The Grayscale Bitcoin Trust (GBTC) is a financial vehicle that allows investors to trade shares in trusts that hold large pools of Bitcoin. The price of each share is meant to reflect the value of Bitcoin held per share. However, GBTC shares have frequently traded at a premium or discount to the actual price of Bitcoin. The trust's shares have traded at a discount to the net asset value (NAV) for extended periods due to regulatory uncertainty. GBTC is designed to track the price of Bitcoin, but only roughly.

| Characteristics | Values |

|---|---|

| Launched | 2013 |

| Founder | Grayscale |

| Type of Fund | Private, open-ended trust |

| Available to | Individual and institutional investors |

| Minimum buy-in | $50,000 |

| Annual account fee | 2% |

| Management fee | 1.5% |

| Sponsor fee | 0.25% |

| Number of BTC held | >649,130 |

| Value of BTC held | $16 billion |

| Share price | $20.40 |

| Share value in BTC | 0.00094825 BTC |

| Share value in USD | $40 |

What You'll Learn

The Grayscale Bitcoin Trust

The trust acts as a bitcoin fund, allowing investors to speculate on bitcoin's price by buying its shares. The trust owns bitcoins on its investors' behalf, entrusting them to the cryptocurrency custody service Coinbase Custody Trust Company, LLC to keep them safe. Each share currently represents ownership of approximately 0.092 bitcoin, an amount that will slowly decrease over time as management fees are charged.

Grayscale charges a 2% annual management fee for the fund, which is relatively high compared to gold ETFs, for example. The minimum buy-in is $50,000 and each GBTC share, as of February 2021, entitled the holder to 0.00094825 BTC (approximately $40).

The main benefit of purchasing shares in the Grayscale Bitcoin Trust over buying bitcoin directly is convenience. It eliminates the need for investors to organise the safe storage and custody of the digital asset, and saves a number of associated costs. It also allows institutional investors to complete large buy orders with minimal slippage compared to centralized crypto exchanges, which often lack sufficient liquidity.

Bitcoin: Currency or Investment?

You may want to see also

The iShares Bitcoin Trust

IBIT can help investors remove operational burdens associated with holding bitcoin directly, as well as potentially high trading costs and tax reporting complexities.

Shares of the Trust are intended to reflect, at any given time, the market price of bitcoin owned by the Trust at that time less the Trust's expenses and liabilities. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the bitcoin represented by such shares.

Warren Buffett's Take on Bitcoin Investments

You may want to see also

The Bitcoin Investment Trust

The Grayscale Bitcoin Trust allows investors to gain exposure to bitcoin without the hassle and stress of buying it directly. This eliminates the need to organise the safe storage and custody of the digital asset, saving a number of associated costs. It also allows institutional investors to complete large buy orders with minimal slippage compared to centralised crypto exchanges, which often lack sufficient liquidity.

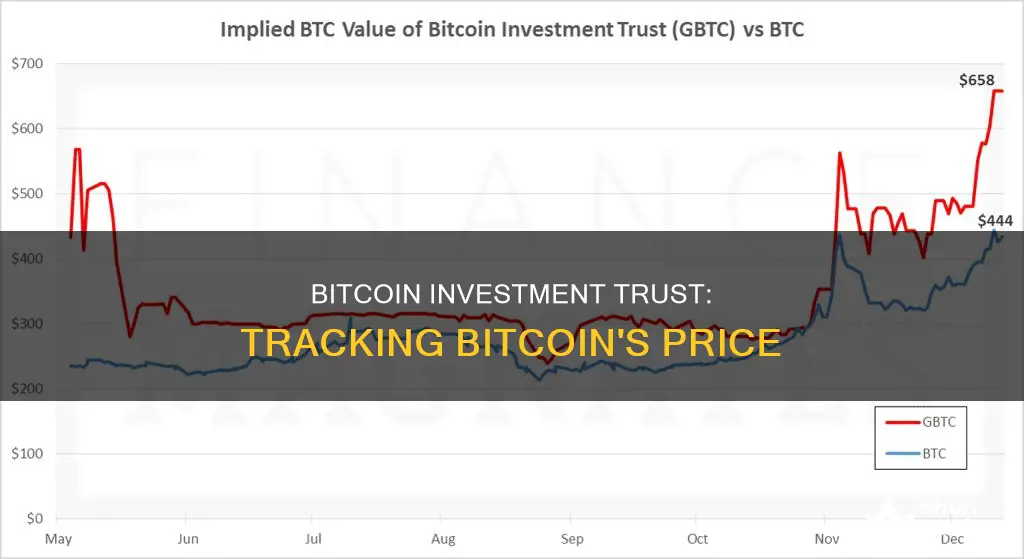

The trust was originally launched in 2013 as the Bitcoin Investment Trust (BIT) but was later renamed the Grayscale Bitcoin Trust (GBTC). It is the world's largest bitcoin fund and the first investment vehicle of its kind to report financials regularly to the U.S. Securities and Exchange Commission (SEC). The fund tracks the price of bitcoin using the XBX index published by TradeBlock. During periods of high bitcoin market volatility, GBTC shares trade at a discount or premium depending on investor demand.

