The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the military. It is similar to a 401(k) plan and offers tax benefits, low fees, and employer contributions. The TSP has a range of investment options, including bonds, stock funds, and a government securities fund.

When deciding how to invest your TSP, it is important to consider your risk tolerance and time horizon. The TSP offers five individual investment funds and Lifecycle (L) funds, which are a combination of the five individual funds. The five individual funds are:

- The Government Securities Investment (G) Fund

- The Fixed Income Index Investment (F) Fund

- The Common Stock Index Investment (C) Fund

- The Small Capitalization Stock Index Investment (S) Fund

- International Stock Index Investment (I) Fund

The G Fund is the safest option, investing in government securities and offering stable returns. The F Fund invests in bonds and is relatively safe, while the C, S, and I Funds are stock funds that carry more risk but offer higher potential returns.

When choosing how to allocate your TSP investments, it is recommended to consult a financial advisor who can consider your unique circumstances and goals.

| Characteristics | Values |

|---|---|

| Type of plan | Retirement savings and investment plan |

| Who is it for? | Federal employees and members of the military |

| Tax benefits | Same as 401(k) |

| Contributions | Taken straight out of your paycheck |

| Contribution limit | $22,500 for 2023 ($23,000 for 2024) with an additional $7,500 for those aged 50 or older |

| Matching contributions | Yes, up to 5% |

| Investment options | Five different individual fund options, or a Lifecycle fund |

| Investment recommendations | 80% in the C Fund, 10% in the S Fund, and 10% in the I Fund, or 60-20-20 option |

What You'll Learn

Traditional vs Roth TSP Investing

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the military. It is similar to a 401(k) plan: a tax-advantaged retirement savings plan offered through an employer. The TSP is administered by the Federal Retirement Thrift Investment Board (FRTIB).

There are two types of TSPs: traditional and Roth. The main difference between the two is how they are taxed.

Traditional TSP

With a traditional TSP, you make contributions with pre-tax dollars, which lowers your taxable income for the year. This means you pay less in taxes now, but you will have to pay taxes on your withdrawals during retirement. Contributing to a traditional TSP can also help you qualify for certain tax credits and perks, such as Child Tax Credits and IRA contribution limits.

A traditional TSP may be a better choice if you want to reduce your current taxable income and expect to be in a lower tax bracket during retirement. It can also be advantageous if you believe that tax regulations will be in your favour later in life.

Roth TSP

With a Roth TSP, contributions are made with after-tax dollars, meaning you pay taxes on the money upfront. However, your retirement withdrawal will be tax-free, provided that certain requirements are met.

A Roth TSP might be a better choice if you expect your taxes to be higher in the future, for example, if your salary is expected to increase. It can also be beneficial if you believe that tax rates will increase, as you can pay taxes now and enjoy tax-free withdrawals in retirement.

Other Factors to Consider

When deciding between a traditional and Roth TSP, there are several other factors to consider:

- The state you will be living in during retirement, as different states have different income tax rates.

- Whether you have any heirs, as they will be responsible for the tax bill with a traditional TSP, whereas with a Roth TSP, they can withdraw their inheritance tax-free.

- When you will be accessing these accounts, as there is a standard 10% penalty for accessing TSPs before the age of 59.5, and Roth TSPs have an additional requirement of five years since the first contribution.

- How much money you will need at once, as withdrawing a large sum from a traditional TSP can cause a taxable income increase or push you into a higher tax bracket.

- Required Minimum Distributions (RMDs), which apply to traditional TSPs but not Roth TSPs.

- Contribution limits, which apply to the combined total of your traditional and Roth TSP contributions.

- Matching contributions, which go to your traditional TSP and cannot be converted to Roth.

The decision between a traditional and Roth TSP depends on your individual circumstances and future expectations for taxes and income. Both options offer advantages that will fit your financial situation. In some cases, it might even make sense to use both traditional and Roth TSP accounts to enjoy the benefits of each, a strategy known as tax diversification.

Diversification: Investors Seek Safer Havens

You may want to see also

How to Enrol in the TSP

Enrolling in the Thrift Savings Plan (TSP) is automatic for federal employees who joined the service on or after 1 October 2020. Civilian employees are automatically enrolled, but servicemembers are not. Servicemembers need to log in to the TSP website, select a contribution percentage, and choose how to invest their savings.

If you are not automatically enrolled, you can enrol online via your agency's electronic payroll system or by paper form. You can also obtain information about the TSP online at tsp.gov if you're a new employee. That is where you can also establish an account to track the performance of your TSP and make any investment changes.

TSP participants can save much more than 5% of their pay as long as they don't exceed the annual contribution limit per year. The government match of 5% would bring your total annual savings to 15% if you were to contribute 10% of your pay.

