Investing in cryptocurrency is a hot topic, with many people eager to get in on the action. However, it's important to remember that crypto is a high-risk and volatile asset class. So, when deciding how much to invest, it's crucial to consider your financial goals, risk tolerance, and disposable income.

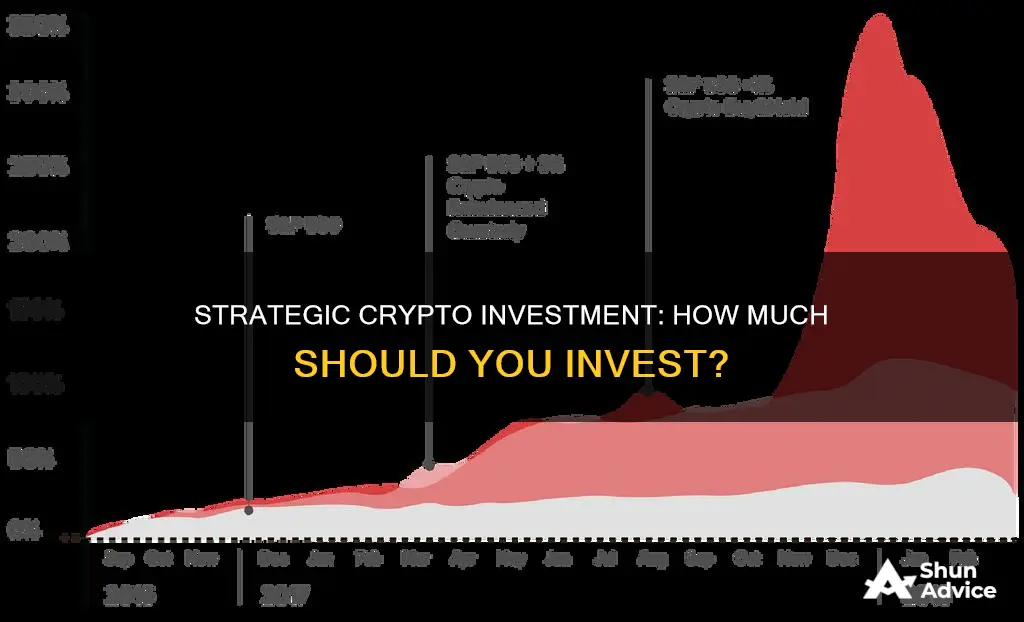

Experts generally recommend investing a small percentage of your portfolio in cryptocurrency, often quoted as 5% or less. This allows you to test the market and gauge your risk appetite without putting your entire net worth on the line.

It's also essential to do your research and understand the risks involved. Crypto markets can be extremely volatile, with sharp increases followed by sudden drops. As such, it's a good idea to only invest what you can afford to lose and to ensure your finances are in order before dipping your toes into the crypto waters.

Additionally, diversification is key. Investing in a range of cryptocurrencies and other asset classes can help reduce the overall risk of your portfolio.

So, before investing in crypto, carefully consider your financial situation, risk tolerance, and investment goals to determine how much you are comfortable allocating to this risky but potentially lucrative asset class.

| Characteristics | Values |

|---|---|

| Amount to invest | Erik Finman, a 19-year-old bitcoin millionaire, recommends investing 10% of your income into the top cryptocurrencies, especially bitcoin. However, personal finance experts suggest that you should consider investing a smaller percentage of your savings, as low as 1%, due to the high risk and volatility of the crypto market. Ultimately, the decision depends on your risk tolerance and financial situation. |

| Risk tolerance | Consider an amount that you feel comfortable losing entirely. Avoid investing money that you need or cannot afford to lose. |

| Profit tolerance | Think about how you would react if your investment grew 20x in value. Would you make emotional decisions that could lead to losses? |

| Diversification | Consider diversifying your investment portfolio by allocating your capital to different investment vehicles, such as real estate, stocks, gold, or other cryptocurrencies. |

| Timing | Consider the current market conditions and trends when deciding the amount to invest. For example, if the market is close to its all-time high, you may want to invest a smaller amount initially and adjust it as the market changes. |

| Change of mind | Leave room for changing your mind in the future. Instead of investing a lump sum, consider dividing your investment over time, such as investing a fixed amount monthly or quarterly. |

| Minimum investment | There is no minimum amount required to start investing in cryptocurrency. However, some platforms may have minimum trade requirements, typically around $5 to $10. Be mindful of fees, as they can quickly eat into small investments. |

What You'll Learn

Risk tolerance: Only invest what you're comfortable losing

Risk tolerance is a measure of the degree of loss an investor is willing to endure within their portfolio. It is an important component of investing and often determines the type and amount of investments that an individual chooses.

The crypto market is marked by high volatility and massive price swings that occur within a few hours. Not everyone is comfortable with the risks attached to such a volatile market. Hence, it is crucial to have a clear understanding of your risk tolerance before investing in crypto.

- Age, investment goals, and income: These factors contribute to an investor's risk tolerance. Older investors with shorter investment horizons may have a lower risk tolerance, while younger investors with longer time horizons may be more willing to take on risk.

