TD Direct Investing is an online brokerage brand of TD Waterhouse, which is a Canadian financial services corporation. It offers services to trade stocks, options, mutual funds, fixed-income investments, and IPOs. To buy an IPO with TD Direct Investing, you must register for WebBroker, their online trading and investing platform. Once you have an account, you can place your 'Expressions of Interest' online through WebBroker. It is important to note that the list price of the IPO stock may be volatile during opening hours and may take time to settle.

| Characteristics | Values |

|---|---|

| How to buy IPO stock | To buy IPO stock, you must work directly with a registered stockbroker. |

| TD Direct Investing New Issues Centre | Provides 24-hour access to New Issues, including IPOs and other primary market security offerings. |

| Eligibility requirements for New Issues | Your account must have adequate cash, equity or margin available at the time you place your "Expression of Interest". |

| Minimum quantity for an equity New Issue | Generally, the minimum quantity is "one board lot", or 100 shares. |

| Minimum quantity for a fixed income New Issue | The minimum is a $5,000 face value. |

| Settlement date of a New Issue | The date set by the issuer and the lead underwriters for the purchasers of the securities to take delivery and pay for those securities. |

| "Contracted" definition | New Issue fills are normally "contracted" into a client account after the terms of the issue have been finalized and approved by Canadian securities regulators. |

| Direct Public Offering (DPO) | A way for companies to become publicly traded without a bank-backed Initial Public Offering (IPO). |

| TD Direct Investing Europe | Sold in 2016 to Interactive Investor. |

What You'll Learn

Understanding the basics of an IPO

An Initial Public Offering (IPO) is when a private company sells shares of its stock to the public for the first time. This is the first time that members of the public can buy shares in a company, and it marks the transition of a company from private to public ownership.

The IPO process can be split into two parts: the pre-marketing phase and the initial public offering itself. During the pre-marketing phase, the company advertises to underwriters by soliciting private bids or making a public statement to generate interest. The underwriters are chosen by the company and lead the IPO process, playing a role in every aspect of the IPO due diligence, document preparation, filing, marketing, and issuance.

Underwriters present proposals and valuations that cover the services they will provide, the type of security to be issued, the offering price, the number of shares, and the estimated timeframe for the market offering. The company then chooses its underwriters and agrees to the terms through an underwriting agreement. An IPO team is formed, comprising underwriters, lawyers, certified public accountants, and Securities and Exchange Commission (SEC) experts.

The next step is to compile all the information required for the IPO documentation. The primary IPO filing document is the S-1 Registration Statement, which includes preliminary information about the expected filing date and is revised throughout the pre-IPO process. Marketing materials are also created at this stage to estimate demand and establish a final offering price.

Once the IPO date arrives, the company issues its shares, and capital from the primary issuance to shareholders is recorded as stockholders' equity on the balance sheet. After the IPO, some provisions may be put in place, such as a specified time frame for underwriters to buy additional shares.

There are several benefits to a company going public through an IPO. Firstly, it provides access to investment from a wide range of public investors, making it easier to raise capital. This increased exposure and prestige can also help improve the company's sales and profits. Additionally, the increased transparency that comes with quarterly reporting can lead to more favourable credit borrowing terms.

However, there are also some disadvantages to consider. IPOs are expensive, and the costs of maintaining a public company are ongoing. Fluctuations in share prices can be a distraction for management, and the company must disclose financial, accounting, tax, and other sensitive business information, which could benefit competitors.

Overall, an IPO is a significant step for a company, providing access to new sources of capital and greater opportunities for growth and expansion.

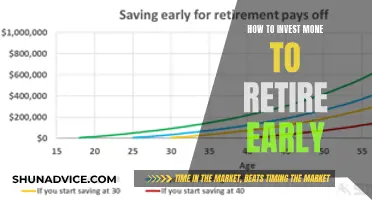

Invest to Exit: A Guide to Early Retirement Through Smart Monthly Investments

You may want to see also

How to use TD Direct Investing to buy an IPO

TD Direct Investing is the online brokerage brand of TD Waterhouse, a Canadian financial services corporation. It offers services to trade stocks, options, mutual funds, fixed-income investments, and IPOs.

- Register for WebBroker: TD Direct Investing's online trading and investing platform.

- View New Issue offerings: Log in to your WebBroker account to view current New Issue offerings available through TD Direct Investing.

- Place an 'Expression of Interest': If you find an IPO that interests you, you can place an 'Expression of Interest' online through WebBroker or by contacting TD Direct Investing by phone at 1-800-465-5463 (Monday to Friday, 7 am to 6 pm ET).

- Meet eligibility requirements: Ensure that your account has adequate cash, equity, or margin available at the time you place your 'Expression of Interest'. For Registered accounts (RSP, RIF, RESPs), cash or near-cash (e.g., money market mutual funds) must be available.

- Understand the risks: IPOs can have great first-day gains or losses, and the stock price may be volatile during the opening hours of trading.

- Purchase the IPO stock: Once your 'Expression of Interest' is accepted and the IPO occurs, you can purchase the stock by calling your broker, logging into your WebBroker account, or using the TD app. Enter the stock symbol of the company and purchase the desired amount of shares.

- View your confirmed order: After the IPO offering is closed, you can view your confirmed order by selecting 'List Expressions' within the New Issues Centre.

Note: TD Direct Investing may not offer every IPO, but they can often accommodate firm 'Expressions of Interest' on issues they are not actively selling. If you are interested in an IPO they are not offering, contact them with the issue name, lead underwriter, issue price per share, the number of shares you want to buy, and your account information.

Additionally, TD Direct Investing offers other investment types such as Direct Public Offerings (DPOs), an alternative to IPOs where companies become publicly traded without a bank-backed offering. DPOs provide a quicker and less expensive way to raise capital, but the opening stock price is subject to market demand and potential swings.

