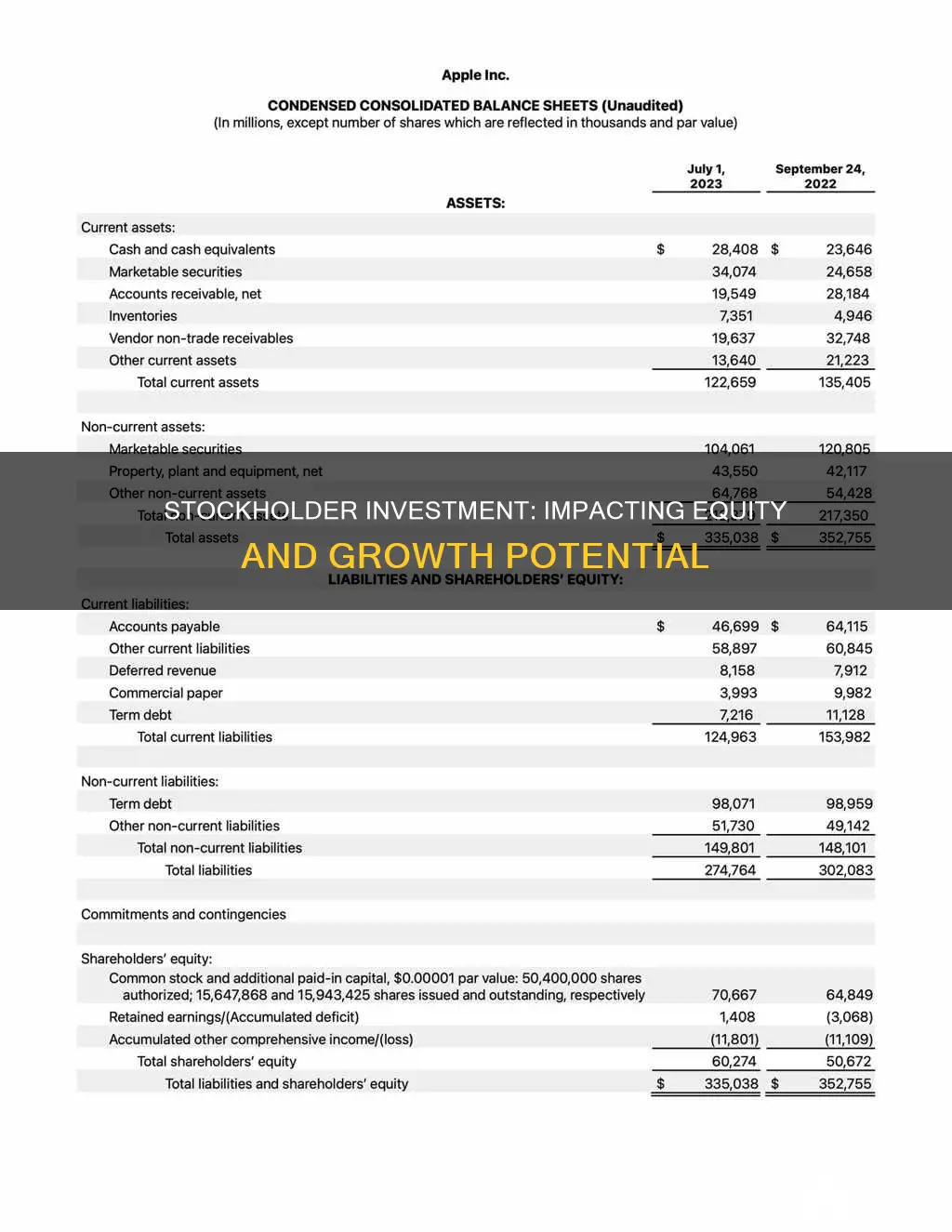

Stockholder investment affects equity in several ways. Firstly, when a company issues shares of stock to its investors, it leads to an increase in shareholder equity as the proceeds from share sales contribute to the company's assets. Conversely, when a company repurchases previously issued shares from investors, shareholder equity decreases as the repurchase amount is subtracted from the total equity. Additionally, shareholder equity is impacted by the payment of cash dividends to shareholders, which results in a reduction of shareholder equity by the total value of dividends paid. The type of dividend issued also matters, as cash dividends have a different effect on shareholder equity than stock dividends. While cash dividends directly reduce shareholder equity, stock dividends do not. Lastly, shareholder equity is calculated by subtracting a company's total liabilities from its total assets, and any changes in these values will impact the equity. This includes increases in assets such as sales, accounts receivable, property values, and cash, as well as decreases in liabilities such as reductions in money owed to suppliers or inventory costs.

