Silver is a popular investment option for those looking to diversify their portfolios. While it is not as valuable as gold, it is often referred to as poor man's gold and has a long history of being a valid investment. Silver is also used as a hedge against inflation, with its price rising over the very long term.

There are several ways to invest in silver, each with its own advantages and disadvantages. Here are some of the most common methods:

- Buying physical silver coins or bullion: This is the most direct way to invest in silver. You can purchase silver coins or bars from local dealers, pawn shops, or online dealers. Physical silver offers the advantage of tangibility, and it can be sold virtually anywhere in the world. However, storing and protecting physical silver can be challenging, and there may be added costs such as insurance and storage fees.

- Silver futures and options: These are derivatives contracts that allow investors to gain exposure to silver without actually owning the physical metal. Futures contracts obligate two parties to exchange a certain amount of silver for money at a specified time in the future. Options contracts give the holder the right, but not the obligation, to buy or sell silver at a predetermined price during a specific time frame.

- Silver mining stocks: Investing in silver mining companies offers indirect exposure to silver by providing ownership in companies responsible for its extraction. If these companies turn a profit, they can reinvest those funds into expanding production. However, the success of a mining company's stock is not solely tied to the price of silver and can be influenced by various other factors, such as management decisions or mine accidents.

- Silver-backed exchange-traded funds (ETFs): ETFs offer an easy way to gain exposure to silver without the complexities of owning the physical metal. Leading silver ETFs include iShares Silver Trust (SLV) and Aberdeen Standard Physical Silver Shares ETF (SIVR). ETFs can be purchased through brokers and held in brokerage or retirement accounts.

| Characteristics | Values |

|---|---|

| Reasons for investing in silver | Silver is a store of value, a hedge against inflation, and a way to diversify a portfolio. |

| Ways to invest in silver | Buy physical silver, invest in silver mining stocks, buy silver futures, buy silver ETFs, buy silver streaming stocks, invest in a silver IRA |

| Advantages of buying physical silver | You physically own the investment, it's a tangible asset, it's highly liquid, it's private and confidential, it can't be hacked or erased |

| Disadvantages of buying physical silver | Harder to sell, illiquid, higher risk of theft, storage costs |

| Advantages of buying silver ETFs | Accessible and liquid, instant selling at market price, no need to worry about physical storage |

| Disadvantages of buying silver ETFs | Counterparty risk, potential losses if fund manager closes, fund fees |

| Advantages of buying silver futures | Wager on rising or falling silver prices without the difficulty of owning silver, use of leverage for greater investment potential |

| Disadvantages of buying silver futures | May not result in ownership of silver, complicated nature, fees |

| Advantages of buying silver mining stocks | Indirect way of investing in silver, ownership of a company that attempts to extract the precious metal |

| Disadvantages of buying silver mining stocks | Not true ownership of silver, susceptible to uncontrollable forces, unique business risks |

What You'll Learn

Buying physical silver coins or bullion

There are several ways to invest in silver, and one of the most direct ways is to buy physical silver coins or bullion. This method offers investors the ability to physically hold their investment, which can be psychologically and emotionally satisfying.

When buying physical silver, investors have a few options:

