Wealthsimple Invest is a digital investment platform that offers a simple and accessible way to invest in a diversified portfolio of stocks, bonds, and ETFs. It provides an automated investment strategy, known as Robo-Investing, which allows users to build a personalized investment plan based on their financial goals, risk tolerance, and time horizon. The platform's algorithm makes investment decisions on behalf of the user, rebalancing the portfolio regularly to maintain the desired asset allocation. Wealthsimple Invest aims to make investing easy and affordable for everyone, offering low fees and a user-friendly interface, making it an attractive option for those looking to start or grow their investment portfolio without the complexity of traditional financial advice.

What You'll Learn

WealthSimple Invest: Automated Portfolio Management

WealthSimple Invest is an automated investment platform that offers a simple and efficient way to build and grow your wealth. It is designed to cater to individuals who want to invest but may lack the time, knowledge, or expertise to manage their investments actively. Here's how WealthSimple Invest works and how it can benefit you:

Automated Portfolio Management: At the core of WealthSimple Invest is its automated portfolio management feature. This means that the platform takes care of the complex task of building and managing a diversified investment portfolio on your behalf. When you sign up, you'll be asked to complete a brief assessment to understand your financial goals, risk tolerance, and investment time horizon. This information is crucial in determining the right asset allocation for your portfolio. The platform then creates a customized portfolio tailored to your needs, automatically investing your funds across various asset classes.

The algorithm behind WealthSimple Invest continuously monitors market trends, economic indicators, and your personal financial situation to make informed investment decisions. It adjusts your portfolio's asset allocation automatically, rebalancing it to maintain your desired risk level. This automated approach ensures that your investments are regularly reviewed and optimized, providing a hands-off investment experience.

Diversification and Asset Allocation: WealthSimple Invest emphasizes the importance of diversification, which is a key strategy to manage risk and maximize returns. By investing in a wide range of assets, including stocks, bonds, and alternative investments, the platform aims to provide a balanced and well-rounded portfolio. The asset allocation strategy is based on your risk tolerance and investment goals, ensuring that your portfolio aligns with your preferences. For example, if you are a conservative investor, the platform may allocate a larger portion of your portfolio to bonds and less volatile investments.

Low Fees and Accessibility: One of the advantages of WealthSimple Invest is its focus on keeping fees low. Traditional investment management often comes with high management fees, but WealthSimple aims to make investing more accessible and affordable. The platform offers a low-cost, transparent fee structure, allowing users to see exactly how much they are paying. This approach enables individuals to build wealth over time without incurring excessive expenses.

