The amount of money people invest in cryptocurrencies varies. Some sources suggest that people should invest 5% to 30% of their investment capital in Bitcoin, with 5% being very safe and 30% being pretty risky. However, it is important to note that investing in cryptocurrencies is highly speculative due to its volatile nature and lack of underlying hard assets or cash flow. Cryptocurrencies are also not widely regulated, which adds to the risk. Despite the risks, there is a growing interest in cryptocurrencies, with a record 43% of respondents in a survey saying they are likely to invest in the next year.

| Characteristics | Values |

|---|---|

| Percentage of people who are likely to invest in crypto in the next year | 43% |

| Percentage of people who already own crypto | 23% |

| Percentage of people who view crypto as an investment | 75% |

| Percentage of people who are unlikely to invest in crypto | 83% |

| Percentage of people who would consider investing in crypto through their retirement account | 44% |

| Percentage of people who would consider investing in crypto if they could store it in their bank account | 57% |

| Percentage of people who would consider a credit card with crypto rewards | 81% |

| Percentage of people who understand how crypto works "very well" | 18% |

What You'll Learn

Young people can attain wealth quickly by investing in crypto

Young people have been increasingly investing in cryptocurrencies, with some even becoming millionaires. While there are risks associated with investing in crypto, there are also success stories of young individuals who have achieved significant financial gains. This has led to a growing perception among young people that investing in crypto is a viable way to attain wealth quickly.

Crypto's Appeal to Young People

Several factors contribute to the appeal of crypto investing among young individuals. One significant reason is the technological fluency of younger generations. Growing up with the internet, smartphones, and computers has made them more adaptable to technological advancements, including cryptocurrencies. The decentralised nature of cryptocurrencies also resonates with young people who have developed a lack of trust in traditional financial institutions due to economic difficulties and recessions.

Erik Finman's Story

A notable example of a young person who achieved financial success through crypto investing is Erik Finman. Finman received a $1,000 gift from his grandmother at age 12, which he used to buy his first bitcoin. By the time he was 18, he had become a millionaire. Finman currently owns 401 bitcoins, which is equivalent to millions of dollars. He advises young people to invest in crypto, stating that it is one of the fastest ways for them to change their economic class.

Tips for Investing in Crypto

While the potential for high returns exists in crypto investing, it is important to approach it with caution. Experts generally advise against investing in crypto due to its volatile nature. Instead, it is recommended to invest a small amount of money that you are willing to lose. Diversifying your investments across different cryptocurrencies, especially the top ones like Bitcoin, is also suggested. Additionally, it is crucial to closely monitor the market and be prepared to switch to a better currency if needed.

The Bottom Line

Investing in crypto has provided young people with opportunities to attain wealth quickly. However, it is important to approach crypto investing with a balanced perspective, considering both the potential gains and the associated risks. Success stories like Erik Finman's highlight the potential for financial success, but it is essential to remember that there are also stories of individuals who have lost money due to the volatile nature of cryptocurrencies.

Bitcoin vs Gold: Which is the Better Investment?

You may want to see also

Crypto investments are high-risk

Cryptocurrency is a high-risk, high-reward investment. While it has yielded high returns in the past, it is subject to extreme volatility, with prices fluctuating rapidly and frequently. The cryptocurrency market is highly speculative, and its future as a currency is uncertain. As a result, the price of digital coins constantly rises and falls.

Unlike stocks, which have a long history of growth over time, cryptocurrency is still in its infancy. Cryptocurrencies are not regulated like stocks, nor are they insured like real money in banks. The lack of regulation and insurance means that investors could lose their entire investment. Cryptocurrency investors have also faced technical issues when trying to cash out their gains, such as forgetting their passwords and being locked out of their accounts.

The cryptocurrency market is also susceptible to scams. Crypto scammers often target young minority investors through social media, promising high returns and removing barriers such as credit checks or income requirements. Unsuspecting investors may fall prey to these scams, losing their investments in the process.

