There are many options for retired people to invest their money, and the best approach will depend on their individual circumstances and risk tolerance. Here are some of the most common investment options for retirees:

- Annuities: Annuities are contracts between an individual and an insurance company, where the individual pays a sum of money in exchange for regular income payments. Annuities can be fixed, providing a guaranteed income stream, or variable, with payouts tied to an index. While annuities offer a steady, predictable source of income, they are subject to the risk of inflation and may not be very liquid.

- Bonds: Bonds are fixed-income instruments that were previously considered less competitive for retirees. However, with rising interest rates, bond yields have also increased, making them more attractive. Bonds offer a stream of income with potentially competitive yields and provide effective diversification to a portfolio that includes equities and other asset classes.

- Total return investment approach: This approach involves investing in a diverse mix of stock and bond funds, with the aim of generating interest, dividends, and capital gains. This strategy provides flexibility and the potential for superior returns compared to more traditional retirement investment approaches. However, there is no guarantee that funds will last throughout retirement, and the value of returns can vary.

- Income-producing equities: Some equities, such as dividend-paying stocks and real estate investment trusts (REITs), provide income in the form of dividends. While dividend-paying stocks may not offer the same capital appreciation potential as other stocks, they can provide a regular stream of income and the opportunity for capital appreciation. However, dividend payouts can vary and may become less attractive in a high-interest-rate environment.

- Savings accounts and certificates of deposit (CDs): While these options may not provide high returns, particularly in a low-interest-rate environment, they are safe and reliable, with FDIC-insured bank accounts offering principal protection.

- Part-time employment: For retirees who want to stay active, part-time work or short-term gigs can provide additional income and social engagement.

| Characteristics | Values |

|---|---|

| Investments | Stocks, bonds, annuities, savings accounts, CDs, dividend-paying stocks, income-producing property, real estate investment trusts, mutual funds, money market accounts, high-yield savings accounts, cash, certificates of deposit, equities, exchange-traded funds, fixed annuities, systematic withdrawals, life insurance, home equity, REITs, bond funds, income-producing equities, total return investment approach |

| Considerations | Risk tolerance, age, personal circumstances, tax, retirement goals, financial goals, liquidity, market volatility, inflation, investment fees, investment options, retirement income strategy, tax-efficiency, diversification, investment portfolio, retirement savings, retirement income, retirement account options, net worth, investment decisions, investment strategies, investment income potential, retirement security, retirement plans, retirement expenses, retirement income protection, retirement cash flow, retirement investments, retirement cash flow, retirement goals, retirement needs |

