Buying a house is a long-term investment that can be a good financial decision, but it's not always the best choice. While property values tend to increase over time, there are also risks and significant upfront and ongoing costs involved.

The main benefit of buying a house is the potential for long-term value growth. Historical data shows that real estate values typically rise over time, leading to a profitable sale down the line. Additionally, homeowners can build equity by paying off their mortgage, further increasing their wealth.

However, it's important to remember that the housing market is cyclical, and short-term gains are not guaranteed. The location of the property also plays a significant role in its appreciation.

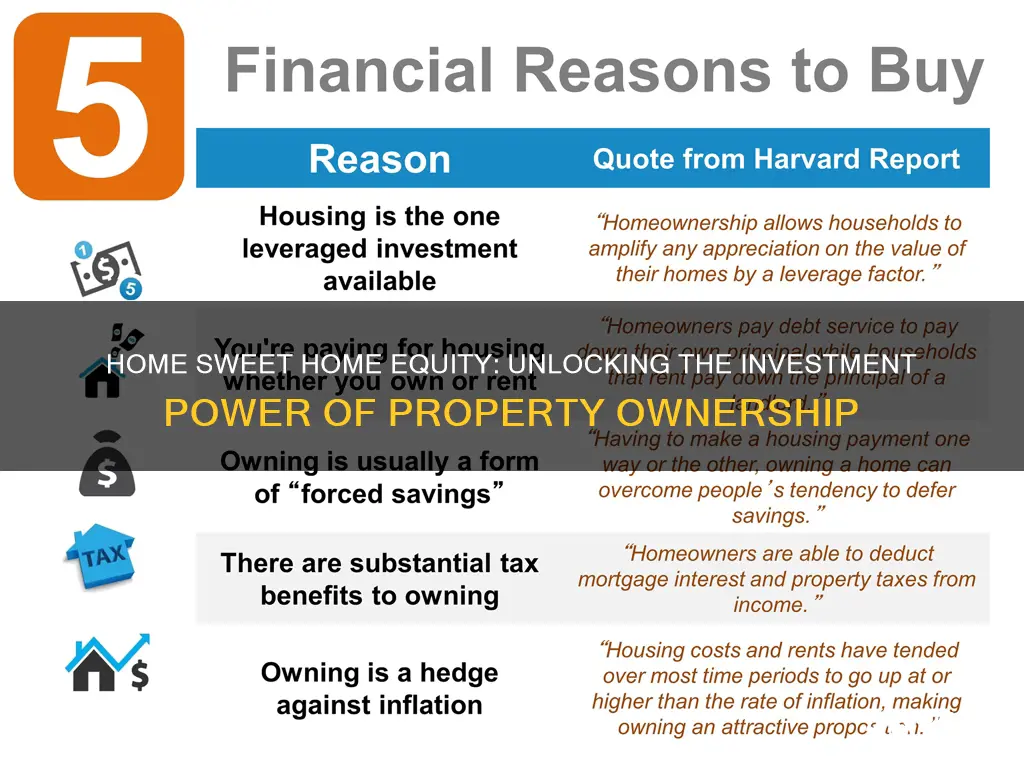

Another advantage of homeownership is the tax benefits it offers. Homeowners can deduct expenses such as mortgage interest, property taxes, and certain home improvements from their taxable income.

On the other hand, buying a house requires a substantial financial commitment. Upfront costs include a down payment and closing costs, which can range from 2% to 6% of the property's value. Ongoing expenses include mortgage payments, property taxes, insurance, utilities, and maintenance.

Before purchasing a home, it's essential to carefully consider your financial situation and do a thorough cost-benefit analysis. While buying a house can be a good investment, it may not always be the best decision for everyone.

| Characteristics | Values |

|---|---|

| Appreciation | The value of a house can increase over time. |

| Tax deductions | Mortgage interest, property tax payments, home office expenses, and more can be deducted from taxes. |

| Financial stability | Homeowners have a higher average net worth than renters. |

| Savings on rent | Money spent on rent is unrecoverable, whereas mortgage payments build equity. |

| Lifestyle benefits | Homeowners have more space and freedom to decorate or make changes to their property. |

| Closing costs | Additional costs of 3-6% of the loan amount are typically required when buying a house. |

| Maintenance costs | Regular maintenance costs can be expensive, averaging 1-4% of a home's total value annually. |

| Depreciation | Houses can decrease in value, especially during economic downturns. |

| Timing the market | It can be challenging to sell a house at the optimal time to maximize profit. |

What You'll Learn

Long-term home and equity appreciation

The housing market has its ups and downs, but historically, real estate values tend to increase over time, and your house is likely to grow in value over the long term. This is what we mean by long-term home and equity appreciation.

