Keeping track of your crypto investments is imperative. Crypto is a highly volatile asset, and with thousands of different cryptocurrencies, the value of each is ever-changing. Crypto markets trade 24/7/365 and are easily influenced by news and world events. To make informed decisions about your investments, you need to monitor your holdings and stay updated with market news and trends. Crypto portfolio trackers are digital platforms or apps that allow you to do just that. They connect with your crypto wallets and exchange accounts, providing live data on the value of your investments. They help you track profits and losses, monitor investments in real-time, and make more informed decisions about buying and selling assets.

| Characteristics | Values |

|---|---|

| Purpose | Monitor and manage your digital asset investments |

| Data sources | Cryptocurrency exchange accounts, wallets, blockchain |

| Data tracked | Current price, historical performance, other metrics |

| Additional features | News alerts, price predictions, risk analysis tools, tax reporting |

| Security | Two-factor authentication, data encryption, cold storage for API keys |

What You'll Learn

Use a cryptocurrency portfolio tracker app

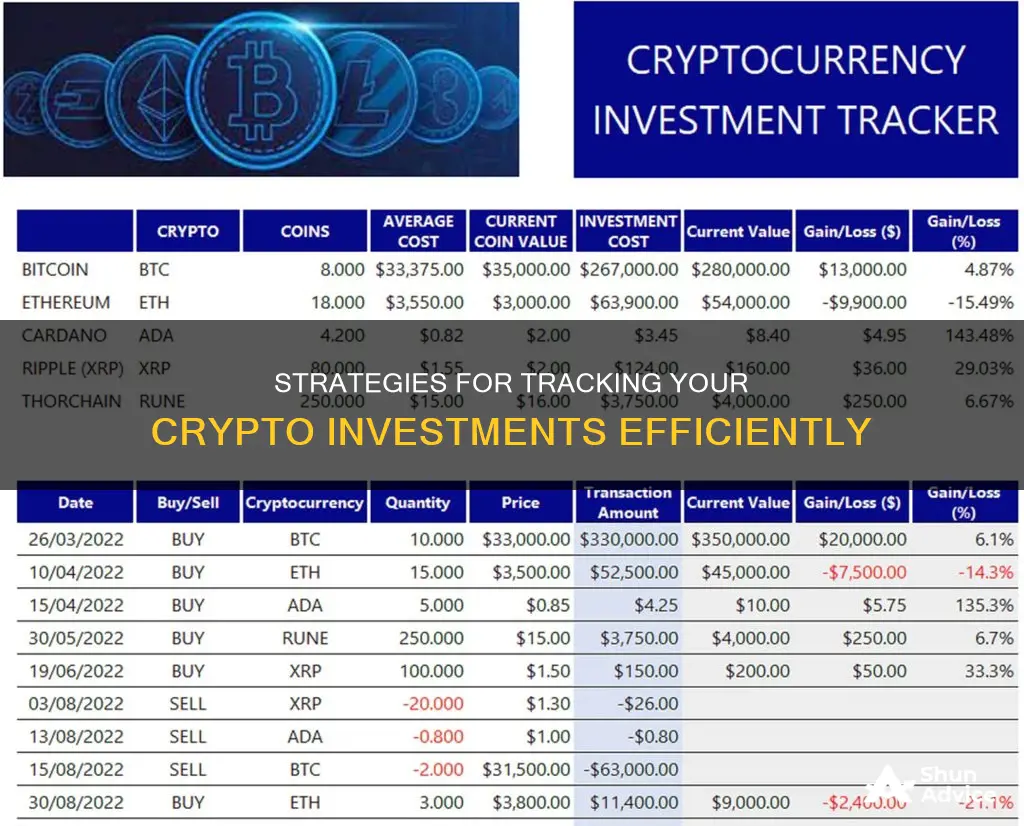

Cryptocurrency portfolio trackers are digital platforms that allow you to monitor and manage your crypto investments. They provide up-to-date data on the value of your investments, including price, market cap, volume, and trading pairs. By using a cryptocurrency portfolio tracker, you can easily keep track of the ever-changing value of your coins and properly manage your portfolio.

- Real-time Data and Updates: Portfolio tracker apps provide live data and updates on cryptocurrency prices, market trends, and the performance of your investments. This helps you make informed decisions about buying, selling, or holding your assets.

- Comprehensive Portfolio View: These apps allow you to connect multiple crypto exchange accounts and wallets, giving you a comprehensive view of your entire portfolio in one place. This simplifies the process of monitoring your investments across various platforms.

- Automated Tracking: With portfolio tracker apps, you can automate the tracking of your crypto holdings. Once your exchange accounts and wallets are connected, the app will automatically import and update your transactions, saving you time and effort.