The TSP offers many funds to choose from, including:

- The Government Securities Investment (G) Fund

- The Fixed Income Index Investment (F) Fund

- The Common Stock Index Investment (C) Fund

- The Small Capitalization Stock Index Investment (S) Fund

- International Stock Index Investment (I) Fund

Investments: Top Ten Picks

You may want to see also

Choosing the Best TSP Funds

The Thrift Savings Plan (TSP) offers a range of investment options, including bonds, stock funds, and a government securities fund. When choosing the best TSP funds, investors should consider their financial goals, risk tolerance, and time horizon. Here are some factors to consider when selecting TSP funds:

- Risk and Return: TSP funds offer a variety of risk and return profiles. The G Fund, invested in government securities, is considered the safest option with stable returns but low growth potential. The C, S, and I Funds are stock funds that offer higher potential returns but come with higher risk.

- Diversification: Diversifying your investments across different asset classes and sectors can help manage risk. The C Fund focuses on large US companies, the S Fund invests in small- to mid-sized companies, and the I Fund provides international exposure.

- Time Horizon: Your investment horizon plays a crucial role in fund selection. If you're closer to retirement, you may want to consider more conservative options like the G or F Funds. If you have a longer time horizon, you can afford to take on more risk with stock funds for potentially higher returns.

- Investment Strategy: Consider your investment strategy and how actively you want to manage your portfolio. The L Funds, or Lifecycle Funds, are target retirement funds that automatically adjust their asset allocation based on your target retirement date. These funds can be a "set-it-and-forget-it" option for those who want a hands-off approach.

- Fees and Expenses: TSP funds are known for their low fees, but it's important to consider any associated costs when making your selection. Additionally, some funds, like the I Fund, may carry additional currency and inflation risks that can impact your returns.

- Performance and Track Record: While past performance doesn't guarantee future results, it can provide insights into how funds have navigated different market conditions. Review historical returns and consider how each fund has performed during bull and bear markets.

- Individual Circumstances: Everyone's financial situation is unique. Consult a financial advisor to discuss your specific circumstances, risk tolerance, and goals. They can help you tailor your TSP fund selections to your needs and ensure they align with your overall investment strategy.

- 80% C Fund, 10% S Fund, 10% I Fund: This allocation focuses primarily on US stocks while providing some international exposure.

- 60% C Fund, 20% S Fund, 20% I Fund: This option provides a more balanced approach, reducing the weight of US stocks while still maintaining a significant allocation.

- All C Fund or All L Fund: Some investors opt for a 100% allocation to either the C Fund or an appropriate L Fund based on their risk tolerance and time horizon.

Remember, there is no one-size-fits-all approach to choosing TSP funds. It's essential to carefully consider your financial goals, risk appetite, and investment horizon before making any investment decisions.

Elon Musk's Current Investment Focus

You may want to see also

TSP Investment Programs

The Thrift Savings Plan (TSP) is a retirement savings program created by the U.S. government and administered by the Federal Retirement Thrift Investment Board (FRTIB). It is similar to a 401(k) plan and offers federal government employees and military service members a tax-advantaged way to save for retirement.

TSP Investment Options

The TSP offers five individual investment funds, as well as Lifecycle (L) funds, which are composite funds that invest in a combination of the five core funds. The five individual funds are:

- Government Securities Investment (G) Fund: Invests in short-term U.S. Treasury securities with no exposure to stock or bond market risk. It is the safest and most conservative investment choice in the TSP but has the lowest expected returns.

- Fixed Income Index Investment (F) Fund: Invests in a wide range of debt instruments, including government and corporate bonds. It is a relatively safe investment option but still carries market, credit default, and inflation risks.

- Common Stock Index Investment (C) Fund: An S&P 500 Index fund that invests in large and mid-cap U.S. companies. It is suitable for long-term investors who can tolerate ups and downs in their account value.

- Small Capitalization Stock Index (S) Fund: Invests in small and mid-cap U.S. stocks that are not in the S&P 500. It carries market risk due to its focus on domestic equities but offers higher potential returns.

- International Stock Index Investment (I) Fund: Invests in international stocks in 21 developed markets outside the U.S. and Canada. It provides diversification benefits but carries currency and inflation risks in addition to market risk.

Choosing TSP Investments

When choosing how to invest your TSP, consider your risk tolerance, investment horizon, and proximity to retirement. The G and F Funds are the most conservative options, while the C, S, and I Funds offer higher potential returns but come with greater risk. Lifecycle funds are suitable for those who want a "set-it-and-forget-it" investment option, as they automatically adjust their asset allocation to become more conservative as the target retirement date approaches.