The value of your home typically rises as you pay off your mortgage. Assuming your home value grows over a long period, you can sell your home for a substantial return on your investment. For example, a home purchased for $250,000 in 2020 would be worth about $350,000 in November 2023, according to Zillow.

However, it's important to keep in mind that not all properties will appreciate at the same rate. The potential for growth is influenced by various factors, such as location, population growth, property condition, property type, government policies, and the economic climate.

Location is a significant factor in how much your home appreciates. Homes in desirable areas, such as those close to amenities and good schools, generally appreciate faster. Additionally, the size of your home relative to nearby homes will also influence its value. Larger homes with more usable space tend to be valued higher.

Another factor that affects home appreciation is the real estate market conditions. In a seller's market, where buyer demand outpaces the number of available homes, you are more likely to get top dollar when you sell your home. On the other hand, in a buyer's market, home prices are likely to decrease to attract buyers.

While there are no guarantees, understanding these factors can help you make informed decisions when purchasing a home with long-term appreciation potential. It's also important to remember that building home equity is a slow and steady process, and it may take time to see significant returns on your investment.

Investing in People: Definition and Impact

You may want to see also

Money savings on rent

One of the most significant advantages of owning a home is the money savings on rent. Renting can be expensive, and it's only getting pricier. The national median rent for a two-bedroom apartment in the United States is $1,374 per month, and rent affordability has been declining since 2010, with a sharp increase during the Covid pandemic in 2020.

By owning a home, you avoid spending money on rent, which is essentially unrecoverable. Instead, you can put that money toward a mortgage and build equity in something tangible that can increase in value over time. For instance, a house purchased for $250,000 in 2020 could be worth around $350,000 in November 2023, resulting in a substantial return on your investment.

Additionally, homeowners have greater financial stability compared to renters. According to 2022 data, the average net worth of homeowners is $300,000, which is significantly higher than the average net worth of renters, which is $8,000. This is because homeowners build equity through mortgage payments and potential increases in their home's value.

Furthermore, owning a home provides tax benefits. You can deduct mortgage interest and property tax payments from your taxes each year if you itemize your deductions.

However, it's important to remember that buying a house also comes with additional costs, such as closing costs, which can range from 3% to 6% of the loan amount, and maintenance expenses, which can be around 1% to 4% of the home's total value annually.

In summary, while buying a house can offer significant savings on rent and provide financial benefits, it's crucial to carefully consider all the associated costs and ensure you are financially prepared for the commitment.

Capacity Investment: Finding the Right Formula

You may want to see also

Greater financial stability

Homeownership can provide greater financial stability in several ways. Firstly, it enables individuals to build equity, which is an investment in homeownership. Equity grows over time as mortgage payments are made and property values increase. This equity can be leveraged for other financial purposes, providing a valuable asset. Additionally, homeownership offers fixed monthly mortgage payments, contributing to long-term financial planning and budgeting.

Another aspect of financial stability stems from the tax benefits associated with owning a home. Homeowners can benefit from tax deductions on mortgage interest, property taxes, and other expenses, reducing their taxable income and overall tax liability. This results in significant savings over time.

Furthermore, homeownership provides a sense of stability and belonging within a community. Homeowners often feel a stronger sense of permanence and security in their homes, fostering the development of meaningful relationships with neighbours and the broader community. This sense of belonging can positively impact an individual's financial decisions and long-term financial goals.

Additionally, homeownership is often viewed as a long-term investment, with the potential for property values to appreciate over time. While there may be fluctuations in the market, historical trends indicate that real estate values tend to increase, contributing to the financial stability of homeowners.

Lastly, owning a home eliminates the uncertainty associated with renting, such as unpredictable rent increases or lease terminations. With a fixed-rate mortgage, homeowners can plan their long-term finances more effectively, knowing their monthly payments will remain consistent.

Will Rogers' Investing Wisdom: Timeless Quotes, Timeless Lessons

You may want to see also

Tax benefits

There are several tax benefits associated with buying a house, which can provide significant savings on your tax bill. Here are some key tax advantages to consider:

- Mortgage Interest Deduction: Homeowners can deduct the interest paid on mortgage debt up to a certain limit. In the US, this limit is currently \$750,000 for individuals and \$375,000 for married individuals filing separately.

- Property Tax Deduction: Homeowners can deduct up to \$10,000 (\$5,000 for married filing separately) from their property, state, and local income taxes. This is known as the State and Local Taxes (SALT) deduction and can provide significant relief, especially in high-property-tax areas.

