The length of time it takes for an investment to pay for itself is known as the payback period. This is a key metric used to determine the financial viability of an investment decision, and it is calculated by dividing the initial investment by the average annual cash flow. The payback period is an important consideration for investors, businesses, and individuals alike, as it helps them understand how long it will take to recover the costs of their investment and start turning a profit.

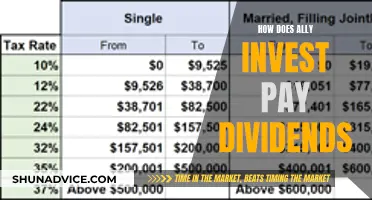

| Characteristics | Values |

|---|---|

| Name | Payback Period |

| Definition | The amount of time it takes to recover the cost of an investment |

| Formula | Cost of Investment ÷ Average Annual Cashflow = Payback Period |

| Calculation | The payback period is calculated by dividing the amount of the investment by the annual cash flow |

| Advantages | Simple calculation; useful for small companies; allows for risk comparison |

| Disadvantages | Ignores time value of money; doesn't account for profitability; doesn't factor in other factors like the lifespan of an asset |

Payback period

The payback period is a metric used to determine the length of time it takes for an investment to pay for itself. It is calculated by dividing the initial investment by the average annual cash flow, and the result is expressed in years or fractions of a year. This calculation allows investors to determine whether an investment is financially viable and how long it will take to break even.

For example, if you invest $15,000 in solar panels that save you $1,500 per year on your energy bill, the payback period would be calculated as follows:

$15,000 (initial investment) / $1,500 (annual savings) = 10 years

So, it would take 10 years to recoup the initial investment, after which you will pocket the $1,500 savings each year. The payback period is an important consideration for anyone thinking about investing, as it helps determine how long it will take to recover the initial costs. Generally, shorter payback periods are more desirable, as they indicate a quicker return on investment and lower risk.

However, it's important to note that the payback period calculation has some limitations. One of the main drawbacks is that it disregards the time value of money, which refers to the idea that money today is worth more than the same amount in the future due to its earning potential. Additionally, the payback period does not take into account the overall profitability of an investment after the payback occurs. Other metrics, such as the net present value (NPV) or internal rate of return (IRR), may be preferred by investors as they consider the time value of money.

Despite its limitations, the payback period is a useful tool for investors, financial professionals, and corporations when evaluating potential investments. It is particularly advantageous for small companies that don't have a large number of investments and for comparing the risk levels of different projects. When deciding between multiple projects or investments, the shortest payback period is generally considered the most acceptable.

Makeup Investment: Who's Spending?

You may want to see also

ROI

The payback period is the amount of time it takes for an investment to pay for itself. It is a key metric used to determine the length of time a business investment takes to pay for itself. This calculation allows investors to determine whether an investment decision makes financial sense and how much money it will take to reach the break-even point.

The payback period formula is calculated by dividing the cost of the investment by the average annual cash flow:

Payback Period = Cost of Investment / Average Annual Cash Flow

For example, if solar panels cost $5,000 to install and save $100 each month, it would take 4.2 years to reach the payback period:

$5,000 / $100 per month = 4.2 years

In general, investments that generate positive cash flow over time are considered to have a shorter payback period, making them more attractive investments. Conversely, investments that produce negative cash flow over time are considered to have a longer payback period, making them less desirable.

The payback period is an important metric for investors, financial professionals, and corporations when evaluating potential investments. It is often used in conjunction with the return on investment (ROI) to determine whether or not to invest. While the payback period focuses on the length of time to recoup the initial investment, the ROI measures the profitability of the investment.

It is worth noting that the payback period has some limitations. One of the main downsides is that it disregards the time value of money, which refers to the idea that money today is worth more than the same amount in the future due to its earning potential. Additionally, it does not account for the effects of inflation or the complexity of investments with unequal cash flow over time.

Ally Invest Dividends: Unlocking the Power of Passive Income

You may want to see also

Self-amortization

The payback period is the amount of time it takes to recover the cost of an investment. It is calculated by dividing the cost of the investment by the average annual cash flow. For example, if an investment costs $15,000 and is expected to save you $1,500 each year, the payback period would be 10 years.