What You'll Learn

Understand your retirement account options

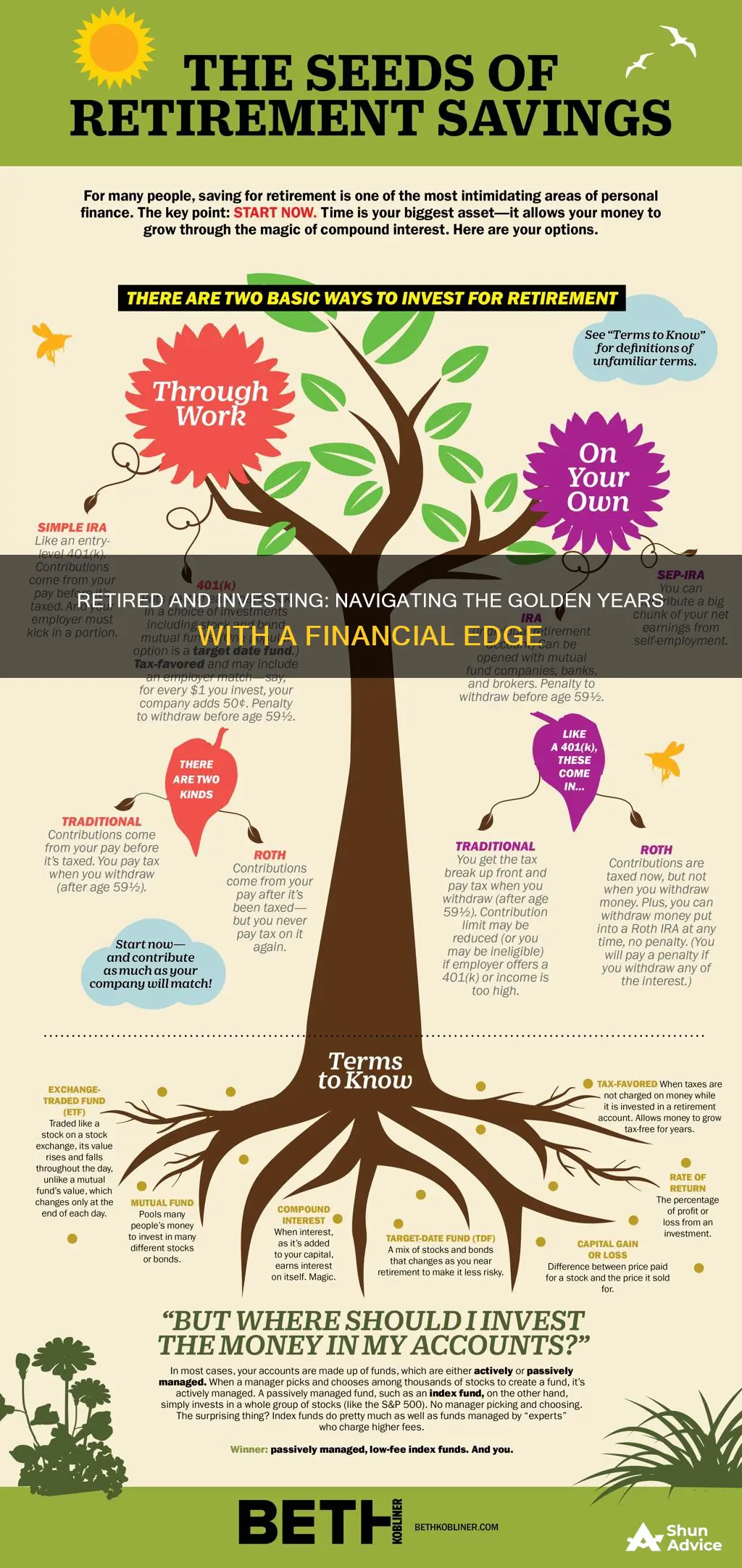

There are several options for retirement accounts, including tax-advantaged and taxable accounts. These include 401(k) plans, individual retirement accounts (IRAs), brokerage accounts, defined-benefit plans, and company plans. Here's a closer look at each:

- 401(k) plans: These are employer-sponsored defined-contribution plans that employees fund. They offer tax incentives, automatic savings, and sometimes matching contributions from employers. The contribution limits for 2023 and 2024 are different, so be sure to check the current limits.

- Individual Retirement Accounts (IRAs): IRAs offer tax-deferred investing for retirement. With traditional IRAs, you can deduct contributions if you meet certain requirements, and withdrawals in retirement are taxed as income. Roth IRAs, on the other hand, don't allow tax deductions on contributions, but qualified distributions are tax-free, and there are no required minimum distributions.

- Brokerage accounts: Most brokerage accounts are taxable and are funded with after-tax dollars. You pay taxes on any investment income or capital gains in the year you receive them.

- Defined-benefit plans: Also known as pensions, these are funded by employers and guarantee a specific retirement benefit based on salary history and employment duration. They are becoming less common outside of the public sector.

- Company plans: These include 401(k) plans and other employer-sponsored defined-contribution plans. For 2024, the contribution limit is $23,000, or $30,500 if you're 50 or older due to the catch-up contribution.

It's important to understand the differences between these account options and how they can fit into your overall retirement plan. Each has its own set of benefits, tax implications, and considerations. Additionally, within these accounts, you'll be choosing specific investments to help grow your retirement savings.

Miami: A Smart Investment Move

You may want to see also

Calculate your net worth

When it comes to investing after retirement, there are many options to consider, from stocks and bonds to cash and certificates of deposit. But before you start investing, it's important to understand your financial position by calculating your net worth. This will give you a clear picture of your financial health and help you make informed investment decisions. Here's a step-by-step guide to calculating your net worth:

Step 1: Identify Your Assets

Assets are the valuable possessions that you own. These can be divided into a few categories:

- Cash and cash equivalents: This includes the money in your bank accounts, such as checking, savings, and retirement accounts. It also includes things like Treasury bills and certificates of deposit (CDs).

- Securities: This refers to investments such as stocks, mutual funds, and exchange-traded funds (ETFs).

- Real property: This includes any real estate you own, such as your primary residence, rental properties, or a second home.

- Personal property: This covers a range of valuable items, such as vehicles, boats, collectibles, jewelry, and household furnishings.

Make a list of all your assets and their current market value. This may involve checking the balance of your bank accounts, the current value of your investments, and the estimated value of your personal and real property.

Step 2: Calculate Your Liabilities

Liabilities are the financial debts that you owe to others. These can include:

- Credit card debt: Any outstanding balances on your credit cards.

- Loans: This includes personal loans, auto loans, student loans, payday loans, and title loans.

- Mortgages: If you own a home, include the remaining balance on your mortgage.

- Other debts: Any other money owed, such as unpaid bills or taxes.

Create a list of all your liabilities and their outstanding amounts. This will give you a clear picture of your financial obligations.

Step 3: Subtract Liabilities from Assets

Once you have a comprehensive list of your assets and liabilities, it's time to calculate your net worth. The formula is simple:

Net Worth = Total Assets - Total Liabilities

Subtract the total value of your liabilities from the total value of your assets. The resulting number will be your net worth. It's important to remember that net worth can be positive or negative. A positive net worth indicates that your assets exceed your liabilities, while a negative net worth means your liabilities exceed your assets.

Step 4: Track Your Net Worth Over Time

Calculating your net worth at a single point in time is useful, but it's even more beneficial to track it over the years. Consider calculating your net worth annually or at significant milestones in your life. This will help you understand if you're on the right financial path and if you need to make any adjustments to your investment strategies or spending habits.