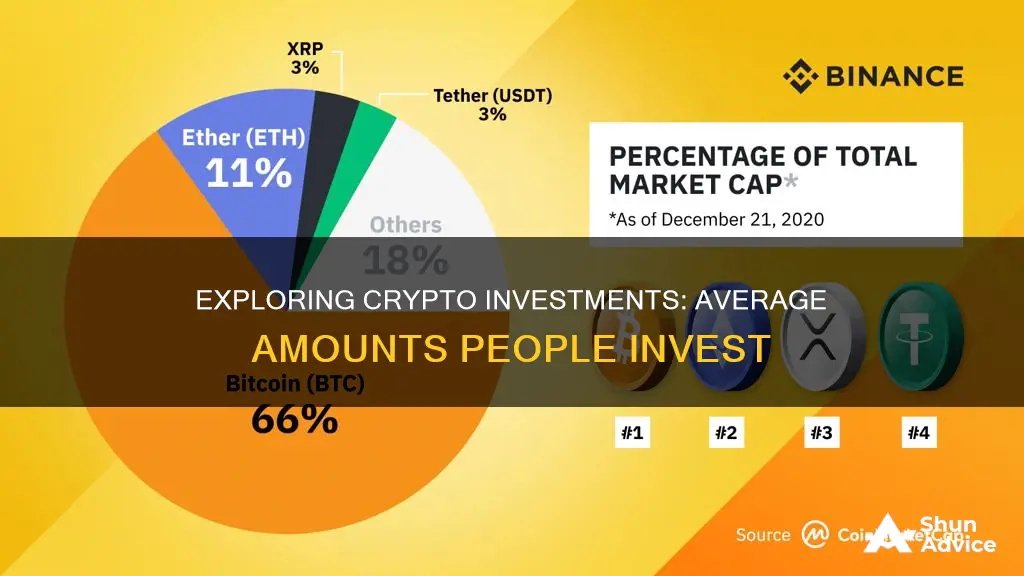

Additionally, the price of cryptocurrency is influenced by many factors, including high-profile support from companies like Tesla and Mastercard. The sector is also highly competitive, with over 23,200 cryptocurrencies and nearly 600 crypto exchanges as of April 2023. This competition further adds to the volatility and risk of the market.

Finally, investing in cryptocurrency carries the risk of regulatory uncertainties. Government regulations around crypto are constantly evolving and may differ based on geographical location. These regulations can impact how investors use or access their crypto, causing further volatility and uncertainty in the market.

In conclusion, while cryptocurrency investments can offer high rewards, they also come with significant risks. Investors considering this market should educate themselves about these risks and only invest what they can afford to lose.

Investing in Rare Coins: Worthwhile or Risky?

You may want to see also

Crypto investments are not regulated

While the cryptocurrency market continues to grow, with many institutional investors joining the space, there are no concrete regulations governing the industry. Crypto assets have been around for over a decade, but regulatory efforts have only recently gained momentum as these assets have evolved from niche products to mainstream speculative investments. The rapid growth in market capitalization, the expansion of crypto products and offerings, and the failures of crypto issuers, exchanges, and hedge funds have all contributed to the push for regulation. However, regulating crypto is challenging due to the fast-evolving nature of the industry, the lack of standardized terminology, and the difficulty in monitoring the thousands of actors involved.

One of the main concerns with the lack of regulation in crypto is the potential for fraud, scams, and abuse. SEC Chairman Gary Gensler has highlighted the need for better protection for investors, who are currently vulnerable to market manipulation, insider trading, and hidden risks. For example, investors may not fully understand the risks associated with putting their savings into an interest-earning crypto platform, and there are limited safeguards if a platform goes bankrupt or is hacked. The anonymous nature of crypto trading also makes it attractive for money laundering and tax evasion, with concerns that it is being used to finance terrorism or funnel money from illegal activities.

Another issue is the impact of crypto on the wider economy, particularly with stablecoins, which are cryptocurrencies that peg their value to commodities like gold or fiat currencies like the US dollar. For example, Tether (USDT), the biggest stablecoin by market cap, is only able to support about half of its tokens in the event of a run, which could affect the stability of the short-term credit market. Without clear guidelines, it is challenging for investors and users to navigate the crypto space safely, hindering future growth.

