Investment pools, also known as collective investment schemes, are a popular financial vehicle that allows multiple investors to pool their money together to invest in various assets. These pools are managed by a fund manager or an investment company, which makes investment decisions on behalf of the group. The concept of investment pools is based on the idea of shared risk and potential rewards, where individual investors can benefit from the expertise and diversification offered by the pool. By contributing their capital, investors gain access to a wider range of investment opportunities, such as stocks, bonds, real estate, or alternative assets, which can be more challenging to acquire on an individual basis. Understanding how investment pools work is essential for investors looking to diversify their portfolios and potentially increase their returns while sharing the associated risks.

What You'll Learn

- Structure: Investment pools are structured as a collective investment scheme, pooling funds from multiple investors

- Management: Professional fund managers oversee the pool's investments, making decisions on asset allocation and strategy

- Diversification: Pools offer diversification by investing in a range of assets, reducing risk for individual investors

- Distribution: Profits and returns are distributed among pool members based on their investment proportions

- Regulation: Regulatory bodies oversee investment pools to ensure compliance with financial laws and protect investors

Structure: Investment pools are structured as a collective investment scheme, pooling funds from multiple investors

Investment pools are a financial arrangement that brings together a group of investors to collectively invest in various assets or projects. This structure is designed to provide a more efficient and diversified approach to investing, allowing individuals to pool their resources and gain access to opportunities that might not be available to them individually. The concept is simple: multiple investors contribute their capital, and this collective fund is then invested according to a predefined strategy or set of criteria.

The structure of investment pools is crucial to their success and appeal. By pooling funds, investors can achieve several advantages. Firstly, it reduces the risk associated with individual investments. When money is spread across multiple investments, the impact of any single loss is minimized, providing a level of diversification that individual investors might struggle to achieve on their own. This collective approach also allows for larger, more substantial investments, which can be beneficial for accessing exclusive or high-value opportunities.

In a typical investment pool structure, investors agree to contribute a specific amount of capital, often with a defined contribution period. This capital is then managed by a designated fund manager or a committee, who are responsible for making investment decisions. The fund manager might be an individual, a financial institution, or even a group of investors who have a shared vision and expertise in a particular market or asset class. The manager's role is to allocate the pooled funds strategically, ensuring that the investments align with the pool's objectives and risk profile.

One of the key benefits of this structure is the potential for lower costs. With a larger pool of capital, the fixed costs associated with investment management, such as transaction fees and administrative expenses, can be spread across more investors. This can result in cost savings for individual investors, making it an attractive option for those who want to invest but may have been deterred by the high costs of traditional investment vehicles.

Additionally, investment pools often provide a level of transparency and accountability. Investors can typically access regular reports and updates on the pool's performance, ensuring they are well-informed about how their money is being managed. This transparency can foster trust and confidence in the investment scheme, encouraging investors to participate and potentially attracting new members to the pool.

Invest Aggressively Now?

You may want to see also

Management: Professional fund managers oversee the pool's investments, making decisions on asset allocation and strategy

Investment pools, also known as collective investment schemes, are a popular way for individuals to pool their money and invest in a diversified portfolio of assets. These pools are managed by professional fund managers who have the expertise and experience to make strategic investment decisions on behalf of the pool's participants. Here's an overview of how this management structure works:

Professional fund managers play a crucial role in investment pools by taking on the responsibility of managing the collective assets. They are appointed or selected based on their investment skills, knowledge, and track record. These managers typically have a team of analysts and researchers supporting them, ensuring a comprehensive approach to investment decision-making. The primary objective of these fund managers is to maximize returns for the pool's investors while managing risk effectively.

One of the key aspects of their management role is asset allocation. Fund managers decide how the pool's capital should be distributed across various asset classes such as stocks, bonds, real estate, commodities, or a combination of these. This allocation is based on thorough research, market analysis, and a strategic vision. By diversifying the portfolio, managers aim to reduce risk and provide stable returns over the long term. They continuously monitor market trends, economic indicators, and industry-specific news to make informed decisions.

Strategy formulation is another critical task for fund managers. They develop and implement investment strategies tailored to the pool's goals and risk profile. This may include growth-oriented strategies, income-focused approaches, or a mix of both. Managers might also decide on specific sectors or industries to target, based on their research and market insights. Their strategic decisions guide the overall direction of the investment pool, ensuring it aligns with the investors' objectives.

Effective management also involves regular performance evaluation and risk management. Fund managers assess the pool's performance against predefined benchmarks and industry standards. They identify areas for improvement and make necessary adjustments to the investment strategy. Additionally, they actively manage risk by implementing various techniques such as diversification, position sizing, and risk mitigation strategies to protect the pool's assets.

In summary, professional fund managers are the driving force behind investment pools, providing expert management and strategic direction. Their skills and knowledge enable them to navigate complex financial markets, make informed investment choices, and ultimately aim to deliver favorable returns to the pool's investors. This structured approach to investment management is a key advantage of investment pools, offering individuals access to professional-grade asset management without the need for individual expertise.

