The amount of cryptocurrency in an investment portfolio is a hotly debated topic. Some experts recommend allocating no more than 5% of a portfolio to crypto, while others suggest starting with just 1%. The volatility of the crypto market and the lack of historical data make it a risky investment compared to traditional assets. However, the potential for outsized returns and the increasing adoption of crypto by companies and institutional investors have made it an attractive option for diversifying investment portfolios. Ultimately, the decision depends on factors such as an investor's risk tolerance, financial circumstances, and knowledge of cryptocurrencies.

| Characteristics | Values |

|---|---|

| Recommended Allocation | 1-20% |

| Conservative Allocation | 1-5% |

| Volatile Nature | High |

| Risk Level | High |

| Potential for Greater Returns | High |

| Portfolio Diversification | High |

| Long-Term Investment | Yes |

Risk tolerance and beliefs

When deciding how much crypto to include in your portfolio, it's important to consider your risk tolerance, which refers to the amount of risk you are comfortable taking on in your investments. If you have a high-risk tolerance, you may be comfortable allocating a larger portion of your portfolio to crypto. On the other hand, if you have a low-risk tolerance, you may want to allocate a smaller portion or avoid investing in crypto altogether.

Your beliefs about crypto also play a role in determining the appropriate allocation. If you strongly believe in the potential of crypto and its long-term growth prospects, you may be willing to allocate a larger portion of your portfolio to it. On the other hand, if you are sceptical or uncertain about crypto, you may prefer to allocate a smaller amount or avoid it altogether.

It's important to keep in mind that crypto is a relatively new and highly volatile asset class. There is limited historical data available, and regulatory policies are still being debated. As such, it is generally recommended that investors only allocate a small percentage of their portfolio to crypto, typically ranging from 1% to 10%. However, some experts suggest allocations of up to 20% or more for investors with a high-risk tolerance and a strong belief in the potential of crypto.

Ultimately, the decision of how much crypto to include in your investment portfolio comes down to your personal risk tolerance and beliefs about the potential of this asset class. It's important to carefully consider these factors and seek professional advice before making any investment decisions.

Invest in Circle Crypto: A Beginner's Guide

You may want to see also

Timing

As with any investment, it is generally recommended to take a long-term perspective when investing in crypto. This means holding your investments for years or even decades, rather than trying to time the market or make short-term speculative bets. By taking a long-term approach, you can reduce the impact of short-term volatility and increase the potential for gains over time.

However, it is important to recognise that the cryptocurrency market is still relatively new and prone to sharp increases and sudden drops in value. As such, the timing of your entry and exit points can have a significant impact on your overall returns.

One strategy to consider is dollar-cost averaging, which involves making small, recurring purchases of crypto on a set schedule, such as weekly or monthly. This approach helps to remove the emotion from investing and reduces the impact of trying to time the market perfectly. By making regular purchases, you will buy relatively more crypto when prices are low and less when prices are high, smoothing out the impact of volatility.

Additionally, it is worth noting that the timing of your crypto investments should also take into account your overall financial situation and goals. It is generally recommended to ensure that you are meeting all your other financial obligations and have a healthy emergency fund in place before considering investing in crypto.

Furthermore, the timing of your crypto investments may depend on your risk tolerance and investment horizon. Younger investors with a longer time horizon may be more comfortable taking on the additional risk of investing in crypto, as they have more time to recover from potential downturns in the market.

In summary, while taking a long-term perspective is generally recommended, the timing of your crypto investments can be influenced by various factors, including market volatility, your financial situation, and your risk tolerance. By considering these factors and utilising strategies like dollar-cost averaging, you can improve the timing of your investments and potentially increase your chances of achieving favourable returns.

Coinbase: A Worthy Investment App?

You may want to see also

Volatility

Cryptocurrency is considered a volatile asset class. This volatility is due to the frequent sharp increases in crypto share prices followed by sudden drops in value. These rapid swings can present an opportunity for impressive gains but also carry the risk of severe losses for investors.

The volatility of cryptocurrencies can be attributed to their distributed nature, which enables a network effect. This means that as the number of users grows linearly, the network value grows geometrically, resulting in exponential growth potential.

