How Much Am I Willing to Invest?

The amount of money one is willing to invest is a highly personal decision that depends on several factors, including financial situation, income, savings, debts, and investment goals. While the general rule of thumb is to invest 10%-20% of your income, the more realistic answer may be to invest whatever amount you can comfortably afford.

Before diving into investing, it's crucial to understand your current financial situation by considering factors such as taxed income, debt, emergency funds, and rainy day funds. It's recommended to prioritise paying off high-interest debt and credit card balances before investing.

When determining how much to invest, it's essential to set clear investment goals and understand your risk tolerance. Are you investing for retirement, purchasing a home, or funding your child's education? Your timeline and risk tolerance will influence your investment strategy.

Additionally, consider the different types of investments available, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each investment option carries varying levels of risk and potential returns, so it's important to choose the ones that align with your financial goals and comfort level.

Remember, investing is a long-term commitment, and it's better to start early, even with a small amount, to take advantage of compound earnings.

| Characteristics | Values |

|---|---|

| Amount to invest | As much as you can afford, ideally 10-20% of your income |

| Investment goals | Clear and precise goals, both short-term and long-term |

| Risk tolerance | Depends on your comfort level and investment timeline |

| Investment style | DIY or professional guidance |

| Investment account | Brokerage account, retirement account, managed account |

| Taxes | Taxable, tax-deferred, or tax-free |

| Investment options | Stocks, bonds, mutual funds, ETFs |

What You'll Learn

How much you should invest depends on your financial situation

Income

Firstly, the amount you can invest will depend on your income. It's important to understand your net income, which is your income after tax and other expenses have been deducted.

Financial Goals

You should also consider your financial goals. Are you investing for retirement, to buy a home, or to fund your child's education? Deciding on your end goal will help you set a realistic timeline for reaching it and determine how aggressively you should be investing to make it a reality.

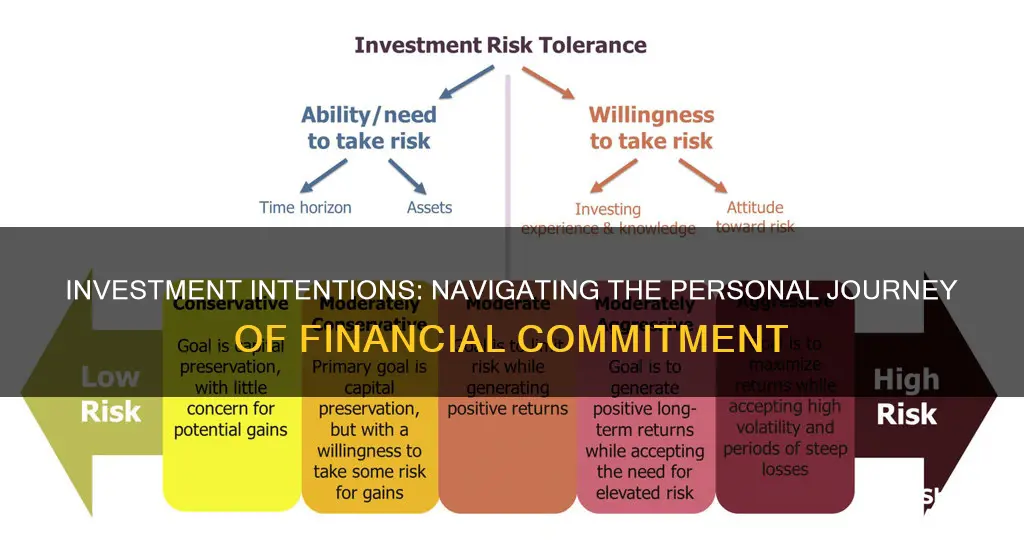

Risk Tolerance

Another factor to consider is your risk tolerance. All investments carry some level of risk, and you need to decide how comfortable you are with assuming that risk. Generally, higher-risk investments offer the potential for higher returns, while lower-risk investments are safer and offer lower returns.

Emergency and Savings Funds

Before investing, it's important to ensure you have enough savings to cover emergency expenses. Experts recommend having between three and six months' worth of living expenses saved in an emergency fund. It's also important to consider any high-interest debt you may have and create a plan to pay it off.

Rules of Thumb

There are a few rules of thumb that can help guide your decision on how much to invest. The 50/30/20 rule suggests allocating 50% of your income to essentials, 30% to discretionary spending, and 20% to savings and investments. Within that 20%, the portion allocated to stocks or riskier investments depends on your risk tolerance. If you're risk-averse, you may prefer a more conservative approach, allocating around 10-15% to stocks. If you have a higher risk tolerance, you could allocate a larger portion, up to 25-30%.

Another general guideline is to invest 10-20% of your income regularly, particularly if you're investing for retirement and hoping to retire by your mid-60s. However, this may not be feasible for everyone, and it's important to invest whatever amount you can comfortably afford.

When to Invest

The sooner you start investing, the better, as your investments will have more time to grow. However, investing a large amount right away may not be suitable for everyone, and it's crucial to consider other factors, such as your financial goals, risk tolerance, and current financial situation.

The Smart Money Move: Pay Off Debt, Then Invest

You may want to see also

Experts recommend investing 10-20% of your income

Experts recommend that you invest between 10% and 20% of your income. This is a general rule of thumb and the exact amount will depend on your financial situation and income level.

The 50/30/20 rule is a popular model to help you craft a financially sound investing and spending plan. According to this rule, 50% of your income should be saved for needs like rent, food, and insurance, 30% should be spent on wants like date nights and subscriptions, and 20% should be invested for long-term goals like retirement.