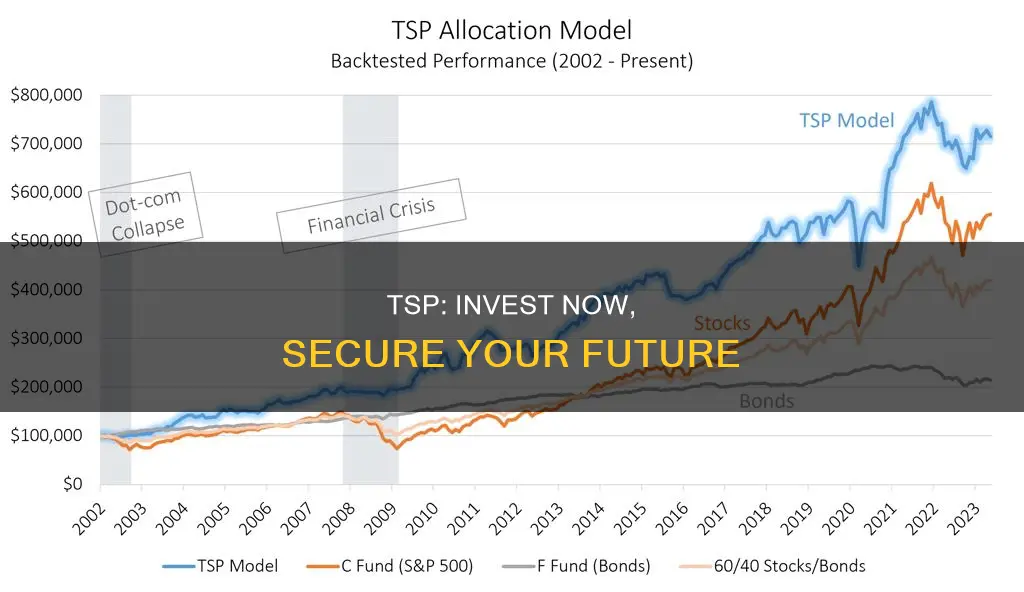

For those seeking higher returns and willing to take on more risk, private market-timing strategies offered by sites like Tsptalk.com and TSPCenter.com may be worth considering. However, these programs often charge fees, and their results cannot be guaranteed.

It is important to remember that past performance does not guarantee future results, and it is always advisable to consult with a financial advisor to determine the best investment strategy for your individual circumstances.

Investor's Losing Bet: Why Double Down?

You may want to see also

TSP Contribution Limits

The Thrift Savings Plan (TSP) is a retirement savings program created by the U.S. government. It is essentially a 401(k) plan for federal government employees. TSP contribution limits are announced by the Internal Revenue Service (IRS) and are subject to change from year to year.

The TSP contribution limit for 2024 is $23,000, an increase of $500 from 2023. This is the elective deferral limit, which applies to traditional (tax-deferred) and Roth contributions made by an employee during the calendar year. The combined total of traditional and Roth contributions cannot exceed this limit. It is important to note that this limit does not apply to certain other types of contributions, such as Agency/Service Automatic (1%) Contributions, Agency/Service Matching Contributions, and catch-up contributions.

Speaking of catch-up contributions, individuals who are 50 or older, or will turn 50 in the calendar year, can contribute an additional $7,500 as a catch-up contribution. This means that eligible employees can contribute up to $30,500 in total for 2024. It is important to plan contributions accordingly, as Federal Employees Retirement System (FERS) employees who reach the elective deferral limit before the last pay date of the year will not receive all the matching contributions they are entitled to.

For those with both civilian and uniformed services TSP accounts, the elective deferral and catch-up contribution limits apply to the combined amounts of traditional and Roth contributions made to both accounts. It is worth noting that TSP contributions are reported by pay date, which is established by the participant's employing agency and may differ from the date contributions are received and posted to the account.

To maximise the 2024 contribution using 26 pay periods, employees should contribute $884.61 to $885 bi-weekly. For those who want to maximise the contribution using fewer than 26 pay periods, they can divide the remaining number of pay periods in the tax year by $23,000 to calculate the amount to contribute per pay period.

Invest or Save: What's Best Now?

You may want to see also

Frequently asked questions

The Thrift Savings Plan is a retirement savings and investment plan for federal employees and members of the military. It includes the same tax benefits as a 401(k) plan and many agencies offer matching contributions.

The TSP offers many funds to choose from. The five core funds are the Government Securities Investment (G) Fund, the Fixed Income Index Investment (F) Fund, the Common Stock Index Investment (C) Fund, the Small Capitalization Stock Index Investment (S) Fund, and the International Stock Index Investment (I) Fund. There are also Lifecycle (L) Funds, which are target retirement funds that adjust based on how close you are to retirement.

One common suggestion is to save at least 15% of your income for retirement. To get the maximum employer contribution for a TSP, you should contribute at least 5% of your income.

Advantages of a TSP include diversification, low fees, tax advantages, employer contributions, automatic enrollment, and portability. Disadvantages include limited investment options, early withdrawal penalties, defined contribution plans, and the inability to contribute after government service ends.