The Black-Litterman Model is a tool that can help investors decide how much to allocate to crypto by taking into account their growth estimations and confidence levels. This model starts with a neutral "equilibrium" portfolio and provides a formula for increasing holdings based on the investor's views and growth estimates.

Most financial experts recommend investing a small percentage of your portfolio in cryptocurrency, with a common suggestion being around 5%. This allows investors to gain exposure to potential gains while limiting the impact of losses.

Some experts suggest even lower allocations, such as 1%, especially for those new to crypto investing. It is important to consider your financial circumstances, risk tolerance, and other factors when deciding how much to allocate to crypto.

It is worth noting that the volatility of cryptocurrencies can also provide opportunities for investors. For example, the dollar-cost averaging strategy involves making small, recurring purchases on a set schedule, which can help to reduce the impact of volatility and build a position over time.

Additionally, crypto investors can use technical indicators, such as moving averages and relative strength, to inform their decision-making and better time their entries and exits.

While crypto's volatility can present challenges, it is possible to carefully include it as part of a well-balanced portfolio by following core principles such as strategic asset allocation, secure storage, and buying fundamentally strong projects.

Understanding Bitcoin Investment Income Tax Requirements

You may want to see also

Diversification

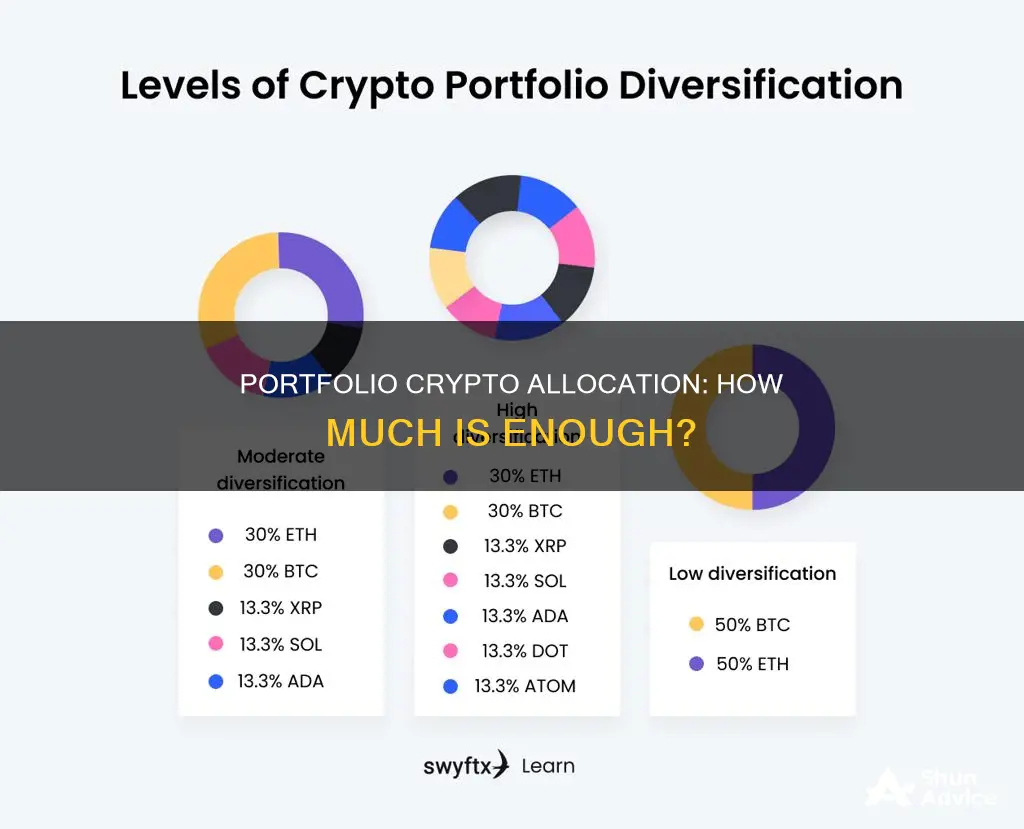

Diversifying your crypto portfolio means spreading your investments across a range of cryptocurrencies and blockchain technologies, rather than putting all your money into one or two coins. This approach can provide more stability and potentially higher returns over time. It also allows investors to benefit from the growth of the overall crypto market and expose themselves to more crypto assets for the long term.