However, investing 10% of their monthly income might not be feasible for some people. The important thing is to start investing whatever amount you can afford. Even investing a few dollars each month can be enough to see a return if you use the right investment strategy.

Before deciding how much to invest, it's important to understand your current financial situation, including your income, debt balances, and emergency savings. You should also set clear investment goals and determine your risk tolerance.

It's also important to remember that your investment strategy may change over time, so it's crucial to regularly check in with yourself and your budget to ensure that the amount you're investing each month still feels reasonable.

Magic: The Gathering — A Collectible Investment

You may want to see also

Budgeting strategies can help you decide how much to invest

Budgeting is a vital skill to help you manage your finances and improve your financial skills. Budgeting strategies can help you decide how much to invest by determining how much money you can afford to put aside.

There are several budgeting strategies to help you decide how much to invest. Here are some of the most popular ones:

Subtraction budgeting

This is one of the simplest forms of budgeting. You add up all your monthly expenses and subtract that total from your overall monthly earnings. The amount left over can be used for savings and entertainment.

Cash budgeting

This strategy, also known as envelope budgeting, involves using physical cash instead of digital currency for purchases and expenses. You put your paycheck into envelopes for specific expenses, such as rent and utilities, to avoid spending it on other things.

Proportional budgeting

With this strategy, you divide your expenses into three categories: savings, needs, and wants. You then decide what percentage of your income will go into each category.

Two-bank budgeting

This strategy involves paying yourself before paying any other expenses. You deposit your paycheck into one account and then transfer a portion to a secondary account, leaving a small amount in the original account for emergencies or other goals.

50/30/20 budgeting

This traditional strategy uses ratios to manage your money. 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment.

Zero-based budgeting

This strategy focuses on ensuring you have enough income to cover your necessary expenses. You subtract your expenses from your monthly income until you have a zero balance, ensuring that every dollar is accounted for.

Savings and emergency budgeting

This strategy is ideal if you want to maximize your savings. A certain percentage of your income goes into a general savings account, and another percentage goes into an emergency fund.

Priority budgeting

This strategy involves determining your own spending priorities instead of relying on predetermined ones. You list your expenses and priorities and decide how much to allocate to each category.

By using these budgeting strategies, you can gain control over your finances, identify areas where you can cut back, and decide how much money you are willing and able to invest.

The Boomer Retirement Crisis: Navigating the Investment Maze

You may want to see also

The amount you invest depends on your income, savings and debts

The amount you invest depends on several factors, including your income, savings, debts, and financial goals.

Firstly, consider your income. Review all your sources of income and check if your employer offers any investment options with tax benefits or matching funds. This will help you maximise your investments.

Next, assess your savings. It is recommended to have an emergency fund that covers three to six months' worth of living expenses before investing. This will ensure you have a financial buffer in case of unexpected costs.

After that, evaluate your debt balances. Prioritise paying off high-interest debt, such as credit card balances. Create a payment plan to manage your debts effectively. Remember, the less debt you have, the more disposable income you will have available for investing.

Finally, define your investing goals. Are you investing for retirement, to purchase a home, or to fund your child's education? Each goal will have a different timeline, affecting your investment strategy. For example, if you are investing for retirement, you may have several decades to grow your fund, allowing you to start small and gradually increase contributions.

While there is no one-size-fits-all answer to how much you should invest, experts generally recommend investing around 10% to 25% of your income. However, the most important thing is to start investing whatever amount you can afford and consistently contribute over time.

Planning for Prosperity: Strategies for Late-Stage Retirement Investing

You may want to see also

Your investment goals will determine how much you invest

For example, if you are investing for retirement, you will likely adopt a different strategy than if you are investing to purchase a home or fund your child's education. The timeline of your investment goal is also important. If you are investing for retirement, you may have decades to grow your money, whereas if you are investing for a shorter-term goal, you will have less time to build up your investments.

Another factor that will influence your investment strategy is your risk tolerance. If you are comfortable with a higher level of risk, you may choose to invest in more volatile assets such as cryptocurrencies or growth-focused stocks. On the other hand, if you have a lower risk tolerance, you may opt for more traditional investments such as treasury bonds or blue-chip stocks.

Your income, age, and savings goals will also play a role in determining your investment strategy. It is generally recommended that you invest a percentage of your after-tax income, with experts suggesting anywhere from 10% to 25%. However, the specific percentage that you invest will depend on your unique financial situation and budget.

It's important to remember that investing is a long-term project and that you don't need to have a large sum of money to start. Even investing a small amount each month can be enough to see a return if you use the right investment strategy. Additionally, it's crucial to periodically reevaluate your investment strategy as your financial situation and goals may change over time.

Safe Havens: Where to Invest Now

You may want to see also

Frequently asked questions

Experts recommend investing around 10-20% of your income. However, the answer will depend on your financial situation, goals, and risk tolerance.

You should review your income sources, establish an emergency fund, pay off high-interest debts, and create a budget to determine how much you can comfortably invest.

Your risk tolerance will influence the types of investments you choose. Lower-risk investments include dividend stocks, bonds, and blue-chip stocks, while high-risk options include small-cap stocks, growth stocks, and sector-specific investments.

It's important to start investing early, even if it's a small amount. You can invest in index funds, exchange-traded funds, or mutual funds with low or no minimum investment requirements. Focus on contributing regularly and choosing the right investment strategy for your goals.