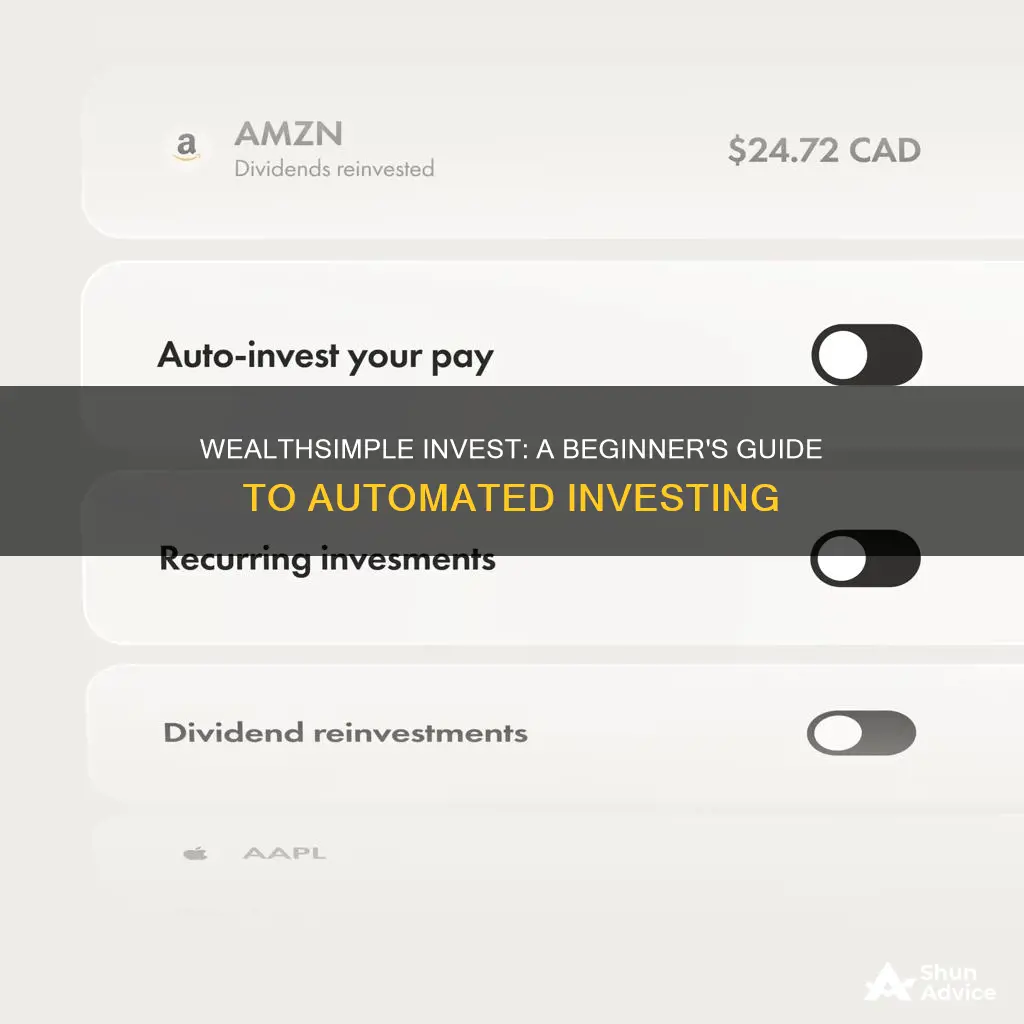

Additionally, WealthSimple Invest is designed with accessibility in mind. The platform provides an intuitive and user-friendly interface, making it easy for beginners to navigate and understand their investment journey. Users can track their portfolio performance, view their holdings, and make adjustments as needed, all within the platform's secure dashboard.

In summary, WealthSimple Invest offers a comprehensive solution for individuals seeking automated portfolio management and a simplified investment experience. By handling the complex tasks of asset allocation and diversification, the platform enables users to focus on their financial goals while benefiting from a low-cost, efficient investment strategy. This approach has gained popularity among those who prefer a hands-off investment method, allowing them to build and grow their wealth over time.

Investing Wisely to Achieve the Dream: Home Ownership in Five Years

You may want to see also

Investment Strategies: Diversification and Risk Assessment

WealthSimple is an online investment platform that offers a range of investment products and services, primarily catering to individual investors in Canada. One of the key principles behind WealthSimple's approach is the concept of diversification, which is a fundamental strategy in investment management. Diversification involves spreading your investments across various asset classes, sectors, and geographic regions to reduce risk and optimize returns. Here's how WealthSimple implements this strategy:

Asset Allocation: WealthSimple employs a sophisticated algorithm that analyzes an investor's risk tolerance, investment goals, and time horizon. Based on this assessment, the platform automatically allocates the investor's funds across different asset classes such as stocks, bonds, real estate, and commodities. This automated approach ensures that investors are not overly exposed to any single asset class, thus reducing the risk associated with market volatility. For instance, a conservative investor might have a larger portion of their portfolio in bonds and less in stocks, while a more aggressive investor might have a higher allocation to stocks.

Diversified Portfolios: The platform offers pre-built portfolios or ' baskets ' that are carefully diversified to suit different risk profiles. These portfolios are designed by WealthSimple's investment team, who have expertise in asset allocation and risk management. For example, the 'Balanced' portfolio is designed for investors seeking a mix of growth and income, with a balanced allocation across various asset classes. This approach simplifies the decision-making process for investors who may not have the time or expertise to construct their own diversified portfolios.

Regular Rebalancing: WealthSimple's investment strategy also involves regular portfolio rebalancing. Over time, market movements can cause the composition of an investment portfolio to deviate from the original allocation. WealthSimple's algorithm monitors these changes and automatically rebalances the portfolio to maintain the desired asset allocation. This process ensures that the risk exposure remains consistent with the investor's risk tolerance, providing a level of stability and control.