- Home Office Deduction: With the rise of remote work, this deduction has become increasingly relevant. If you use part of your home exclusively for business, you may be able to deduct certain home-related expenses, such as mortgage interest and insurance premiums.

- Capital Gains Tax Exclusion: When selling your primary home, you may be able to exclude a portion of the capital gains from taxation. This exclusion is \$250,000 for single filers and \$500,000 for joint filers.

- Medically Necessary Home Improvements: You can deduct the cost of medically necessary home improvements, such as installing ramps or widening doorways, as a medical expense. However, this deduction is subject to certain conditions and limitations.

- Tax Credits for First-Time Homebuyers: Some jurisdictions offer tax credits to qualified first-time homebuyers. For example, you may be eligible for a mortgage credit certificate, which provides a tax credit based on a percentage of your mortgage interest.

- Tax Incentive Programs: Real estate investors may benefit from various tax incentive programs, such as the 1031 exchange, which allows you to defer capital gains taxes when selling an investment property and reinvesting the proceeds in a similar property.

- Depreciation Deduction: Rental property owners can deduct depreciation, which accounts for the wear and tear on a property over time. This helps offset the cost of maintenance and repairs and can lower your taxable income.

- Pass-Through Deduction: If you own rental property as a sole proprietor, partnership, or through an LLC or S-Corp, you may be able to deduct up to 20% of your qualified business income (QBI) through the qualified business income (QBI) deduction.

- Self-Employment FICA Tax Exemption: Rental income is generally not subject to FICA taxes, which means you can avoid paying the self-employment tax on this income.

Investing in People: Avoid the Wrong Ones

You may want to see also

Lifestyle benefits

Predictable Monthly Payments and Financial Stability: Homeownership offers predictable monthly payments, shielding you from unpredictable rent increases. With a fixed-rate mortgage, your payments remain consistent, making budgeting easier. Additionally, you build equity with each mortgage payment, increasing your financial stability and net worth.

Freedom to Modify and Decorate: As a homeowner, you gain the freedom to modify and decorate your living space according to your preferences. You can paint walls, replace cabinets, add a deck, or make any desired changes without seeking a landlord's approval. This freedom empowers you to truly make the space your own and live by your own rules.

Increased Privacy: Owning a house often provides superior privacy compared to renting. You have the option to choose building materials that offer better soundproofing, such as concrete and stucco. Additionally, you can enhance privacy by making modifications like installing a fence or adding landscaping elements.

Community Engagement and Stability: Buying a house in a neighbourhood allows you to establish long-lasting relationships within the community. Your taxes contribute to local infrastructure, schools, and organisations, giving you a sense of connection and involvement. Staying in one neighbourhood for several years provides educational and social continuity for children, fostering a stable environment for their development.

Improved Credit Score: Purchasing a house can improve your credit score, especially if you have a limited credit history. Making consistent mortgage payments demonstrates your responsibility as a borrower, and credit bureaus often give more weight to mortgage payment history than revolving credit accounts.

Wealth Accumulation: Homeownership is a reliable way to accumulate wealth, especially for those without extensive investment portfolios. The equity you build in your home acts as a forced savings plan, and homeowners typically acquire significantly more net wealth than renters.

Lifestyle Flexibility: Buying a house offers the flexibility to adapt it to your lifestyle. Whether you want a menagerie of pets, a home workshop, or vibrant decor, you have the freedom to make it happen. Additionally, as your family grows or your needs change, you have the option to modify your space accordingly.

Global Bargain Hunting

You may want to see also

Frequently asked questions

There are several benefits to buying a house, including the potential for long-term financial gains, the opportunity to build equity, tax benefits, and the ability to make deductions on expenses such as mortgage interest and property taxes. Additionally, buying a house can provide a sense of stability and allow for more customization and renovation compared to renting.

Buying a house comes with financial risks, including high upfront costs, ongoing maintenance expenses, and the possibility of depreciation or negative returns if the market conditions change. There is also the risk of being trapped in your investment, as selling the house may require finding another place to live and using the equity from the sale to fund the new purchase.

Buying a house can be a good investment if you are financially stable, looking for a long-term place to live, and willing to build equity. It is important to carefully review your finances and consider both the pros and cons of homeownership before making a decision.

It is essential to consider your financial situation, including your income, savings, and debt-to-income ratio. Additionally, researching the housing market, understanding the associated costs such as closing costs and maintenance, and evaluating your long-term plans can help inform your decision.