Rice investment is a strategic approach to financial planning, particularly in the agricultural sector. It involves investing in rice production, either directly by purchasing land and equipment or indirectly through companies that specialize in rice farming. This investment strategy can offer both short-term and long-term benefits, including stable income from rice sales, potential for price appreciation, and the opportunity to contribute to food security and rural development. Understanding the mechanics of rice investment is crucial for investors looking to diversify their portfolios and support sustainable agricultural practices.

What You'll Learn

- Investment Structure: Rice investments often involve contracts or agreements with farmers, specifying terms and payment schedules

- Market Dynamics: Understanding rice price fluctuations, supply/demand trends, and market factors influencing investment returns

- Sustainable Practices: Rice investment may promote eco-friendly farming methods, benefiting the environment and investors

- Risk Assessment: Identifying and managing risks associated with rice cultivation, such as weather impacts and crop diseases

- Supply Chain Management: Efficient supply chain logistics ensure timely delivery of rice, impacting investment success

Investment Structure: Rice investments often involve contracts or agreements with farmers, specifying terms and payment schedules

In the world of agriculture, rice investments have become an innovative approach to support farmers and provide a stable income stream for investors. This investment structure is particularly appealing as it offers a unique opportunity to contribute to the agricultural sector while also providing financial benefits. The process typically begins with a detailed agreement between the investor and the farmer, outlining the specific terms and conditions of the investment.

These contracts are crucial as they define the scope of the investment, including the quantity and quality of rice to be produced, the duration of the agreement, and the expected returns for both parties. For instance, an investor might agree to provide financial support for a specific rice crop, ensuring the farmer has the necessary resources for successful cultivation. In return, the investor receives a predetermined payment schedule, which could be a fixed amount per acre or a percentage of the total rice yield.

The payment schedule is a critical aspect of this investment structure. It ensures that farmers receive timely compensation for their efforts and provides investors with a clear understanding of their expected returns. This transparency is essential for building trust and long-term relationships between investors and farmers. For example, payments could be made at regular intervals during the growing season or upon harvest, with the terms negotiated to suit the needs of both parties.

Additionally, these agreements may include provisions for risk management. Rice investments can be susceptible to various risks, such as adverse weather conditions, pests, or market fluctuations. To mitigate these risks, the contract might include clauses that allow for adjustments in the investment terms or provide compensation in case of significant crop losses. This ensures that both investors and farmers are protected and encourages a more sustainable investment model.

By implementing this investment structure, rice investments can foster a mutually beneficial relationship between investors and farmers. It provides farmers with the necessary capital and support to enhance their agricultural practices, while investors gain a stable and potentially profitable venture. The use of detailed contracts and payment schedules further ensures that both parties are protected and informed, making it an attractive and responsible approach to agricultural investment.

The Domino Effect: How These Factors Influence Investment Decline

You may want to see also

Market Dynamics: Understanding rice price fluctuations, supply/demand trends, and market factors influencing investment returns

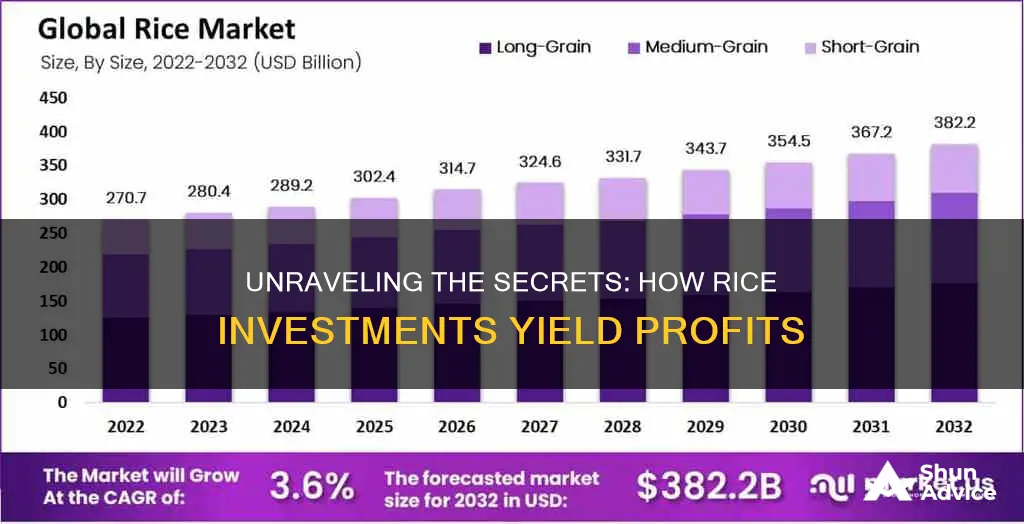

The rice market, a vital component of the global agricultural sector, is subject to various dynamics that influence its price fluctuations, supply and demand trends, and ultimately, investment returns. Understanding these market dynamics is crucial for investors and traders seeking to navigate the rice investment landscape effectively.

