A Unit Investment Trust (UIT) is a US investment company that offers a fixed portfolio of stocks, bonds, or other securities to investors for a specific period. UITs are similar to open-ended and closed-end mutual funds in that they are collective investments where investors pool their funds to be managed by a portfolio manager. However, unlike mutual funds, UITs have a stated expiration date and their holdings are fixed and not actively traded. UITs are bought and sold directly from the issuing company or on the secondary market, and they often have low minimum investment requirements. Investors can sell their holdings back to the issuing company at any time, but brokerage fees can be high.

| Characteristics | Values |

|---|---|

| Definition | A unit investment trust (UIT) is an investment company that offers a fixed portfolio, generally of stocks and bonds, as redeemable units to investors for a specific period of time. |

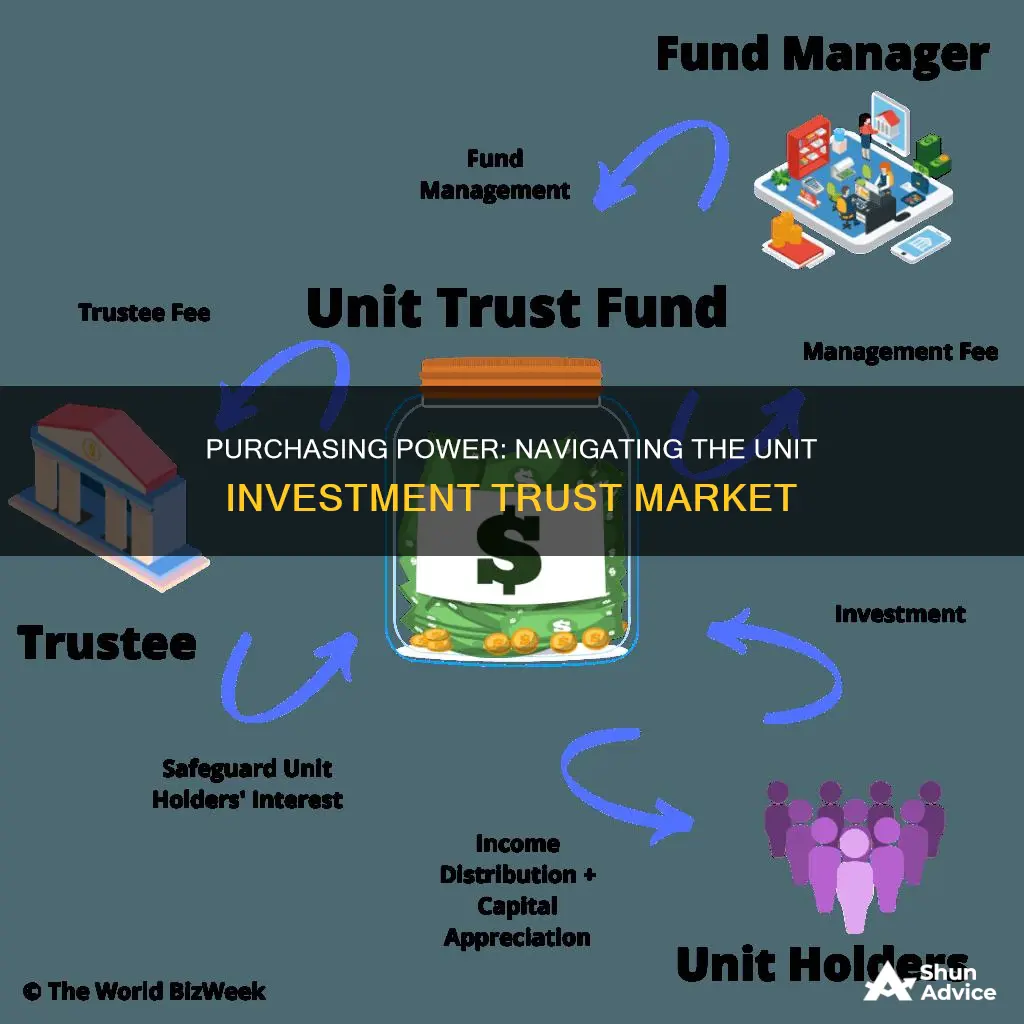

| How it works | Money from many investors (called "unit holders") is pooled and managed by a fund manager to achieve a specific return. The fund manager creates a portfolio of investments and assets. The fund is then split into units, which are what investors buy. |

| Benefits | Diversity, accessibility, regulation, management, simplicity, liquidity, transparency, income predictability, low minimum investment requirements. |

| Drawbacks | Risk, costs, limited control, capital risk, high brokerage fees, limited flexibility, tax inefficiency, lack of diversification, illiquidity, foreign currency risk, counterparty risk. |

| How to buy | Generally, investors buy and sell through a broker, though prices for some UITs are quoted on the Nasdaq mutual fund quotation service. |

What You'll Learn

Understanding Unit Investment Trusts (UITs)

A unit investment trust (UIT) is a US financial company that buys or holds a group of securities, such as stocks or bonds, and makes them available to investors as redeemable units. UITs are similar to open-ended and closed-end mutual funds in that they all consist of collective investments where many investors combine their funds to be managed by a portfolio or fund manager.

