Value investing is a strategy that involves identifying and purchasing stocks or other securities that are considered undervalued by the market. The core principle is that the intrinsic value of a company, which is determined by its assets, earnings, and growth prospects, is higher than its current market price. Investors who follow this approach aim to buy these undervalued assets at a discount, with the expectation that the market will eventually recognize their true worth, leading to a potential increase in the stock's price. This strategy requires thorough research and analysis to identify companies with strong fundamentals and the potential for long-term growth, often focusing on factors like financial stability, competitive advantage, and management quality.

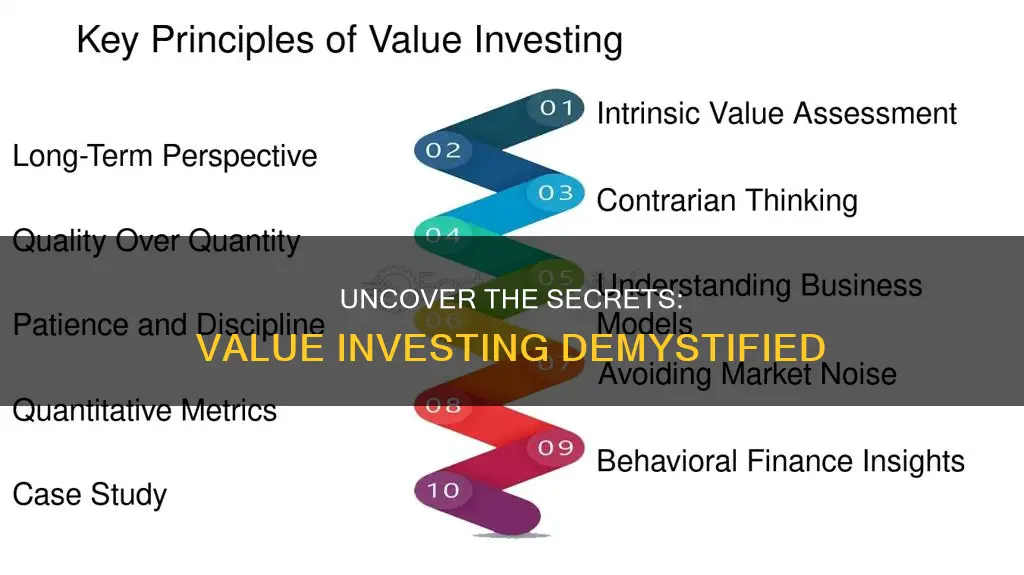

What You'll Learn

- Identifying Undervalued Stocks: Look for companies with strong fundamentals trading below their intrinsic value

- Long-Term Focus: Value investors buy and hold for extended periods, ignoring short-term market fluctuations

- Margin of Safety: Buy when the market price is significantly below the estimated intrinsic value

- Fundamental Analysis: Study financial statements, industry trends, and management quality to assess a company's true worth

- Patience and Discipline: Stick to the strategy, avoiding emotional decisions and market timing

Identifying Undervalued Stocks: Look for companies with strong fundamentals trading below their intrinsic value

Value investing is a strategy that involves identifying and purchasing stocks that are trading at a price lower than their intrinsic value, which is the estimated worth of a company based on its assets, earnings, and growth prospects. This approach is based on the idea that the market sometimes overreacts to short-term events or news, causing stock prices to deviate from their true value. By carefully analyzing a company's financial health and prospects, investors can uncover opportunities to buy stocks at a discount, which can lead to significant gains when the market eventually recognizes the company's true worth.

When employing a value investing strategy, one of the key steps is to identify companies with strong fundamentals. These are the underlying factors that contribute to a company's long-term success and stability. Strong fundamentals include a solid balance sheet, consistent revenue growth, a competitive advantage in the market, and a history of profitable operations. For instance, a company with a robust balance sheet, characterized by low debt and high cash reserves, is more likely to weather economic downturns and maintain its operations. Similarly, a company with a consistent track record of revenue growth and increasing profits over several years is likely to be more resilient and attractive to investors.

To identify such companies, investors can delve into a company's financial statements, including the income statement, balance sheet, and cash flow statement. These documents provide a comprehensive view of the company's financial health and performance. For example, a company with a consistent and increasing revenue stream, coupled with controlled expenses, is likely to have strong fundamentals. Additionally, investors should look for companies that have a competitive edge, such as a unique product or service, a strong brand, or a dominant market position, as these factors contribute to long-term profitability and stability.