Price Fluctuations: Rice prices can experience significant volatility due to a multitude of factors. One primary driver is weather conditions, particularly in major rice-producing regions. Adverse weather events like droughts, floods, or storms can reduce crop yields, leading to tighter supply and higher prices. Conversely, favorable weather conditions can result in abundant harvests, causing prices to drop. Additionally, political and economic factors play a role. Changes in government policies, trade agreements, or economic instability in rice-exporting countries can impact the global rice market. For instance, a country's decision to impose export restrictions or tariffs can disrupt supply chains and drive prices upwards.

Supply and Demand Trends: The rice market's equilibrium is governed by the delicate balance between supply and demand. Rice production is influenced by factors such as farming techniques, crop varieties, and technological advancements. Increased adoption of modern farming practices and improved crop varieties can boost yields, potentially leading to a surplus in the market. On the demand side, population growth, income levels, and dietary preferences are key considerations. As populations expand, especially in developing countries, the demand for rice as a staple food increases. Rising income levels may also shift consumer preferences towards more diverse diets, impacting rice consumption. Understanding these trends is essential for investors to anticipate market movements and make informed decisions.

Market Factors Affecting Investment Returns: Several factors can significantly impact investment returns in the rice market. Firstly, the global rice trade is a critical aspect. International trade agreements and policies can open up new markets for rice exporters, increasing demand and potentially boosting investment returns. Secondly, the presence of large-scale rice traders and processors can influence market dynamics. These entities often have substantial buying and selling power, which can affect rice prices and market stability. Additionally, the integration of rice markets with other agricultural commodities should be considered. Correlations between rice prices and those of other crops or food commodities can impact investment strategies, especially for diversified portfolios.

In summary, the rice investment landscape is shaped by intricate market dynamics. Price fluctuations are influenced by weather, political, and economic factors, while supply and demand trends are driven by agricultural practices, population growth, and dietary preferences. Investors must stay informed about these factors to make strategic investment choices. Understanding the global rice trade, the role of large traders, and market correlations with other agricultural commodities are essential components of a comprehensive investment approach in this sector.

Unlocking Wealth: Understanding the Mechanics of Norland Investment Strategies

You may want to see also

Sustainable Practices: Rice investment may promote eco-friendly farming methods, benefiting the environment and investors

The concept of investing in rice cultivation is an innovative approach that has the potential to revolutionize the agricultural industry and promote sustainable practices. By channeling financial resources into rice farming, investors can actively contribute to the adoption of eco-friendly methods, which in turn brings about numerous benefits for both the environment and the investors themselves.

One of the key advantages of rice investment is its ability to encourage farmers to embrace sustainable farming techniques. Traditional rice cultivation often involves intensive use of chemical fertilizers and pesticides, which can have detrimental effects on the environment, including water pollution and soil degradation. However, by investing in rice projects, investors can incentivize farmers to adopt organic and natural farming methods. This includes the use of organic fertilizers, integrated pest management, and water-efficient irrigation systems. These practices not only reduce the environmental impact but also promote healthier and more resilient ecosystems, ensuring the long-term sustainability of rice production.

Furthermore, sustainable rice investment can lead to improved soil health and water management. Eco-friendly farming methods often focus on soil conservation and water conservation techniques. Farmers may implement practices such as crop rotation, cover cropping, and precision irrigation, which help prevent soil erosion, maintain soil fertility, and optimize water usage. These methods not only benefit the environment by preserving natural resources but also enhance the overall quality of the rice produced, resulting in higher yields and better-tasting rice.

Investors can also play a crucial role in promoting transparency and ethical standards in the rice industry. By supporting sustainable practices, investors can encourage farmers to provide accurate information about their farming methods, ensuring that the rice is produced ethically and environmentally responsibly. This transparency can lead to the development of certified sustainable rice brands, which can command premium prices in the market, benefiting both farmers and investors.

In addition, investing in rice with an environmental focus can have a positive social impact. Sustainable farming practices often go hand in hand with fair labor practices and community development. Investors can support initiatives that provide farmers with better working conditions, fair wages, and access to education and healthcare. This not only improves the well-being of farmers but also contributes to the overall development of rural communities, creating a more sustainable and equitable food system.

In summary, rice investment has the potential to drive significant positive change in the agricultural sector. By promoting eco-friendly farming methods, investors can contribute to environmental conservation, improve soil and water management, and support ethical and transparent practices. This approach not only benefits the environment but also provides investors with opportunities for financial gains through premium-priced sustainable rice products and the development of a more resilient and responsible agricultural industry.

Unleash Your Wealth: Understanding Drop's Investment Program

You may want to see also

Risk Assessment: Identifying and managing risks associated with rice cultivation, such as weather impacts and crop diseases

Rice cultivation is a complex process that involves numerous potential risks and challenges, especially in the face of environmental and biological threats. One of the primary risks associated with rice farming is the impact of weather conditions. Rice is a water-intensive crop, and its growth is highly sensitive to changes in temperature, rainfall, and humidity. For instance, prolonged droughts can lead to water stress, reducing crop yields and quality. Conversely, excessive rainfall and flooding can cause waterlogging, which may result in root rot and other fungal diseases. To mitigate these weather-related risks, farmers can adopt various strategies. Implementing irrigation systems that can manage water distribution efficiently is crucial. This includes the use of drip irrigation or precision irrigation techniques that minimize water wastage and ensure optimal water availability for the rice plants. Additionally, farmers can consider planting rice varieties that are more resilient to specific weather conditions, such as drought-resistant or flood-tolerant strains.