Like open-ended mutual funds, UITs are bought and sold directly from the company that issues them, and they often have low minimum investment requirements. However, UITs can also be bought on the secondary market, like closed-end funds, and are issued via an initial public offering (IPO).

Unlike mutual funds, UITs have a stated expiration date, often between 12 to 24 months, based on the investments held in its portfolio. When the portfolio terminates, investors receive their share of the UIT's net assets. UITs are not actively traded, meaning securities are not bought or sold unless there is a change in the underlying investment, such as a corporate merger or bankruptcy.

UITs are either regulated investment corporations (RIC) or grantor trusts. A RIC is a corporation in which investors are joint owners, while a grantor trust grants investors proportional ownership in the UIT's underlying securities. Investors can redeem mutual fund shares or UIT units at the net asset value (NAV) to the fund or trust. The NAV is the total value of the portfolio divided by the number of shares or units, and it is calculated each business day.

There are two main types of UITs: stock trusts and bond trusts. Stock trusts make shares available during a specific amount of time, known as the offering period, and investors' money is collected during this time. Stock trusts generally seek to provide capital appreciation, dividend income, or both. Trusts that seek income may provide monthly, quarterly, or semi-annual payments, and they can invest in domestic or international stocks or both. Bond UITs have historically been more popular than stock UITs due to their predictability and lower risk of losses. Investors seeking steady, predictable sources of income often purchase bond UITs, and payments continue until the bonds begin to mature.

While UITs are designed to be bought and held until termination, investors can sell their holdings back to the issuing investment company at any time, and some UITs permit investors to exchange their holdings for a different UIT at a reduced sales charge. UITs are legally required to provide a prospectus to prospective investors, which highlights fees, investment objectives, and other important details. Investors generally pay a load when purchasing UITs, and accounts are subject to annual fees.

Louisiana's Future: Examining the Impact of Investment Act 92

You may want to see also

How to buy UITs

A unit investment trust (UIT) is a US financial company that buys or holds a group of securities, such as stocks or bonds, and makes them available to investors as redeemable units. UITs are similar to both open-ended and closed-end mutual funds in that they all consist of collective investments where many investors combine their funds to be managed by a portfolio manager.

- Understand the basics: UITs are bought and sold directly from the company that issues them or on the secondary market. They are issued via an initial public offering (IPO) and have a stated expiration date, usually between 12 to 24 months, based on the investments in their portfolio.

- Know the types of UITs: There are two main types of UITs: stock trusts and bond trusts. Stock trusts seek to provide capital appreciation or dividend income, while bond trusts offer steady, predictable income through payments until the bonds mature.

- Weigh the pros and cons: UITs offer benefits such as diversification, liquidity, transparency, and income predictability. However, they also have high brokerage fees and may not be suitable for short-term investors due to their limited liquidity.

- Consult a broker: Generally, investors buy and sell UITs through a broker, although prices for some UITs are quoted on the Nasdaq mutual fund quotation service.

- Evaluate the fund: Consider the fund's investment objectives, strategies, risks, and costs. Ensure that the fund's investment strategies align with your objectives and risk profile.

- Review the prospectus: UITs are legally required to provide a prospectus highlighting fees, investment objectives, and other important details. Be sure to understand all fees and expenses before making a purchase.

- Make the investment: If the UIT meets your investment criteria and you are comfortable with the risks and costs, proceed with purchasing the UIT through your chosen broker or platform.

Remember, UITs are long-term investments with a fixed portfolio, so it's essential to carefully consider your investment goals and conduct thorough research before buying.

Libra Investment Prospects: Exploring the Viability of Backing Zuckerberg's Crypto Venture

You may want to see also

Advantages and disadvantages of UITs

Unit Investment Trusts (UITs) have several advantages over other types of pooled investments. UITs provide investors with access to a diversified portfolio of securities, which can help reduce the risk of losses due to any single security's underperformance. They are also required to disclose their portfolios regularly, providing investors with greater transparency into their holdings and investment strategy.

UITs are generally passive investments, meaning they do not involve active management or frequent trading, which can result in lower fees and expenses compared to actively managed funds. They are also typically structured as pass-through entities, meaning they do not pay taxes at the trust level, resulting in greater tax efficiency.

Additionally, UITs often have low minimum investment requirements, making them accessible to a wider range of investors. The simplicity of a UIT, with its fixed portfolio of securities and set investment strategy, also makes it more predictable than actively managed funds that may change their holdings over time.

However, UITs also have several disadvantages. Due to their fixed portfolio and set investment strategy, investors have limited control over the investments made by the trust, and poor performers may be retained. While UITs provide some diversification, they typically invest in a specific market sector or asset class, which may not offer the same level of diversification as more broadly diversified investments.

UITs are designed as long-term investments, so they may not be suitable for investors who need quick access to their funds. They are also not traded on exchanges like mutual funds, and investors may incur higher costs when purchasing or selling units.