The minimum buy-in is $50,000 and each GBTC share, as of February 5, 2021, entitled the holder to 0.00094825 BTC (approximately $40). The trust is solely and passively invested in BTC, enabling investors to gain exposure to BTC as a security while avoiding the challenges of buying, storing, and securing bitcoins directly. Shares are designed to track the BTC market price with fewer fees and expenses.

Bit Coin: Safe Investment or Risky Gamble?

You may want to see also

GBTC shares and their premium/discount to net asset value

The Grayscale Bitcoin Trust (GBTC) is a closed-end fund (CEF) that issues common units of fractional shares, representing ownership in the Trust. It is a crypto investing giant with a market cap of almost $14 billion.

The discount/premium to NAV (Net Asset Value) is a percentage that calculates how much an exchange-traded fund or closed-end fund is trading above or below its net asset value. This metric is important for CEFs, as they do not issue new shares after the initial offering, which can cause the price to deviate from the true net asset value.

When the market price of GBTC shares is higher than the NAV, the difference is called a "premium". This premium is dictated by supply and demand on the stock market and is a result of trading activity. A high premium indicates a bullish market sentiment, suggesting investors are willing to pay more for GBTC shares than the actual net asset value of the Bitcoin it holds. This can signal a potential downside risk, as investors may be paying a premium for exposure to Bitcoin.

Conversely, when the market price is lower than the NAV, it is referred to as a "discount". A low premium or discount indicates a bearish market sentiment, suggesting investors are hesitant to pay extra for GBTC shares compared to the net asset value of Bitcoin. This scenario indicates a potential upside risk, as investors may be getting exposure to Bitcoin at a discount.

GBTC has experienced both premium and discount periods. In January 2021, it traded at a 6% premium, but by July 2024, it had shifted to a 30% discount. This discount narrowed to about 25% in July 2024, the smallest discount since early 2022, as the possibility of the SEC approving the conversion of GBTC into an ETF grew.

The structure of the trust is crucial in understanding the discount/premium dynamics. As a CEF, GBTC lacks the arbitrage mechanism that ETFs employ to keep prices aligned with the value of their assets. ETFs can create or redeem shares to drive the price towards the value of their holdings, but CEFs like GBTC do not have this flexibility, making them more susceptible to price deviations.

The Right Time to Invest in Bitcoin?

You may want to see also

The pros and cons of the Grayscale Bitcoin Trust

The Grayscale Bitcoin Trust (GBTC) is a financial vehicle that enables investors to trade shares in trusts holding large pools of Bitcoin. Here are some pros and cons of the investment product:

Pros

- Simplified access to bitcoin: GBTC allows investors to trade shares in traditional brokerage accounts without the complexities of direct asset ownership.

- Security: Storing cryptocurrency can be challenging, and Grayscale claims its assets adhere to industry-leading security standards.

- Tax advantages: GBTC provides investors with exposure to bitcoin in a tax-friendly manner, which is particularly advantageous considering the capital gains tax implications of direct cryptocurrency investments.

- Regulatory compliance: GBTC is an SEC-reporting company, providing investors with a compliant and secure investment avenue.

Cons

- Trading premiums: GBTC shares have frequently traded at a large premium or discount to the actual value of the underlying bitcoin, known as its net asset value (NAV).

- High management fees: GBTC's annual management fee of 1.5% is considered high compared to other investment vehicles and may erode returns, especially in a bear market.

- Volatility: Critics argue that GBTC carries significant risks, including volatility.

Gold Coin Investment: Which is the Best Buy?

You may want to see also

Frequently asked questions

The Bitcoin Investment Trust (GBTC) is a bitcoin fund that allows investors to bet on the price of bitcoin by buying its shares. The trust owns bitcoins on its investors' behalf, entrusting them to a cryptocurrency custody service to keep them safe.

The price of Bitcoin Investment Trust shares is meant to reflect the value of bitcoin held per share. However, GBTC shares have frequently traded at a large premium or discount to the actual value of the underlying bitcoin, known as its net asset value (NAV).

The main benefit is convenience. The Bitcoin Investment Trust allows investors to speculate on bitcoin without having to buy it directly, eliminating the need to organise the safe storage and custody of the digital asset, and saving a number of associated costs.

Only accredited investors can invest in Bitcoin Investment Trust financial products. An accredited investor is someone who can show an annual income of at least $200,000 or a combined spousal income of $300,000 for the past 2 years with the expectation of receiving the same or more during the current year.