Motif investing is a unique investment platform that allows investors to create or buy motifs, which are baskets of up to 30 stocks or ETFs that follow specific themes or trends. Motif investing offers a cost-effective way to trade and provides investors with the flexibility to choose areas they want to invest in without having to make expensive individual stock purchases. When creating a motif, investors can select a combination of up to 30 stocks and/or ETFs that align with their interests and values. Motif investing is particularly appealing to those who want to take an active role in customising their portfolios and to those who want to invest in companies that reflect their personal values.

What You'll Learn

Motif investment accounts: trading vs impact

Motif Investing is a full-service brokerage that offers securities carrying various investment themes. Motif Impact is an automated investing service that is similar to the services offered by robo-advisors. It is not a robo-advisor, but it provides a platform for buying and selling stocks. It also offers automated investing and rebalancing of a personalized stock portfolio.

Motif Impact

Motif Impact is a fully automated portfolio that is created based on your investing goals, risk tolerance, and personal values. It offers a flat monthly fee of $9.95 for your first $100,000, with an additional $9.95 per month for every additional $100,000. The portfolio is created using stocks or ETFs from seven asset classes: U.S. Stocks, Developed Countries Stocks, Emerging Countries Stocks, U.S. Real Estate Stocks, Commodities Stocks, U.S. Bonds, and International Bonds.

Trading Account

Motif also offers three subscription trading plans: Blue Starter, Blue Standard, and Blue Unlimited. These plans charge a monthly fee for a varying number of free motif trades, rebalances, and stock or ETF trades. Blue Starter is the cheapest plan at $4.95 per month, while Blue Standard and Blue Unlimited offer more features at $9.95 and $19.95 per month, respectively.

If you don't want to commit to a subscription, you can open a pay-as-you-go trading account. The cost to buy or sell any motif is $9.95, with a minimum payment of $250. Trading an individual stock or ETF costs $4.95 per trade, with no minimum payment for buying stocks.

Comparison

Motif Impact is better suited for investors who prefer a more hands-off approach and want a fully automated portfolio based on their goals, risk tolerance, and values. The Trading Account option, on the other hand, offers more flexibility and is ideal for those who want to actively manage their investments and have more control over their portfolio.

While Motif Impact provides a simple, automated service, the Trading Account offers more customization options and allows investors to choose from a wide range of motifs or create their own. The Trading Account is a better choice for those who want to take an active role in customizing their portfolios and invest in companies that align with their values.

In summary, Motif Impact is ideal for hands-off investors seeking a fully automated portfolio, while the Trading Account suits those who want more control and flexibility in their investment choices.

Savings Investment Strategies: Where to Invest Your Money Wisely

You may want to see also

Motif fees and charges

Motif Investing offers a unique service that isn't quite that of a broker or a robo-advisor. It provides a platform for buying and selling stocks and ETFs, with some automated features.

Fees and Charges

Motif Investing has a variety of plans and fee structures. The platform offers two types of accounts: Motif Impact and Trading Accounts.

Motif Impact

Motif Impact is a fully automated portfolio service. The fee structure is as follows:

- $9.95 per month for every $100,000 in assets (flat rate).

- $9.95 per month for each additional $100,000.

- No fee for the first month.

This account has a minimum balance requirement of $1,000.

Trading Accounts

Trading Accounts come with three subscription plans: Blue Starter, Blue Standard, and Blue Unlimited, as well as a pay-as-you-go option.

#### Blue Starter

- $4.95 monthly fee.

- Auto-invest and auto-rebalance one motif.

#### Blue Standard

- $9.95 monthly fee.

- Trade one stock or motif per month with no commission.

- Auto-invest in an unlimited number of motifs.

- Access to market reports and insights.

#### Blue Unlimited

- $19.95 monthly fee.

- Includes all Blue Standard features.

- Two additional commission-free stock or motif trades per month (total of three).

- Real-time stock quotes.

- Unlimited commission-free next market open trades.

#### Pay-as-you-go

- $9.95 to buy or sell any motif, with a minimum payment of $250.

- $4.95 per trade for an individual stock or ETF.

- No minimum payment for buying stocks.

- IPOs have no fee or commission but require a minimum investment of $250.