Risk Assessment and Management: Diversification is closely tied to risk assessment and management. WealthSimple's risk assessment tools help investors understand the potential risks associated with their investments. By diversifying across various assets, the platform aims to mitigate the impact of individual asset risks. For instance, investing in a mix of large-cap and small-cap stocks can reduce the risk of a downturn in any single stock, as small-cap stocks often have different growth patterns and are less correlated with large-cap performance.

Additionally, WealthSimple provides investors with regular performance reports and insights, allowing them to monitor the risk exposure and overall performance of their portfolios. This transparency empowers investors to make informed decisions and adjust their strategies as needed. In summary, WealthSimple's investment strategies emphasize diversification as a core principle, utilizing automated asset allocation, pre-built diversified portfolios, and regular rebalancing to manage risk and optimize returns for its users.

Investing in a Pre-Recession World: A Guide for the Retired

You may want to see also

Fee Structure: Transparent and Competitive Pricing

WealthSimple is a Canadian financial technology company that offers a digital investment platform, providing users with a straightforward and accessible way to invest in a variety of assets. One of the key aspects that sets WealthSimple apart is its commitment to transparency and competitive pricing, ensuring that users understand the costs associated with their investments.

The fee structure at WealthSimple is designed to be clear and straightforward, allowing users to make informed decisions about their money. They offer a simple pricing model, which is based on a percentage of the assets under management. This means that the fees are directly proportional to the amount of money an individual has invested, making it a fair and transparent system. For example, if a user has $10,000 invested, the fee structure might be a flat rate of 0.5% per year, ensuring that the cost is consistent and easy to calculate. This approach provides a clear incentive for users to invest more, as the fees remain stable regardless of the investment amount.

Transparency is a core value at WealthSimple, and they ensure that all fees are disclosed upfront. Users can easily access detailed information about the costs associated with their accounts, including any additional charges for specific services. This level of transparency empowers individuals to make informed choices and understand the value they receive for their money. By providing clear fee structures, WealthSimple builds trust with its users, which is essential in the financial services industry.

In addition to transparent pricing, WealthSimple aims to offer competitive rates in the market. They regularly review and adjust their fee structure to ensure it remains competitive with other investment platforms. This competitive pricing strategy allows WealthSimple to attract a wide range of investors, from those just starting to build their portfolios to experienced investors seeking cost-effective solutions. By keeping fees low, WealthSimple makes investing more accessible to a broader audience, which is a key goal of the company.

The fee structure at WealthSimple is designed to be user-friendly and flexible, catering to various investment needs. They offer different account types, such as tax-free savings accounts (TFSA) and registered retirement savings plans (RRSP), each with its own fee structure. This customization ensures that users can choose the option that best suits their financial goals and preferences. Whether it's a one-time investment or a long-term savings strategy, WealthSimple provides a transparent and competitive pricing model to accommodate diverse investment journeys.

People Prefer Spending Over Saving and Investing

You may want to see also

User Interface: Intuitive and Secure Investment Platform

WealthSimple is an online investment platform that aims to make investing accessible and user-friendly for everyone, regardless of their financial knowledge or experience. One of its key strengths is its user-friendly interface, which is designed to be intuitive and easy to navigate, ensuring that users can effortlessly manage their investments. The platform offers a seamless and straightforward experience, allowing users to quickly set up their accounts, connect their bank accounts, and start investing with just a few clicks.

The dashboard is the central hub of the WealthSimple platform, providing a comprehensive overview of a user's investments. It displays essential information such as account balance, investment performance, and portfolio allocation. The dashboard is organized logically, with clear sections for different investment products, making it easy for users to track their investments at a glance. Users can quickly switch between various investment options, such as stocks, bonds, or ETFs, and view detailed performance metrics, ensuring they stay informed about their investment choices.

WealthSimple's user interface emphasizes simplicity and clarity. The platform uses straightforward language and avoids complex financial jargon, making it accessible to users from all walks of life. The design is clean and uncluttered, with a focus on visual cues and intuitive navigation. Users can easily find the information they need, whether it's setting up automatic contributions, adjusting investment allocations, or accessing educational resources. The platform also provides personalized recommendations and insights based on the user's risk tolerance and financial goals, further enhancing the user experience.