The Fine Line: When Investments Invalidate a Will

You may want to see also

Diversification: Pools offer diversification by investing in a range of assets, reducing risk for individual investors

Investment pools, also known as mutual funds or exchange-traded funds (ETFs), are a powerful tool for investors seeking to diversify their portfolios and manage risk. The concept of diversification is a fundamental principle in investing, and investment pools excel in this area. By design, these pools offer a unique advantage to individual investors by providing access to a diverse range of assets, which is a key strategy to mitigate risk.

In the world of investing, risk is an inherent component, and it is often associated with the potential for significant losses. However, by spreading investments across various assets, the impact of any single asset's poor performance is minimized. This is the essence of diversification. When an investor puts their money into an investment pool, they are essentially pooling their funds with other investors, allowing the pool manager to invest in a wide array of securities, such as stocks, bonds, commodities, or real estate. This diversification strategy ensures that the pool's performance is not solely dependent on the success of a single asset.

The beauty of investment pools lies in their ability to provide instant diversification. Instead of buying and holding individual stocks or bonds, investors can gain exposure to a diverse portfolio with a single purchase or investment. For instance, an investor might choose to invest in a stock market index fund, which tracks a broad market index, instantly diversifying their holdings across hundreds or even thousands of companies. This approach significantly reduces the risk associated with picking individual stocks, as the performance of the fund is influenced by the overall market or a specific sector, rather than the performance of a single company.

Furthermore, investment pools often have built-in mechanisms to ensure ongoing diversification. These mechanisms can include regular rebalancing, where the portfolio manager adjusts the asset allocation to maintain the desired level of diversification. This process ensures that the pool's holdings remain diverse over time, adapting to market changes and economic cycles. As a result, investors benefit from a well-managed, diversified portfolio, which can provide more stable returns and potentially reduce the impact of market volatility.

In summary, investment pools are a powerful tool for investors seeking to diversify their portfolios and manage risk effectively. By investing in a range of assets, these pools offer a level of diversification that individual investors might struggle to achieve on their own. This diversification strategy is a key advantage, allowing investors to potentially reduce the impact of market fluctuations and enjoy more stable, long-term returns. Understanding and utilizing investment pools can be a significant step towards achieving financial goals and building a robust investment strategy.

Heavy Price Tag, Heavy Considerations

You may want to see also

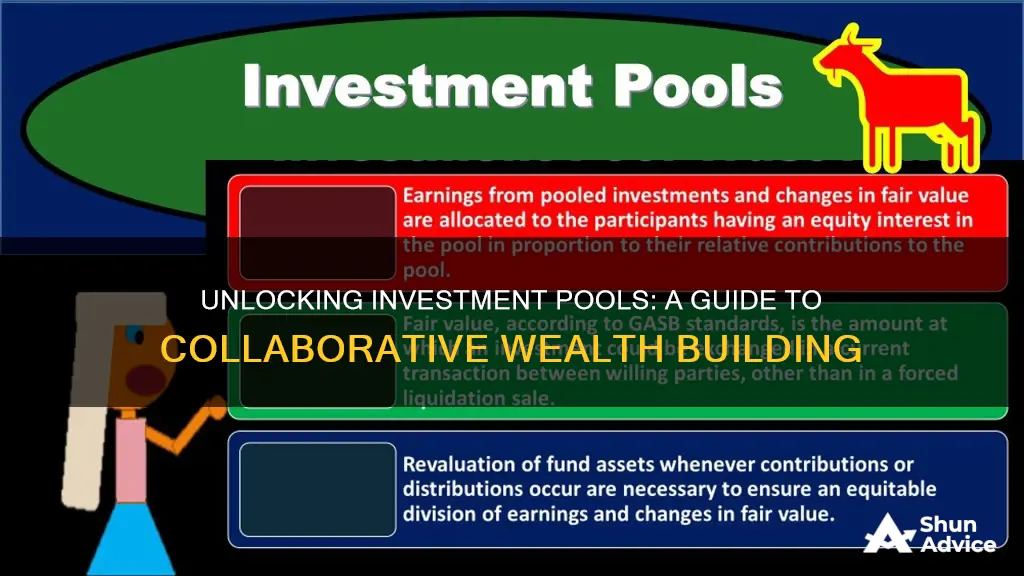

Distribution: Profits and returns are distributed among pool members based on their investment proportions

When it comes to investment pools, the distribution of profits and returns is a crucial aspect that ensures members benefit from their collective investments. This process involves a fair and structured approach to allocating the gains made by the pool to its participants. Here's a detailed explanation of how this distribution works:

In an investment pool, members contribute their capital, and the collective fund is then invested according to the pool's strategy. As the investments generate returns, these profits are not kept solely by the pool manager but are shared with the members. The distribution is based on the principle of proportional investment, meaning each member receives a share of the profits that is directly related to their initial investment. This ensures that the more one invests, the larger their potential return.