There are also some additional fees to be aware of, including:

- $95 to close an IRA account.

- $65 partial fee for transferring money out of a Motif IRA while leaving at least $100 in the account.

- $65 to transfer all securities to another brokerage without selling them.

- Semi-annual Platform Fee of $10 for users without a subscription trading account, with less than $10,000 in combined securities and cash, and no trades within six months.

Comparison to Other Robo-Advisors

Motif Investing's fees are generally lower than those of other robo-advisors, which often charge annual management fees. However, other robo-advisors may offer more tools for monitoring and optimising your portfolio, such as tax-loss harvesting.

For example, Wealthfront offers tax-loss harvesting on all accounts and charges a flat annual management fee of 0.25%. Betterment offers a similar service with a management plan that provides unlimited phone access to a human advisor, with a minimum investment of $100,000 and an annual fee of 0.40%.

It's worth noting that Motif Investing's Blue subscription services also charge a flat monthly fee, rather than an annual management fee.

Savings vs. Investments: What's the Difference?

You may want to see also

Motif investment options

Motif Investing is an innovative investment platform that offers a unique spin on investing with its thematic portfolios or "motifs". A motif is a bundle of up to 30 stocks or ETFs that are grouped together based on a specific theme, trend, or strategy. For example, you could create a bundle that includes only stocks of companies that promote environmental sustainability. Instead of investing in 30 individual stocks or bonds, you can simply buy your motif, which includes all of those stocks.

There are two types of accounts offered by Motif: Trading Accounts and Impact Accounts. Trading Accounts are designed for DIY investors who want to trade actively, while Impact Accounts are fully automated and designed for passive, not active, trading.

With Motif, you can invest in Motif's professionally built portfolios, motifs built by the community, or create your own. Motif also offers Impact portfolios that are designed for investors who want to align their financial goals with their personal values. For example, you might want to invest in green companies that minimize climate impacts or companies that promote fair labour practices.

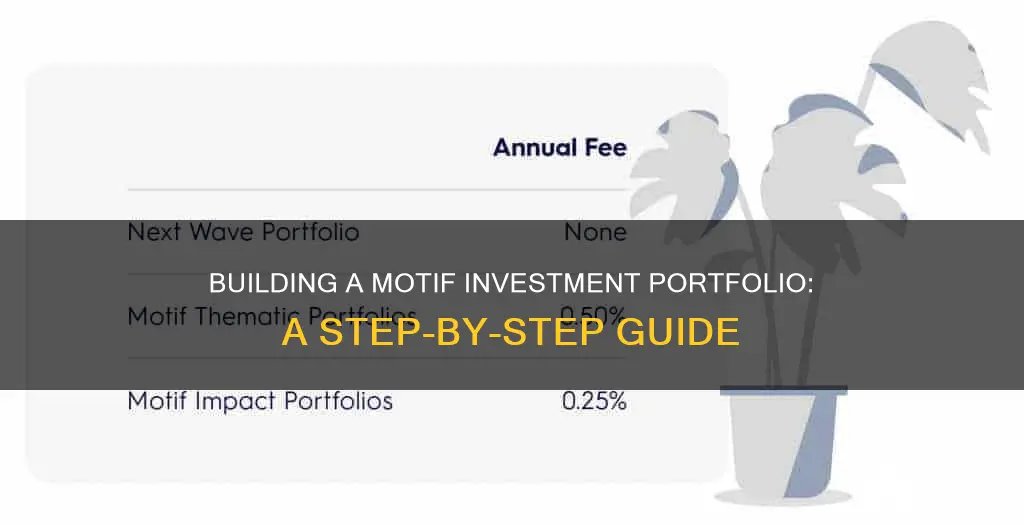

The fees for investing with Motif depend on what you're investing in. Impact portfolios charge a flat management fee of 0.25% of your assets annually, while the fee for thematic portfolios is 0.50%. Trading fees range from $0 to $19.95 per trade, and there is a $9.95 fee for real-time trading of Motif portfolios.

One of the benefits of Motif is that it offers low-cost investment options. For example, you can invest in a motif for a flat commission of $9.95, and there are no additional charges attached to Motif's service. This makes it a profitable option for traders with little capital.