- Future earning capacity and other assets: Investors with a higher future earning potential or other stable sources of funds, such as a home, pension, or inheritance, may have a higher risk tolerance.

- Aggressive vs. conservative investors: Aggressive investors have a higher risk tolerance and are willing to risk more money for potentially higher returns. They often invest in volatile assets. Conservative investors, on the other hand, seek investments with guaranteed returns and are less tolerant of risk.

- Emotional response to financial losses: Understanding your emotional response to financial losses is crucial in determining your risk tolerance. Some investors may experience sleepless nights after a small decline in their portfolio, while others may remain calm even after significant losses.

- Time horizon: The time horizon for an investment also affects risk tolerance. Longer-term investments may allow for higher-risk assets, while shorter-term financial goals may be more suitable for lower-risk investments.

To assess your risk tolerance, you can take online risk tolerance assessments or risk-related surveys. It is also helpful to review historical returns for different asset classes to understand the volatility of various financial instruments.

Remember, it is essential to be realistic about how much variability you are willing to withstand in your investments. Educate yourself about the risks involved in the crypto market, including price volatility, hacking and digital theft, unfavorable government regulations, and the influence of whale activities.

Only invest what you are comfortable losing, and always do your research before making any investment decisions.

Certified Coins: Worthy Investment or Overhyped?

You may want to see also

Diversification: Spread your investments beyond crypto

Diversification is a key concept in investing, and it's especially important in the volatile cryptocurrency market. By spreading your investments across different asset classes, you can reduce your risk and stabilise your portfolio. While diversification within the crypto market is important, true diversification means spreading your investments beyond crypto.

- Stocks: Invest in stocks of companies focused on the crypto sector or with large cryptocurrency holdings.

- Bonds: Consider blockchain-based bonds or bonds that invest in cryptocurrencies.

- Real Estate: Explore blockchain-based real estate tokens or traditional real estate investments.

- Precious Metals: Gold and other precious metals are safe-haven assets that can provide stability during market turmoil.

- Currencies: Cash is a safe-haven asset, but it's generally not advisable to hold cash long-term due to inflation.

Remember, diversification doesn't eliminate risk entirely, but it helps to mitigate it. By diversifying your investments beyond crypto, you can reduce your exposure to market risk and improve the stability of your overall investment portfolio.

Ameritrade's Bitcoin Investment: A Beginner's Guide

You may want to see also

Volatility: Be aware of crypto's rapid price changes

Volatility is a measure of how much the price of an asset changes over time. It is the speed and extent of these price changes in any market. Generally, the more volatile an asset is, the riskier it is considered to be as an investment. Volatile assets can offer higher returns or higher losses over shorter periods of time compared to less volatile assets.

As a relatively new asset class, crypto is widely considered to be volatile. Crypto markets are known for their significant price swings, which would be considered major events in traditional financial markets. Crypto's volatility is in a league of its own when compared to more mainstream markets.

Bitcoin (BTC), for example, has witnessed over eight 50% corrections in its 15 years of existence. However, it has also managed to recover from each correction and reach new all-time highs. This is indicative of the high volatility in the crypto market, where prices can skyrocket or drop aggressively in a short space of time.

The unique characteristics of the crypto market contribute to its volatility. The market is still in its early and high growth phase, with new participants constantly entering and trying to establish consensus on the fair value of digital assets. The relatively small size of the crypto market, with its lower liquidity and depth, also makes it more susceptible to price movements.

The distribution between supply and demand further influences volatility. The limited supply of certain crypto assets, such as Bitcoin, can create conditions where sudden increased demand puts upward pressure on prices, increasing volatility. The actions of large holders, often called "whales", can also significantly impact prices. The crypto market's immaturity and lack of comprehensive regulation further contribute to its volatile nature.

Understanding the volatility of crypto is crucial for investors. While it presents opportunities for high returns, it also carries the risk of significant losses. Investors need to carefully consider their risk tolerance and make informed decisions about how much they are comfortable investing in crypto.

Bitcoin Stock Investment: A Guide to Getting Started

You may want to see also

Research: Understand what you're investing in

Understanding what you're investing in is a crucial step in the process of investing in cryptocurrency. Here are some key considerations to make when conducting your research:

- Review the white paper: A white paper is a document that outlines the objectives, technical details, and vision of a cryptocurrency project. It should be easily accessible and provide specific details about the project, including a timeline, an overview, and the problem it aims to solve. Be wary of projects with incomplete or misleading white papers.

- Research the team: Cryptocurrencies are typically created by a team of founders and software developers. Review the professional experience and background of the team members, including their previous projects and roles. Be cautious if the founders or developers remain anonymous or have no relevant experience.

- Learn about the leadership: Understand the leadership structure of the crypto project and research their backgrounds. Consider their history of successful leadership positions, reputation in the industry, and involvement in the crypto space.

- Get to know the crypto community: Most cryptocurrencies rely on community support to grow. Join community platforms such as Discord, Telegram, or social media channels to gauge the level of community engagement and the quality of discussions. A well-organized and active community can be a positive sign for the project's potential.