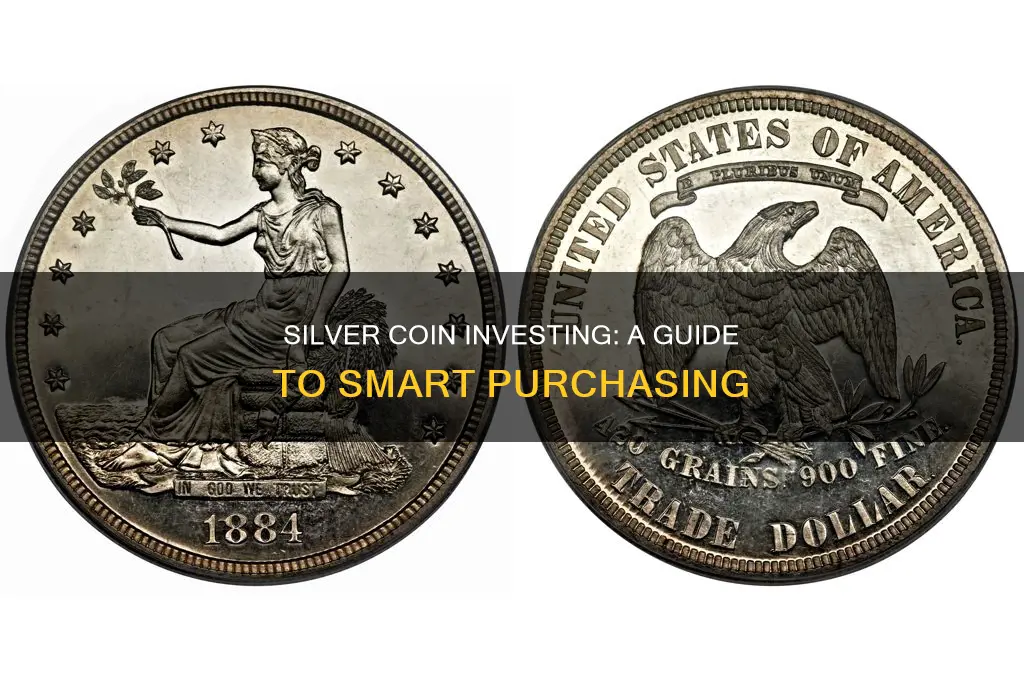

- Bullion coins: These are made almost exclusively from precious metal and are considered investment-grade silver. The most popular form is government-minted "sovereign" coins, which are guaranteed by their respective governments and have a face value.

- Rounds: Rounds are similar to coins but are produced by private mints rather than governments. If you buy silver rounds, ensure the purity is at least 99.9%.

- Numismatic coins: These are rare coins bought and sold by collectors. Their value is based on rarity, condition, and demand, and they usually have higher premiums than bullion coins.

- Semi-numismatic coins: These are made to be collector coins but don't yet have historical significance, so they may be purchased closer to bullion prices.

- Junk silver: This refers to old quarters, dimes, and half-dollars that are made of 90% silver and circulated before 1964.

When buying physical silver, it's important to be aware of the potential drawbacks. Physical silver can be more difficult to store and protect compared to other investment methods. There may also be added costs such as commissions, storage, and insurance. Additionally, it may be harder to sell physical silver quickly, and local dealerships may not be offering the most up-to-date spot pricing.

When purchasing physical silver, it's recommended to use reputable, well-established dealers such as JM Bullion, APMEX, and SD Bullion. Online dealers often offer a wider selection and more competitive pricing than local shops. It's also a good idea to compare prices and read reviews before choosing a dealer.

Other Ways to Invest in Silver

While buying physical silver provides the advantage of direct ownership, there are other ways to invest in silver that may be more convenient and lower risk:

- Silver-backed securities: These include exchange-traded funds (ETFs) that invest in physical silver or silver mining companies, as well as silver futures and options contracts.

- Silver mining stocks: Investors can buy shares of silver mining companies, benefiting from their future mining operations.

- Silver streaming stocks: Investors can buy shares of silver streaming or royalty companies, which finance mining projects and receive a portion of the profits.

ROR Rise: Investor Rush

You may want to see also

Silver futures contracts

A silver futures contract is a legally binding agreement for the delivery of silver at an agreed-upon price in the future. The contract is standardised in terms of quality, quantity, time, and place of delivery, with only the price being variable. The COMEX exchange, now part of Chicago's CME Group, is the most recognised exchange when it comes to metals trading.

To trade silver futures, you will need to set up an account with a platform that allows futures trading. Many online trading platforms and full-service brokerages offer futures trading, but you will need to request approval to use this feature. Once you have an account with access to futures markets, the process is similar to trading other types of investments: you will need to fund the account and then enter an order directing the platform to establish a position in a specific futures contract.

When trading silver futures, it is important to remember that this type of investment involves substantial risk and is not suitable for everyone. The leverage in futures contracts can magnify both gains and losses. If the market moves against you, you will need to put up more money to hold your position. If you are unable to do so, the broker will close out your position and you will be left with a loss.