However, it's important to note that Motif does not offer automatic tax-loss harvesting, so investors will need to handle that on their own. Additionally, dividends are disbursed as cash flow, and reinvesting must be done manually, incurring an additional transaction fee.

Savvy Savings: Guide to Smart Investments and Reddit Tips

You may want to see also

Motif IPOs

Motif Investing was an innovative online broker that allowed investors to buy groups of similar stocks in one transaction. It was also a promising platform for investors seeking access to initial public offerings (IPOs).

Motif Investing provided IPO access to ordinary investors for a minimum investment of $250. From late 2016 through 2019, Motif Investing facilitated more than 200 IPOs and secondary offerings on its platform. Some of the more notable deals included Trivago, Redfin, several biotech IPOs, and a handful of Reg A+ IPOs.

In April 2020, Motif Investing ceased its operations and sold its customers and technology to two different buyers, effectively breaking up the company. The customers were sold to Folio Financial, while the technology was acquired by Charles Schwab.

Here's how Motif IPOs worked:

- Motif worked with over 20 underwriters to deliver IPO and secondary offerings.

- Investors could sign up for real-time IPO notifications and start participating in public offerings with as little as $250, commission-free.

- Investors could select the IPO they were interested in and place their order with the minimum investment amount.

- Once the IPO was priced, investors would receive their allocated shares.

It's important to note that investing in an IPO is subject to unique risks, potential loss of principal, and volatility. Motif could not guarantee the availability of IPO shares, as the number of shares requested might exceed the supply. Therefore, customers should carefully consider the risks and review the Terms and Conditions for IPO Participation before making any investment decisions.

Savings, Spending, and Investment: Understanding the Interplay

You may want to see also

Motif account management

Trading Accounts

These accounts are designed for DIY investors who want to trade actively. The main features of Motif trading accounts include:

- Trading fees ranging from $0 to $19.95 per trade.

- The ability to buy and sell individual stocks and exchange-traded funds (ETFs).

- The option to invest in Motif professional or community-built portfolios.

- The ability to build your own 30-stock portfolio with a $300 minimum.

- Access to initial public offerings (IPOs).

If you want to trade on margin, you'll need to request an account upgrade from Motif and maintain a minimum balance of $2,000.

Impact Accounts

Impact accounts are fully automated portfolios. Motif uses your risk tolerance and time horizon to create a custom portfolio that aligns with your values. For example, you might want to invest in green companies that minimise climate impacts or focus on social causes.

- A $1,000 minimum investment is required.

- These accounts are designed for passive, not active, trading.

- Fees are charged annually instead of per trade.

- Rebalancing is automatic.

- Funds are invested across seven asset classes.

It's important to note that trading accounts cater to active traders, while Impact accounts are designed for passive investing. You can open both types of accounts if you meet the minimum investment requirements for each.

Monthly Subscription Service

Motif offers a monthly subscription service for trading account investors called Motif Blue. For $19.95 per month, you'll get:

- Three commission-free real-time trades each month.

- Five commission-free next-market-open trades for your custom motifs or motifs built by another Motif community member.

- Early notifications about new IPOs.

- Real-time market quotes.

If you plan to do a lot of trading, Motif Blue could be a valuable option.

Loans: Saving or Investing? Understanding the Financial Impact

You may want to see also

Frequently asked questions

A motif investment portfolio is a basket of up to 30 stocks and/or ETFs that an investor can group together based on a specific theme or idea. Motif portfolios are similar to low-cost, theme-based ETFs.

Creating a motif is simple and can be done in three steps. First, go to motif.com to create an account and build your first basket of securities. Second, give your motif a name and, optionally, a description and image. Third, add up to 30 stocks or ETFs to your motif. You can do this by adding stocks individually or by searching for stocks based on a theme.

There is a minimum deposit of $250 to open an account and a $9.95 flat fee when you buy, sell, or rebalance your motif. You can add additional stocks or ETFs for a cost of $4.95 per stock or ETF.

Motif investment portfolios offer flexibility to investors, allowing them to decide on areas they would like to invest in without having to make expensive individual stock purchases. Motif portfolios are also cost-effective, as you only pay a one-time commission when purchasing a motif.