There are several ways to diversify a crypto portfolio:

- Different Cryptocurrencies: Investing in a variety of cryptocurrencies with different use cases and functionalities, such as Bitcoin, Ethereum, Cardano, and stablecoins like Tether.

- Market Capitalization: Diversifying across cryptos with different market caps can provide a mix of stability and growth potential. A crypto with a larger market cap may be more stable, while smaller market caps may offer stronger growth potential.

- Location: Choosing crypto projects from different locations can expose investors to a wider range of innovations.

- Industries: Cryptocurrencies are used in various industries, including finance (Decentralized Finance or DeFi), gaming, supply chain, healthcare, and entertainment.

- Asset Classes: Branching out to different asset classes, such as utility tokens (e.g., Basic Attention Token), non-fungible tokens (NFTs), stocks of crypto-focused companies, blockchain-based bonds, and real estate tokens.

- Risk Level: Allocating more to stable and established cryptos like Bitcoin and Ether and adding smaller percentages of riskier emerging crypto projects.

It is important to note that while diversification can reduce risk, it does not eliminate it completely. The crypto market is subject to high volatility, and investors should carefully consider their risk tolerance and investment goals before allocating their portfolio.

Financial experts generally recommend that investors allocate a small percentage of their portfolio to cryptocurrency due to its emerging and volatile nature. Suggested allocations range from 1% to 20%, depending on the investor's risk appetite and beliefs about crypto. It is crucial to do your own research and consult with financial professionals before making any investment decisions.

Strategizing Bitcoin Investments: Tracking for Success

You may want to see also

Long-term returns

When considering the long-term returns of adding crypto to your investment portfolio, it's important to weigh the potential benefits against the risks.

Potential Benefits of Crypto in Your Portfolio

Adding cryptocurrencies to your portfolio can potentially improve your long-term returns. A report by the CFA Institute Research Foundation found that a quarterly rebalanced 2.5% allocation to Bitcoin improved returns from a traditional portfolio by nearly 24% between January 2014 and September 2020.

Cryptocurrencies, particularly Bitcoin, have the potential for exponential growth due to their finite supply and increasing demand. This can result in outsized gains for investors.

Risks of Crypto in Your Portfolio

However, it's crucial to approach crypto investments with caution. Cryptocurrencies are highly volatile and prone to sharp increases and sudden drops in value. This volatility can lead to significant losses if the timing of your investment is not ideal.

Additionally, cryptocurrencies are considered riskier investments compared to traditional securities in the stock market due to their relatively short history and limited regulatory policies.

Expert Recommendations

Most financial experts recommend allocating a small percentage of your portfolio to cryptocurrencies due to their risky and volatile nature. The suggested allocation ranges from 1% to 5%, with some experts suggesting up to 10% for enthusiasts or those with a higher risk tolerance.

Ric Edelman, founder of Digital Assets Council of Financial Professionals, suggests that even a 1% allocation to cryptocurrency can provide the benefits of diversification without risking the entire portfolio.

It's important to assess your financial circumstances, risk tolerance, and investment goals before deciding how much crypto to include in your portfolio.

Gold Coin Investment: A Smart Move?

You may want to see also

Frequently asked questions

Most financial experts recommend investing only a small percentage of your portfolio in cryptocurrency because it is an emerging and volatile asset class. Some advisors advocate for allocating 5% or less of your total portfolio toward crypto, while others recommend starting with just 1%.

Cryptocurrency is considered a riskier investment than traditional assets like stocks, bonds, and real estate. Crypto is generally volatile in nature and there is less historical data to help investors build smart portfolios. There are also some lingering questions and debates around regulatory policy with respect to crypto.

Cryptocurrency can be a good way to diversify your portfolio and potentially achieve higher returns. Cryptoassets provide an excellent tool for portfolio management due to their asymmetric risk.