The next step in value investing is to determine the intrinsic value of these companies. This involves a thorough analysis of the company's assets, earnings, and growth prospects. Investors can use various valuation techniques, such as the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, or Discounted Cash Flow (DCF) analysis, to estimate the intrinsic value. For instance, the P/E ratio compares a company's stock price to its earnings, while the P/B ratio compares the stock price to the company's book value. A company trading below its intrinsic value, as calculated by these methods, is a strong candidate for a value investment.

Finally, investors should also consider the market sentiment and recent events that might have caused the stock price to deviate from its intrinsic value. Sometimes, negative news or market sentiment can lead to a temporary undervaluation of a company's stock. By carefully assessing these factors, investors can make informed decisions about when to buy and when to hold off, ensuring that they capitalize on undervalued stocks while minimizing risks. This approach to investing, focusing on strong fundamentals and intrinsic value, is a cornerstone of value investing and can lead to substantial returns over the long term.

Principal or Investment: Where Should Your Money Go?

You may want to see also

Long-Term Focus: Value investors buy and hold for extended periods, ignoring short-term market fluctuations

Value investing is a long-term strategy that focuses on identifying and purchasing undervalued assets with the expectation that their true value will be recognized over time. This approach is in stark contrast to short-term market maneuvers, where investors aim to capitalize on quick price movements. Value investors believe that the market can be inefficient, and certain stocks may be priced lower than their intrinsic worth due to temporary factors like negative news, economic downturns, or investor sentiment. By adopting a long-term perspective, they aim to benefit from the market's eventual realization of the asset's true value.

The key principle behind this strategy is patience and a disregard for short-term market volatility. Value investors are willing to ignore temporary market fluctuations and focus on the fundamental value of the investment. They believe that short-term price movements are often driven by emotional and irrational factors, while long-term trends are more closely tied to the underlying business's performance and value. This approach allows them to buy quality assets at a discount, benefiting from the market's eventual correction and the realization of the asset's true worth.

When implementing this strategy, investors typically hold their positions for an extended duration, sometimes even years. They avoid the temptation of frequent trading, as they understand that short-term market movements are often unpredictable and can be influenced by external factors. By maintaining a long-term perspective, value investors aim to benefit from the compounding effect of their investments, where the power of compounding returns can significantly increase the value of their portfolio over time.

A critical aspect of this strategy is thorough research and analysis. Value investors spend considerable time studying financial statements, assessing management quality, understanding industry trends, and evaluating competitive advantages. They look for companies with strong fundamentals, solid management teams, and a history of resilience during economic cycles. This research-intensive approach helps them identify businesses that are undervalued and have the potential to create long-term value.

In summary, the long-term focus of value investing involves a patient and disciplined approach to buying and holding undervalued assets. By ignoring short-term market fluctuations and concentrating on the intrinsic value of investments, value investors aim to benefit from the market's eventual recognition of the asset's true worth. This strategy requires a commitment to long-term holding periods and a thorough understanding of the underlying businesses, allowing investors to potentially achieve significant returns over time.

Home Sweet (Financial) Home?

You may want to see also

Margin of Safety: Buy when the market price is significantly below the estimated intrinsic value

Value investing is a strategy that focuses on identifying and purchasing stocks that are trading at a significant discount to their intrinsic value. This concept is often associated with the idea of a "margin of safety," which is a key principle in value investing. The margin of safety refers to the difference between a company's market price and its estimated intrinsic value, and it is a crucial factor in determining when to buy a stock.

When a stock is trading at a price that is significantly lower than its intrinsic value, investors can take advantage of this opportunity by purchasing the stock at a discount. This strategy is based on the belief that the market often underestimates the true value of a company, and by buying at a lower price, investors can benefit from the potential for future growth and increased profitability. The margin of safety provides a buffer, ensuring that even if the market price does not increase as expected, the investor has not paid a premium price.

To calculate the margin of safety, investors need to estimate the intrinsic value of a company. This involves analyzing various financial metrics such as earnings, cash flow, assets, and liabilities. By comparing the market price to this intrinsic value, investors can determine the extent of the discount. A larger margin of safety indicates a more significant undervaluation, providing a safer investment opportunity.

The key idea behind this approach is to buy stocks when they are temporarily out of favor and trading at a price that does not reflect their true worth. Value investors aim to capitalize on the market's short-term inefficiencies, believing that over time, the market will recognize and reward the intrinsic value of these companies. This strategy requires a thorough understanding of financial analysis and the ability to identify undervalued assets.