The Secret to Unlocking Investment: The Top500 Strategy

You may want to see also

The risks and opportunities of a direct listing

A direct listing is a process by which a company can go public by selling existing shares directly to the open market, instead of offering new ones. This method is usually cheaper than an IPO as it does not require underwriters or a lock-up period.

Opportunities

Direct listings offer several benefits over traditional IPOs:

- Cost savings: Companies can avoid the significant fees associated with underwriters, enabling them to allocate more resources to other areas of their business.

- Increased transparency: Direct listings allow the market to determine the stock price based on supply and demand, which can help avoid potential underpricing that may occur in IPOs when underwriters set the initial offering price.

- Greater access for existing shareholders: Direct listings provide existing shareholders with immediate access to liquidity, as there is no dilution of ownership and no lock-up period by default.

- No underwriters: The absence of underwriters means companies have more control over the listing process and can avoid the potential conflict of interest that may arise when underwriters support the offering price.

- Efficiency: Direct listings can be a more efficient way for companies to go public, as they bypass the regulatory requirements and costs associated with IPOs.

Risks

However, there are also several risks and drawbacks associated with direct listings:

- Lack of capital raising: In a direct listing, companies do not issue new shares or raise additional capital, which may not be suitable for businesses seeking to fund growth initiatives.

- Limited investor base: Direct listings can result in a limited investor base as there are no guaranteed institutional investors, and attracting retail investors can be challenging.

- Increased volatility and uncertainty: The lack of underwriters and institutional investors in direct listings can lead to increased volatility and uncertainty during the initial trading period, resulting in unpredictable stock price movements.

- No safety net: Without an intermediary, there is no safety net to ensure that the shares will sell.

- Less established process: Direct listings are relatively new and may be riskier, especially for companies that lack guidance on legal considerations and other complexities.

Severance Windfall: Investing for the Future

You may want to see also

How to express interest in a new issue

To express interest in a new issue, you must first register for WebBroker, the online trading and investing platform of TD Direct Investing. You can do this by applying online or calling 1-800-667-6299. Once registered, you can place your 'Expressions of Interest' online.

TD Direct Investing provides you with two ways to place your 'Expression of Interest' in a New Issue. You can either use the New Issues Centre within WebBroker or contact them at 1-800-465-5463 (Monday to Friday, 7 am to 6 pm ET). Your 'Expression of Interest' will be given the same fill priority whether it is placed online or over the phone.

It is important to note that there may be times when there are not enough shares of an issue to meet all 'Expressions of Interest'. Therefore, when placing an 'Expression of Interest', you must be willing to receive either a full fill, partial fill, or no fill at all.

Additionally, TD Direct Investing may be able to accommodate firm 'Expressions of Interest' on issues that they are not actively selling. In such cases, you can contact TD Direct Investing with the following details: the issue name, the lead underwriter, the issue price per share, the number of shares you are committed to buying, and your account information. They will then attempt to fill your 'Expression of Interest'.

Furthermore, if you are interested in a direct public offering (DPO), which is an alternative to an IPO, you can participate by placing trades as soon as the shares are available in the open market if you are already a TD Ameritrade client. If you are not yet a client, you will need to open and fund an account. Please note that funds must be fully cleared in your account before they can be used for trading.

Mortgage REITs: A Smart Investment Strategy?

You may want to see also

Understanding the stock pop

An Initial Public Offering (IPO) is the first time a company makes its shares available for purchase by the public. It is a unique opportunity that can deliver massive returns for individual investors. It is not uncommon to see an IPO stock pop more than 100% on its first trading day. However, it is important to remember that IPO stocks tend to underperform the market for several years after they go public since the losers outnumber the biggest winners.

The stock pop is driven by high demand from investors. When a company files for an IPO, it is largely an unknown entity, making it difficult to determine its prospects. However, if established and reputable banks are underwriting the IPO and publicly traded competitors are performing well, it could suggest that the IPO will be in demand and perform well.

The opening price of an IPO is another critical aspect. The company holding the IPO wants a high price, while investors prefer something lower. It is up to the investment banks to find a middle ground, and sometimes they miss badly. If a stock jumps above its opening price, it is perceived as a bullish sign that investors are willing to pay more. However, if a stock falls below its opening level, it may require further "price discovery", meaning it could drop further until it reaches a point where it is considered fairly valued.

While the stock pop can be enticing, it is important to remember that IPOs are among the riskier investments. There may not be much information available about a newly listed company, and some may not even be making profits yet. This can make it challenging to determine the company's true value, and investors could end up overpaying for the shares.

Additionally, there may be a lot of demand for an IPO, which can cause the stock price to trade above its original listing price when it first hits the market. Early investors may try to make a quick profit by selling the shares on the exchange soon after they start trading, which can drive down the price.

Therefore, it is crucial to carefully consider the risks and do your research before investing in an IPO.

Apple's Liquidmetal Investment: Exploring the Boundaries of Innovation

You may want to see also

Frequently asked questions

IPO stands for Initial Public Offering, which is when a private company offers its stock to the public for the first time.

To purchase stock through an IPO, you must work with a registered stockbroker. If the company is not yet public, you can contact the company's investor relations representative to inquire about shares for sale. If you want to purchase stock at the IPO or afterward, register with a stockbroker and wire funds to your brokerage account.

The TD Direct Investing New Issues Centre gives you access to IPOs and other primary market security offerings. You can register for WebBroker, TD's online trading and investing platform, to place 'Expressions of Interest' online.

You can use the New Issues Centre within WebBroker or contact TD Direct Investing at 1-800-465-5463 (Monday to Friday, 7 am to 6 pm ET).