Another significant risk factor in rice cultivation is the presence of crop diseases and pests. Rice is susceptible to a range of fungal, bacterial, and viral infections, which can cause substantial yield losses if not managed properly. For example, rice blast, caused by the fungal pathogen *Magnaporthe oryzae*, is a major concern in many rice-growing regions. This disease can lead to leaf spots, blisters, and grain loss, significantly impacting crop productivity. To assess and manage these risks, farmers should conduct regular field inspections to identify early signs of disease or pest infestations. Implementing integrated pest management (IPM) practices is essential, which may include the use of resistant rice varieties, crop rotation, and targeted pesticide application only when necessary. Biological control methods, such as introducing natural predators or using beneficial microorganisms, can also help reduce pest populations without the need for chemical interventions.

Furthermore, soil health and fertility play a critical role in rice cultivation and risk management. Poor soil quality can lead to nutrient deficiencies, affecting plant growth and yield. Regular soil testing and the application of appropriate fertilizers can help maintain soil fertility. However, over-reliance on chemical fertilizers may have environmental consequences, such as soil degradation and water pollution. To address this, farmers can adopt sustainable practices like organic farming, which emphasizes natural fertilizers and soil conservation techniques. This approach can improve soil structure, enhance water retention capacity, and promote a healthier ecosystem for rice cultivation.

In addition to these risks, economic factors should also be considered in rice investment assessments. Market fluctuations, price volatility, and changing consumer preferences can impact the profitability of rice cultivation. Farmers should stay informed about market trends and adapt their production strategies accordingly. Diversifying crop production or engaging in value-added processing can help mitigate market risks and ensure a more stable income.

In summary, successful rice cultivation requires a comprehensive risk assessment and management approach. By understanding the weather-related, biological, and economic risks, farmers can implement appropriate strategies to minimize losses and maximize yields. This includes adopting sustainable farming practices, utilizing resistant crop varieties, and staying informed about market dynamics. Effective risk management is essential for the long-term success and sustainability of rice investments.

Retirement Reinvented: Exploring the Top Investment Havens for Savvy Seniors

You may want to see also

Supply Chain Management: Efficient supply chain logistics ensure timely delivery of rice, impacting investment success

Efficient supply chain management is a critical aspect of successful rice investments, ensuring that the product reaches consumers in a timely and cost-effective manner. The process involves a complex network of activities, from farming and harvesting to transportation and distribution. Each stage plays a vital role in maintaining the quality and freshness of the rice, which is essential for meeting consumer demands and maximizing investment returns.

In the initial stages, farmers and producers must focus on sustainable and efficient farming practices. This includes selecting the right rice varieties suited to the local climate and soil conditions, implementing proper irrigation techniques, and using organic or eco-friendly methods to ensure the produce is of high quality and safe for consumption. Efficient farming practices also involve timely harvesting to prevent spoilage and maintain the desired moisture content, which is crucial for the next phase of the supply chain.

Logistics and transportation are key components of supply chain management. Once the rice is harvested, it needs to be transported to processing facilities or storage areas promptly. Efficient logistics involve optimizing routes, using appropriate vehicles, and ensuring timely loading and unloading of the rice. Quick transportation reduces the risk of spoilage and allows for better control over the supply chain, especially in maintaining the quality and freshness of the product.

The distribution phase is where the rice reaches the end consumers. Efficient supply chain management ensures that the rice is stored and transported to distribution centers or directly to retailers in optimal conditions. This includes proper temperature control, humidity management, and secure packaging to prevent damage during transit. Efficient distribution networks also involve effective inventory management, ensuring that the right amount of rice is available at the right time and place to meet consumer demand.

Furthermore, supply chain management includes implementing robust quality control measures. This involves regular testing and inspection of the rice at various stages to ensure it meets the required standards. Quality control helps identify and mitigate potential issues, such as pest infestations, mold growth, or contamination, which can significantly impact the investment's success. By maintaining high-quality standards, investors can ensure customer satisfaction and build a positive brand image.

In summary, efficient supply chain logistics are essential for the timely delivery of rice, a critical factor in the success of rice investments. It involves a comprehensive approach, from sustainable farming practices to optimized transportation and distribution networks. Effective supply chain management ensures that the rice reaches consumers in optimal condition, maintaining its quality and freshness. This, in turn, leads to increased consumer satisfaction, reduced waste, and improved investment returns, making it a key strategy for investors in the rice industry.

Car-eful" Considerations: Unraveling the Myth of New Cars as Investment

You may want to see also