While some argue that regulation goes against the decentralized nature of cryptocurrency and could stifle innovation, others believe that sensible regulation is necessary to create a safe environment for investors and allow the industry to reach its full potential. A well-designed regulatory framework can provide consumer protection, prevent financial crime, and promote confidence in the industry. However, heavy-handed regulation that hampers legitimate projects should be avoided, as it could drive the crypto industry into more lenient jurisdictions, making it harder to ensure investor protection.

Coinexchange: The Best Place to Invest Your Money?

You may want to see also

Crypto investments are taxable

The world of cryptocurrency is a complex and ever-evolving space, and it's important to understand the tax implications of investing in this asset class.

In the United States, the Internal Revenue Service (IRS) considers cryptocurrencies to be property for tax purposes. This means that any profits or income derived from cryptocurrency investments are generally subject to capital gains taxes. The tax treatment depends on the holding period, with short-term gains (held for 365 days or less) taxed as ordinary income, and long-term gains (held for more than 365 days) taxed at a lower rate. It's worth noting that simply buying crypto is not a taxable event; taxes come into play when you sell, trade, or dispose of your cryptocurrency and realise a gain.

Additionally, the use of cryptocurrency to purchase goods or services is also a taxable event. The increase in value of the cryptocurrency between the time of purchase and the time of spending is taxed, and any other applicable taxes, such as sales tax, may also apply. It's important to keep accurate records of your transactions, as calculating gains or losses can become complex, especially when different types of cryptocurrencies are traded.

For cryptocurrency miners, the value of the crypto at the time it was mined is considered income. If mining is part of a business, expenses such as hardware and electricity can be deducted. On the other hand, if you receive cryptocurrency as payment for goods or services, it must be reported as business income.

The tax treatment of cryptocurrency can vary across different countries. For example, in the Philippines, there is currently a lack of specific guidelines from the Bureau of Internal Revenue (BIR) on the classification and taxation of cryptocurrency income. However, under their Tax Code, gross income includes all income derived from any source, which would include income from cryptocurrency transactions.

Given the dynamic nature of the cryptocurrency market and the evolving regulatory landscape, it's essential to stay informed about the tax implications of your crypto investments. Consulting with a certified accountant or tax professional familiar with cryptocurrency is advisable to ensure compliance with the applicable tax laws and to optimise your tax obligations.

Stablecoins: A Smart Investment Strategy?

You may want to see also

Crypto investments are not insured

Investing in cryptocurrencies is risky, and your assets are not insured in the same way that they are with a bank or brokerage firm. Crypto investments are not insured by the Federal Deposit Insurance Corporation (FDIC) or the Securities Investor Protection Corporation (SIPC). In the event of a crypto exchange bankruptcy, customers with custodially held assets are often last in line to receive any payments, and there is no insurance available for non-custodial wallets, where the investor owns the private keys.

Some crypto exchanges, such as Coinbase, carry crime insurance that protects a portion of digital assets against losses from theft, including cybersecurity breaches. However, these policies do not cover losses resulting from unauthorized access to personal accounts due to a breach or loss of credentials. It is the user's responsibility to maintain strong passwords and control their login credentials. While Coinbase may endeavour to make users whole in the case of a covered security event, total losses may still exceed insurance recoveries.

In the case of crypto firm bankruptcies, investors could lose their assets. For example, in May 2024, Coinbase CEO Brian Armstrong warned users that their assets could be considered part of the company in bankruptcy proceedings, leaving them as unsecured creditors. This risk was realised in the case of Celsius's bankruptcy, where users only had a contract right to be paid back, and custodial account holders were unable to retrieve their assets.

Due to a lack of regulatory oversight, crypto accounts generally fall outside the protective purview of the federal government. The regulatory framework for legal definitions surrounding cryptocurrencies is still being developed. As a result, crypto users should consider arranging their own insurance coverage to protect their investments. Private insurance policies can cover theft, loss of access, business risk, and decentralised finance (DeFi) coverage. However, it is important to understand the terms and read the fine print before purchasing a policy, as some insurance may be a marketing gimmick rather than a legitimate protection.

Overall, crypto investments are not insured, and investors should be aware of the risks involved. While some exchanges offer crime insurance, it may not cover all scenarios, and users are often responsible for securing their own assets. In the event of bankruptcy, investors may lose their assets, and regulatory protections are still being developed.

The Ultimate Bitcoin Stock: Where to Invest?

You may want to see also