In some cases, UITs may not provide as much information about their investment strategy, performance, fees, expenses, or future plans as other types of investments. This lack of transparency can make it challenging for investors to make fully informed decisions.

Ready to Invest? Here's What You Need to Know

You may want to see also

Types of UITs

There are several types of Unit Investment Trusts (UITs) available, each with its own unique features and benefits. Here are some of the most common types of UITs:

- Fixed Income UITs: These UITs focus on investing in fixed-income securities such as bonds, mortgages, and other debt instruments. They offer stable and predictable income streams, making them attractive to risk-averse investors.

- Equity UITs: Equity UITs invest primarily in stocks or equity-related securities. They offer the potential for higher returns but come with greater risk compared to fixed-income UITs.

- Balanced UITs: Balanced UITs aim to provide a mix of both fixed-income and equity investments, offering a balance between income generation and capital appreciation.

- International UITs: International UITs invest in securities from companies located outside of the investor's home country, providing exposure to global markets and diversifying an investor's portfolio.

- Sector UITs: Sector UITs focus on specific industries or sectors, such as technology, healthcare, or energy. They can provide specialized exposure to particular areas of the market and are suitable for investors who want to target specific sectors.

- Target-Date UITs: These UITs are designed for investors with a specific time horizon in mind, such as retirement. The portfolio's asset allocation gradually becomes more conservative as the target date approaches, making them a "set-it-and-forget-it" option for long-term investors.

- Socially Responsible UITs: Socially responsible UITs invest in companies that meet certain environmental, social, and governance (ESG) criteria. They appeal to investors who want their investments to align with their values and promote positive change.

- Tax-Advantaged UITs: Tax-advantaged UITs are designed to provide tax benefits to investors. They may utilize strategies such as tax-exempt securities or focus on tax-efficient investments to minimize the tax liability for investors.

Each type of UIT offers distinct advantages and considerations. Investors should carefully review the investment objectives, risks, and expenses associated with each UIT before making a decision. Diversification and asset allocation do not ensure a profit or guarantee against loss.

Bezos' Billion-Dollar Question: The Doge Dilemma

You may want to see also

How UITs differ from other investment options

Unit Investment Trusts (UITs) are a type of investment company that offers a fixed portfolio of stocks and bonds to investors for a specific period of time. They are similar to mutual funds and exchange-traded funds (ETFs) in that they pool investors' money to purchase a range of securities. However, UITs differ from other investment options in several key ways:

Fixed Portfolio and Investment Period

UITs offer a fixed portfolio of securities, typically stocks and bonds, that are held for a specified period, usually between one and five years. During this time, the underlying investments are not actively traded, providing investors with more predictability and transparency. In contrast, mutual funds allow fund managers to actively buy and sell securities within the portfolio at any time.

Maturity and Rollover Options

UITs have a specified lifespan and a set maturity date, after which the fund terminates, and investors receive a payment based on their share of the assets. This maturity date is often aligned with the maturity date of the underlying bond investments. Investors in UITs also have the option to roll over their investment into another UIT if it is part of a series. Mutual funds, on the other hand, do not have expiration dates and can be held indefinitely.

Trading and Liquidity

UITs are traded on exchanges or bought and sold through the issuer. However, unlike mutual funds, UITs have a closed investment period, meaning investors can only buy into the fund during a specific time frame. Additionally, UITs are not actively traded during their lifespan, and the underlying securities are fixed, providing less flexibility for investors who want to rebalance their portfolio.

Management and Fees

UITs are passively managed, meaning there is no active buying and selling of securities during the investment period. This lack of active management contributes to lower annual fees for UITs compared to mutual funds. UITs also tend to have lower management fees since there is less ongoing management required due to the set end date and the absence of buying and selling of securities.

Tax Implications

UITs may offer certain tax advantages due to their passive investment strategy. Since there is less frequent buying and selling of securities, UITs may generate fewer capital gains, resulting in potential tax efficiencies for investors. However, it's important to note that the tax treatment of UITs can vary depending on the types of securities held and the investor's individual tax situation.

Dogecoin: Invest Now or Never?

You may want to see also

Frequently asked questions

A Unit Investment Trust is a US financial company that buys or holds a group of securities, such as stocks or bonds, and makes them available to investors as redeemable units.

UITs pool money from multiple investors to purchase a fixed portfolio of securities, such as stocks or bonds. Once the trust is created, investors purchase units that represent a proportional ownership interest in the underlying assets. The trust is then managed, and income is distributed over the life of the assets.

UITs provide investors with access to a diversified portfolio of securities, helping to reduce the risk of losses. They are also generally passive investments, resulting in lower fees and expenses. UITs are also typically more tax-efficient and have low minimum investment requirements.

UITs have a fixed portfolio of securities, so investors have little control over the investments made by the trust. They may also not provide the same level of diversification as other investments. UITs are designed to be long-term investments, so they may not be suitable for those who need quick access to their funds.

Investors typically buy and sell UITs through a broker, although prices for some UITs are quoted on the Nasdaq mutual fund quotation service. It is important to note that UITs are usually traded through a full-service brokerage, so costs can be high.