanding the Power of US Investing

You may want to see also

Market Analysis: Research and insights to identify investment opportunities and trends

Market analysis is a critical component of the investment process, providing a comprehensive understanding of various markets and their potential. It involves a systematic approach to gathering and interpreting data, allowing investors to make informed decisions. The primary goal is to identify trends, assess risks, and uncover investment opportunities that can drive profitability. Here's an overview of how market analysis contributes to the investment landscape:

Data Collection and Research: Market analysis begins with extensive data collection from various sources. This includes financial statements, industry reports, economic indicators, and market research publications. Investors and analysts delve into these resources to gather historical and current market data. For instance, they might examine stock prices, sales figures, consumer behavior patterns, and industry-specific trends. The more comprehensive the data, the better the insights gained.

Identifying Investment Opportunities: Through rigorous analysis, investors can pinpoint specific sectors or industries with strong growth potential. This process involves studying market dynamics, such as supply and demand, competitive landscapes, and regulatory environments. For example, a team might identify a niche market with high demand for a particular product, coupled with a lack of competition. By analyzing historical data and market trends, they can predict future demand and assess the viability of entering that market.

Trend Analysis: Market analysis also entails identifying and understanding emerging trends. This could include technological advancements, changing consumer preferences, or shifts in global economic patterns. For instance, the rise of renewable energy sources might prompt investors to explore opportunities in the green energy sector. By staying abreast of these trends, investors can make timely decisions, ensuring their portfolios are aligned with the market's evolving nature.

Risk Assessment: A crucial aspect of market analysis is evaluating and managing risks. Investors must consider various factors such as political instability, economic downturns, industry-specific risks, and company-specific challenges. For example, a team might analyze the potential impact of a new government policy on a particular industry and assess how it could affect investment returns. This risk assessment process helps in developing strategies to mitigate potential losses.

Competitive Analysis: Understanding the competitive landscape is essential for making informed investment choices. Market analysts study the strengths and weaknesses of competitors, their market share, and their strategies. This analysis provides insights into industry dynamics and helps investors identify gaps in the market that their investments could potentially fill. By assessing the competitive environment, investors can make strategic decisions to gain a competitive edge.

In summary, market analysis is a powerful tool for investors, enabling them to navigate the complex world of finance with confidence. It involves a meticulous process of data collection, trend identification, risk assessment, and competitive analysis, all aimed at uncovering valuable investment opportunities. Effective market analysis empowers investment teams to make strategic choices, adapt to market changes, and ultimately achieve their financial goals.

Rethink's AI Appeal to Investors

You may want to see also

Performance Tracking: Monitoring and evaluating the success of investments over time

Performance tracking is a critical component of the investment process, as it allows investors to monitor the progress and success of their investments over time. This process involves a systematic approach to measuring and evaluating the performance of various investment strategies, assets, or portfolios. By implementing effective performance tracking, investors can make informed decisions, adapt their strategies, and optimize their investment outcomes.

The first step in performance tracking is to establish a comprehensive set of metrics and key performance indicators (KPIs) relevant to the investment objectives. These metrics should be tailored to the specific investment strategy and the goals it aims to achieve. For example, if the investment is focused on equity markets, metrics such as return on investment (ROI), total return, and market share gains could be defined. Alternatively, for a real estate investment, metrics might include rental income, property appreciation, and occupancy rates. The choice of KPIs should be aligned with the investment's nature and the desired outcomes.

Once the relevant metrics are identified, investors need to set a baseline for comparison. This baseline could be the initial investment value, the expected return rate, or any other predetermined reference point. Regularly recording and comparing actual performance against these benchmarks is essential. Investors should also establish a time frame for performance evaluation, which could be monthly, quarterly, or annually, depending on the investment's nature and the market dynamics.

Performance tracking involves the continuous monitoring of investment data, including market trends, financial reports, and performance reports. Investors should analyze various factors such as market volatility, economic indicators, and industry-specific data to assess the investment's performance. This analysis helps identify patterns, trends, and potential risks or opportunities. For instance, if an investment portfolio is heavily weighted in a particular sector, tracking sector-specific performance can provide insights into the overall portfolio's health.

Regular reviews and adjustments are crucial in performance tracking. Investors should schedule periodic reviews to analyze the investment's performance, identify areas of improvement, and make necessary adjustments to the investment strategy. These reviews can also help in rebalancing the portfolio to maintain the desired risk-reward profile. Additionally, investors should stay updated on market changes and adapt their strategies accordingly to ensure optimal performance.

In summary, performance tracking is an essential practice for investors to gauge the success and effectiveness of their investment decisions. It involves defining relevant metrics, setting baselines, and continuously monitoring and evaluating investment performance. By following a structured approach, investors can make data-driven decisions, adapt to market changes, and ultimately enhance their investment outcomes. Effective performance tracking empowers investors to stay on track, make timely adjustments, and achieve their financial goals.

Medicare and Investment Strategies: Exploring Pre-Payment Options

You may want to see also

Frequently asked questions

Team Invest is a collaborative investment platform that enables teams or groups of people to pool their resources and invest together. It provides a way for friends, family, or colleagues to diversify their portfolios and potentially earn higher returns by combining their investment knowledge and capital.

Team Invest allows users to create or join investment teams, where members can contribute funds and make investment decisions collectively. The platform provides a user-friendly interface to track investments, manage contributions, and communicate with team members. It offers a range of investment options, including stocks, bonds, mutual funds, and ETFs, allowing teams to build a well-rounded portfolio.

Team Invest is designed for groups of people who want to invest together. This can include friends, family members, colleagues, or even community organizations. Each team has a specific set of members who contribute to the collective investment strategy.

Some advantages of Team Invest include:

- Diversification: By pooling investments, teams can access a wider range of assets and reduce the risk associated with individual investments.

- Shared Expertise: Team members can contribute their financial knowledge and experience, leading to better investment decisions.

- Social Motivation: Investing with friends or family can create a sense of accountability and encourage long-term financial goals.

- Potential for Higher Returns: With combined resources, teams may have the opportunity to invest in more substantial opportunities.

Getting started is simple! You can sign up for an account on the Team Invest website or mobile app. Once registered, you can create a new team or join an existing one. Set up your investment preferences, contribute funds, and collaborate with your team members to make investment choices. The platform provides educational resources and tools to help you understand the investment process and make informed decisions.