Exchange-traded funds (ETFs) are a popular investment option due to their simplicity, diversification, and low fees. They are traded on stock exchanges like individual stocks, but they provide investors with exposure to a diversified portfolio of assets. With thousands of ETFs available, choosing the right one for your portfolio can be challenging. Here are some key considerations to help you select the best ETF for your investment goals:

- Investment Focus and Diversification Strategy: Determine your desired asset class, such as equities, bonds, or commodities, and decide on its weighting in your portfolio. Consider whether you want broad diversification across an asset class or want to focus on specific market segments, industries, or countries.

- Index Selection: Choose an index that covers a significant portion of the market you want to follow. Well-known indices like the FTSE All-World or MSCI World are offered by many ETF providers and tend to be inexpensive.

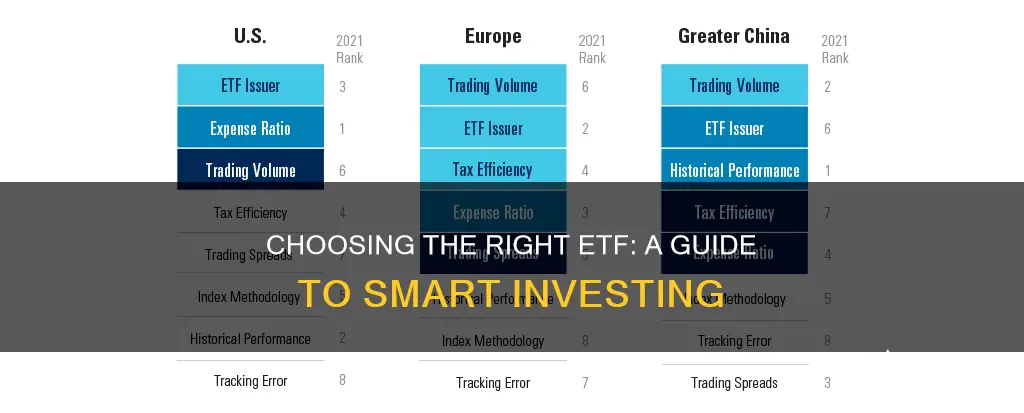

- ETF Selection Criteria: Evaluate the ETF's performance, tracking difference, fund size, fund age, trading costs, liquidity, tax status, sustainability, replication method, income treatment, provider reputation, fund currency, and fund domicile.

- Investment Goals and Risk Tolerance: Reflect on your financial goals, risk tolerance, and desired level of exposure to specific sectors or assets. This will help you choose an ETF that aligns with your investment strategy.

- Expense Ratio and Trading Volume: Look for ETFs with lower expense ratios, as they cut into profits. Also, consider the trading volume, as higher volume indicates increased liquidity and potentially lower transaction costs.

- Underlying Index or Asset: Consider investing in an ETF based on a broad, widely followed index for better diversification.

- Tracking Error: Choose an ETF with minimal tracking error, meaning it closely tracks its underlying index.

- Market Position: Opt for ETFs that are the first to enter a particular sector, as they tend to attract more assets and market share.

- Brokerage Account and Screening Tools: Open a brokerage account and utilize its screening tools to narrow down ETFs based on criteria like asset type, geography, industry, trading performance, and fund provider.

Remember, selecting the right ETF requires careful research, an understanding of the market, and alignment with your financial goals.

What You'll Learn

Understand the role you want the ETF to play in your portfolio

When choosing an ETF, it is important to first understand the role you want it to play in your portfolio. This means knowing what you are looking for and how the ETF fits into your broader investment strategy.

ETFs can be used as foundational building blocks or to fill specific gaps in your portfolio. For example, if you are looking to fill the bucket of large-cap US stocks, then an S&P 500 ETF might be a good option. On the other hand, if you are a hands-on investor looking for a tactical tilt towards a particular sector or industry, you may want an ETF with specific exposure, such as an ETF that focuses on small companies or dividend-paying stocks.