Self-amortizing loans are a type of loan that is paid off over a specific period of time through regular instalment payments. With each payment, the borrower pays off part of the principal and the interest. Self-amortizing loans differ from interest-only mortgages, where the borrower only pays interest and does not make payments towards the principal during the life of the mortgage. An advantage of self-amortizing loans is that the borrower does not have to make a lump-sum payment of the principal at maturity. However, these loans typically have higher monthly payments than other types of loans.

Self-amortizing mortgages, also known as self-liquidating mortgages, are residential mortgages that are fully paid over a scheduled time period, typically 15 to 30 years, through regular payments of principal and interest. Lenders usually provide amortization tables that show the breakdown of principal and interest paid over the full term of the loan.

Coastal Property: A Smart Investment?

You may want to see also

Break-even point

The term "break-even point" is used to describe the moment when an investment, business, or project starts earning a profit. In other words, it is the point at which the original cost of an investment equals the market price. This can be applied to various contexts, such as corporate accounting, stock market trading, and property.

In corporate accounting, the break-even point is the production level at which total revenues for a product equal total expenses. It is calculated by dividing the fixed costs of production by the price per unit minus the variable costs of production. This formula can be used to determine how many units need to be sold to cover fixed costs and break even.

For example, consider a company with $1 million in fixed costs and a gross margin of 37%. To break even, the company needs to generate $2.7 million in revenue ($1 million divided by 0.37). If the company generates more sales, it will make a profit; if it generates fewer sales, it will incur a loss.

The break-even point is also important in stock market trading. For instance, if an investor buys a stock at $110, that becomes their break-even point on the trade. If the price rises above $110, the investor makes a profit; if it drops below $110, they lose money.

In property, the break-even point is the amount of money a homeowner needs to generate from a sale to offset the net purchase price, including closing costs, taxes, fees, insurance, and interest paid on the mortgage, as well as maintenance and home improvement costs.

The break-even point is a valuable tool for decision-making, as it helps businesses and investors determine the minimum sales volume or price movement needed to cover all costs and break even. However, it has limitations, such as its reliance on the assumption that costs can be neatly divided into fixed and variable categories, and its ignorance of external factors like market competition and consumer satisfaction.

Is It Worth Investing in Ripple?

You may want to see also

Discounted payback period

The discounted payback period is a capital budgeting procedure used to determine the profitability of a project. It is a modified version of the payback period that accounts for the time value of money.

The discounted payback period gives the number of years it takes to break even from an initial expenditure by discounting future cash flows and recognizing the time value of money. It is used to evaluate the feasibility and profitability of a given project.

The payback period formula divides the total cash outlay for the project by the average annual cash flows, but this does not provide an accurate answer to the question of whether to take on a project because it assumes only one upfront investment and does not factor in the time value of money.

The discounted payback period is calculated by first estimating the periodic cash flows of a project and showing them by period in a table or spreadsheet. These cash flows are then reduced by their present value factor to reflect the discounting process. This can be done using the present value function and a table in a spreadsheet program.

Next, assuming the project starts with a large cash outflow, the future discounted cash inflows are netted against the initial investment outflow. The discounted payback period process is applied to each additional period's cash inflow to find the point at which the inflows equal the outflows. At this point, the project's initial cost has been paid off, with the payback period being reduced to zero.

The discounted payback period is considered more accurate than the standard payback period calculation because it factors in the time value of money. The shorter the discounted payback period, the sooner a project or investment will generate cash flows to cover the initial cost.

The discounted payback period can be calculated using Microsoft Excel. Create a cell for the discounted rate and columns for the year, cash flows, the present value of the cash flows, and the cumulative cash flow balance. Input the known values (year, cash flows, and discount rate) in their respective cells. Use Excel's present value formula to calculate the present value of cash flows.

SEO Investment: When to Take the Plunge?

You may want to see also

Frequently asked questions

The payback period is the amount of time it takes to recover the cost of an investment and reach a break-even point.

The payback period is calculated by dividing the amount of the investment by the annual cash flow.

Formula: Payback Period = Cost of Investment / Average Annual Cash Flow

The shorter the payback period, the better. A shorter payback period indicates less risk and a quicker route to profit.

The payback period calculation is simple but does not account for the time value of money, the effects of inflation, or the complexity of investments with unequal cash flow over time.