- Understand the technology: Gain a basic understanding of blockchain technology and how it works. Learn about the specific blockchain used by the cryptocurrency, its consensus protocol, and how it maintains security and integrity.

- Review the road map: A road map outlines the expected progress and milestones of a cryptocurrency project over time. Look for clear and concise milestones that demonstrate forward momentum and a clear direction. Be cautious if the road map is vague or based solely on funding.

- Learn the tokenomics: Tokenomics refers to the distribution, circulation, and total supply of a cryptocurrency. Understand the circulating supply, total supply, and maximum supply of the token, as these factors can impact its price over time. Be wary of uneven token distribution methods that may influence prices artificially.

- Scam awareness: Be vigilant for potential scams and fraudulent activities. Never share your personal or account information with unverified sources. Use regulated and reputable exchanges, and be cautious of social media approaches and offers that seem too good to be true.

By conducting thorough research and due diligence, you can make more informed decisions about investing in a particular cryptocurrency and better understand the potential risks and rewards.

Bat Crypto: Worth Investing or Not?

You may want to see also

Long-term goals: Consider crypto's future potential

Investing in crypto is a risky business, but it can be rewarding over time. The crypto market is infamous for its unpredictability, creating millionaires as often as it bankrupts investors.

If you're considering investing in crypto for the long term, it's important to understand the market and the potential risks and rewards. Here are some things to keep in mind:

Long-Term Investment Strategies

Long-term crypto investment strategies involve holding digital assets for an extended period, often years. Here are some popular long-term investment strategies:

- Buy-and-Hold: This classic strategy involves buying promising cryptocurrencies and holding onto them through market ups and downs. The idea is to weather short-term volatility and focus on potential long-term price appreciation.

- Dollar-Cost Averaging (DCA): This disciplined approach involves investing a fixed amount of money at regular intervals (e.g. weekly or monthly), regardless of the asset's price. This strategy allows you to buy more when prices are low and less when prices are high, ultimately lowering your average purchase price over time.

- Research-Backed Investments: Conduct thorough research and due diligence on promising projects with strong fundamentals. Look for teams with a track record, clear roadmaps, and partnerships that indicate long-term potential.

- Diversification: Diversifying your portfolio across different crypto assets can spread risk and enhance your chances of long-term success. Consider investing in a mix of established cryptocurrencies (e.g. Bitcoin, Ethereum) and promising altcoins.

Understanding the Crypto Market

The crypto market is highly dynamic and volatile, and it's essential to understand its unique characteristics before investing. Here are some key considerations:

- Volatility: Cryptocurrencies are extremely volatile and subject to large swings in both directions. This volatility presents opportunities for incredible gains but also poses the risk of crushing losses.

- High Risk: Investing in crypto is generally considered high risk due to the unpredictable nature of the market and the lack of centralized entities to hold responsible. It's crucial to only invest what you can afford to lose.

- Long-Term Potential: Despite the volatility and risks, cryptocurrencies have the potential for long-term growth. Bitcoin, for example, has been one of the best-performing assets in the world over the past decade.

- Blockchain Technology: Crypto investments allow you to capitalize on the transformative power of blockchain technology, which has the potential to revolutionize various industries.

Choosing the Right Cryptocurrencies

When deciding which cryptocurrencies to invest in for the long term, consider the following:

- Market Capitalization: Many long-term investors choose to invest in the top coins by market capitalization, such as Bitcoin (BTC), Ethereum (ETH), and XRP. These coins have a strong track record and are widely considered to be more stable than newer, smaller-cap coins.

- Fundamentals: Look for cryptocurrencies with strong fundamentals and real-world utility. Assess the adoption potential, technical specifications, the development team, community engagement, and competitors.

- Long-Term Roadmaps: A robust long-term development roadmap signals a crypto project's commitment and direction. It outlines future enhancements, partnerships, and technology upgrades, indicating sustainability and growth potential.

- Performance in a Bear Market: Consider how a cryptocurrency performs during bearish market conditions. A coin that demonstrates positive performance during tough times may be a sign of a solid long-term investment.

In conclusion, long-term crypto investing requires a careful and well-thought-out strategy. It's essential to conduct thorough research, understand the market dynamics, and choose cryptocurrencies that align with your investment goals and risk tolerance. Remember, crypto investing is a dynamic and volatile endeavour, and there are no one-size-fits-all solutions.

Best Bitcoin Investment Sites: Where to Invest?

You may want to see also

Frequently asked questions

In theory, it only takes a few dollars to invest in cryptocurrency. However, some trading platforms will take a large chunk of your investment as a fee if you're trading small amounts. It's important to look for a broker or exchange that minimises your fees.

This depends on your risk tolerance and the amount of money you can afford to lose. It's recommended that you invest somewhere between 5% and 30% of your investment capital.

Beginners should shop around for the crypto platform that works for them, knowing that they won't allocate more than 10% of their investment portfolio to buying coins.

Finman recommends investing 10% of your income into the top cryptocurrencies, especially bitcoin.

Financial pros recommend allocating 1% to 5% of your portfolio to crypto.