Step 5: Take Action to Improve Your Net Worth

If you find that your net worth is not where you want it to be, there are steps you can take to improve it. You can focus on reducing your liabilities by paying off debts and loans. Additionally, you can work on increasing your assets by investing wisely, saving more, or finding ways to increase your income. Remember that a positive and increasing net worth is generally indicative of good financial health.

Calculating your net worth is a crucial step in financial planning, especially when considering investments during retirement. It provides a snapshot of your financial position and can help guide your investment decisions. By understanding your net worth, you can make more informed choices about where to allocate your resources and how to achieve your retirement goals.

Hertz: Why Investors Are Betting Big

You may want to see also

Keep your emotions in check

It is important to keep your emotions in check when investing as a retired person. Investments can be influenced by your emotions far more easily than you might realise. Emotional investing can make it difficult to build wealth over time. When investments perform well, you may feel overconfident, underestimate risks, and make bad decisions that cause you to lose money. On the other hand, when investments perform badly, you may sell at a loss and put all your money into low-risk cash and bonds, missing out on the potential for the market to recover.

To avoid emotional investing, it is important to:

- Be realistic: Not every investment will be a winner and not every stock will grow.

- Keep emotions in check: Be mindful of your wins and losses, both realised and unrealised. Rather than reacting, take the time to evaluate your choices and learn from your mistakes and successes. You’ll make better decisions in the future.

- Maintain a balanced portfolio: Diversify in a way that makes sense for your age, risk tolerance, and goals. Rebalance your portfolio periodically as your risk tolerance and goals change.

The Student Debt Dilemma: To Invest or To Repay?

You may want to see also

Tax-efficient portfolio

Municipal bonds, or muni bonds, are issued by local governments to fund projects like road improvements or building schools. When you invest in a municipal bond, you are effectively loaning money to the government and earning a guaranteed rate of return in the form of interest payments, which are exempt from federal taxes.

Tax-exempt mutual funds are another option. These funds are assigned tax-exempt status, meaning you pay no taxes on the returns. They typically hold municipal bonds and other government securities, offering tax benefits and simplified diversification. However, it is important to consider the return and expense ratio of these funds before investing.

Exchange-traded funds (ETFs) are similar to mutual funds but trade on an exchange like a stock. ETFs can be municipal bond-focused, providing the same tax-exempt benefit. There are short-, mid-, and long-term options depending on your goals.

Another option is a Roth IRA or Roth 401(k). With a Roth IRA, you contribute after-tax dollars to your account, up to an annual limit. In 2024, the limit is $7,000, and you can continue adding after-tax dollars indefinitely as long as you have earned income for the year. You can start withdrawing money tax-free from your Roth IRA once you turn 59 1/2, and Roth IRAs are not subject to required minimum distributions (RMDs) once you reach age 72.

Health Savings Accounts (HSAs) are another tax-efficient option. With an HSA, you can save for future medical expenses while reducing your taxable income. You can make contributions to your account each year, up to the annual limit, and the money grows on a tax-deferred basis. When you withdraw the money for qualified medical expenses, the distribution is 100% tax-free.

Finally, consider a 529 college savings plan. These plans offer tax-free investment growth and withdrawals for qualifying education expenses.

It is important to note that while these strategies can help reduce your tax liability, you will not be able to avoid taxes altogether. Consulting a financial advisor can help you develop a long-term tax planning strategy and determine the best investments for your portfolio.

Current Investment Banking Deals: Where?

You may want to see also

Annuities

There are four basic types of annuities:

- Fixed annuities: These offer a contractually guaranteed rate of return on your investment and will pay out over a specified period. The advantage is that you know the rate of return when you set up the annuity, helping you plan your budget. However, the purchasing power of a fixed amount of income each month will decline over time due to inflation.

- Variable annuities: These allow for a payout that may grow over time by investing your money in various mutual funds or other funds that hold stocks, bonds and other assets. The advantage is the potential for greater returns, but there is also more risk during recessions.

- Immediate annuities: With this type, you pay the insurer a lump sum and start collecting regular payments right away.

- Deferred annuities: This is more of a long-term tool. After paying in, you don't collect until a specified date in the future.

Understanding Investment Pay Periods: Unlocking the Timeline of Returns

You may want to see also

Frequently asked questions

Some low-risk income sources for retirees include fixed annuities, dividend-paying stocks, income-producing properties, savings accounts and CDs, and part-time employment.

Some high-return, low-risk investments for retirees include high-yield savings accounts, money market funds, blue-chip stocks, bank certificates of deposit, and bond funds.

Some tips for successful retirement investing include understanding your retirement account options, starting early, calculating your net worth regularly, paying attention to investment fees, and working with a financial professional if needed.

Some strategies for investing after retirement include taking inventory of your spending needs, avoiding fear-driven investment decisions, ensuring your portfolio is diversified, aiming for tax efficiency, and considering annuities for income protection.