In summary, the margin of safety is a critical concept in value investing, allowing investors to make informed decisions by comparing market prices to estimated intrinsic values. By buying stocks at a significant discount, investors can potentially benefit from future growth and market recognition of the company's true value. This approach requires careful analysis and a long-term perspective, as value investing often involves patience and the willingness to wait for the market to correct its mistakes.

Conservative Investing in Retirement: Strategies for a Secure Future

You may want to see also

Fundamental Analysis: Study financial statements, industry trends, and management quality to assess a company's true worth

Fundamental analysis is a critical component of value investing, a strategy that involves identifying and purchasing stocks that are undervalued by the market. This approach is based on the belief that a company's intrinsic value, which is its true worth, can be determined through a thorough examination of its financial health and prospects. By studying a company's fundamentals, investors can make informed decisions about whether a stock is a good investment opportunity.

The process begins with a deep dive into the company's financial statements, which provide a comprehensive overview of its financial performance and position. These statements include the balance sheet, income statement, and cash flow statement. The balance sheet reveals the company's assets, liabilities, and shareholders' equity, offering insights into its financial structure and stability. The income statement, on the other hand, showcases the company's revenue, expenses, and net income over a specific period, highlighting its profitability and financial performance. Lastly, the cash flow statement details the sources and uses of cash, providing a clear picture of the company's liquidity and ability to generate cash.

Analysts scrutinize these financial statements to identify key metrics and ratios that provide valuable insights. For instance, they calculate the price-to-earnings (P/E) ratio, which compares a company's stock price to its earnings per share, to assess whether the market has undervalued or overvalued the company. They also examine debt-to-equity ratios to understand the company's financial leverage and risk. Additionally, metrics like return on equity (ROE), return on assets (ROA), and gross profit margin are analyzed to gauge the company's efficiency and profitability.

Beyond financial statements, fundamental analysis also involves studying industry trends and competitive positioning. This includes researching the company's market share, competitive landscape, and growth prospects within its industry. Understanding the industry's dynamics, such as regulatory changes, technological advancements, and market demand, is crucial to assessing the company's long-term viability. Furthermore, evaluating the quality of management is essential. A competent and experienced management team can make strategic decisions, navigate challenges, and drive sustainable growth, making it a critical factor in the value investing process.

By combining these elements of fundamental analysis, investors can identify companies that are undervalued by the market and possess strong growth potential. This approach allows for a more comprehensive understanding of a company's intrinsic value, enabling investors to make well-informed decisions and potentially uncover hidden gems that offer attractive investment opportunities.

Ally Invest: A Beginner's Guide to Online Investing

You may want to see also

Patience and Discipline: Stick to the strategy, avoiding emotional decisions and market timing

Value investing is a long-term strategy that requires patience and discipline. It involves a systematic approach to identifying undervalued assets, which can be a challenging and time-consuming process. One of the key principles of value investing is to stick to your strategy and avoid making emotional decisions or trying to time the market.

Emotional decisions can often lead to poor investment choices. When the market is volatile, it's easy to get caught up in the fear of missing out or the panic of losing money. This can result in selling investments prematurely or buying at the wrong time, which can significantly impact your returns. By maintaining a disciplined approach, you can avoid these pitfalls and stick to your investment plan.

Discipline is crucial in value investing as it involves a rigorous process of research, analysis, and decision-making. It requires a commitment to following a set of criteria and rules to identify undervalued securities. This process can be tedious and may not always yield immediate results, but it is essential for long-term success. By staying disciplined, you ensure that your investment decisions are based on fundamental analysis rather than short-term market fluctuations.

Avoiding market timing is another critical aspect of this strategy. Trying to predict the market's peak and troughs can be extremely difficult and often leads to poor outcomes. Value investors focus on identifying undervalued companies and holding them for the long term, allowing the market to do the heavy lifting. This approach requires patience, as it may take time for the market to recognize the true value of the investment.

Patience is a virtue in the world of investing. It allows you to weather the short-term market volatility and focus on the long-term growth potential of your investments. By sticking to your strategy, you can benefit from the power of compounding, where your investments grow over time as you reinvest the returns. This approach can lead to significant wealth accumulation, but it requires a patient and disciplined mindset.

In summary, value investing is a strategy that demands patience and discipline. It involves a thorough and systematic approach to identifying undervalued assets, avoiding emotional decisions, and resisting the temptation to time the market. By maintaining a disciplined and patient mindset, investors can benefit from the long-term growth potential of their investments and achieve their financial goals.

The Student Debt Dilemma: To Invest or To Repay?

You may want to see also