- Profit and Loss Tracking: These apps enable you to track the profits and losses of your crypto investments. This helps you understand the performance of your portfolio and make more strategic decisions.

- Security: Reputable portfolio tracker apps prioritize security and use encryption and two-factor authentication to protect your data. This ensures that your sensitive financial information remains secure.

- CoinStats: This app offers real-time tracking of centralized and decentralized exchanges, supporting over 8,000 cryptocurrencies and 400 exchanges. It can be linked to hardware wallets like Ledger Nano X and software wallets like Metamask.

- CoinMarketCap: CoinMarketCap tracks the performance of more than 10,000 cryptocurrencies from over 400 exchanges. It provides real-time market data, news, and analysis. The platform also offers a free portfolio tracker where you can manually add your holdings or import them from a wallet.

- CoinTracker: CoinTracker automatically tracks your balances, trades, and tax obligations across various exchanges and wallets. It supports over 2,500 cryptocurrencies and 500+ exchanges and blockchains. The app provides real-time price tracking, custom watchlists, and advanced tax calculations.

- Delta: Delta offers powerful tools and charts to provide a clear overview of your portfolio balance, profit and loss, and global asset trends. It supports over 7,000 cryptocurrencies and 300+ exchanges. You can set custom notifications and alerts to manage your holdings effectively.

- Kubera: Kubera is a digital service provider that offers an online portfolio and net worth tracking solution. It allows you to monitor various financial accounts, including crypto exchange accounts, self-custody crypto wallets, and decentralized finance (DeFi) assets. Kubera provides real-time updates on cryptocurrency prices and detailed analysis of portfolio performance.

Blockchain Bitcoin Investment: A Beginner's Guide to Getting Started

You may want to see also

Keep a record of your trading history

Keeping a record of your trading history is essential for managing your cryptocurrency portfolio and tracking your profits. Here are some tips to help you keep track of your crypto investments:

- Choose cryptocurrency exchanges that provide transaction history and allow you to export your trades to a CSV file or fetch them via an API. This ensures you have easy access to your trading data, including prices and fees paid.

- Regularly download your trade history and choose the right exchanges. In the event of a hack or legal issue that causes an exchange to shut down, you may not be able to retrieve your transaction history. Having your own records ensures you're not left in the dark.

- Keep track of wallet addresses for token sales and mining transactions. If you're earning cryptocurrency through mining or as salary, you need to record these wallet addresses to claim this income for tax purposes.

- Utilise cryptocurrency portfolio trackers. These are digital platforms or apps that enable you to monitor the value of your coins and manage your portfolio. They connect with your crypto wallets and some even integrate with crypto exchange accounts.

- Consider using a crypto portfolio manager application. These apps can help you make more informed decisions about when to buy and sell assets, and they can provide real-time insights to help you monitor your investments over the long term.

US Mint Coins: Global Bullion Investment Strategy?

You may want to see also

Choose the right exchanges

Choosing the right exchanges is a crucial step in keeping track of your crypto investments. Here are some key considerations to help you select the right exchanges:

Credibility and Operational Success

It is essential to choose exchanges that have a solid reputation and a track record of successful operations. Opting for well-established exchanges with a strong market presence can provide more reliability and stability for your transactions.

Transaction History and Tax Compliance

Select exchanges that provide a comprehensive transaction history, including the ability to export data to CSV or fetch trades via API. This ensures you have easy access to your trading data, which is crucial for tax calculations and compliance.

Security Measures

Given the decentralised nature of cryptocurrency, prioritising security is vital. Choose exchanges that employ robust security protocols, such as strong password requirements, two-factor authentication, data encryption, and blockchain technology. This helps protect your account and assets from unauthorised access and potential cyber threats.

Integration with Multiple Wallets

Look for exchanges that integrate seamlessly with multiple custodial and non-custodial wallets. This allows you to aggregate your crypto assets across various wallets and exchanges onto a single platform, providing a comprehensive view of your portfolio.

User-Friendly Interface

The chosen exchange should offer a user-friendly and intuitive interface, making it easy to navigate and execute trades. This is particularly beneficial for beginners or users who are not familiar with complex trading platforms.

Customisation Options

Different investors have different needs and preferences. Opt for exchanges that provide customisation options, allowing you to organise and visualise your portfolio data according to your specific requirements and investment strategies.

By carefully considering these factors and selecting exchanges that align with them, you can effectively manage and track your crypto investments, making informed decisions while staying secure and compliant.

Dogecoin: Losing More Than You Invested?