Silver futures are generally more suitable for advanced and sophisticated traders. You will usually need a large account balance to get started, and only some online brokers offer futures trading.

Pay Down Mortgage or Invest in RRSP: Which is the Smarter Financial Move?

You may want to see also

Silver mining stocks

- First Majestic Silver (NYSE:AG)

- Pan American Silver (NASDAQ:PAAS)

- Wheaton Precious Metals (NYSE:WPM)

- Hecla Mining (NYSE:HL)

- Coeur Mining (NYSE:CDE)

- Endeavour Silver (NYSE:EXK)

- MAG Silver (NYSE:MAG)

- Fortuna Silver (NYSE:FSM)

The Great Debate: Mortgage vs. Investment — Where Should Your Money Go?

You may want to see also

Silver ETFs

ETFs are generally more liquid than the precious metal itself, and they offer investors a lower-risk method of investing in silver compared to silver futures. Silver ETFs are also structured as grantor trusts, meaning that each share of ownership in the ETF corresponds to a specific quantity of the underlying silver. This makes silver ETFs a convenient option for investors wanting to own physical bullion.

- IShares Silver Trust (SLV): This ETF is a grantor trust that holds physical silver and tracks the price set by the LBMA. It aims to provide investors with an inflation hedge and exposure to the daily movements of silver bullion prices.

- Abrdn Physical Silver Shares ETF (SIVR): SIVR is also a grantor trust backed by physical silver bullion held in a London vault. It aims to track the performance of silver prices, minus the expenses of the trust's operations.

- Invesco DB Silver Fund (DBS): Unlike the previous two, DBS is structured as a commodity pool that invests in silver futures. It tracks an index composed of silver futures, plus the interest income from holdings in U.S. Treasuries and money market securities.

It is important to note that silver ETFs hold silver as a commodity or silver futures, not stocks of companies that mine or process silver. When considering investing in silver ETFs, always assess the fund's investment strategy, expenses, liquidity, and historical performance.

Government Shutdown: Navigating the Investment Landscape

You may want to see also

Silver streaming stocks

Silver streaming companies are a sub-industry of the precious metals mining industry. They are less risky than typical mining companies as they are not directly involved in the exploration and extraction of silver but rather purchase it from producers to profit from price appreciation. Streaming companies make upfront payments to mining companies in return for the right to buy their metal production at a low, fixed cost. This is an attractive investment option as streaming companies can benefit from rising silver prices while reducing the downside risks that traditional mining companies face.

One of the biggest silver streaming companies is Wheaton Precious Metals, a Canada-based company that trades on the NYSE and TSX. Wheaton Precious Metals has streaming agreements in place for 18 operating mines and 2 development-stage projects and is interested in companies operating in politically stable jurisdictions. The company's value should, in theory, rise with the price of silver and gold. Other major players in the silver streaming industry include Franco-Nevada, Royal Gold, Osisko Gold Royalties, and Sandstorm Gold.

The Retirement Mortgage Dilemma: Pay Off or Invest?

You may want to see also

Frequently asked questions

Silver coins are a tangible asset that you can physically hold in your hand. They are also a store of value and are highly liquid, meaning they can be sold anywhere in the world. Additionally, they offer privacy and confidentiality, and cannot be hacked or erased.

There are five basic categories of silver coins: bullion coins, rounds, numismatic coins, semi-numismatic coins, and junk silver. Bullion coins are made almost exclusively from precious metal, while rounds are produced by a private mint. Numismatic coins are rare coins bought and sold by collectors, and semi-numismatic coins are made to be collector coins but do not yet have historical significance. Junk silver refers to old coins that are made of 90% silver.

When buying silver coins for investment, look for coins with a low premium over the silver spot price. Common silver bullion coins, also known as sovereign coins, are a good option as they are pure silver and have low premiums. Examples include American Eagles, Canadian Maple Leafs, and Austrian Philharmonics.

You can buy silver coins online or at a local coin shop. Online dealers often offer better pricing, even after shipping costs, but it is worth comparing prices between different dealers to find the best deal.