To get a sense of what role an ETF might play in your portfolio, start by looking at its asset class and objective. Check each ETF's benchmark, or the index it is measured against, and its exposures—that is, what percentage of its portfolio is invested in various asset classes and segments. This will give you a better idea of what you will actually be investing in. Reading the ETF's fact sheet or prospectus on the fund sponsor's website can also help clarify its aim.

Another consideration is whether you want an actively or passively managed ETF, or a mix of both. Active ETFs are generally run by professional managers who evaluate investments and decide what to hold in the ETF, with the goal of beating the performance of an index. Passive ETFs, on the other hand, aim to track the performance of an index as closely as possible, usually by holding the same investments. While some investors prefer one strategy over the other, many find that there are pros and cons to each, and that both can have a place in a portfolio.

Millennials: The ETF Generation?

You may want to see also

Consider the ETF's expense ratio

When choosing which ETF to invest in, it's important to consider the expense ratio. The expense ratio is the annual cost of investing in the fund as a percentage of assets managed. For example, an ETF with an expense ratio of 0.25% would cost $2.50 per year for every $1,000 invested. ETFs are known for their relatively low costs, but it's still important to compare the expense ratios of different ETFs to find the most cost-effective option.

The expense ratio of an ETF is influenced by various factors, including administrative, legal, operational, and marketing costs incurred by the ETF's management. While a low expense ratio is generally preferable, it's important to note that it doesn't include all costs associated with the ETF, such as transaction costs or taxes. Therefore, it's essential to consider other factors in addition to the expense ratio when evaluating the overall cost of an ETF.

When assessing the expense ratio of an ETF, it's worth considering the fund size and age. A larger fund size, typically over £100 million, indicates higher economic efficiency and profitability, reducing the risk of liquidation. Additionally, ETFs that are older than one year provide a more reasonable track record for performance evaluation.

It's also crucial to evaluate the ETF's performance over different time frames and compare it with similar ETFs and its benchmark index. However, remember that past performance does not guarantee future results. Observing the daily average trading volume can also provide insights into the ETF's liquidity and potential transaction costs.

In summary, considering the expense ratio is an essential part of choosing an ETF to invest in. By evaluating the costs associated with the ETF and comparing it with other options, you can make a more informed decision about which ETF aligns with your financial goals and investment strategy.

XBI SPDR S&P Biotech ETF: Unity Biotechnology Investment Analysis

You may want to see also

Assess the ETF's performance relative to its benchmark

When choosing an ETF, it's important to assess its performance relative to its benchmark to understand how well it has achieved its goals. Here are some factors to consider:

- Relative Performance: Compare the ETF's performance against a benchmark index to determine how your portfolio is doing relative to an alternative or a standard. The S&P 500 is often used as a benchmark for broad-based portfolios and ETFs.

- Active vs Passive ETFs: Passive ETFs aim to replicate the performance of a benchmark index, while active ETFs try to beat it. Active ETFs may introduce higher fees but aim to outperform the index. It's important to evaluate if the extra expense is worth it by assessing the fund's performance over time.

- Risk-Adjusted Performance: Consider evaluating the portfolio's beta, which measures how the portfolio moves relative to the benchmark. A beta of 1.0 indicates the portfolio moves in tandem with the index, while a beta less than 1.0 indicates lower volatility, and a beta greater than 1.0 indicates higher volatility.

- Tracking Error: This measures the difference between the performance of an ETF and its underlying index. A smaller tracking error indicates that the ETF is closely following its benchmark.

- Performance vs Benchmark Over Time: Look at the ETF's performance relative to its benchmark over longer periods, such as 3, 5, and 10 years. This can provide a better indication of the ETF's performance trend.

- Tax Efficiency: Evaluate the distribution history of the ETF. Ideally, ETFs should make zero short-term capital gains distributions, as these are taxed at higher rates. Ordinary income distributions are generally unavoidable and taxed at a more favourable rate.

A Beginner's Guide to Silver ETF Investing

You may want to see also

Evaluate the ETF's trading activity

When evaluating an ETF's trading activity, it's important to consider the following factors:

Trading Volume

A higher trading volume for an ETF indicates higher liquidity, which means it can be bought and sold more easily without significantly impacting the price. This is an excellent indicator of liquidity, regardless of the asset class.