Security is a top priority for WealthSimple, and the platform employs robust measures to protect user data and funds. The interface incorporates advanced encryption technologies to secure user information, ensuring that sensitive data remains confidential. Two-factor authentication adds an extra layer of security, requiring users to provide additional verification during login. WealthSimple also offers fraud protection and regularly monitors accounts for any suspicious activities, providing users with peace of mind.

In addition to its user-friendly design, WealthSimple provides excellent customer support. The platform offers a comprehensive help center with FAQs and how-to guides, ensuring users can find answers to their queries quickly. Users can also access live chat or email support for more complex issues, ensuring prompt assistance. The platform's commitment to security and user-centric design has earned it a reputation as a trusted and reliable investment platform, attracting a growing number of users seeking a simple and secure way to invest.

Savings and Investment: Two Sides of the Same Coin?

You may want to see also

Customer Support: Dedicated Assistance for Investors

WealthSimple Invest is an online investment platform that offers a user-friendly and automated approach to investing. It is designed to make investing accessible and straightforward for individuals who want to build their wealth over time. Here's an overview of how WealthSimple Invest works and the customer support it provides:

Investment Process: WealthSimple Invest utilizes a robo-advisor model, which means it provides automated investment advice and portfolio management. Users can start by setting up an account and answering a series of questions about their financial goals, risk tolerance, and investment preferences. The platform then creates a personalized investment plan based on these inputs. It invests in a diversified portfolio of assets, including stocks, bonds, and other securities, to help grow the user's wealth. The algorithm continuously monitors the market and adjusts the portfolio to optimize returns while managing risk.

Customer Support: WealthSimple Invest understands the importance of providing dedicated assistance to its investors. They offer a comprehensive customer support system to ensure a smooth and positive experience for their users. Here's how their customer support works:

- 24/7 Support Channels: WealthSimple provides multiple channels for customers to reach out for assistance. This includes a dedicated customer support team available via phone, email, and live chat. Users can get immediate help with any queries or issues they encounter.

- Online Resources: The platform also offers an extensive knowledge base with articles, FAQs, and tutorials. These resources cover various topics, from investment strategies to account management, empowering users to find answers independently.

- Personalized Assistance: For more complex issues or specific investment advice, WealthSimple's team of financial advisors is readily available. They provide one-on-one support, helping users navigate their investment journey and make informed decisions.

- Regular Updates and Notifications: Investors receive regular updates and notifications about their portfolio performance, market trends, and any relevant news. This proactive approach keeps users informed and engaged.

WealthSimple Invest's customer support is designed to be responsive and efficient, ensuring that investors can quickly resolve any concerns and make the most of their investment journey. The platform aims to provide a seamless experience, allowing users to focus on their financial goals while offering the necessary assistance whenever needed.

With its user-friendly interface and dedicated support, WealthSimple Invest strives to make investing a simple and accessible process, catering to a wide range of investors.

Steady Annual Returns: Exploring the 7% Gain

You may want to see also

Frequently asked questions

Wealthsimple Invest is an automated investment platform that allows users to invest in a diversified portfolio of stocks, bonds, and other assets. It uses a robo-advisor approach, where an algorithm manages your investments based on your risk tolerance, goals, and time horizon. You can choose from various pre-built portfolios or customize your own. The platform aims to make investing accessible and simple by handling the complex decision-making and rebalancing for you.

Wealthsimple Invest has a low barrier to entry, allowing users to start investing with as little as $1. This makes it an attractive option for those who want to begin building their investment portfolio without a significant initial investment. The platform also offers fractional shares, enabling investors to purchase a portion of a stock, which is particularly useful for investing in expensive assets.

Wealthsimple Invest automatically rebalances your portfolio to maintain your desired asset allocation. The frequency of rebalancing depends on the investment strategy you choose. For example, the 'Aggressive' strategy may rebalance more frequently to take advantage of market opportunities, while the 'Balanced' strategy might rebalance less often, focusing on long-term growth. You can adjust the rebalancing frequency or choose a fixed schedule to suit your preferences.