You may want to see also

Stay aware of updates on exchange policy

Staying Informed on Exchange Policy Updates

Staying informed about exchange policy updates is crucial for effectively managing your crypto investments. Crypto exchange regulations are dynamic and rapidly evolving, so keeping abreast of the latest policies ensures you remain compliant and make informed investment decisions. Here are some strategies to stay updated:

Understand the Basics of Crypto Exchange Regulation:

Firstly, it's essential to understand the fundamentals of crypto exchange regulation. While specific crypto rules vary across nations, gaining a solid grasp of the underlying principles will help you navigate the complex landscape.

Follow Crypto News Sites and Exchanges' Official Channels:

Staying informed about policy changes can be as simple as following reputable crypto news sites such as CoinDesk, CoinTelegraph, and Bitcoin.com. Additionally, subscribing to the official blogs, newsletters, and updates from major crypto exchanges like Coinbase, Kraken, and Binance will provide you with direct access to important policy changes and industry insights.

Monitor Crypto Exchange Regulation Discussions:

Keep an eye on discussions and announcements from regulatory bodies and governments. For example, the Securities and Exchange Commission (SEC) plays a significant role in shaping crypto policies. Monitoring their statements, rulings, and discussions can provide valuable insights into potential regulatory shifts.

Utilize Social Media and Influencers:

Leverage the power of social media platforms like Twitter to follow crypto influencers and analysts who provide timely updates and insights into the crypto space. Additionally, joining relevant Telegram groups and channels, such as those mentioned in the Sandoche ADITTANE article, can provide a constant stream of information and alerts about the latest developments in crypto exchange policies.

Review Customer Feedback:

Before choosing a crypto exchange, it's beneficial to review customer feedback on third-party sites. This due diligence helps you select a reputable and well-regulated platform. Customers often share their experiences, including any issues or benefits related to policy changes, which can provide valuable insights into an exchange's reliability and responsiveness to regulatory updates.

By incorporating these strategies into your investment routine, you'll be well-positioned to stay informed about exchange policy updates, enabling you to make timely decisions and effectively manage your crypto investments.

Doge Coin Stock Investment: A Beginner's Guide

You may want to see also

Track addresses for token sales and mining transactions

Tracking addresses for token sales and mining transactions is essential for keeping a close eye on your crypto investments and can help you accurately report your earnings to the relevant tax authorities. Here are some tips to help you effectively track addresses for token sales and mining transactions:

- Use a Cryptocurrency Portfolio Tracker: A cryptocurrency portfolio tracker is a digital platform, such as an app or website, that enables you to monitor the ever-changing value of your different coins. It helps you manage your portfolio by connecting with your crypto wallets and, in some cases, integrating with your crypto exchange accounts. This is especially useful if you actively trade more than three different types of coins. Examples include Kubera, Delta, FTX (formerly Blockfolio), CoinStats, CoinTracking, Coin Market Manager, and Coinbase.

- Keep a Record of Wallet Addresses: When tracking token sales and mining transactions, it's important to keep a record of the relevant wallet addresses involved. This is good practice for security and can also help you organize your transactions for tax purposes.

- Utilize Crypto Tax Software: To simplify the process of tracking and reporting crypto transactions for tax purposes, consider using purpose-built crypto tax software solutions such as Koinly, CoinLedger, and Accointing. These tools can help you generate the necessary reports for your cryptocurrency transactions.

- Maintain a Comprehensive Transaction List: Create a detailed list of all your cryptocurrency transactions, including token sales and mining-related activities. Record the type of cryptocurrency or asset, the date of the transaction, the amount, the value at the time of the transaction, and the associated wallet addresses. This information will be crucial for tax calculations and reporting.

- Stay Updated with News and Influencers: Subscribe to newsletters, follow community groups, and track influencers to stay informed about the latest developments and rumours in the crypto space. This can help you make informed decisions and potentially predict market movements that may impact your token sales and mining transactions.

The Arrival of Bitcoin ETFs: When to Invest?

You may want to see also

Frequently asked questions

A cryptocurrency portfolio tracker is a digital platform, such as an app or website, that enables investors to keep track of the ever-changing value of their coins so that their portfolio can be managed properly.

Some examples of cryptocurrency portfolio trackers include Kubera, CoinStats, CoinMarketCap, CoinTracker, and Delta.

Cryptocurrency portfolio trackers can help investors monitor their holdings, trace their profits and losses, and stay informed about market news. They can also help with tax reporting and provide advanced features like price tracking, news alerts, and risk analysis tools.

When choosing a cryptocurrency portfolio tracker, it is important to consider factors such as cost, security, compatibility, and user interface. It is also essential to ensure that the tracker supports the cryptocurrency exchanges and wallets you use and offers the necessary features, such as real-time price tracking, portfolio performance tracking, and profit and loss calculations.