Liquidity

Liquidity refers to how efficiently an ETF can be traded on the stock exchange. Broad market ETFs are usually very liquid because the underlying securities they hold are regularly traded in large volumes. The liquidity of an ETF depends on factors such as the tradability of the underlying securities, fund size, daily trading volume, and the number of market makers.

Bid-Ask Spread

The bid-ask spread is the difference between the buying and selling price of an ETF, and it increases as liquidity decreases. A lower bid-ask spread is preferable as it minimizes the transaction costs for buying or selling the ETF.

Tracking Efficiency

Tracking efficiency measures how closely an ETF follows its underlying index or benchmark. A good measure of tracking efficiency is the tracking error or tracking difference, which indicates how much an ETF has lagged its benchmark over a specific period. A lower tracking error indicates a more efficient ETF.

Tax Efficiency

ETFs are generally considered tax-efficient due to their structure and lower turnover. To evaluate tax efficiency, consider the capital gains distributions and the general tax treatment of the fund. Lower capital gains distributions maximize tax efficiency. Additionally, equity ETFs are typically more tax-efficient for long-term holders compared to currency funds.

ETFs: An Introduction to Exchange-Traded Funds Investing

You may want to see also

Analyse the ETF's underlying index or asset

When choosing an ETF, it's important to consider the underlying index or asset class that the ETF is based on. From a diversification standpoint, investing in an ETF based on a broad, widely followed index may be preferable.

For example, the more equities a market-cap index tracks, the better it represents its market. Broad market indices are ideal for diversification, whether you want to invest in a single ETF or build a portfolio of several ETFs. Conversely, the more an index concentrates on specific firms, industries, or countries, the riskier it becomes relative to a broader index.

ETFs can be designed to track specific investment strategies, income generation, speculation, and price increases, or to hedge or offset risk in an investor's portfolio. They can also be structured to track the price of a commodity, a large and diverse collection of securities, or specific industries or sectors like automotive, foreign stocks, or energy.

- Stock ETF: A stock ETF is a basket of stocks that track a single industry or sector. For example, Blackrock's iShares U.S. Technology ETF (IYW) mirrors the performance of the Russell 1000 Technology RIC 22.5/45 Capped Index and holds 1374 stocks of technology sector companies.

- Commodity ETF: A commodity ETF invests in commodities like crude oil or gold. For instance, the SPDR Gold Shares ETF (GLD) tracks the price of gold.

- Currency ETF: A currency ETF tracks the performance of currency pairs consisting of domestic and foreign currencies.

- Bitcoin ETF: A bitcoin ETF, approved by the SEC in 2024, exposes investors to bitcoin's price moves by purchasing and holding bitcoins as the underlying asset.

- Ethereum ETF: A spot ether ETF, approved by the SEC in May 2024, provides a way to invest in ether without directly owning the cryptocurrency.

- Inverse ETF: An inverse ETF earns gains from stock declines by shorting stocks using derivatives.

- Leveraged ETF: A leveraged ETF seeks to return multiples on the return of the underlying investments. These products use debt and derivatives to leverage their returns.

When selecting an ETF, it's crucial to understand the underlying index or asset and how it aligns with your investment goals and strategy.

Ally Invest's SPDR ETF Offerings: What You Need to Know

You may want to see also

Frequently asked questions

You should first determine your investment focus by deciding on an asset class (such as equities, bonds or commodities) and its weighting in your portfolio. Then, you should consider your diversification strategy. For example, you can choose to invest across the entire world with one ETF, or focus on specific industries, equity strategies or investment themes (e.g. renewable energy).

There are two main structural types: physically-backed ETFs, which own the assets they track, and synthetically-backed ETFs, which use derivatives to replicate the index's performance. There are also equity ETFs, non-equity ETFs and complicated ETFs with strategies such as ESG or smart beta.

ETFs are an excellent entry point into the stock market for new investors. They are typically cheaper than investing in individual stocks and carry lower risk due to their inherent diversification. They are also more flexible and liquid than other investment options like mutual funds.