| Characteristics | Values |

|---|---|

| Definition | Stockholders' equity is the value of a company's assets that remain after subtracting liabilities. |

| Other names | Shareholders' equity, book value, owners' equity, net worth |

| Calculation | Stockholders' equity = Total assets – Total Liabilities |

| Balance sheet location | A company's balance sheet and financial statements |

| Indicates | The financial health of a company |

| Indicates | The economic stability of a company |

| Indicates | The capital structure of a company |

| Sources | Capital stock, paid-in surplus, retained earnings |

| Impact of dividends | Cash dividends reduce stockholder equity, while stock dividends do not |

| Impact of treasury stock | The purchase of treasury stock reduces stockholders' equity |

Dividend payments

When a company pays cash dividends to its shareholders, its stockholders' equity is decreased by the total value of all dividends paid. This is because cash dividends are paid out of retained earnings, which directly reduces stockholder equity. However, the effect of dividends changes depending on the kind of dividends a company pays. Stock dividends do not have the same effect on stockholder equity as cash dividends. Stock dividends distribute additional shares to shareholders and do not affect the balance of stockholders' equity.

For shareholders, dividends are considered assets because they add value to an investor's portfolio, increasing their net worth. For a company, dividends are considered a liability before they are paid out.

Whether a cash dividend or a stock dividend is better depends on the shareholder and their financial profile. If an individual is dependent on a steady income stream, then a cash dividend would be a better option. On the other hand, if a shareholder is not in need of immediate cash, a stock dividend is a better option as it allows for further investment in a company that can lead to bigger payouts in the future.

Foreign Investment in India: Global Money Magnet?

You may want to see also

Share buybacks

A company might choose to do this if it believes its shares are undervalued, to improve its financial statements, or to prevent a major shareholder from taking a controlling stake in the company. Share buybacks also increase the proportion of shares owned by investors and can be used to compensate employees and executives.

However, share buybacks can also be controversial. They may give the impression that the company has failed to identify profitable new opportunities, and they can leave a business vulnerable if the economy takes a downturn. Share buybacks can also be used to artificially inflate a company's share price, possibly to produce higher executive bonuses.

How Much Cash Should You Hold in Your Investment Portfolio?

You may want to see also

Retained earnings

The retained earnings section of a company's balance sheet reflects the total amount of profit retained over time. At the end of the fiscal year, a company can choose to pay dividends to shareholders, reinvest the funds into the company, or leave them on account. The portion of profits left on account is rolled over each year and listed on the balance sheet as retained earnings.

Investments vs Savings: Liquidity and Financial Planning

You may want to see also

Capital stock

Stockholders' equity is important as it is a means of judging the funds retained within a business and is a metric frequently used by analysts and investors to determine a company's general financial health. A positive equity means the company has enough assets to cover its liabilities, while negative equity may indicate an impending bankruptcy.

Issuing capital stock allows a company to raise money without incurring debt. However, this also means the company is relinquishing more control and diluting the value of outstanding shares.

Angel Investing in India: Understanding the Basics

You may want to see also

Paid-in surplus

The paid-in surplus represents the additional funds that a company has raised from investors beyond the nominal par value of the shares. These funds can be used for any purpose, such as financing operations, making investments, or paying down debt. Paid-in surplus is one of the sources of stockholders' equity, which also includes capital stock and retained earnings. Stockholders' equity is the value of a company's assets that remain after subtracting liabilities and can be found on a company's balance sheet. It is a measure of a company's financial health and stability.

H1B Investment: US vs India — Where to Invest?

You may want to see also

Frequently asked questions

Stockholders' equity is the value of a company's assets that remain after subtracting liabilities. It is calculated by subtracting a company's total liabilities from its total assets.

Issuing shares of stock to investors increases shareholder equity. The proceeds from share issuance can be used to fund research and innovation, purchase another entity, or buy new equipment.

Cash dividends reduce stockholder equity. When a company pays cash dividends, its stockholders' equity is decreased by the total value of all dividends paid.

When a corporation purchases stock that was previously issued to its investors, it results in a reduction of stockholders' equity by the total purchase amount.

Stockholder investment is a source of funding for companies, which can be used to acquire assets, hire personnel, and create operations to market, produce, and distribute products or services. Companies with positive and growing stockholder equity are usually considered financially stable.