The distribution process typically involves a few key steps. Firstly, the pool manager calculates the total profits or returns generated during a specific period, which could be monthly, quarterly, or annually. This calculation takes into account the performance of all investments made by the pool. Once the total gains are determined, the manager then allocates these profits according to the investment proportions of each member. For instance, if a member invested $5,000 and another invested $10,000, the former would receive half of the total profits, and the latter would receive the other half.

This distribution method provides an incentive for members to invest more, as their potential returns increase with their contributions. It also promotes a sense of shared success, as the entire pool benefits from the collective efforts. Additionally, this approach allows for a more dynamic and responsive investment strategy, as the pool can adapt to market conditions and make decisions that maximize returns for all participants.

It is important to note that the specific rules and regulations regarding distribution may vary depending on the jurisdiction and the type of investment pool. Some pools might have different distribution models, such as fixed returns or performance-based allocations. However, the core principle of distributing profits based on investment proportions remains a fundamental aspect of investment pools, ensuring a fair and transparent system for all members.

Investments That Reward: Strategies for Long-Term Gain

You may want to see also

Regulation: Regulatory bodies oversee investment pools to ensure compliance with financial laws and protect investors

Regulatory bodies play a crucial role in the oversight and management of investment pools, ensuring that these financial instruments operate within a legal framework designed to protect investors and maintain market integrity. These entities are tasked with the responsibility of monitoring and enforcing regulations that govern the creation, operation, and distribution of investment pools. The primary objective is to safeguard investors by implementing a set of rules and standards that investment pool managers must adhere to.

One of the key aspects of regulatory oversight is the establishment of guidelines for the formation and structure of investment pools. Regulatory bodies define the criteria that investment pool managers must meet, including the minimum capital requirements, the types of assets that can be included, and the transparency standards for reporting and disclosure. These rules are designed to ensure that investment pools are well-capitalized, diversified, and managed by competent professionals, thereby reducing the risk of fraud and mismanagement.

In addition to setting up the framework, regulatory authorities also monitor the ongoing operations of investment pools. They require regular reporting and financial disclosures, allowing them to track the performance and activities of these pools. This includes reviewing investment decisions, assessing risk management practices, and verifying the accuracy of financial statements. By doing so, regulators can identify potential issues, such as excessive risk-taking, insider trading, or mismanagement, and take appropriate actions to mitigate the risks.

The regulatory process also involves the enforcement of penalties and sanctions for non-compliance. When investment pool managers fail to adhere to the established regulations, regulatory bodies have the authority to impose fines, revoke licenses, or even criminal charges. This deterrent effect is crucial in maintaining the integrity of the investment pool market and ensuring that investors' interests are protected. Furthermore, regulators often provide a mechanism for investors to report any suspected violations, fostering a culture of accountability and transparency.

In summary, regulatory bodies are essential in overseeing investment pools to maintain a fair and secure environment for investors. Through the establishment of comprehensive rules, ongoing monitoring, and enforcement of penalties, these regulators ensure that investment pools operate within the boundaries of the law. This regulatory framework not only protects investors but also contributes to the overall stability and trust in the financial markets.

The Ultimate Guide to Buying T-Bills: A Step-by-Step Investment Journey

You may want to see also

Frequently asked questions

An investment pool, also known as a collective investment scheme or fund, is a financial vehicle that pools money from multiple investors to invest in various assets. It allows individuals to invest in a diversified portfolio without having to manage the investments themselves.

Investment pools earn returns by investing the pooled money in a range of assets such as stocks, bonds, real estate, or other securities. The fund manager or investment team makes investment decisions on behalf of the pool, aiming to maximize returns while managing risk. Profits are then distributed to the investors based on their shareholdings.

Investing in an investment pool offers several advantages. Firstly, it provides diversification, reducing risk by spreading investments across different asset classes and industries. Secondly, it allows investors to access professional management, benefiting from the expertise of fund managers. Additionally, pools often have lower minimum investment requirements, making it more accessible to a wider range of investors.

Investing in an investment pool typically involves the following steps. First, you research and choose a reputable fund or investment manager that aligns with your financial goals and risk tolerance. Then, you complete the necessary paperwork, which may include filling out an application form and providing personal and financial information. Finally, you make your initial investment, and the fund manager will handle the rest, including asset allocation and distribution of returns.

Investment pools can be suitable for various investors, but it depends on individual circumstances. They are often favored by those who prefer a hands-off approach to investing, as they provide professional management. However, it's essential to consider factors like investment goals, risk tolerance, and the time horizon. Some pools may also have specific eligibility criteria or minimum investment amounts, so thorough research and understanding of the fund's terms are necessary before investing.